Content supplied by the World Gold Council

As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance:

- financial market instability

- monetary policy and the US dollar

- structural economic reforms.

Against this backdrop, we believe that gold has an increasingly relevant role to play in investors' portfolios.

Gold’s price seesawed in 2018 as investor interest ebbed and flowed despite steady growth in most sectors of demand.

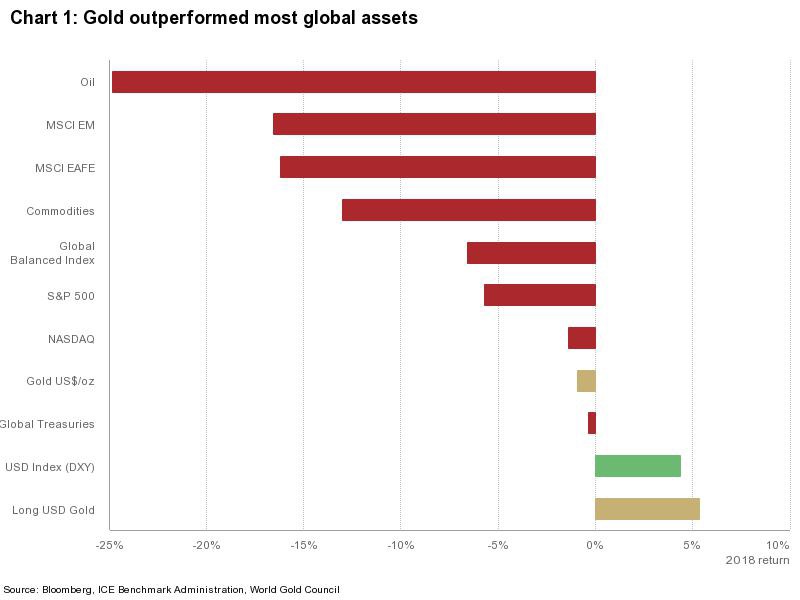

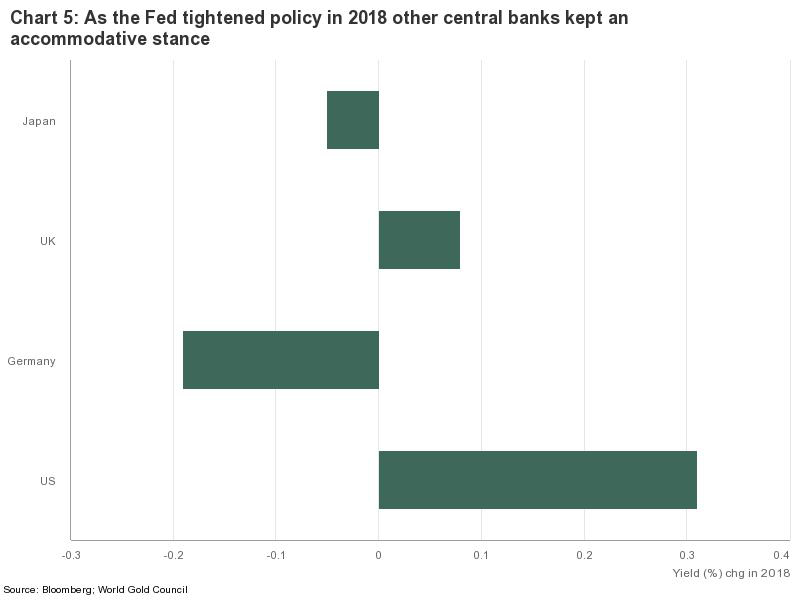

Gold faced significant headwinds for most of the year. The dollar strengthened, the Fed continued to hike steadily while other central banks kept policy accommodative, and the US economy was lifted by the Trump administration’s tax cuts. These factors fuelled positive investor sentiment which, in turn, pushed US stock prices higher, at least until the start of October.

But as geopolitical and macroeconomic risks continued to increase, emerging market stocks pulled back. Eventually, developed market stocks followed, in a selloff led by US tech companies. This resulted in short-covering in gold with its price ending the year near US$1,280/oz (-1% y-o-y).

*As of 31 December 2018. Based on named indices, WTI front Future, BBG Commodities Index, New Frontier Global Balance Index, LBMA Gold Price, Bloomberg Barclays Global Treasury Index, Solactive Long USD Gold Index.

Potential for growth and heightened risk in 2019

We expect that many of the global dynamics seeded over the past two years and the risks that became apparent later in 2018 will carry over. And with them, we see a set of trends developing that will be key in determining gold’s demand. In turn, their interplay will be most relevant for gold's short- and long-term price behaviour (Focus 1).

We expect:

- Increased market uncertainty and the expansion of protectionist economic policies will make gold increasingly attractive as a hedge

- While gold may face headwinds from higher interest rates and US dollar strength, these effects are expected to be limited as the Fed has signalled a more neutral stance

- Structural economic reforms in key gold markets will continue to support demand for gold in jewellery, technology and as means of savings.

1. Financial market instability

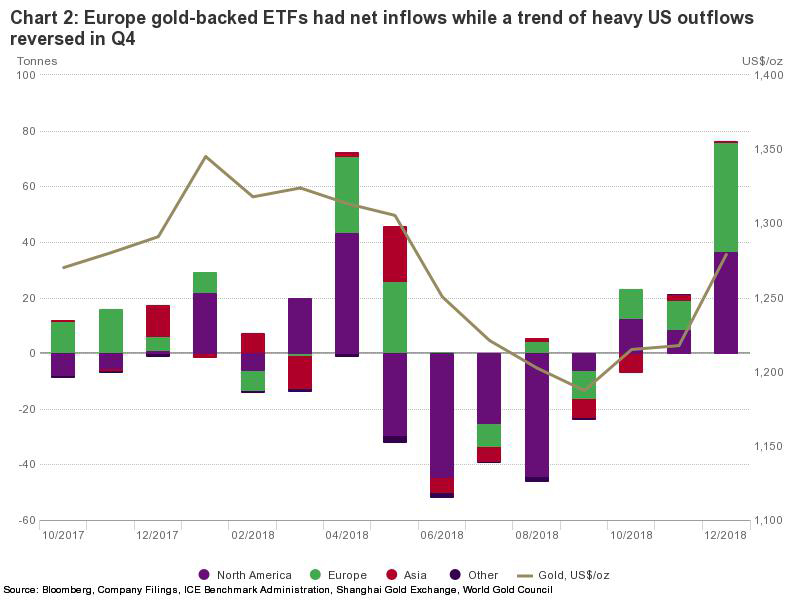

Globally, there were net positive flows into gold-backed ETFs in 2018. While North American funds suffered significant outflows in Q2 and Q3, this trend started to shift in Q4 as risks intensified (Chart 2).

We believe that in 2019 global investors will continue to favour gold as an effective diversifier and hedge against systemic risk. And we see higher levels of risk and uncertainty on multiple global metrics:

- Expensive valuations and higher market volatility

- Political and economic instability in Europe

- Potential higher inflation from protectionist policies

- Increased likelihood of a global recession.

Focus 1: Drivers of gold

Gold has a dual nature: consumption and investment. And gold price drivers can be grouped into four categories:

- wealth and economic expansion

- market risk and uncertainty

- opportunity cost

- momentum and positioning.

As a consumer good and long-term savings vehicle, gold demand historically has been positively correlated to economic growth. As a safe-haven, its demand historically has been strongly responsive to periods of heightened risk. In the short and medium term, however, the level of rates or the relative strength of currencies, as well as investor expectations, can either enhance or dampen gold’s performance. See The relevance of gold as a strategic asset, January 2018.

*As of 31 December 2018.

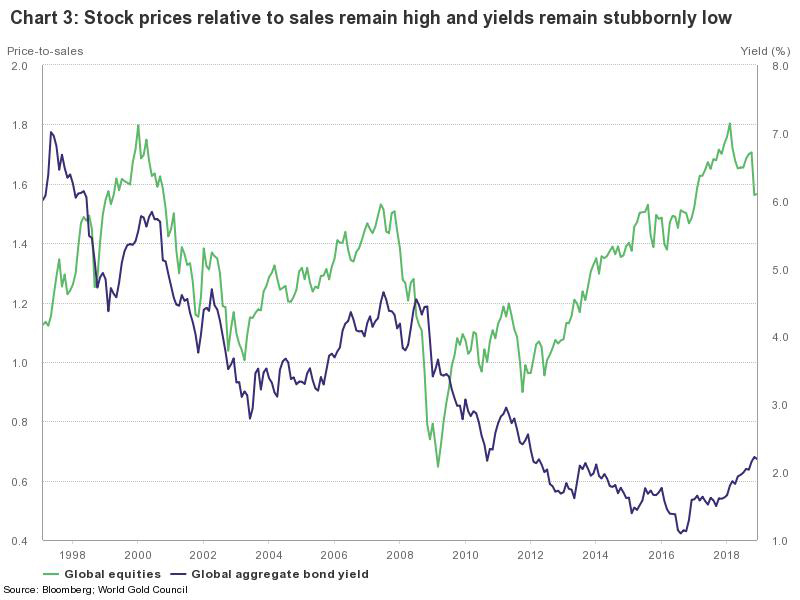

First, despite the recent market correction, many stock valuations remain elevated, especially in the US, after almost a decade of almost uninterrupted price appreciation. Yet bond yields remain stubbornly low (Chart 3). Even in the US the 10-year Treasury yield is 1.5% below its 2008 pre-Lehman crisis level, providing investors less cushion in case of further market volatility. Indeed, volatility metrics have begun to creep up, with the VIX jumping from an average of 13 in Q3 2018 to an average of 21 in Q4.

*As of 30 November 2018.

Second, while European growth has recovered from the aftermath of the sovereign debt crisis it has failed to reach the level of the US economy, making it more vulnerable to shocks – and explaining why Europeans have been adding gold to their portfolios steadily since early 2016. Today, Europe is facing major challenges. The most obvious is Brexit. Not only has it imposed a continuous level of unease among investors, but its timing and implications – both for the UK and for continental Europe – are best left to diviners. What is certain, however, is that clarity will not come any time soon. In addition, continental Europe continues to face internal turmoil. France is grappling with social unrest; Spain is fending off secessionism and fragile political alliance, and Italy's populist government continues to highlight the inherent instability of the monetary union – to name just a few.

Third, more and more governments around the world seem to be embracing protectionist policies as a counter movement after decades of globalization. And while many of these policies can have a temporary positive effect, there are longer term consequences that investors will likely grapple with in the coming years; for example, higher inflation. Protectionist policies are inherently inflationary – either as a result of higher labour and manufacturing costs, or as a result of higher tariffs imposed to promote local producers over foreign ones. They are also expected to have a negative effect on long-term growth. And although so far investors have taken some of the trade war rhetoric as posturing, it is not without risk to restrict the flow of capital, goods and labour.

*As of 30 November 2018.

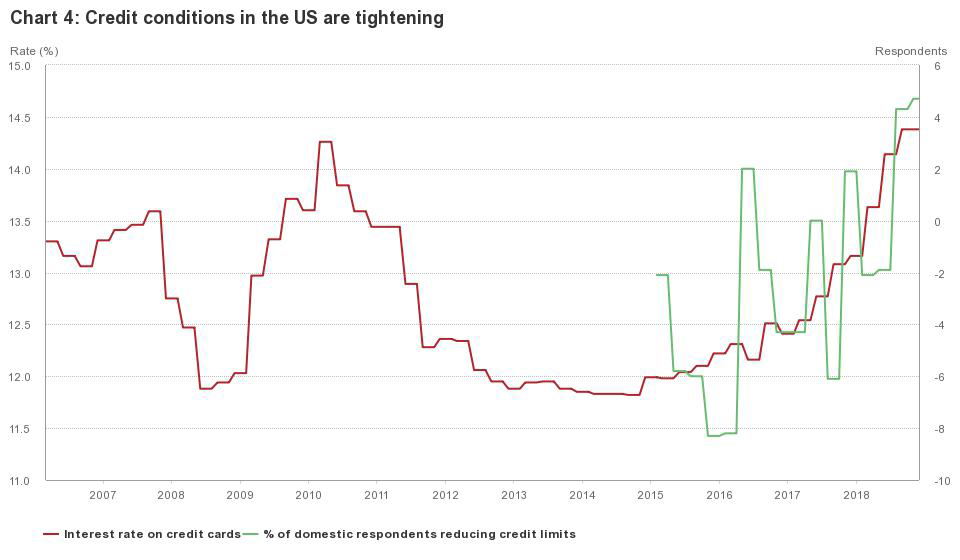

Combined, these trends have increased the risk of recession. For example, in the US there are a few signs that investors are becoming wary. A good percentage of the growth seen in 2018 was a byproduct of tax cuts. But similar measures may be more difficult to enact with a split congress. There has also been a deterioration of credit markets with spreads widening by more than 70bps (+50%) since the January 2018 lows, while credit conditions for consumers are tightening. In addition, the US treasury curve is very flat: the 2s/10s curve currently stands at 13bps, a level of curve flattening last seen before the 2008 financial crisis, with some economists predicting its inversion in the first half of 2019. While an inverted yield curve does not cause recessions, it has generally preceded them – albeit with a long lead. And it indicates that bond investors are concerned about the sustainability of long-term growth.

2. The impact of rates and the dollar

While market risk will likely remain high, two factors could limit gold’s upside: higher interest rates and US dollar strength.

Higher US interest rates alone are not enough to deter investors from buying gold, as seen between 2004 and 2007 or 2016 and the early part of 2018. And while higher interest rates combined with a strong dollar can dampen gold’s performance, there are reasons to believe that the upward trend of the US dollar may be losing steam.

First, the US dollar DXY Index, which measures the relative direction of the dollar against a basket of key currencies, has already appreciated by almost 10% from its 2008 lows. A similar trend in 2016 was followed by a significant correction.

*As of 30 November 2018.

Second, the positive effect of higher US rates on the dollar will diminish as the Fed policy stance becomes neutral, especially since the recent US dollar strength was fuelled in part by the more accommodative monetary policy maintained by other central banks (Chart 5).

Third, the Trump administration has often voiced frustration about competitive disadvantage caused by a strong US dollar.

Finally, emerging market central banks continue to diversify exposure to the US dollar.

3. Structural economic reforms

Emerging markets, making up 70% of gold consumer demand, are very relevant to the long-term performance of gold. And among these, India and China stand out.

These two countries have begun to implement economic changes necessary to promote growth and secure their relevance in the global landscape.

China’s Belt and Road initiative, for example, is focused on promoting regional economic development, boosting commodity markets and upgrading infrastructure (see The economic outlook for China, Gold Investor, October 2018).

India has been active in modernising its economy, reducing barriers to commerce and promoting fiscal compliance. In fact, India’s economy is expected to grow by 7.5% in 2018 and 2019, outpacing most global economies and showing resilience to geopolitical uncertainty.

Given its unequivocal link to wealth and economic expansion, we believe gold is well poised to benefit from these initiatives. We also believe that gold jewellery demand will strengthen in 2019 if sentiment is positive, while increase marginally should uncertainty remain.

Similarly, efforts to promote economic growth in western markets are expected to result in positive consumer demand, as has been observed generally in the US since 2012.

Why gold why now

Gold’s performance in the near term is heavily influenced by perceptions of risk, the direction of the dollar, and the impact of structural economic reforms. As it stands, we believe that these factors likely will continue to make gold attractive.

In the longer term outlook, gold will be supported by the development of the middle class in emerging markets, its role as an asset of last resort, and the ever-expanding use of gold in technological applications.

In addition, central banks continue to buy gold to diversify their foreign reserves and counterbalance fiat currency risk, particularly as emerging market central banks tend to have high allocations of US treasuries. Central bank demand for gold in 2018 alone was the highest since 2015, as a wider set of countries added gold to their foreign reserves for diversification and safety.

More generally, there are four attributes that make gold a valuable strategic asset by providing investors:

A more tactical opportunity

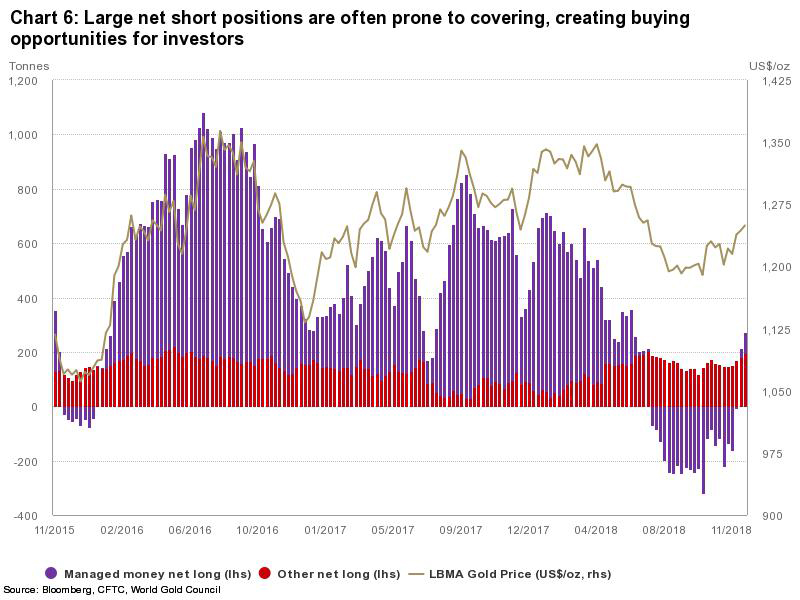

In addition, gold speculative positioning in futures markets remains low by historical standards after hitting record lows in the final months of 2018. CME managed money net long positions stand near record low since 2006 – when data was first broken down by investor type. Furthermore, net combined speculative positions, which go back further, are negative for the first time since December 2001. And large net short positions have historically created buying opportunities for strategic investors, as such positions are prone to short-covering adding momentum to rallies in the gold price (Chart 6).

*As of 18 December 2018.

This article is a re-post from here. The original article also has detailed Notes and Sources.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.