New mortgage commitments hit their highest monthly tally in March since late 2021, according to the latest Reserve Bank figures.

The mortgage total of $8.488 billion for March 2025 is the highest figure since November 2021 at the tail end of the pandemic housing price surge.

And the number of loan commitments, at 21,915, is also the highest since November 2021.

As a separate data series shows the latest figures have been kicked along by a wave of people switching loan providers.

This data series goes back to 2017. And it shows that both the numbers and the amount of 'new' mortgages due to change of loan provider hit a new high in March 2025.

The amount of the new loans taken out by those switching loan providers was $2.107 billion, which just beat the previous high water mark in December.

Likewise, the number of mortgage commitments representing a change in loan provider was a new high of 3,122 for the month.

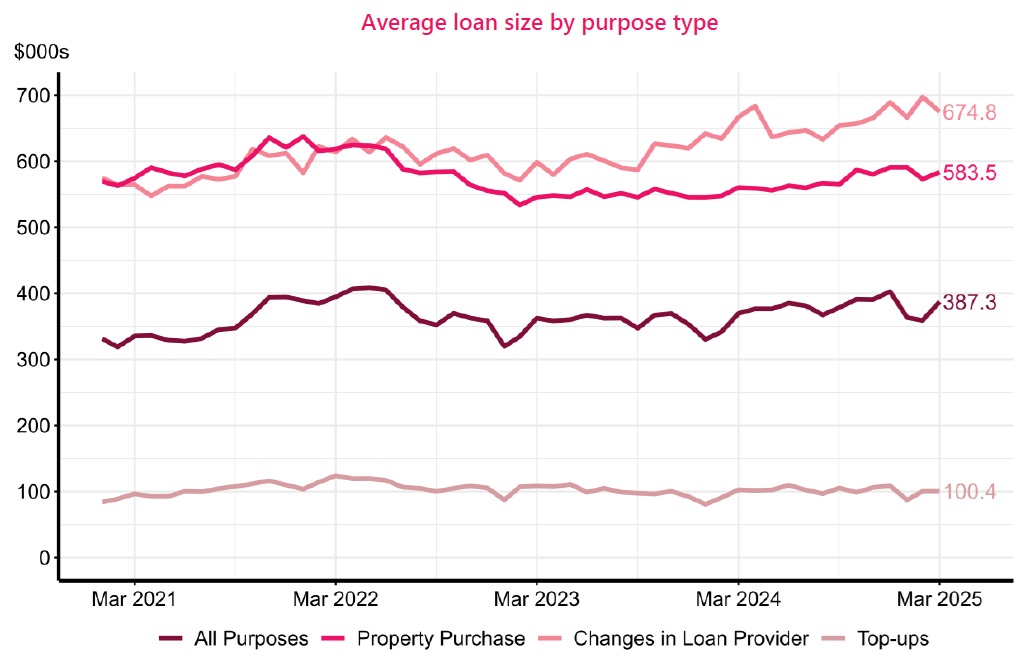

Looking at the average size of those switched commitments suggests that those moving loan provider had plenty of motivation to do so.

That's because the average size of loan for those switching was just under $675,000. This compares with the average during the month of loans specifically for house purchases, which was a bit under $585,000 and the "all purposes" average during the month (including top-ups), which was a little over $385,000.

The graphs in this article come from the RBNZ's summary of the mortgage figures.

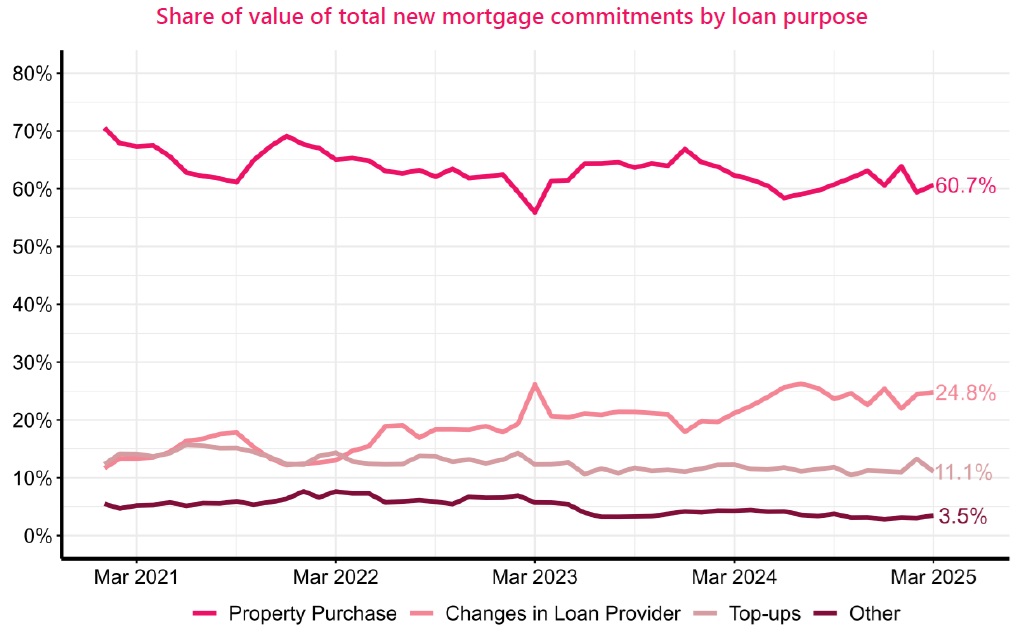

In the past year or so, those changing loan providers have been increasingly a factor in the overall mortgage figures.

Of the $80.364 billion new mortgage commitments in the 12 months to March 2025, just under a quarter - $19.545 billion - were attributed to a change of loan provider.

The share of new mortgages in March taken up by changes of loan provider was 24.8%. That's not the high water mark as the overall numbers of mortgages have been rising. The biggest share was 26.2% in July of 2024

The $19.545 billion mortgages attributed to change of loan provider in the 12 months to March 2025 compared with a tally of just $13.147 billion in the 12 months to March 2024 - nearly 50% more.

But does this all mean that the mortgage market is ONLY being given life by loan provider switching?

Well, actually no.

The $5.149 billion worth of mortgages in March 2025 that were specifically for buying a house was the biggest such tally since December 2021, as was the number of mortgages taken out for buying a house, at 8,825. In the 12 months ending March 2025, some $48.86 billion was advanced for house purchases, which was up 20% on the $40.721 billion for the 12 months to March 2024.

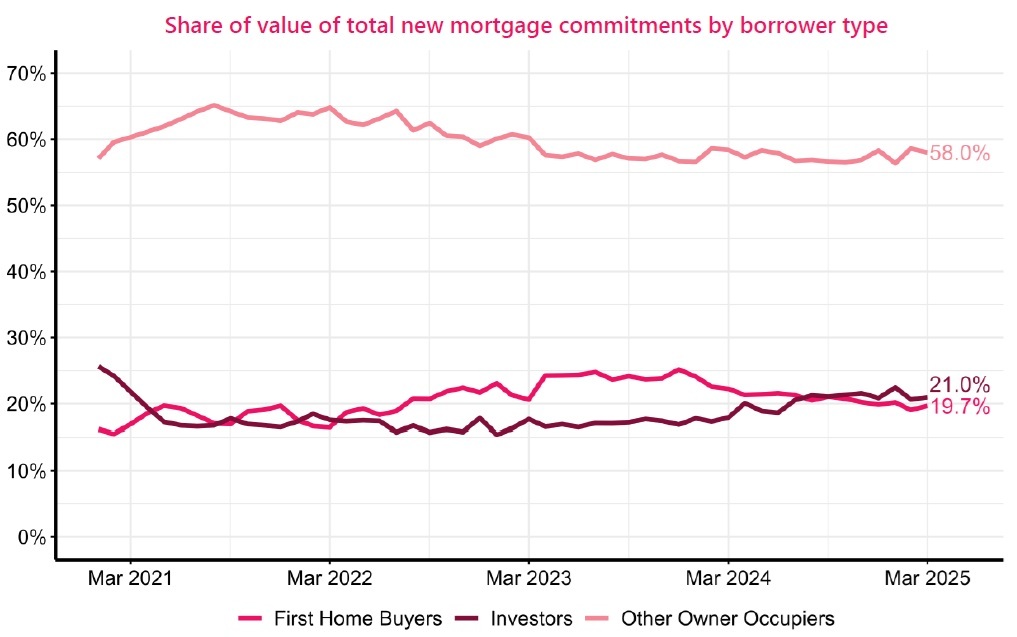

First home buyers saw their share of the monthly mortgage commitments rise for the first time in three months, with a 19.7% share. The record for this grouping in a data series that dates back to 2014 is the 25.2% share in December 2023. The $1.67 billion taken by the FHB group in March 2025 was this group's highest tally since November 2021, as was the number of mortgages advanced, at 2,943..

As we've noted before, the investors have long been on the sidelines, but started to perk up last year at about the same time mortgage rates started to come down - and of course after the coalition Government had begun reversing such measures as the longer period for the bright line test (AKA capital gains tax) and the previous removal of interest deductibility for investors.

The $1.779 billion advanced to investors in March 2025 was the highest amount for this grouping in exactly four years, while the share percentage rose to 21% from 20.6% in February. The 3,310 mortgage commitments to investors in March 2025 was the highest number since April 2021.

The investors had lagged behind FHBs in terms of percentage share of mortgage advances since April 2022, but overtook the FHB grouping again in August 2024. Since surging at the start of the second half of last year, the share of the investors has stayed fairly steady at a little over 20%.

Well, that's the new mortgages.

What about existing ones and how much they are costing?

Well the RBNZ 'loan reconciliation' data series shows that in the March quarter the amount charged for interest on all existing mortgages - at $5.571 billion - dropped for the first time since the September 2021 quarter.

Looking at the 12 months to March 2025, some $22.616 billion was charged in interest, which is the largest amount in a 12 month period since this data series started in 2014.

That's all a far cry from the under $10 billion charged for interest in the 12 months to March 2022 in the period when interest rates had bottomed and were beginning to rise, although it should be said that the outstanding mortgage pile as at March 2022 was just a little over $330 billion, while as at the end of March 2025 it was over $370 billion.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.