The housing market is likely to favour buyers even more over winter, as vendors drop their asking prices to try and achieve a sale and buyers can choose from a mountainous stock of properties for sale.

The April data from property website Realestate.co.nz shows the national average asking price of residential properties on the site declined for the second month in a row in April to $851,746, down from $884,995 in February. That's a decline of $33,249 (-3.8%).

Around the main centres, asking prices declined in Auckland -$46,035, Wellington -$40,066, Canterbury -$16,347 and Otago -$50,128. See the table below for the full regional figures.

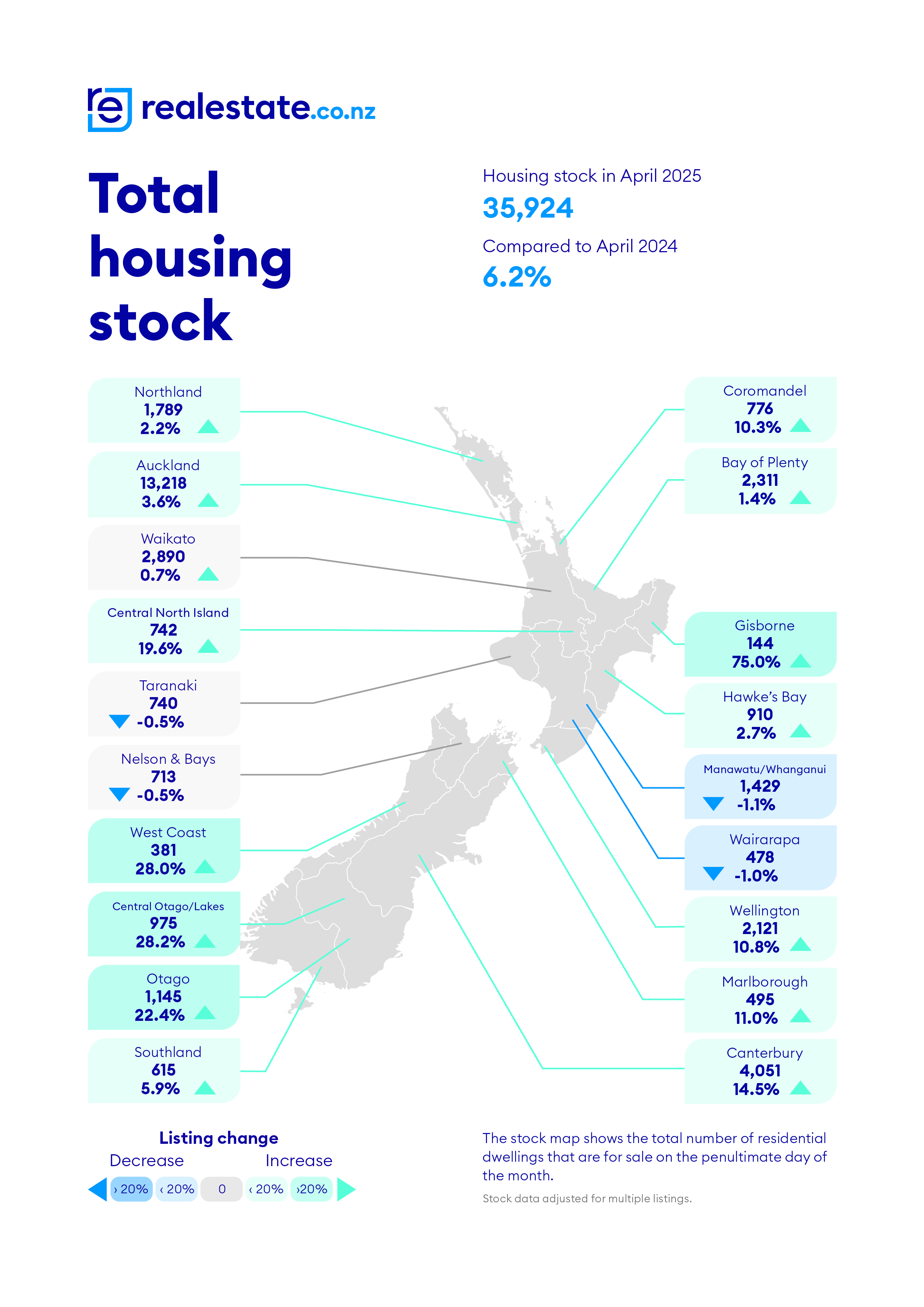

The main cause of the current price weakness is the huge stock of properties on the market.

This has more than doubled over the last four years, rising steadily from 15,838 in April 2021 to 35,924 in April 2025. See the graph below for the monthly trends.

Although the stock of properties declined by 946 between March and April this year, that was a very modest decline considering new listings onto the website fell by 838 over the same period.

That suggests more properties are sitting unsold on the market for longer.

Those figures are particularly concerning because February and March are traditionally the busiest months of the year for residential real estate and the market is now on the downward slope into winter.

"There's plenty of stock on the market but we're not seeing a boom in sales activity to move it through yet," Realestate.co.nz Chief Executive Sarah Wood said.

That gives buyers plenty of choice, and with vendors dropping prices and mortgage interest rates low and possibly heading lower, the market is increasingly in buyers' favour.

The comment stream on this article is now closed.

15 Comments

.

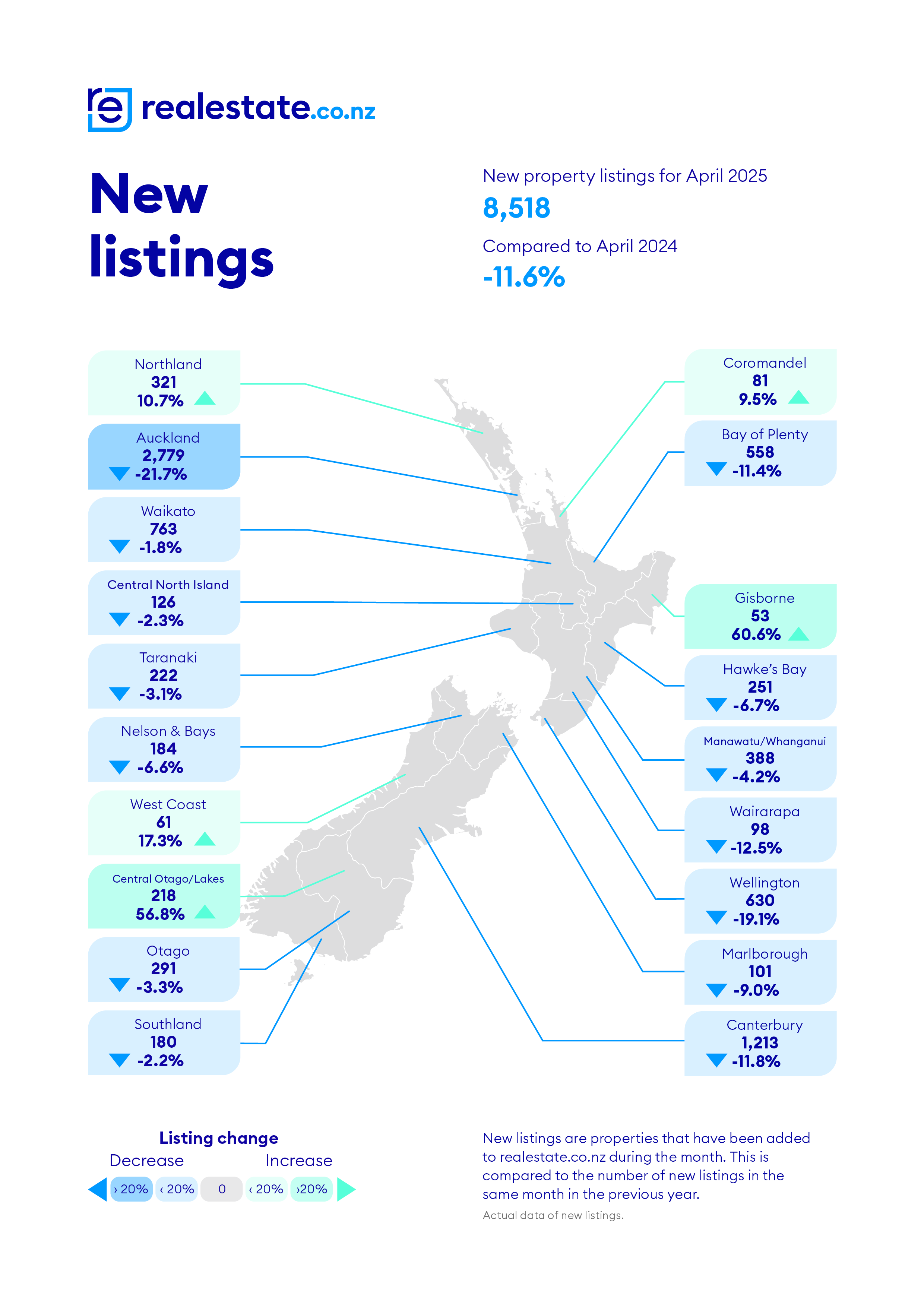

New listings down 21% in Auckland.

Supply quickly shrinking

Bodes well for further 2025 price increases! 🥂

no - further falls in auckland this year.

Yet housing stock up 3%

Yes the stock is at a very high level. A couple of things that are interesting - firstly there is usually a seasonality that has median prices dropping in jan/feb - I suspect because there is more first/second home owners changing homes at a time that matches school year. But this is the opposite

What is also interesting is TM has 16,000 listings for auckland, of which 4,000 (25%) are new homes. So that is all additional supply rather than just churn. In comparison wellington has 3,300 listings by 240 (7%) new homes listed. So auckland is down for a while.

Stock up, sales flat, rents down, rates up, mortgagee sales up, mortgage arrears growing, Banks still trimming headcount (overhead), talk of Stagflation in the US, and spinnaker is well raised on an international trade war. Can it continue to be "It only goes up maaaaaate" or "they are not making anymore maaaaate".

Stats show that is not the case, but good luck to the gamblers.

The music is fading and all the chairs seem to have been taken...

The “not making anymore” part is kinda true as consents fall away in the bust…& then as a result of not making anymore we’ll create another boom at some point maaaaate 🤦🏻♂️😂

Perhaps. Recent consent and build rush was 2% debt fueling affordability. Aka a "fake" economy. Shame everyone tried to do it at the same time and got seen off in delays plus higher costs from materials, labour and consent. Has the clean out of non completed, non settled, and unable to rent mortgage arrears been completed, or is the real truth being suppressed by the banks. We all know the answer here.

My pick is a lot more mortgagee sales suppressing the mid to lower market before the next green shoots of construction start. The real shame here is another generations of younger tradie's will go west.

Summary. We agree, but differ on how long it will take to actually happen.

I didn’t say the boom was around the corner, I just think that we are unfortunately doing the same things that will get the same long term result.

If I’m guessing, and shit, given the current situation it’s a guess at best, prices continue to decline for another year, then stabilise for a year or two with very modest growth, the economy starts to improves, immigration rises on the back of that, sentiment changes then suddenly we have a shortage again, and as you say a shortage of skilled tradies so getting a surplus pushed out further…and the boom/bust cycle continues.

Maybe I should get a tape measure and a hammer…in five or so years I might be able to charge whatever I need to get a new ranger and a stabi 🤔🤷🏻♂️🤣

If it all goes to plan you will be hammering kingys not nails...

😂😂

The problem with these boom bust cycles is that over the last few cycles, the next boom has been enabled by larger credit and increasing DTIs. To the point where RBNZ is concerned enough to limit DTIs

We are only about 20% off hitting DTI limits, take away transactional costs and its not much potential lift vs possible fall, now if we fell another 20% from here , then it becomes more game on from those lower levels.

Past booms have been via cheap credit to escape recession, supplied from international markets.

I follow the Christchurch residential market regularly, with a medium term interest in eventual relocation.

Last year I saw a definite listing pattern play out regularly over several months: Deadline sale/Closed Tender > Auction > Offers above > Fixed price

This year the big brand agencies (eg Harcourts, Bayleys) seem to increasingly be going straight to auctions.

Not sure what this really indicates: possibly resetting vendor reality early to avoid wasting agency time? ChCh prices started from a lower base in the 2021 inflation & haven't dropped back as AKL & WLG, my impression is that ChCh sale prices have also firmed up over this year (for standalone 3+brm 2 bath double garage in the NW, there remain multitudes of unsold apartments across town).

I'm interested in any comments from anyone knows the ChCh market well?

Flicking through Granny, thought this was a pearler. Forget Aotearoa, go to Dubai if you're looking for quick wins in property.

In New Zealand, it takes around 15 years to double your money in property. In Dubai, people are doing it in three years. It’s one of the highest return on investment markets for real estate. They have really great payment plans, which mean you can pay places off quickly without having to pay years of interest, they have top quality developments, they have great infrastructure and the population is growing fast. The Government is a standout for me, the way it encourages investment and makes it accessible for foreigners to own property. They want Dubai to be the most livable city in the world and it’s an amazing place to be. It feels very safe, and very luxurious. You don’t understand wealth until you go to Dubai.

https://www.oneroof.co.nz/news/kiwi-agent-rubbing-shoulders-with-the-su…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.