Rising interest rates globally brought the 2020-22 house price boom to an end, "but it’s surprising they didn’t do more damage", according to independent global economics researcher Capital Economics (CE).

In a paper titled 'Have we reached the end of the housing correction?', CE senior property economist Andrew Wishart has had a deep dive into the house market performance in: the US, Canada, the UK, Norway, Sweden, Denmark, Germany, France, Spain, Italy, Australia, and...yes...New Zealand, which gets many honourable mentions.

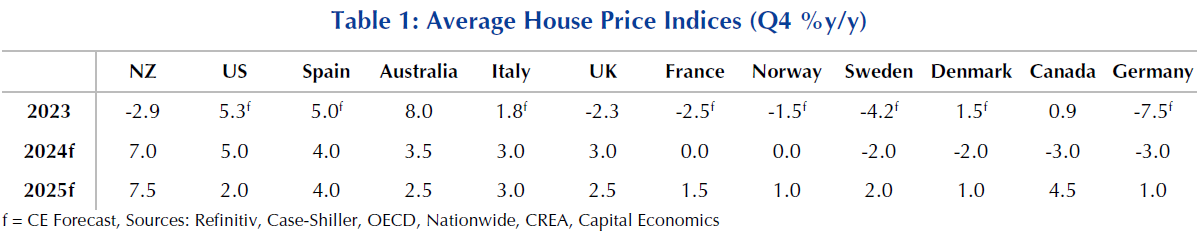

Spoiler alert: Wishart pretty much concludes that we have reached the end of the housing correction, with perhaps a few exceptions. But he's forecasting price gains of 7% for New Zealand in both this year and next - and that's the highest forecast among the 12 countries covered in the research.

"Falls in nominal house prices have been modest in most developed economies and almost non-existent in some others," Wishart says.

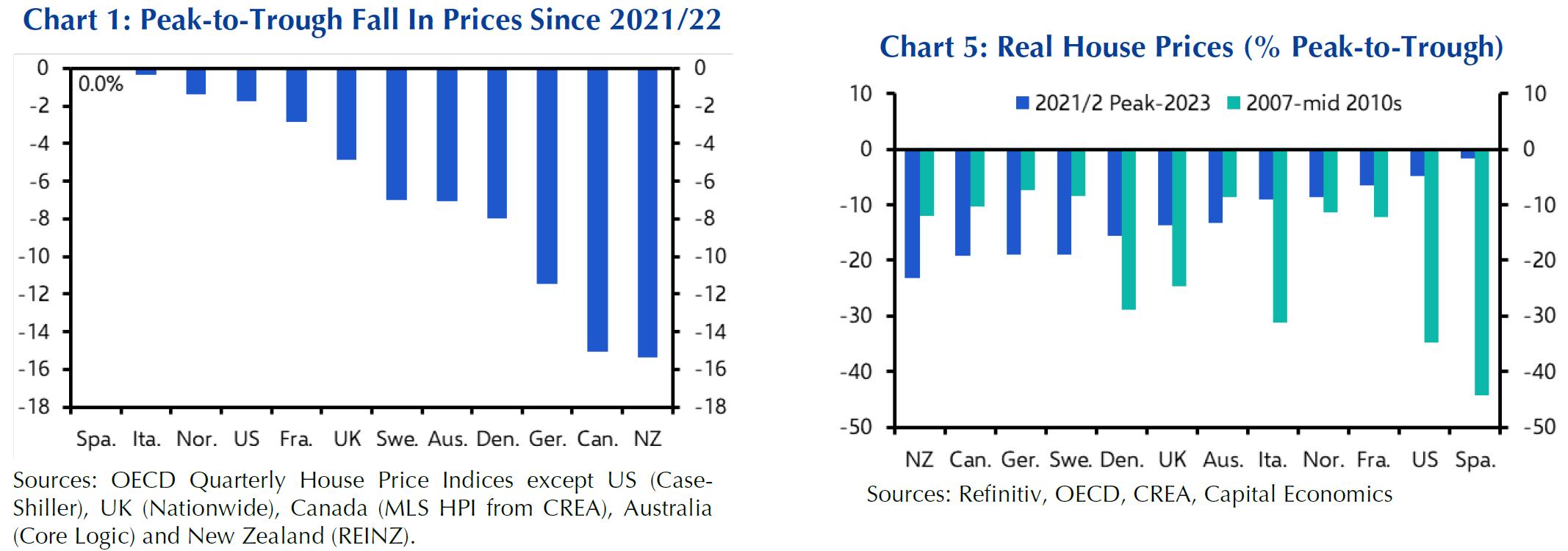

"Of course, that’s partly due to high inflation, including significant increases in pay. But even in real terms, falls in house prices have been fairly small compared to the more dramatic falls in some countries during the Global Financial Crisis (GFC)," Wishart says.

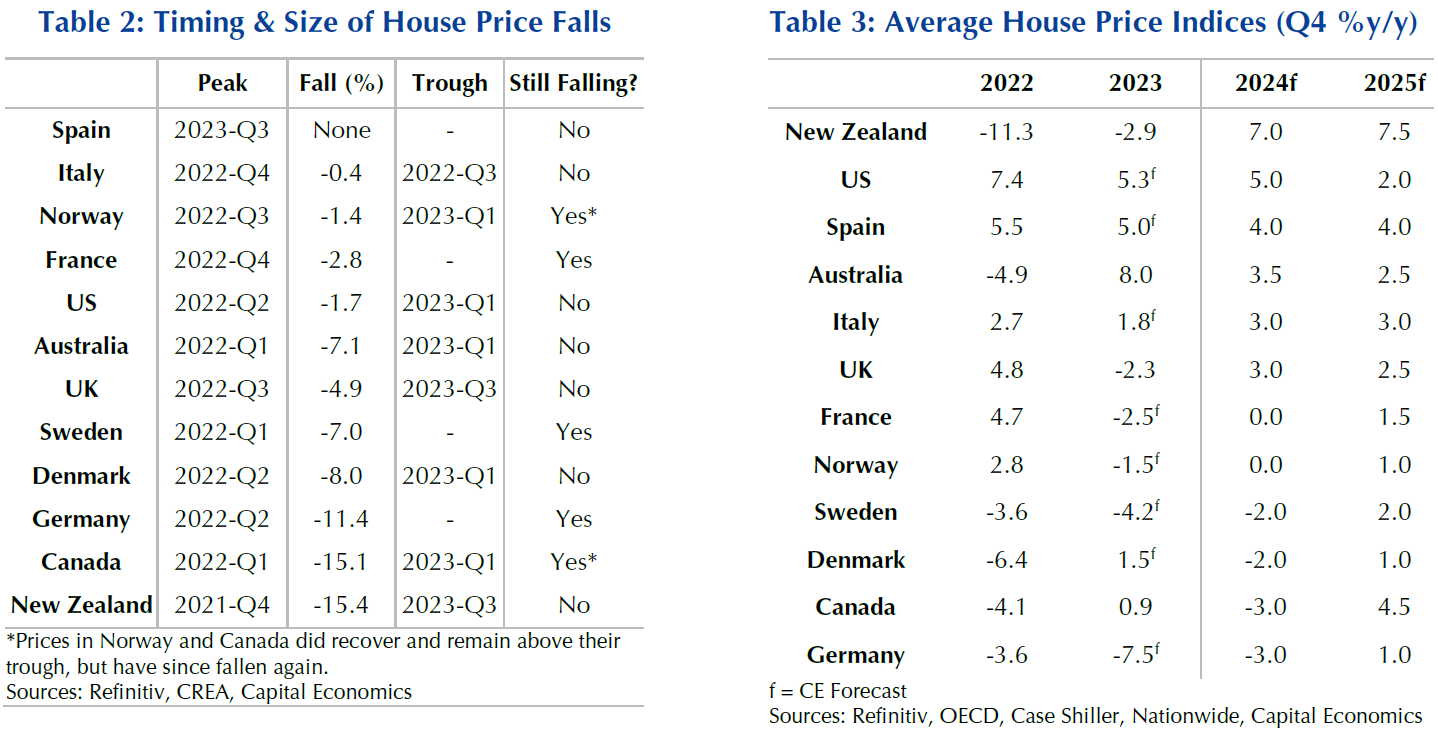

"The average mortgage rate across the countries included in this analysis increased from 2% at the start of 2021 to over 5% last year. That rise in the cost of borrowing caused demand from buyers who need a mortgage to slump. House prices have fallen in most developed economies as a result, with the largest drops in New Zealand (15%), Canada (15%) and Germany (11%). But there are also exceptions. House prices didn’t fall at all in Spain, and only declined marginally in Italy," he says.

In general, nominal house price falls have been smaller than in the GFC, Wishart says.

"Whereas then house prices dropped by an average of 8% across our sample, the peak to trough fall in 2022-23 was 5%. And as that followed the widespread house price boom in 2020-2022, house prices are on average still 20% above their 2019 level and over 40% higher in the US.

"Even in Canada, New Zealand and Germany where prices have fallen the furthest from their peak, they are significantly higher than in 2019."

The most recent data suggest that house price falls have now bottomed out in most countries, Wishart says.

"In Q3 2023, the latest quarter for which we have data for all 12 markets, only five continued to see quarter-on-quarter house price falls in nominal terms compared to 11 in Q1."

However, the picture changes substantially when high inflation in recent years is taken into account. Inflation was close to zero in 2009, whereas it was running at around 7% in 2022 and reached double figures in some countries.

"So in real terms the average fall in house prices was very similar to that in 2007-8. On this basis, most of the rise in house prices since 2020 has been reversed.

"That said, there haven’t been as many cases of dramatic falls in real house prices of over a quarter. The only country that has seen a drop of that scale is New Zealand, where real values fell by 23%," Wishart says.

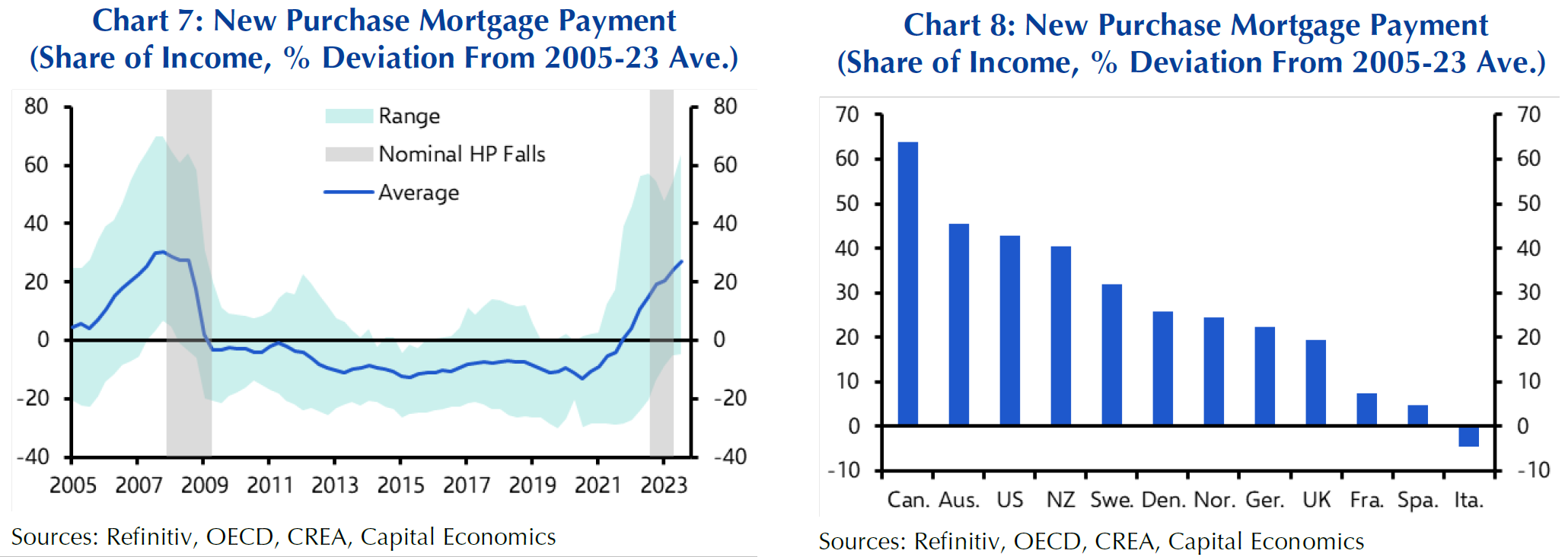

He says with the mortgage rates available on new loans averaging over 5% currently compared to 2% in 2019, mortgage affordability is much worse now than it was then across advanced economies. And in the US, Canada and Australia the cost of buying a home using a mortgage is extremely high by past standards.

"We calculated the cost of typical mortgage payments on a loan for house purchase as a share of average income in our selected economies. For this we used the average mortgage rate on new loans, which should capture the cost of the most popular mortgage product whether fixed or variable rate.

"Across our sample this cost is 30% higher than the average since 2005. In 2007-10 large falls in house prices and cuts to interest rates caused affordability to improve enough for demand to recover and house prices to stop falling, as shown by the steep fall in the blue line on Chart 7.

"The surprise this time is that house prices stopped falling in most places despite mortgage costs continuing to rise throughout 2023. The upshot is that mortgaged buyers are accepting far higher mortgage payments than usual in order to buy.

"Admittedly, there are some markets where affordability is less problematic. In Italy, France, and Spain, mortgage affordability is still around its historical average, and therefore less of a drag on demand. (See Chart 8.) But in Canada, the US, and Australia, the cost of mortgage payments is around 50% above the historical average.

"So, the end of house price declines cannot be explained by improvements in mortgage affordability. In fact, at the current level of mortgage rates, house prices in many countries look unsustainable."

In summing up the position, Wishart says worsening mortgage affordability has led to steep falls in demand and housing transactions in most advanced economies. The sensitivity of buyer demand to mortgage costs varies by country, depending partly on whether there is a large rental market that provides an alternative to buying. But on the whole, given how far demand has fallen, declines in prices have been small.

"Of the few markets that have this sort of data available, only New Zealand saw a period where supply significantly outstripped demand. This helps explain the 15% peak-to-trough drop in house prices there."

So what happens now?

"While we have a good handle on where demand is likely to be weakest on the basis of affordability, whether that will mean house prices fall depends on what happens to supply," Wishart says.

"The softest outcome, which seems to be the course most housing markets are taking, is that prices rise modestly in nominal terms, with the correction coming through a further drop in real house prices.

"We expect that to be the case in New Zealand, the US, Australia, and the UK despite these being the places where house price valuations are most stretched. More plentiful supply in Canada of late means house prices there are set to drop a bit further.

"Were supply conditions to become much less supportive, these markets would be first in line for a much worse outcome, in which prices fall significantly further. This situation would most likely play out if interest rates stay at their peak for much longer and unemployment rises significantly. That is plausible if inflation proves more stubborn than expected.

"However, as things stand it is more likely that house prices in Germany, Denmark and Sweden will perform worst in 2024, due to high mortgage costs and the presence of a large rental market. That said, assuming we are on the cusp of cuts to policy rates as we and most investors expect, the falls in prices should be limited."

88 Comments

Real values fallen by 23% - but definitely not a crash.

"So in real terms the average fall in house prices was very similar to that in 2007-8. On this basis, most of the rise in house prices since 2020 has been reversed.

"That said, there haven’t been as many cases of dramatic falls in real house prices of over a quarter. The only country that has seen a drop of that scale is New Zealand, where real values fell by 23%," Wishart says.

Do you think that other investments are not subject to inflation

TLDR - we expect further real house price falls in NZ.

"The softest outcome, which seems to be the course most housing markets are taking, is that prices rise modestly in nominal terms, with the correction coming through a further drop in real house prices.

"We expect that to be the case in New Zealand, the US, Australia, and the UK despite these being the places where house price valuations are most stretched. More plentiful supply in Canada of late means house prices there are set to drop a bit further."

How does that mesh with their prediction of 7% increases for 2024 & 2025? That is significantly above inflation, indicating that house prices would be increasing in real terms?

A number of very poor observations in that piece. Most people here of course know that the price falls in NZ are much more to do with our high interest rates (world leading, no coincidence that price falls are world leading) than the bolstering of supply. And of course, those high interest rates are unlikely to fall meaningfully in 2024, making a mockery of their 7% prediction.

Well said, agree.

The biggest falls have been large resi in Auckland where the developer purchased for land value of about 4k per sq m in late 2021...

often 800 sq m so thats a cool 3.2mil

often with an old renter on it that is marginal re healthy homes. Right now if they put these to auction they may well only get 2 mil

I know of multiple sites where they are in big trouble. add in interest costs and inflation and they are clinging on, in some cases renting out there own homes and moved in or sold better homes and moved in.

These sites set the marginal price for suburbs, IE my nice house on 800sq m must be worth more then that site , now not so much.

I think there are 10% falls coming this year, people cannot afford to buy at these levels and interest rates.

Hows your subdivision round the back of kaipara

Wainui, thanks for asking, moving along nicely. you are such an ^%$ clown..... (insert your own adjective readers)

Did that get under your skin, my deepest apology

"The biggest falls have been large resi in Auckland where the developer purchased for land value of about 4k per sq m in late 2021..."

In June 2021, a developer / land speculator paid $5,100,000 ($5,400 per sq m of land)

Sold in December 2022 for $3,680,000 ($3,923 per sq m) - 27.8% lower.

New lower land cost for the current owner / developer.

https://homes.co.nz/address/auckland/epsom/12-claude-road/R5XWY

Also note: that on an inflation adjusted basis, the price fall was -32.5% - so much for the narrative that land prices keep up with inflation.

"I know of multiple sites where they are in big trouble"

What are the addresses of those sites?

by HouseMouse | 13th Feb 24, 10:43pm

Perhaps if FBU’s CEO walks then there could be a bounce

What’s your point and how is it relevant?

Banks will start to rein in on bad debt..

The glory days are over..

Stress levels and desperation will start to make a mark

"No profit grows where no pleasure is taken"~ William Shakespeare

Did Wills tell you that himself

You appear to be suffering a pleasure deficit yourself.....

His hands say otherwise 👀

That gives new meaning to Handy-man

Heard that story again today of a bank, having had no mortgage payments made for 2 years, telling the owners not to worry as long as the house is on the market. Makes me worry about bank risk, I currently have a lot deposited with banks and I’m beginning to think they are not all that safe.

"Heard that story again today of a bank, having had no mortgage payments made for 2 years, telling the owners not to worry as long as the house is on the market."

Which bank was the lender?

Sorry I don’t know, just a story relayed to me. The story teller was just as horrified as I was.

Concerning that the market is not operating as it normally does with defaulters being required to leave the market. I fear that with distressed loans not being dealt with appropriately it could all come crashing down at some point.

Thank you for your response.

"I fear that with distressed loans not being dealt with appropriately it could all come crashing down at some point."

The financial system relies on confidence of depositors. That is the reason that Financial Stability is such an important part of the RBNZ remit.

Silicon Valley Bank, Credit Suisse in 2023 is a clear example of what happens when depositors lose confidence in the bank.

Does anyone know if the bank deposit guarantee is up and running in NZ now?

CN,

It's not in place yet. later this year i think.

Probably because the is plenty of equity to pay for the penalty interest and clear the mortgage when sold. Super profits for the bank.

Invest in bricks and mortar and Safe as houses are meaningless sayings when the SHTF

Sure to rise... no that's the edmonds cookbook

I totally agree, prices don't make sense @7+% rates...

The next council RV update is not that far away and on the latest rates bill it stated that in my area prices were down 4% compared to the last time the RV's were done in 2021 so hardly a crash. Still coincidently picking 4 to 5% gains this year so overall pretty flat.

by Zwifter | 1st Dec 23, 9:50am

"One Roof is more accurate. Time to buy was August to October pre election"

You're funny....

If the Spruikers are as long as they are loud, they are going to get hammered here..... it does not matter what day they comment, that day is a great day to buy property... me thinks commission based ...

Supply is not selling and people do not have the ability to meet payments at 7%

down another 10% easy this year and once there offers will be another 10% lower

I recall commenters in this thread being surprised when the trademe listings surpassed the 32000 mark a couple of years ago. Now I believe trademe listings have passed that mark again in the North Island alone.

As it turns out I was correct.

That remains to be seen.

PS I said at the time it was *potentially* a good time to buy if you were in the right place at the right time

Not really, clearly prices are up post election. How long do you hold the window open ? long enough for a DGM to fall out of it on here apparently.

Marginally up

let’s see by year’s end

Those 2021 figures would've been assessed months befoe the were published, so looking at the last three years of inflation (according to the RBNZ calculator) add 20% to that 4% and you have you crash.

Takes six months or more from the date of the valuation for notification

What actually happened is that the new RV was set to come out in June at the peak but was delayed by the council to Feb the following year. It will be interesting to see the new RV's which are scheduled to come out in March, I'm expecting the market gains in recent months to offset the falls so anticipate the RV will be pretty much unchanged. Certainly there have been some huge moves in prices in between but its now pretty much where we started.

You just have to laugh, TA surveys Real Estate Agents and surprise surprise, concludes that house prices are going to go up..... soon, please... he also predicts rates have peaked, as he did at all the previous peaks.....

No flies on you mate

Actually in his latest piece he seems almost pessimistic:

https://www.oneroof.co.nz/news/tony-alexander-why-nz-has-suddenly-gone-…

But the main thing to take away from the data is that for the first half of this year interest rates pressure on the NZ economy will remain firm and this will act to constrain not just our pace of economic growth through crunching retailers, but the initial speed of upturn in the housing market.

Only questioning the *initial* speed of the upturn, lol

TA takes the Planning and Foundations of the next upturn very seriously. Be quick...

I somewhat agree with him that the property market follows a cycle, I guess we disagree in as much as I believe there is a downturn in the cycle and he believes its always a great time to buy and prices are going to shoot up any moment now.

The RBNZ is hell bent to make sure the situation gets no worse, as interest rates drop they will do EVERYTHING possible to limit DTI, slowly young Aucklanders will realise that they cannot afford property and a future here and leave for Aussie where property is cheaper in many desirable locations, and wages are higher then her, and kids goto school and you respect the cops because they carry guns and have dogs....

Once it becomes clear there is a missing generation of FHBers at high prices and a realisation that phillipino famillies on $28 per hour will not replace them, the market is truely doomed at these levels, I suggest that we will return to the longer run averages of DTI for average houses.

The Sham saying only ‘rich’ FHBs can now buy a house. A bit hyperbolic, but not much. Certainly you need a household income at the high end of the middle range.

https://www.stuff.co.nz/money/350179672/first-home-buyers-are-rich-peop…

One wonders though at what new efforts may flow from the drove of MPs with sizable personal property portfolios, to support and maintain higher housing costs. Last time around National ramraided younger generations' retirement scheme to enable them to pay higher prices to existing owners. What next, this time?

My pick is they will pull back on the bureaucrat cull in Wellington to limit property price damage there. Nicola has a house there after all, along with a few other ministers.

Would she realise there could be a causal link?

That would equal no tax cuts. Let's see what happens.

Haha and then she’s goneburger. Or at least that was her promise

Expecting the political rhetoric and political spin to come ...

Yes she might weasil out of it by blaming the previous govt for the state of the finances

That would piss a lot of people off though

That would remind people that she never read the budget and Prefu

The markets are still considering these "high" rates as temporary. FHBs are still prepared to buy and struggle because they are certain it will get easier soon when the RBNZ drop rates. If these high rates get more and more embedded I suspect the housing market is in for some very big falls.

Yes Grasshopper

The real issue here after a decade of more of being able to buy, sell, flip for a bigger number owners are unwilling mentally to accept a loss on sale. Those that purchased during the peak are especially at risk. Someone buys something late 2021 during peak stupidity, in fringe rural NZ for $1.5m on a multi bid auction, how much less do they get today with interest rates at 7% debt and a no one interested auction...?

Will they accept red, or the banks gun to their head...?

I made one sale this week. Purchased $1.3mil Jan 2022. Got it done at $1.1mil--loss on top of the $200k would be selling fees and the upgrades -painting etc that went into the sale. Today I will be presenting $1.2mil Unco versus a May 2021 Purchase at $1.4 mil. Likewise the further loss would be as above. I'm expecting it will only get worse over the winter. There was a November blip that change of Government would stop the fall-think Affordability will rule in the end.

They're on the right track here, except a correct and honest analysis shows 10% gains this year and 15% next year.

Some parts of the country are already nearing a10% yearly gain.

I'd be interested to know which parts?

Wellington 6%

Upper Hutt 7.6%

Queenstown 7.7%

Invercargill 6%

And in other news, someone in NZ got a 10% pay rise today, so we should expect wages up 10% this year.

The facts are there in black and white, go ahead and turn a blind eye if U don't like them x

Some parts of the country are already nearing a10% yearly gain.

I don't think of 6% or 7% as "nearing 10%", but to each their own, I suppose.

And in other news, someone in NZ got a 7.7% pay rise today, so we should expect wages up 10% this year.

- I fixed it for you.

How do we know NZ Q3 2023 is the trough and not just a bull trap?

Don't worry RBNZ will ensure its a bull trap, pay attention......

Nice caveat that is likely to apply to New Zealand before the usual desperados call the bottom of the market etc etc.

"We expect that to be the case in New Zealand, the US, Australia, and the UK despite these being the places where house price valuations are most stretched. More plentiful supply in Canada of late means house prices there are set to drop a bit further.

"Were supply conditions to become much less supportive, these markets would be first in line for a much worse outcome, in which prices fall significantly further. This situation would most likely play out if interest rates stay at their peak for much longer and unemployment rises significantly. That is plausible if inflation proves more stubborn than expected."

And I suspect they didn’t look closely at how much supply is still to be delivered in NZ in the first half of this year. If they did, that would conflict with their position of prices rising 7% this year

cue - builder has not sold a house in 12 months sound bite....

Wage inflation

In the last two and a half years my interest only mortgage has decreased by 20% in real terms without paying a cent in principal. Happy Days.

I pity those whose savings have fallen by 20% in real terms.

What about those with savings now earning enough interest so they no longer need to work full time ?

The best term deposit rate I have heard of is 6.1%. After tax this is a real loss.

Not for everyone it isn't.

The inflation rate is different for different people? I must have missed that lecture.

The bank's credit would have also fallen by 20%. The bank probably isn't too happy with you right now.

I know. My heart bleeds for them.

"In the last two and a half years my interest only mortgage has decreased by 20% in real terms without paying a cent in principal"

Can you help me understand what I am missing here?

What about the asset side?

Two and a half years is 30 months so that is August 2021.

1. An example using the median house price in Auckland:

A) August 2021

Median house price in Auckland: 1,200,000

Mortgage at LVR 50%: 600,000

Equity: 600,000

B) Feb 2024

i) Nominal values

Median house price in Auckland: 975,000 (-18.75%)

Mortgage: 600,000

Equity: 375,000 (-37.5%)

ii) inflation adjusted values using the 20% over the period as used above

Median house price in Auckland: 812,500 (-32.29% in inflation adjusted terms) - 975,000 / 1.2

Mortgage: 500,000 (600,000 /1.2)

Equity: 312,500 (-47.9% in inflation adjusted terms)

On an inflation adjusted basis, I see the 20% drop in purchasing power of the mortgage.

I also see a 32.29% drop in purchasing power of the asset value.

So a loss of purchasing power in the equity value of 47.9% over the last 2 and a half years is the result .

2) Compare that with the alternative of depositing cash in the bank.

A) August 2021

Time deposit in a bank - same as equity above: 600,000

B) Feb 2024

i) Nominal value

Bank interest over 2.5 years after 33% tax rate - 3.7% total over 2.5 years: 622,792

ii) inflation adjusted values using the 20% over the period as used above

Bank time deposit: 622,792 / 1.2 = 513,993 (-13.5% in inflation adjusted terms)

On inflation adjusted terms, the equity in the house of $312,500 is 39.7% LESS than the $513,993 on time deposit. (or the amount on time deposit is 66% higher than the equity in the house)

Fair point CN. I am simply pointing out that inflation adjustments apply to mortgages as well as equity, which is something most people overlook with all the talk about real losses.

I am sure my house value has dropped in that time period, and more so in real terms. But the realisation of this loss will only be realised if and when I sell. And I am not planning to sell for at least 10 years. I am confident that in that time I will experience capital gains that will be over the rate of inflation for my deposit. In the meantime, the rents are inflating and this more than off sets the increased costs in rates and interests.

Thank you for your clarification.

Just wanted to make sure I understood you as well as the complete picture.

Perfect. So you have saved paying about 2.5% of the principal amount by going interest only (assuming it's a new loan @ 30 year repayments).

Assuming a $500k mortgage at 7.35%. Over 2.5 years you didn't pay $13k towards the principal amount, and incurred an extra $2k in interest from a higher principal amount. So that $13k had a carry cost of 15%.

my carry cost comes out at 9% not 15%, but yes you are more or less correct. Interest only gives me the liquidity to invest elsewhere at a ROR of circa 25% so I am not worried.

I'm just trying to point out that if talk about 'real losses' in house prices, we also need to inflation adjust debt and other investment classes as well. Apples with apples.

Capital Economics is forecasting 7.0% average house price growth (in nominal terms) in NZ in 2024.

FYI, for the record, a summary of economist's forecasts for house price growth in 2024 can be found here

https://youtu.be/p-jSj3a5Dko?t=226

The median is 5.2%, with the range from 2.0% to 8.0%

Tony Alexander forecast 10% growth in house prices in 2024.

https://www.oneroof.co.nz/news/tony-alexander-expect-10-house-price-gro…

Also, for the record:

REINZ median house price for NZ at Dec 2023: $779,830 - https://www.interest.co.nz/property/125955/auckland-market-led-house-pr…

REINZ median house price estimates at Dec 2024 based on following house price change forecasts:

1) median forecast - 5.2% increase: $820,381

2) 2.0% increase - low of the range: $795,427

4) 10% increase forecast by Tony Alexander: $857,813

This won’t age well. Sounds like Wishart's pretty optimistic, especially about NZ's housing market bouncing back with a 7% gain forecast. But I’m not entirely sold on that. Even though our unemployment ticked up 25% from the low 3.2 to 4%, it's still not alarmingly high by historical standards. Plus, real interest rates only recently swung positive after a long stretch in the negatives, which means the economy has been running on pretty cheap money for a while. Remember, monetary policy is like a slow-cooker, takes time for the effects to really show. I'd say, let's not count our chickens before they hatch. Deflation, rising unemployment, and more bankruptcies might just be around the corner, changing the game for the housing market.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.