Home ownership is the most unattainable it has ever been for aspiring first home buyers since interest.co.nz first began compiling the Home Loan Affordability Report in 2004, even though house prices at the bottom end of the market have dropped back considerably from the dizzying heights they reached a couple of years ago.

According to the Real Estate Institute of NZ, the national lower quartile selling price (that's the price point at which 25% of sales are below and 75% are above), was $599,000 in October this year.

That's down $71,000 from the peak of $670,000 in November 2021.

That has reduced the amount needed for a 20% deposit from $134,000 to $119,800, while a 10% deposit has declined from $67,000 to $59,900.

Over the same period, interest.co.nz estimates the national, combined, median, after-tax pay for couples aged 25-29 (assuming both work full time), has increased from $1818 a week to $1990 a week, up by $172 a week (9.5%).

So in the almost two years since the market peak the cost of homes at the bottom of the market has come down significantly, which has reduced the amount needed for a deposit, while household incomes for typical first home buyers have had a reasonable increase, which should have made home ownership more affordable.

But of course it hasn't - rising mortgage interest rates have made sure of that.

Between the market peak of November 2021 and October 2023, the average of the two year fixed mortgage rates offered by the major banks has increased from 4.08% to 7.01%, which has had a major impact on affordability.

A first home buyer who had a 20% deposit for a home priced at the national lower quartile price back in November 2021, would have needed a mortgage of $536,000. The mortgage payments on that would have worked out at about $596 a week at the time.

By October this year a buyer with a 20% deposit for a home at the current lower quartile price would need a mortgage of $479,200, which is $56,800 less than was required in November 2021.

But the rise in interest rates over that period means the payments on an 80% mortgage would have increased from $596 a week to $736 a week, up an extra $140 a week.

Those buyers with just a 10% deposit would be even worse off, with their mortgage payments on a lower quartile-priced home rising from $770 a week to $930 a week over the same period, up an extra $160 a week.

So the rise in interest rates means first home buyers would likely be paying more in mortgage payments now than they were at the market peak, even though houses are cheaper, allowing them to borrow less.

So where does that leave first home buyers?

There has been a long standing rule of thumb in financial circles that to be considered affordable, housing costs, whether they be mortgage payments or rent, should be no more than a third of gross income.

The trouble with that rule is it takes no account of movements in tax rates, which flow into disposable income and therefore affect mortgage affordability.

So interest.co.nz has always used 40% of after-tax pay as a threshold for determining affordability.

Mortgage payments are considered unaffordable if they chew up more than 40% of after-tax pay.

The tables below give the main affordability measures for buyers with either a 10% or 20% deposit in each of the main urban areas throughout the country.

What these show is that at the national level, if a typical first home buyer had a 20% deposit, the mortgage payments on a lower quartile-priced home should still be affordable, although they'd be towards the upper limits of affordability.

The main exception to that is Auckland, where mortgage payments would take up almost half of typical first home buyers' take home pay, and the Bay of Plenty, where they would eat up almost 42% of take home pay, a point at which household budgets would be starting to become tight.

So with the exception of Auckland and the Bay of Plenty, housing should still be affordable for typical first home buyers in most of the country, provided they can put together a 20% deposit.

But that also presents a problem because at the national level, aspiring home owners would need to save almost $120,000 for a 20% deposit on a home at the national lower quartile price, something interest.co.nz estimates would take almost six years if they saved 20% of their after-tax pay each week and put it into an account earning interest at the 90 day term deposit rate.

If that was too hard, they could try to buy a home with a lower deposit.

The trouble with that is that the mortgage would be considered a low equity loan, which would likely attract higher interest rates and/or fees.

At the national level, mortgage payments on a lower quartile-price home purchased with a 10% deposit would swallow almost 47% of typical first home buyers' take home pay, pushing it well into unaffordable territory, and Northland, Waikato, Hawke's Bay, Wellington, Nelson/Marlborough, Canterbury and Otago would join Auckland and Bay of Plenty in the unaffordable club.

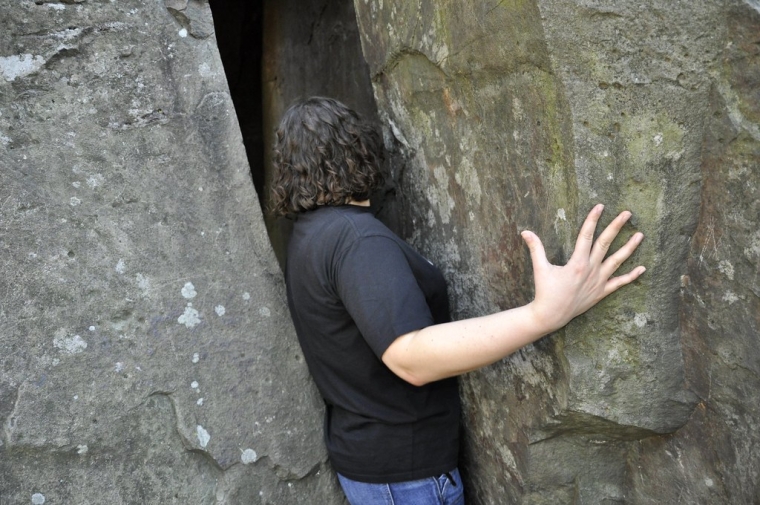

Which leaves typical first home buyers between a rock and a hard place.

On the one side there's the rock of an increasingly unattainable deposit, and on the other there's the hard place of unaffordable mortgage payments with a low equity loan.

Which doesn't leave much wriggle room for first home buyers to find their happy place.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

169 Comments

Nice picture. But I would never go into that space. One small earthquake and....

Many FHB's who, guided poor advice in 20/21, willingly ventured into that very space. Today, they're financially and emotionally wedged between a rock and a hard place. A slow slip event that commenced in Nov-21, is still in progress and is claiming more victims by the day.

Buyers on average income need to have a big one ... umm that's a big deposit

Will first tier lenders be offering loans that eat up >50 percent of would be home owners income. Back in my day they assessed a loan based on 30 percent servicing

Of course they will, if your income is high enough.

Maybe I should walk down to a car yard today and let people know one of them might die in the car.

Then when they do I can say told ya so.

I tried that Nov 21, none of you seemed to want to listen.... Everyone was to busy zooming everywhere..

With your amazing foresight, you told them to lock in a 5 year rate though, right?

Jeez Pa1nter, what crawled up your bum and died?

Sorry to rain on the schadenfreude party.

You told young home owners to lock in a 5 year, sub 3% interest rate over 2020/21, yeah? Then they wouldn't be as financially and emotionally wedged.

Unless.... Unless you want to see people hurt?

I couldn't point to any one particular commentator, but the fact that I started fixing long in 2021 is purely down to reading the articles and comments on this site.

As Yvil points out, "Helping you make financial decisions". He'll no doubt reply shortly and tell me my savings could be put towards a subscription.

I wasn't a purveyor of these fine pages at that point. I assume though much of the same repeatitious bellowing was done then as today. I did tell everyone I knew though that a long term interest rate at what was then the inflation rate was something not to take for granted. And if anything, that was a very uncertain time, so some level of medium term security and certainty wouldn't go amiss either.

Too many people got sucked in by 2.25% for a year or two. I guess mostly in hopes of lower rates still, and if you've only ever see something go one way, and never the other you could be lured into a false sense of security. Sometimes the universe provides, sometimes it takes it away.

Regardless, an economic downturn, despite maybe hitting asset values, is not really a good time for a lot of people. I can't see why people feel the need to revel in such a situation, the universe can and does shit on all of us from time to time. As a wise monk Ajahn Brahm one said:

Why seek for revenge, when Karma will get the bastards anyway

Cough cough?

Pa1nter, that'd be a good idea if every car was crashing

Most people with houses and mortgages are quietly enjoying their homes. Like most car owners.

Basically, you can have any doomsayer position and find examples to somehow validate yourself.

Very few first-home buyers who bought near the peak of the previous cycle are thinking of selling - unless it's to upgrade to a better home.

They remain well-placed for the future - despite the current relatively high mortgage interest rates.

Retired-Poppy, you repeatedly overlook rent - despite it being a critical factor........ In fact, many first-home buyers are ahead financially when the rent payments they have avoided are factored into the calculations. Furthermore, on top of rent avoided come the intangible (non-financial) gains (such as living stability/security and building equity over time) which flow from owning one's own home. While it can be challenging to measure these benefits in money terms, they are highly valued by first-home owners and, indeed, home owners from all age-groups. Thus, the intangible benefits shouldn't be ignored by anyone.

Retired-Poppy - you shoot from the hip, in your message above, choosing highly emotive language. That would be a poor substitute for careful analysis and assessment.

First-home buyers/owners, don't be dismayed by the negative verbiage you read here. Home ownership is a worthy goal/achievement. It's very likely to serve you well over your lifetime.

For individual advice, seek a respected family member and/or a professional person such as a chartered accountant, registered financial advisor, or lawyer.

TTP

TTP, in my support of viable home ownership, what part of my post "FHB's should consider making lowball offers from Autumn 2024" do you not understand?

Anyway, do you remember making this post straight after the 2016 peak?

by tothepoint - d… | 24th Feb 17, 10:00am - "Buyers have largely got the message that biding one's time is a prudent strategy right now, while over-geared owners/investors are displaying a nervousness not evident a few months back"

Those whom you spruiked to buy around the last peak are most likely in negative equity and struggling to meet repayments. Why not show some courage and accept some responsibility.

Careful analysis has already been performed by others more qualified than you that proves renting is currently cheaper than owning. There is no hurry - no need for FOMO.

FYI

by tothepoint

|

14th Oct 21, 11:25am

Shrewd investors will capitalise on perceived price weakness - cementing their position for the next market upswing.

Well located property remains a prime investment for the long term. (But you already know that.)

TTP

Hi Retired-Poppy,

Time has marched on. While the market tapered off in late-2016 and people backed off (as I noted back then) the market surged ahead a year or so later. We are all aware that current property prices are far higher now than they were back in those days. The ups and downs of property cycles continue as always, with the long-term trend of increasing house prices.

Unfortunately, Retired-Poppy, those people who unwittingly take your advice won't ever prosper financially (or non-financially) from home ownership, because you are rigidly anti-property. In fact, you have never recommended buying property - despite the very sizeable capital gains it has delivered to owners over the decades. And capital gains are before the additional returns from rental income (or avoidance of paying rent) are factored in.

In fact, the vast majority of property owners would make a solid return on capital if they sold now. Naturally, the returns will be further amplified if rental return is part of the calculations (which is the correct/professional approach.)

Clearly, most people who have bought property over the last 2 or so years are holding on to it, because they know they're well-placed for the future - just like those who purchased property 5,10, 20, 40 or 80 years ago.

Rental returns, in tandem with capital appreciation make property a well-proven longer term investment - and more so if it's in a good location.

I shall continue to warn others when you omit/ignore rental return in your considerations of property ownership/investment. I will do so because your approach is deficient/unprofessional and therefore unethical. It risks misleading and deceiving others - which, by all accounts, is your intention.

TTP

Be honest, were you keeping a straight face when you posted this garbage? "misleading unethical and deceiving others" especially coming from you that's my favorite! That said, I will continue to remind you and others of the premium outgoings of property ownership versus renting together with the premium interest on offer to patient savers using TD's to get ahead prior to home ownership. In multiple posts I have said "houses are for living in and not speculating on". It's this very statement you seem to struggle with especially.

Thanks TTP, you never cease to be the entertainment :)

Hi Retired-Poppy,

In future, are you going to acknowledge rental return in your comments about property investment? Or are you going to continue ignoring/excluding it - and remain dishonest?

That's no laughing matter.

TTP

TTP, in future, are you going to acknowledge the premium cost of home ownership vs paying rent? Think carefully before you answer this, as its a $38,000.00 question.

https://www.interest.co.nz/personal-finance/124362/bnz-chief-economist-…

Your "convenient" ignorance is truly comical.....

Hi Retired-Poppy,

You've "edited" (or, rather, re-written) your above post at least 3 times in the last 6 minutes - and each time it gets a bit longer, muckier and angrier.

There's absolutely no point in trying to keep up with your "moving feast" of verbiage. You are ethically bankrupt.

TTP

Now void of answers you proceed to make stuff up? Who is the unethical and dishonest one now TTP? Rhetorical question to the vast interest.co membership that already know the answer - LOL!

If you're expecting functional discourse it definitely helps if you don't re-arrange your comments multiple times before someone else can reply.

Take a big breath next time, let the words ricochet around up there a bit longer, THEN release them to the world.

Ah, another frustrated adversary...

Watching people make a word salad on the fly is more amusing than frustrating.

Good to see though you're conscious of your need to act insufferable in absence of decent reasoning. Maybe there's hope yet.

"Watching people make a word salad on the fly is more amusing than frustrating"

Refreshing your screen hundreds of times to identify when people do this sounds quite concerning.

Take care....

No need, it usually happens between reading your post and submitting a reply. Although sometimes you'll do it even after the reply - the time stamps update when you make a change, and your edited post shows up as blue.

Then there's the old full stop place holder. You must be one of those types who likes putting their towel on a pool sun lounger before the sun's up and not use it till later in the afternoon.

Edit

"oh ohhh, wait wait wait. I got a better one, this'll be a doozy"

Edit

Haha, so the sum total of your posting appears to be:

- Hand wringing over people who's naivety has them financially struggling (or potentially financially struggling)

- Attempting a variety of pre-teen methods to be annoying

A life well lived.

Retired Poppy are you Auckland based? Would love to shout you a beer sometime. Supporter of your ongoing commentary here.

TTP is the very type that have resulted in a failed state for the next gen kiwis.

There's a few on here who rather than try and see reason with the message attack the messenger by sensationalizing the smallest of things. They can't even summons the initiative to edit their response to a message that in occasion has been edited!

All this shite above was because I edited/added to one message - LOL!

EDIT (for you Pa1nter)

"I only ever edited one post, one time, ever. And now there's this witch hunt."

You're the sites very own Donald Trump.

All this shite above..

Is Painter getting under your skin. Get a room you two

Yeah it's boring. I skip all of it. I wish they'd stop.

Generally I like to have fairly respectful discourse with people, a conversation flows better and is more interesting if the exchanges are straight up, and to the point.

From my initial posting on the site, poppy has been all over me like a rash. Early on, almost every reply by him to me was some sort of insinuation I was a ghost account of another poster. At first, I assumed he was genuinely confusing me with someone else, instead it became fairly obvious rather than have serious discussion, he's more concerned with trying to wind people up.

Just trying to make light of it, sorry to you and anyone else bored of it.

Aside from the shear tedium of it, it makes reading the comments on a mobile phone a pain; each tit-for-tat reply indents further to the right and the (often verbose) posts have to stretch ever further down the page ....

Oh bollocks, now I'm adding to the problem.. 🙄

I'd like to see more anecdotal reports from individuals on the frontline. Tales of hardship or success under the current conditions. I do enjoy Pa1nter's take on things and efforts to counter the nonsense with dry humour.

Yeah that was my issue too. It was literally the thought I had as I was scrolling endlessly past it all. I wasn't getting at anyone in particular Painter, I enjoy the comments generally from everyone (yourself included). It's just the tit for tat and attacks on people's credibility I find boring. I might be the only person who comes to this site to relax...!

What to do what to do...

Finally in a position to buy, bank has just said they're raising their test rate by 0.25% next week (BNZ).

Sick of waiting on the sidelines, literally 2/3 of my peers in early 30s working professionals are all looking to get in when they can. Is this the new high base level of salary that can fund these insane mortgages? Always had thought things would unwind to something more... "affordable".

Waiting for this comment to attract the boomer bingo comments:

- don’t buy coffee/avocados

- give up sky

- something about mobile phones

-unspecified “sacrifices” and generic “work harder”

- unsolicited references to 15% interest rates (which lasted 6 months and occurred when houses were 2x average income)

You just did it for them.

Something anyone naming themselves as a professional must consider though, is if your status can't get you a house where you are, is whether that status and location are really doing much for you - there's a handy chart up above worth digesting.

No no no, those interest rates were well over 20% and on 3 mortgages. Just don't point out the highly flawed logic that is being in a rush to take out 3 mortgages on such a small house price to income ratio, at a time when term deposit rates were double digits.

Which generation is the frivolous "me me me" want it all now generation again?

Basically any of them since modern cultures eschewed subservience to a higher power in favour of the distinct individual.

Pent up demand from those who delayed will push FOMO

I'm in the same camp of buying new year 2024

I get the feeling there's a lot of people just waiting on the sidelines.

Adding to your existing portfolio in 2024?

Flying high reckoned they're renting at the moment, as best I recall.

An 'OO' owner occupied by the beach somewhere. So that makes two including the first house we bought in 95 and which is rented to some lovely people they said they are from the energy company named Black Power. They are so nice they said we don't have to worry about a thing.

Unfortunately despite many peoples hopes and wishes, "affordability" is more than just the purchase price, and involves other factors like the cost of money, access to it, salaries, the health of the employment market, etc.

While purchase prices can dip, this usually coincides with everything around it dipping also, hence we've seen "affordability" worsen, not improve.

Pretty hard to crystal ball it, there do seem to be economic storm clouds on the horizon (albeit moving at a glacial pace), but fairly unlikely things will improve on the "affordability" front. At best, you might find if you bought something today, interest rates will get cheaper in 12-24 months.

Good luck out there.

Usually not a fan of your opinions on here Pa1nter, but I'd like your thoughts.

Although I don't think it's just and this will continue to degrade NZ into societal divide, how do you see this continuing in terms of funding new buyers.

Is it foreign, is it multi-gen mortgages, is it 1% mortgages, 2% deposits in 10 years time?

Will we go fully corrupt and offer to pay FHB an interest rate to borrow before flipping it into high OCR positive hikes and screwing them over?

Genuinely curious, how does this ponzi continue to fund itself?

I'm not trying to say things people like to hear.

I think the societal divide is pretty inevitable irrespective of housing. Everyone's splintering off into smaller and smaller groups, becoming more individual, with less common views or values. I've seen that in my life happen here, and I can also see it creeping into other cultures around the world - some are just 3-4+ generations behind. Some will probably change less, it depends on a bunch of factors.

In terms of funding new buyers, financial reinvention will be continued as a spur for more debt. So some of the methods you have mentioned, likely more; multi-generational loans, low interest rates, etc etc.

Very hard to draw parables, as other markets that have risen and then fallen away usually don't have as good an ability to retain or grow their demographics.

I think once our own voting demographics shift to where ownership drops decently under 50%, we will see change. Not necessarily an improvement, but the economic dynamics of the country will shift somewhat.

Tough decision. It's a trade off. Interest rates will come down inversely proportionately with house prices rising. If I was you I'd ask myself what is your capacitating factor. If it is serviceability I'd wait a year or two for testing rates to come down. If it is the deposit I'd buy now. With all things equal id lean to buying now if you can. My opinion FWIW.

Good luck balancing the risk of buying and not buying right now, tough decision.

If you do decide to buy, my quick advice

- Make sure you look at least 20 places before you make an offer, you will know lots more about the game in general just by getting out and looking. I fell in love with the 2nd place we saw, by the time we'd seen 20 realised how lucky we were not to buy that 2nd place.

- Negotiate hard. Very hard. Low-ball, stay low. Walk away if need, there will be others coming along all the time. If you can save $30k or $100k by playing hard-ball, think about how many hours worth it would take to earn that $30k at work. It is time very well spent.

- Don't worry too much about finance right now. If you are in a position to get approval, you likely will be when you find the right place. In any case, finance is always house dependent, so just find that right one, and let your broker take care of the rest.

Good luck :)

Lots of deals are falling over at finance around NZ Officebound, its a constant story for RE agents

Yes that a risk for him, but all that's really at risk for buyer if it falls over due finance is cost of building reports/lawyers, and a bit of heartache.

Tough decision. It's a trade off. Interest rates will come down inversely proportionately with house prices rising. If I was you I'd ask myself what is your capacitating factor. If it is serviceability I'd wait a year or two for testing rates to come down. If it is the deposit I'd buy now. With all things equal id lean to buying now if you can. My opinion FWIW.

Appreciate you saying it's your opinion. Many on this site seem to feel they know the future. I'm not sure I agree with you but thats just my opinion and I respect you respectfully sharing yours.

Anyone guaranteeing you a future shouldn't be taken too seriously. But it's not too hard to establish likelihood.

Read the posts on the effects of the NPS-UD, MDRS, new Unitary plans, etc. on housing supply. (i.e. no rush.)

Copy and past this into google: NPS-UD MDRS supply unitary plan flatline site:interest.co.nz

Oh. And vote for a massive overhaul of our tax system to shift from taxing work and necessary spending to include taxing income from wealth.

Lots of great advice here. I will point to DC's advice - Only buy what you are sure you can afford for at least a few years.

Good Luck!

I've got a sibling in a similar position and age to you. They're ready to buy now with their partner but are likely to be impacted by changes in Wellington. (I can't convince them to move north, sadly.) I'm wanting to sell my house to a FHB (in the regions) so that I can pick up a new project which better aligns with my long term interests. (Similar to PDK, I'm looking to "de-growth" before the rush.) The challenge for my place has been prospective buyers' failure to get finance for months now.

Not sure where you're based. The "affordable" areas right now are the regions - e.g. <$500k will get you something in a nice little town or suburb in Manawatū or Horowhenua, or Taranaki. I have a bunch of friends across those three regions who commute to Wellington a couple of times a month but mostly WFH, or work entirely remote.

Good luck!

The article should also mention the big hurdle of bank test rates. Even if a FHB can potentially squeeze in at 7 or 7.5%, there’s every chance they won’t pass go when tested at 9 or 9.5%.

Whats the deal with the co-alition and high density housing in urban areas?

The coalition are all for high density urban housing, outside the 15km exclusion zone centred in Epsom.

Good question, not sure if it’s in the agreement? But they had talked about removing the mandatory requirement for intensification. If so, Auckland Council might pull back quite a lot on their plans for more high density.

I am sure I saw that ACC dont need to let me dig a bit - from herald - interestingly this may allow those who want to provide very high density... but not force council to accept ie must be inside current planning....

here is IMHO a bad example - https://www.trademe.co.nz/a/property/residential/rent/listing/443669330… should have built UP.

Housing, energy, and natural resources

- Replace the Resource Management Act with new laws premised on the enjoyment of property rights.

- Make the medium density residential standards optional for councils.

National has promised to get rid of impediments to building houses by slashing some of the red tape which dictates what should be built and where, so this set of measures is by no means surprising. Reintroducing offshore oil and gas exploration will be seen by some as an unnecessary distraction from meeting climate change objectives, and may well spark protests.

It's a tricky one. We know we need to move away from burning fossil fuels, but still need to keep using them likely for decades yet (unless there's some miraculous technological breakthru), and being beholden to the global market for a base resource carries some level of peril.

re, the listing.

Agreed. Going up would have been far, far better. Could have been a nice building, providing more dwellings, surrounded by gardens and greenery. Shame. (It'll come though. These places will be demolished with 50-70 years. Or end up as slums that nobody wants - until they suddenly do. London is going through this process all the time.)

On the plus side though ... 3 stories and two flights of stairs is going make the occupants either fitter. ;-)

Would hate to be living in the one closest to the driveway. Unless you're first one out and last one to arrive home.

Auckland Council embraced higher densities in their 2016 Unitary plan. I.e. More than half of Auckland already near or exceeds the MDRS. The hassle (and cost) of getting a resource consent remains however. And the NPS-UD, which forces Councils to zone for 6-8+ buildings around CBDs, Metro areas and transport hubs is widely supported by both AC and JAFFAs (and me).

AC's biggest beef with the MDRS was, "Wait? What? We're already (just about) there. We have to do 2016 all over gain?"

This embracing of the NPS-UD, how did that pan out for housing affordability?

The latest version of the NPS-UD is only a few years old and is having a significant effect with lots of new apartments in the pipeline.

And, somewhat topically, a recent article in the last few days points to the cheapest places to buy are apartments in inner city zones.

So overall, quite well. In another 10-20 years we'll all be wondering why we didn't do this 70-90 years ago.

Of course, they are cheaper because they are smaller. Plus they were the ones hardest hit when the flow of overseas students was cut off.

And they are only cheaper relative to the other overpriced other housing. But they are still way more expensive they need to be.

And if given the choice, most people would prefer something bigger than they are in now, especially if it was more affordable.

Also, it would allow bigger apartments in the inner city zone that are more affordable, so families could also live closer in.

If the purpose was to provide truly affordable housing by removing the non-value added costs from the system caused by policies that allow monopolistic speculative rentier gain it to be made, they would also relax the out with the up, but they chose not to.

The price of all housing is set at the fringe, if you want more affordable inner, then you need to remove the self-imposed costs with no added amenity policies that restrict the fringe.

I'm curious to see whether townhouses will become cheaper. The existing ones. There is no longer a tax insensitive for investors so they will likely pile back into older traditional houses. This could be a ray of hope for FHB's

They'll still be more expensive than older traditional houses. An investor should still find a townhouse attractive, because they need less maintenance and are legislatively "healthy" homes.

The building act does not require heating in a new home.

No, but it does outline thermal requirements, broken down into nationwide zones.

Attractive at typical yields (gross) of 4 to 4.5%? With minimal land and therefore less likelihood of bigger capital gains?

Depends what someone's motivations are. Capital gains (or even retained value) will likely feature for some, but many people want as few headaches as possible.

re ... "... so they will likely pile back into older traditional houses."

Dumb ones will. The smart ones were never interested in the "house". Only the land on which the house sits. Land goes up in value. Houses don't.

It's also a better yield.

Working kinda sucks so the prospect of an income you don't have to show up for definitely has some demand.

Houses do go up in value though. If you wanted to replicate a 50s era rimu state house with timber joinery today, it'd probably be double to triple the cost of a GJ Gardiner shoebox. Ultimately the function is the same, bedrooms, lounge, kitchen, bathroom etc, and there's no alternative outside a tent or caravan etc.

If hideously overpriced housing is to be the permanent paradigm in our beloved country, there are two assumptions that come to my mind. Either;

a) Home buyers will be obliged to work longer hours for money than ever before. Quality of life and time spent with family declines as a result, or;

b) Productivity and wages must dramatically rise.

Anecdotally, I get the impression that a) is already happening and that b) is not.

Is there any hard data out there showing the amount of paid hours mums and dads work over generations?

We’ve all heard of previous generations requiring only one breadwinner to support a family but this could be somewhat exaggerated or embellished? Could NZers work even harder while trying to enjoy life and raising families?

In terms of productivity and wages, the data I’ve seen is not looking impressive. Input costs are eating into margins. Immigration levels are very high per capita, thus can anyone tell me if this will magically increase wages and productivity per capita in New Zealand?

I come to this website for new insights. Yet from the people who promote the idea of continually rising house prices, I have seen no recent arguments of substance that would suggest a permanent rise in prices in the face of higher interest rates.

Unless both men and women are working insane hours on average compared to previous generations and productivity is dramatically increasing, I find it hard to see further increases in house prices.

No one's worked out sure fire exponential prosperity once a market matures past manufacturing. There's small glimpses in the likes of Singapore and a few Nordics, but not an easily repeatable formula.

The alternative to the formula you have laid out, which I agree with and can only see further slide, is for the individual to try and address opportunities outside of working for someone else.

"Is there any hard data out there showing the amount of paid hours mums and dads work over generations?

We’ve all heard of previous generations requiring only one breadwinner to support a family but this could be somewhat exaggerated or embellished? Could NZers work even harder while trying to enjoy life and raising families?"

I can only give an anecdotal example, the house I grew up in was paid for on a single income with six kids in the 80's/90's. We are a double income household with 2 kids but despite being wealthier income wise with less dependants than my parents we wouldn't be able to afford the house I grew up in.

For many recent owner occupier buyers, debt to household income ratios are higher now than prior to 2000's.

A lower household debt to income ratio means reduced financial vulnerability, and increased financial resilience.

A higher debt to household income ratio, means increased financial vulnerability, and reduced financial resilience.

Note that many owner occupier mortgages today require 2 or even more household incomes today (a couple who are both income earners combined with others such as boarder, flatmate, other family member such as sibling, parent, adult child, etc), compared to the single household income earner previously.

Perhaps the norm of two working parents is actually the main cause for prices rising? It may act as a way of raising the floor so to speak. We have seen huge from the technological progress of the last 30-40 years (better appliances, internet connections, cheaper clothes and consumables). However, rather than leading to more leisure time, this process been converted into house/rent prices as we all put our extra 'gains' into a scarce resource (land).

Elizabeth and Amelia Warren make an argument similar to that in the two income trap

It sorta leads to two issues:

- single income households struggle to compete for housing

- wages are lower because the workforce population has multiplied

All what you are saying is true and has been well known for decades now.

Review the Demographia 2023 report as pointing to the reasons and solution.

The system has now been designed to extract as much as it can without killing the host, like any good parasite.

Basically in an system the rewards or savings are always captured by the most restrictive part of the system, which in this case is land due to poor land policy followed now by council consent control.

Your option B of incressing wages/income can never work under such a system as the increase is a 'saving' because for an instance it makes housing slightly more affordable increasing demand but not at the rate of supply thus house prices increase within one build cycle.

Any extra money that a person recieved on the wage increase in effect goes to the house and since it can be leveraged through a bank loan, then the house price rise is a multiple times of any income increase.

And then interest rates go up as well.

I would hate to be a first home owner today. The multiples they need to overcome to buy their first home are simply ridiculous. I have only had three homes. My biggest loan was $100k. That loan was no where near one times income. My current home is worth around $3m. Anyone who says the boomers had it harder than todays FHBers is talking nonsense. Us boomers have had the best years.

It doesnt help by having 'out of this world' interest rates. Boomers like yourself rant about interest rates in their day, they forget that under Don Brash rates went skyward in 2007 making a new owner of an ordinary house pay what was then ridiculous sums per week to live there. Its funny but I don't hear any of those 2007/2008 buyers complaining they made the wrong decision.

I am not one of those boomers who rants about the high interest rates we endured. Quite the opposite. In 1987 we bought our second home for $135,000 with a loan of $49,000.00. Our interest rate was 22per cent but for only a few months and they dropped quickly as inflation deflated. Even at that rate we were better off than people today as our loans were so small. That house would be worth $1.5m today at least. I acknowledge I am a boomer and I was lucky to be born when I was. I retired at 58 and I have never owned a rental. I would rather watch paint dry.

You had a low LVR and good equity, was this through capital gains on house 1

What did your interest rate drop to after it started reducing, I saw mortgage rates of 16 percent in 1992 advertised as "special low rate"

Bought in 84 for $69k and sold in 87 for $90k. All paid off in 3 years as 84 loan only $49k. New loan of $49k in 87 for a $135k home which was paid off pretty quick. That was sold for $310k in 96 and bought my current home for $490k in 96 with a $100k loan. I have been very fortunate in terms of housing. That’s why I helped my kids into their first and second homes. Their numbers are much bigger than I ever faced.

👍

We're looking to buy but unfortunately house prices are still too expensive here in Tauranga. As an above median household income family we can only afford the bottom 10-15% of the market which mostly consists of small 2bdrm houses/units and run down old 3bdrm money pits. Hopefully prices stay level so our incomes catch up so we can afford a bottom quartile house next year.

So what are you actually earning ? I know of a couple in the early 20's on very average money who moved into a brand new house a few months back and they have to have flatmates. Not sure you can realistically expect to move into a decent house without flatmates so unless you want to compromise for 7 years or so you have to start cheap.

$140k annual household income debt free, 2 kids. Maximum borrowing amount = $540k. A "decent house" is more than we can afford anyway but there's no point in buying a house that could cost significantly more in the long run in maintenance/repairs.

"Not sure you can realistically expect to move into a decent house without flatmates"

This line of thinking has been normalised for owner occupier buyers in NZ, that people have missed the big picture, and bigger issue for NZ with its unintended social consequences.

If this is the only way that first time owner occupiers can afford to buy, how can first time owner occupier buyers with 2 children afford to buy? Or single parents with 2 children. How about renter households with 2 children who are unable to get a deposit together?

This line of thinking has been normalised for owner occupier buyers in NZ, that people have missed the big picture, and bigger issue for NZ with its unintended social consequences.

Add in that the time it takes to save the 20% deposit has increased with the house prices and hence FHB's are often in their 30's now. How then do they consider having a family if they can't afford not to have flatmates/boarders? And as you already noted, those with kids, be it by choice or by accident, are significantly disadvantaged in this aspect if they wish to own their own home one day.

We were only able to buy because we have two six figure incomes and no kids. That’s what it takes to do it without killing yourself in the process. The once ordinary becomes extraordinary.

I'm glad you pointed it out otherwise I would be coming across as a bit of a bastard if I said simply don't have kids, problem solved. I did it on a single average income with one flatmate, it was more common to have at least two flatmates back in the day. All about priorities I guess.

Wanna know where the problem lies in our housing market?

Go and look in the mirror.

Renter? Go and look in the mirror.

Owner occupier? Go and look in the mirror.

"Investor"? Go and look in the mirror.

Baby? Toddler? Primary, intermediate, high school? Get your voting age parents to go and look in the mirror.

Looking to buy or already bought? Answer me this: Did you factor the capital gains into your decision? (e.g. "But in 20 years it'll be worth 4 times as much.")

And did you buy at the maximum you could afford to maximise those capital gains? (e.g. "My wages will go up next year and the year after but the repayments won't. It'll be a struggle for the first few years - but we'll be fine.")

Kiwis - you're as dumb as dirt.

Not having a capital gain tax means everyone is driving up the price of houses. We've become drug addicts to un-taxed capital gains.

And the winners? Not you. Very, very few people get much more than a 5% return p.a. after all expenses and costs are truthfully taken into account. And for many, their house is probably worse than lowest performing pension fund they could have invested in.

So who are the winners? The real winners are banks. If house prices were to stop rising they'd become obvious for what they really are .. Vastly over valued utility companies.

The real issue is our tax system.

Un-taxed capital gains are just one issue. But as far as house prices are concerned, they're the major issue in NZ. (And before people say CGTs haven't stopped house price rises in countries that have a CGT, I'd suggest they look at those countries and see the level the CGT are set at - and for how long they've be set as low as they are. The "property class" has significant influence on how taxes are set. As our recent election has shown.)

Try this. Next time you hear a person whining about how unaffordable house prices are, ask them if they support a capital gain tax. If they answer "yes", ask them who they voted for to see just how dumb they are. If they answer "no", then they're as dumb as dirt, and you should tell them to stop whining and making a fool of themselves.

Introducing a CGT is like increasing the pension age. We all know we need to. But how old you are significantly influences your view. Much like whether you own a house influences your view on whether we must have a CGT (and must reform of the rest of the tax system).

The answer is simple and obvious. Get the CGT on the books and start at a very low level but mandate that it increases over time.

Like I said, us Kiwis are dumb as dirt. We get everything we didn't know we were voting for.

The answers no where near that simple or obvious, because the same sorts of affordability issues experienced in NZ are occuring in other places with capital gains taxes, DTI thresholds, and all other manner of legislative attempts to do anything but resolve the issue of affordable new house supply.

Very, very few people get much more than a 5% return p.a. after all expenses and costs are truthfully taken into account. And for many, their house is probably worse than lowest performing pension fund they could have invested in.

GetFeeling hasn't considered the fact that houses provide returns. Owning a house means you don't need to rent. Owning an extra house provides a rental return. I doubt, if you factor this in, that houses perform worse than the lowest performing pension fund.

Sorry Zach. I have factored in the "returns" an owner occupier gets from not paying rents. And I've calculated the returns from owning rentals in Auckland. Please don't assume such basic economics escapes me.

For example, have you ever calculated the difference between an owner occupier that needs a 3 bed/1 bath/1 car garage but wants a 4 bed/2 bath/2 car garage place? Do you know the difference between how much the want and need costs? (Hint: it's massive!) But dumb Kiws - maybe even you - think about the un-taxed capital gain and leverage themselves up to their necks and beyond because their maths skills are truly hopeless. Try it. Work out the difference between what you need and what you want and what the difference would earn at 5%. Start with something simple, like a 2nd hand Toyota Vitz vs. a new BMW 3 series.

And when I said "costs are truthfully taken into account", do you know how many "investors" are truthful? Of the hundreds I've surveyed, I can count them on one hand. Three wished they'd never bought a rental when we did the maths based on their honest assessment. That leaves just two with the skills to actually make it better than 5%.

Well, you should have mentioned that in your first diatribe. Kiwi math skills may be poor and sure there are no doubt better "investments" but housing is embedded in NZ culture, especially when one has to borrow megabucks to make that investment. On the whole people have done okay up until now. Not super great but reasonable. They also want, or is it need, to buy a house as their first big investment for more reasons than just an investment.

You sound like someone who has lost out on income because people elected to invest in housing rather than what you were offering? A lot of people don't like their wealth being looked after by other people. Too many horror stories.

The capital gain on property is really just property keeping up with inflation.

And if you read a bit more carefully you will see he mentioned the low rate that CGT is set at in other countries. The level of the tax is pretty important, not just whether the tax exists. They lowered it in Aus, right?

Some of the countries with the highest CGTs are also home to the worlds most expensive housing markets. Like 30-40%. It's because they're expensive because the demand for housing in these places greatly exceeds supply, or supply is very expensive to implement - the tax doesn't do anything but add to the already high cost of the transaction.

Herding millions of people into the same pen and expecting middle class blue and white collars to compete with Lawyers, Plastic surgeons, CEOs, and people with 20-30 years more career and savings behind them for housing is always going to be problematic.

Like where? You throw lots of unsubstantiated ’reckons’ around.

Austria has one of the highest CGTs, about 27% I think. And Vienna has house prices much lower than most comparable larger cities in Euro. Although how much of that is due to a high CGT versus a large provision of social housing (for even middle income households) isn’t clear.

Here's a list

https://taxsummaries.pwc.com/quick-charts/capital-gains-tax-cgt-rates

Basically, there's no real correlation between a CGT, and better housing. It's just the state coming along for the ride.

I'm all in favour of things that work. I'm less interested in the costs of legislating, measuring and implementing things that don't get the results people are expecting.

Surely you jest? You're not one of those people that takes income tax rates (PAYE) ... in isolation ... and concludes we're highly (or lowly) taxed in NZ? You're not that person right?

Or perhaps you are? You say, "there's no real correlation between a CGT, and better housing". I.e. taking just one tax from tax systems that involve many, many taxes - that have many different ways to implement them - doesn't that strike you as just a tad naive?

But when you say, "It's just the state coming along for the ride." It all become clear. You just don't want to be taxed.

You've held up a CGT being the primary reason house pricing is what it is in NZ. I can't find examples of CGTs improving affordability when implemented, nor stopping price increases.

You haven't presented a valid case for your assertions that everyone else is dumb as dirt. You could maybe make a case for CGTs offsetting other tax, which would be a truism.

State coming for the ride = the state gets to capitalise off house price escalation. It's actually a disincentive to them doing anything tangible about new housing supply (cause it's hard and expensive). They also become reliant on values increasing because they want the tax proceeds.

You can't resolve price escalation without first addressing supply. Everything else is bullshit and jellybeans.

Maybe GetFeeling could make a better case if he wasn't so disagreeable?

I'm confused now that he has admitted to owning rental properties.

It's hard to take a position seriously when the person making it leans more towards "everyone else is a dumb dumb" than using some sort of evidence or rationale based case.

re ... "Some of the countries ..."

Which ones, Painter? Representative ones? Or were you referring to Monte Carlo? I can wait.

Ah Painter. We know you hate CGTs. And we know why. You're older, and you have a few rentals. (I'm older too. And I have a few rentals. But I'm far less selfish.)

But now we also know you can't read when you said "because the same sorts of affordability issues experienced in NZ are occuring in other places with capital gains taxes...". Re-read what I said on this issue. And then hit the books. Let me know when you've educated yourself whether what I've said is true.

I'm not that old and don't have rentals. I like money to use not money on paper and residential renting isn't super productive.

Read my other post. Places like France and Austria have 35-40% CGTs and crazy prices. Do you think if the CGT was 100% there house would be dramatically cheaper (in actual likelihood they'd get more expensive as people would be less inclined to liquidate them)?

You are correct re CGTs.

Another example is California has both a state and Federal CGT and very high house prices to median income, and Texas has no state but does have a Federal but has very affordable prices.

Likewise in Aussie Victoria has CGT and other States don't yet all prices are high.

The tax just becomes a revenue take.

People find it hard to understand for some reason that adding costs does not make something more affordable.

Yep. It generates more revenue, but the public pay for it.

It'd be like thinking a GST would make goods cheaper.

Lmao did you really just compare California to NZ?

California has one of the biggest economies globally and it's just a state, the very place of silicon Valley and huge money.

Of course it's going to have high demand, it's one of the most sought after places to live globally and in media.

When you corner a ponzi participant they get desperate. I would've paid for a ticket to the clown circus had I known it was going on.

Just to add to that. They could implement a law in which you have to have a toe amputated to buy a home in Cali, and the market wouldn't budge.

How y'all compare Cali to Auckland for example is delusional.

Auckland is more comparable to California than most other places when you think about it. All of Africa, Pacific Islands, Asia, Russia, Middle East, South and Central America...

The two are a semi-different experience visiting them, that's for sure. California actually has some affordable housing, just not in cities like LA or San Fran. So that's the comparison, other cities that are major draws for both locals living outside of them, and migrants - there's a consistent demand exceeding supply. Ditto Melbourne and Sydney, Seoul, Paris, London, Bangkok, etc etc. That's not to say Auckland is of similar quality, size and attraction, just these are all major regional cities, all expensive, none of their affordability issues being solved by implementing things like CGTs or DTIs.

If anythings silly, it's living long term in any of these places unless you're earning less than $500k a year.

You completely missed the point.

The main comparison was between California and Texas.

Where they are more similar in economy and under the same Federal system, yet Texas median house price to income is less than half of California's. The reason for the difference is state land use regulation.

And you need to explain why you say the reason for California's high property price is because of their economy and thus is not comparable to Aucklands economy, yet Auckland has higher property prices relative to income.

The answer is because our land use regulation is very similar to California's.

This information has been well known for decades.

You need to read a bit of Alan Evans, Alain Bertaud, and review the latest Demographia 2023 report.

re ... "resolve the issue of affordable new house supply."

On that we can 100% agree.

It is interesting to look at the ratio of land value to dwelling value. Or put another way, when a "house" in NZ has a value placed on it, how much is the land valued at vs. how much the actual house costs to build and maintain.

In Auckland we're way out of wack with other major cities. Why? Mainly because our Councils have been wildly slow to embrace going up. How slow? Some would say 50 years too slow (although I'd say 70-90 years too slow!)

We invented cheap cars, built cities around them, and couldn't project what an issue that'd be.

You are taking about the median multiple ratio.

Review the latest Demographia 2023 report.

And there is no correlation anywhere in the world where density is a proxy for affordable housing.

If that was true then Hong Kong with the most dense housing would have the most affordable housing not the most expensive.

I don't think it's that simple Dale. The price pressures in Hong Kong would be even higher if they didn't have high rises and had sprawled across every available space. The fact remains that sprawl costs more to society to provide than higher density, that will only get worse as the maintenance costs for spread out sprawl infrastructure starts to fail 50 odd years after it was built back in the 60/70s. You can see this playing out already with potholes appearing everywhere. We're running a few years behind UK and US but the infrastructure failure with really start to bite in the next decade.

High density doesn't stop values rising, but it does allow for cheaper individual dwellings.

Hence you can buy a 2 bedroom apartment in central Auckland for $300k, but you'll need to spend double or triple that for even a townhouse.

If a Hong Kong apartment is expensive, a townhouse there is moonbeams.

"If a Hong Kong apartment is expensive, a townhouse there is moonbeams."

Imagine buying a residential dwelling on a LVR of 80%. After 11 years, the owner would still be in negative equity. It would have been better financially to rent. The owner has lost 145% of their equity used as a deposit (before any sales costs)

Property prices in Causeway Bay plummet as owner suffers losses of HK$4.23 million over 11 years, marking a 29% decline.

https://www.dimsumdaily.hk/property-prices-in-causeway-bay-plummet-as-o…

Yes, it is not that simple, but not that hard either. You are not seeing the big picture of how land economics works.

My point is that density is not a proxy for affordability. That's what the evidence shows.

Every city in the world has a higher density center (except Moscow) that then sprawls the further you go out (unless there are some physical constraints), even Hong Kong which is attached to China. IE most of Hong Kong's resources that they need to survive come from outside of Hong Kong. Same with Auckland, and any other high-density area.

You cannot separate resources needed from the surrounding sprawl all cities create, yet you can affect the price by arbitrary regulatory lines drawn on a piece of paper.

Also, any developer (I was one) will tell you lower density is cheaper to construct, and the maintenance issue is common to both high and low density and is more a matter of poor operational planning. Further, the 'sprawl' roads could be further saved from wear by stopping all traffic that was going to supply the high density. Remembering it is these roads that carry the burden for everyone, including the higher density.

High density has very low resilience in an emergency. This was shown in the Christchurch Earthquakes, and more importantly, completely dispelled the myth that a city center is the heart of a city and without it, the city could not exist. The truth was that within a few days/week, most businesses had moved to the suburbs and could more efficiently carry on their business.

The irony is that over the last decade, council ideology has been forcing and subsidizing people back into the city.

When the free market is allowed to work, then at any density, housing is more affordable. For example, Houston as we know is a low-density city, but has high density in some areas easily double what Auckland has, but at half the cost on a like-for-like basis. Further, it now has one of the fastest urban intensification rates in the USA for the very reason its organic market sprawl growth gave it the future space to naturally fill in the space with high density as the supporting infrastructure allowed. And all prices are very affordable.

Restrictive land use policies forcing growth always allow rentier monopoly markets to capture unearnt gains. That's what we have in NZ, as the prices show.

I understand land economics. I do see the bigger picture.

"My point is that density is not a proxy for affordability. That's what the evidence shows."

I never said it was. All things being equal density will be a proxy for affordability in most situations. The issue is that not all things are equal. You're not comparing apples with apples when you compare Texas and California or Hong Kong.

The loosening up of density restrictions in Auckland's Unitary plan resulted in stagnating rents and better affordability. The surge in prices over COVID was due to other factors. There is very good evidence density does mean better affordability, especially if you also take into account externality costs like transport and maintenance.

You need to read some Alan Evans, and Alan Bertaud for a refresher on land economics, which is universal, that's the comparison I am making. It's easy to make valid comparisons if you are comparing economic and regulatory policy. You can even do it with Auckland as to why prior to 1993, housing was 3x median income, but since then it has risen to be 10X plus, even though in the majority of cases there has been an increase in the number of people in the household who are contributing to that income.

It makes more sense to look at countries that have affordable housing and follow their regulatory example if you want affordable housing, rather than countries that do not have affordable housing and have the same problems as we do.

Also, you say you never said density was a proxy for affordability and yet further down you there is good evidence to say density does mean better affordability. But again you missed the point, as you are only comparing 1) a small unit in the same unaffordable market with a larger free-standing dwelling house in the same unaffordable market. The question is, why are they ALL unaffordable by international definitions, and in comparison with the same metric being compared against other countries?

The classic myths are Auckland housing is expensive because 1) Desirable city, has high interest rates, high immigration etc. This makes no sense logically when other jurisdictions can claim that, and yet have very affordable housing.

As the theory is explained by the likes of Adam Smith and Alan Evans etc, and the evidence as shown in the NZ Productivity Report into Housing and the Demographia Report 2023, the common denominator between affordable and unaffordable jurisdictions world wide is land use regulation. Those that have less regulation for both up and out have more affordable housing and those that don't have unaffordable housing.

You are hitting the nail on the head. But here is a real world example of a buddy of mine.

Purchase price 2013 oct. $375,000. $20k deposit.

Total costs of ownership over 9 years = $444,000. Including deposit, mortgage payments, rates, maintenance, renos, insurance.

Following the sale ($1.14m) and realtor fees, laywer etc return = $556,000 gain. ROI over 8.8 years = 125%. Annualized ROI 9.63%.

This doesnt take into account the approx 3,000 of unpaid labour that went into the maintenance and renos during that time.

Better than most.

At least they turned their 3,000 hours (it's usually underestimated) into cash ... (at a low hourly rate).

Another major hurdle for FHBs (in addition to absurd DTIs) is NZ's 'sale-by-auction' rort.

It doesn't take many unsuccessful auction attempts to burn a significant hole in your savings, and moral.

This is particularly true in ChCh, where we seem to have an auction fetish and the market is a minefield of EQ repairs..

Yeah basically paying money to not buy a house. Lots of people paying thousands on builders reports/valuations etc only to be outbid or reserve being higher than pre approval.

"Lots of people paying thousands on builders reports/valuations etc only to be outbid or reserve being higher than pre approval."

These conditions combined with increasing house prices can cause fear of missing out, and result in owner occupier buyers overpaying.

Indeed. Also factor the dozens of hours chasing insurance and doing due diligence, as well as the mental toll of getting "auction ready" and going into battle.

It got to the stage where I was prepared to pay well over the odds to avoid putting myself and the kids through that wringer anymore (and to never have to stand in a room full of unctuous RE agents and their fluffers ever again....)

Man I feel for young buyers with limited resources having to go through that.

There usually are plenty of alternative options to auctions. Every month thousands of homes are bought and sold, compare that to the interest.co auction numbers.

Auction is good if you need price certainty under extenuating conditions only, but only gets you 1 bid higher than what the second-highest bidder was willing to pay.

You can't guarantee that, so other methods are often better for optimising the deal.

Don't worry, government has your back, with a knife in it. Actually the bank has your back and your soul, the pain is free though.

Beware of those with vested financial self interests in the comment section telling owner occupiers to buy under ALL market conditions.

Here is something to consider.

For those who require accommodation:

A) under most market conditions the financial choice is between:

1) pay rent

2) buy their own owner occupied residence

B) under market conditions where there are elevated house price risks, the financial choice changes to:

1) pay 10-20% higher rent

2) risk losing 50% - 250% of their life's savings / entire net worth (assuming their net worth is used as equity on a deposit on the purchase of an owner occupied residence) when they buy their own owner occupied residence assuming a 80% LVR mortgage

Most owner occupier buyers are unaware of market conditions when the financial choice changes from A to B and taking on the risk of losing 50% - 250% of their life's savings.

Over the past 2 years, it would have be better financially to rent rather than buy an owner occupied residence using a high LVR loan. There may be non financial reasons for owner occupiers buying in the last 2 years (and these were of a higher priority than the financial reasons), and they chose to buy - they are now facing the financial consequences of that choice.

These buyers of their owner occupied residence might be regretting their choice to buy - they are now in cashflow stress, potentially mental stress - https://www.nzherald.co.nz/kahu/peak-ocr-pain-auckland-couple-working-f…

Look at this Kiwi buyer in Australia - initially overjoyed when they purchased. Now in cashflow stress, and potentially mental stress - https://youtu.be/Nomji5pmhEU?&t=45

At the time, this guy disappointed that he was unable to obtain financing but it was actually a blessing in disguise as he was saved by the bank - if he had purchased, there is a high probability that he would have faced significantly higher cashflow payments, potential cashflow stress - https://www.newshub.co.nz/home/money/2021/11/first-home-buyer-not-very-…

Now he can use his increased deposit to buy a similar residential property at lower prices and take on less debt to finance that purchase. They will pay a lower price and less interest over the term of the mortgage due to lower amount of debt.

There is a lot of unsubstantiated claims being made by those with their vested financial self interest.

Here are some financial calculations for owner occupier buyers to think about. The Peaker and Buyer Today.

How does this compare with a Peaker and a Buyer Today (BT) in NZ?

1) Peaker

The median house price at the peak for Auckland was $1,300,000

With an 80% LVR, this is a mortgage of $1,040,000

The 20% equity is $260,000

2) Buyer Today ("BT")

The current median house price for Auckland is $995,000

For a buyer who waited, and used the same $260,000 equity used above, the mortgage at this price would be $735,000 (an LVR of 74%)

The Peaker has a mortgage which is higher by $305,000 (mortgage of $1,040,000 for Peaker vs $735,000 for BT)

As a result of that additional borrowing, at a 6.8% mortgage interest rates over 30 years, Peaker is paying $722,000 more over the 30 years than BT.

Assuming same incomes, and same living costs (food, travel, etc except mortgage), BT can save the $722,000 in payments that Peaker is paying.

Remember that at the end of 30 years, the house price will be EXACTLY THE SAME for Peaker and BT.

BT will have more money available for retirement than Peaker.

The annual payment on the additional mortgage of $305,000 is $24,087 per year.

1) Peaker pays $24,087 more per year than BT.

2) BT instead saves that same $24,087 per year. At a deposit interest rate of 5.8% (after 33% tax is 3.9% p.a). Saving $24,087 per year and earning 3.9% per year in net interest after tax for 30 years comes to a total of $1,325,473.

$1,328,473 - this is money that BT has available for retirement after 30 years that Peaker will not have.

I wonder if those calculations stay valid for 30 years at a time.

"I wonder if those calculations stay valid for 30 years at a time."

Market conditions change and the input of those calculations change. And the output changes, and based on that output, the decision may change.

At some point, the better decision will be to buy rather than rent.

Everyone should do their own calculations based on their own set of circumstances.

For sure. Some even don't fixate that much on the raw finances of it.

"Some even don't fixate that much on the raw finances of it."

That choice demonstrates their level of financial literacy.

The purchase of a residential dwelling is likely to be the largest financial decision that most owner occupier households make. As a result, this is likely to have the largest financial impact on that household's financial well being at retirement. Many owner occupier buyers are unaware that this single decision can have financial consequences that affect their entire financial future.

If people choose not to focus on that decision, that is entirely their choice. They are free to choose, however they are not free to choose the consequences of their choice.

Under conditions of extremely elevated house price risks, purchasers using high amounts of debt, are unknowingly at increased risk of getting into a potentially financially vulnerable position, and cashflow stress.

That choice demonstrates their level of financial literacy.

Not necessarily. If it's a home for someone, they are potentially going to be applying other values into their decision outside of money.

"If it's a home for someone, they are potentially going to be applying other values into their decision outside of money."

Yes, owner occupiers frequently use non financial criteria, yet there will be financial consequences of using that non financial criteria.

Refer peaker vs buyer today comparison for purchase of the same house at different prices - this is the financial literacy that I am referring to. Is the extra price paid by the Peaker over 30 years worth the non financial benefits? For most, if they knew and looked at those calculations, it is likely that very few would pay Peaker price.

How do your numbers work if the bought at peak at 3% for 5 years, vs buying today's prices at 7%. Don't actually know, and you like doing figures.

"How do your numbers work if the bought at peak at 3% for 5 years, vs buying today's prices at 7%. "

The Peaker scenario above is calculated on a mortgage interest rate of 3.18% p.a for 5 years.

After Peaker interest rate resets, Buyer Today and Peaker are paying the same interest rate.

"Yes, owner occupiers frequently use non financial criteria, yet there will be financial consequences of using that non financial criteria."

There are almost 20,000 house owners who are in cashflow stress and likely mental stress. They could lose their home. Many of these borrowers put themselves in their current situation due to their earlier choice to own a house and buy when house price risks were high and take on a lot of debt relative to their income.

Regardless of whether they used financial criteria or non financial criteria at arriving at their decision to buy, they are now facing the financial consequences of their choice.

People are free to choose, however they are not free to choose the consequences of their choice.

https://i.stuff.co.nz/business/money/301018317/almost-20000-home-loan-b…

"Yes, owner occupiers frequently use non financial criteria, yet there will be financial consequences of using that non financial criteria."

The story of a Kiwi owner occupier in Australia.

At the time of purchase, they were overjoyed at owning their own home rather than paying rent. At the time of purchase, she didn't know what she didn't know. Now she is potentially facing the cashflow stress. Is she now happy that she owns her own home rather than rent?

Beware of those with vested financial self interests in the comment section telling owner occupiers to buy under ALL market conditions.

Yes I agree, everyone should stay away from these imaginary people.

"Yes I agree, everyone should stay away from these imaginary people."

People are free to choose to believe that these are imaginary people. However people are not free to choose the consequences of their choice.

The amount of claims there's posts advising people to buy a house no matter what > the actual posts telling people to buy a house no matter what.

What generally seems observable is that securing a home over your life is financially preferable to not (exceptions excluded). That's not the same as saying it's without any form of hazard. Good luck picking timings.

"Good luck picking timings."

For those who are unable to identify and recognise when house price risks are extremely elevated, it may seem like market timing. They are unable to see what others who can identify and recognise elevated house price risks may see.

At the peak in 2021, similar to this. Except change the title to house price risks. (Conditions have since moderated but they are definitely not low)

https://npr.brightspotcdn.com/dims4/default/8184f2a/2147483647/strip/tr…

Again though, the amount of proclamations of over valuation > the amount of times there actually is a peak.

I've been guilty of that a few times. I certainly still feel that way still about many markets, even excluding housing. But they're mostly for assets you can't replicate for less than the asking of what's already available.

If for instance we could make a new house for 30% less than the average existing house, I'd feel more confident of values permanently shifting downwards. Except I know enough about new dwelling generation to know the inverse is more likely.

February 2021 - message from RBNZ governor about house price risks at the time.

https://i.stuff.co.nz/national/politics/300238808/reserve-bank-governor…

At the time, in an environment of rising house prices, many may have chosen to ignore this message.

Under conditions of falling house prices, the message may now have a different meaning by those same readers.

Even owning land freehold, having over 50% deposit and incomes over 100k is still not enough for disabled people to get mortgages in this country so in many ways these numbers do not cover a greater spectrum of those who are forced into the rental market and yet would see the greatest benefits in regards to housing ownership. Those who are not discriminated against by medical conditions (unrelated to their lifespan & job performance) will always find it much easier to get mortgages and to met deposit requirements. Which is why so many coming into the country find it much easier to buy than trying to buy houses in many other countries. In comparison to those excluded from housing it is a trivial matter to raise enough capital for a deposit. Sadly much of our population is still on, around and even below minimum wage. That is the greater barrier to mortgages and housing ownership. That even median wages in the cities are below the banks required DTI of housing in those same cities. It is telling you need more than one wage and now often more than 2 wages, (considering many people aged 25-29 will not have the equivalent of full time work from a single employer like in the health, retail, hospitality, manufacturing industries), in your calculations. It truly is a mad world.

The return of TTP can only mean he's shat his pants as the promised green shoots have withered and he's had to resort back to his spruiking ways. New commentators beware, Tim is a convicted fraud.

I couldn't have worded that better myself - well said!

The whole issue has things around the wrong way.. putting the cart before the horse.

1st home buyers should be those in 25 to 50% (bell graph) or lower middle quartile of net earnings, to be able to save and buy a home.

Its not that the housing market, well near all markets, are expensive, but rather the middle 50% quartile of the national income is no longer matched to the middle quartile of the family net income.

So we should not be looking at making "affordable housing" but rather fixing the source of the problem, fixing the income of the ave middle income net take home pay.

Fixing this basic standard would not only fix housing 'affordabity' , but also, 'poverty', social issues, maybe crime, other market issues, Infrastructure, expansion, maintenance and upgrades.

All we have been doing for the last 50/60yrs is patch the symptoms rather than fix the problem, then wonder why it doesnt go away, but gets worse.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.