Interest rates may well be coming down now - but the pile of problem mortgages is still growing.

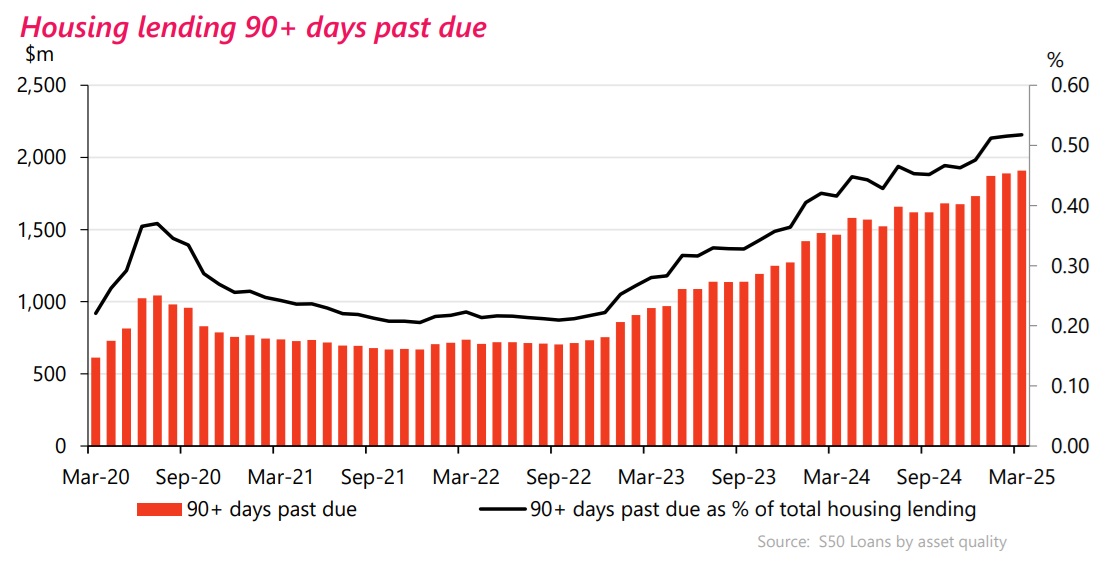

Latest Reserve Bank (RBNZ) figures for the month of March 2025 show that during that month there was a further $61 million rise in the total of non-performing mortgage loans.

This means there's now $2.412 billion worth of non-performing loans, which are the combination of impaired loans plus loans at least 90 days overdue but not impaired.

It also means the percentage of non-performing loans to the total outstanding mortgage stock ($368.569 billion as of March) has blipped up to 0.7%.

The last time the percentage was at that level was in April 2013 when the country was gradually still recovering from the after-effects of the Global Financial Crisis. The non-performing loan ratio frequently tipped as high as 1.2% during the 2009-2011 period.

The latest non-performing loans ratio figures are roughly in line with forecasts made at the time of the RBNZ's last six-monthly Financial Stability Report (the next one's coming out on May 7). The major banks have forecast that the ratio should start coming down in the second half of this year.

In the first three months of this year the non-performing housing loans pile grew by $249 million, or 11.5%. And this has happened at a time when interest rates have now been coming down, with the RBNZ beginning to drop the Official Cash Rate in August last year and mortgage rates starting to come down even before that.

However, crucially, unemployment - which was very low at the time the RBNZ started to hike interest rates in 2021 - has risen quite swiftly, going from 4.0% at the start of 2024 to 5.1% at the end of the year. The next set of unemployment figures are out in the coming week and the RBNZ's forecasting the rate for the March quarter will have risen again, to 5.2%, while some major bank economists are suggesting it will be 5.3%. The RBNZ sees the March quarter as being the peak for unemployment, but is forecasting only a slow decline, to 4.9% by the end of this year.

In terms of the detail of the non-performing housing loans as of the end of March, this includes $1.908 billion of 90 days due but not impaired loans and $504 million worth of impaired loans. The impaired total has increased by about a quarter over the past six months.

Regarding the overall total of non-performing loans, it's risen by $647 million, or 36.7% in the past 12 months.

Prior to the RBNZ beginning to hike the OCR in late 2021 the non-performing loans figure was very low, at well under $1 billion. It's nearly tripled since the end of 2022.

Meanwhile, as some people seek to keep heads above water with existing mortgages, others in increasing numbers now are going out and getting new ones.

We've previously looked at the new mortgage figures for March, which showed that the mortgage total of $8.488 billion is the highest figure since November 2021 at the tail end of the pandemic housing price surge.

And now, separate data, shows that in March 2025 the stock of outstanding bank mortgages grew by $1.88 billion in the month, the biggest rise since December 2021. As stated higher up the article, the pile of outstanding bank mortgages is now $368.569 billion.

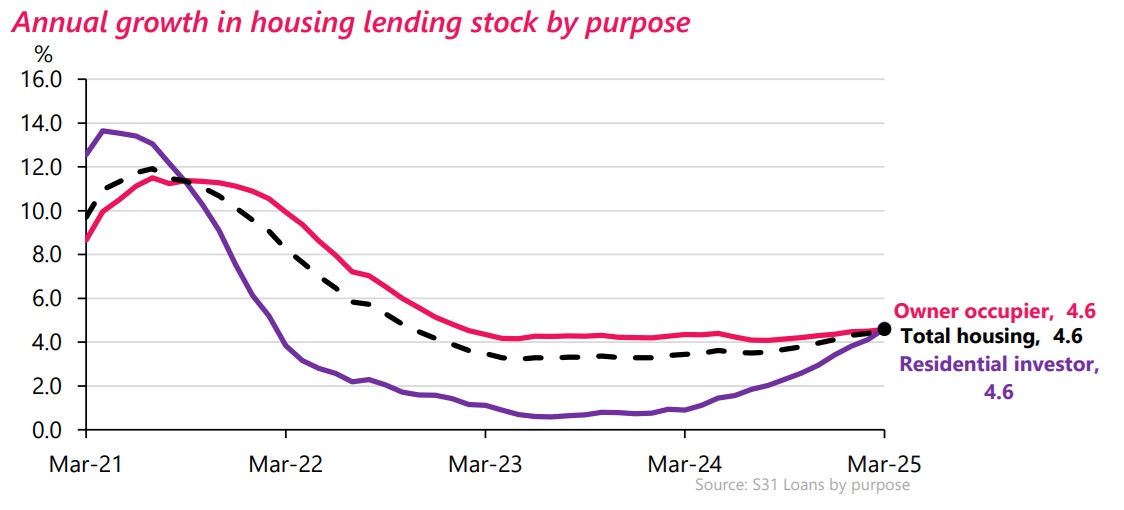

The housing lending annual growth rate rose for the seventh consecutive month, up from 4.4% to 4.6% in March.

Breaking things down a little, the stock of outstanding mortgages for owner occupiers rose $1.283 billion to $273.708 billion in the month.

In terms of the long-dormant investor grouping, it grew its mortgage pile by $597 million in the month to $94.861 billion. That was the biggest rise since April 2021.

The investor mortgage pile has grown by $2.7 billion in the past six months, having increased by just $345 million in the whole of 2023.

8 Comments

Here’s a quick breakdown of last year’s average mortgage sizes in New Zealand (Feb 2025 data)

- Average first home buyer mortgage: $546,741

- Average owner-occupier mortgage: $319,582

- Average investor mortgage: $524,550

Lets assume average OO are not in trouble as they have smaller payments most likely behind mortgage is about 535k

so the $2.4 bil is across about 4,508 households behind.

It would be more households if average OO are impacted

The investor mortgage pile has grown by $2.7 billion in the past six months, having increased by just $345 million in the whole of 2023.

so at average investor mortgage of Average investor mortgage: $524,550 that's 5147 houses if 100% mortgaged, which is doubtful so what say 7,000 houses in 6 months, 1166 a month?

The investor mortgage pile has grown by $2.7 billion in the past six months, having increased by just $345 million in the whole of 2023.

Wow. But not unexpected, I suppose.

TD rates are down; stock market is volatile; bitcoin subject to a lot of uncertainty.

Makes bricks and mortar seem like the safest place to park.

Seems a lot based on TAs surveys, perhaps they are saying one thing and doing another?

TD rates are down; stock market is volatile; bitcoin subject to a lot of uncertainty.

Well yes. If the price of money was not suppressed beyond recognition, TDs would be much higher. I think stock markets should be volatile, but people have been trained to think differently in our universities and by our IFAs. And in reality, pricing the SPX in gold since 2000 suggests there is plenty of smoke and mirrors surrounding stock mkt narratives.

As for ratty being 'uncertain', that's probably a reason to like it if you're referring to the fiat price. It's a completely different mindset for normies. The paradox is that BTC monetary policy is as certain as you can get compared to the monetary policy in our clown world driven by central banking / govts.

J. C.

What do you think the OCR should be?

How many more mortgages are almost showing up in the non-performing figures? Probably quite a few.

The word 'defaulting' has been replaced with 'capitalising'

This allows for under reporting of bad loans by banks - the Reserve Banks seems ok with this

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.