We are going to borrow a phrase from ACC's latest advertising campaign and describe October's housing market results as a "have a hmmm" month.

That's because on the face of it, October's figures look reasonably positive for the start of the summer season, but there are a couple of things that could point to trouble ahead.

Although it's usually house prices that get the most attention when considering the state of the market, it's the volume of housing sales that's the most important indicator of where it's headed.

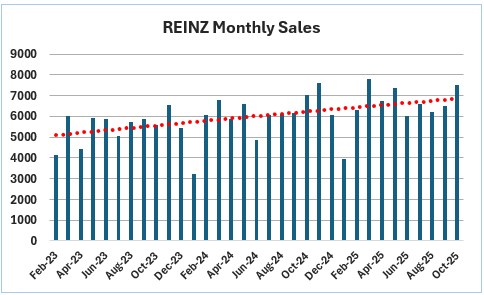

October's sales weren't too bad, with the Real Estate Institute of New Zealand recording 7505 residential sales for the month, up 6.4% compared to October last year.

However, monthly sales can be erratic. To get a better idea of what's happening with residential property sales, take a look at the first graph below, which shows the REINZ's monthly sales from February 2023.

The important feature of the graph is not the monthly sales measures, but the dotted red trend line, which evens out the bumps and dips of the monthly figures.

What it shows very clearly is that sales numbers have been slowly but steadily improving since the beginning of 2023.

So although the main focus of commentary on the housing market in recent times has been on softening prices, the underlying strength of the market as measured by sales, has been steadily improving.

So if sales numbers are looking reasonably good, what's really happening with prices?

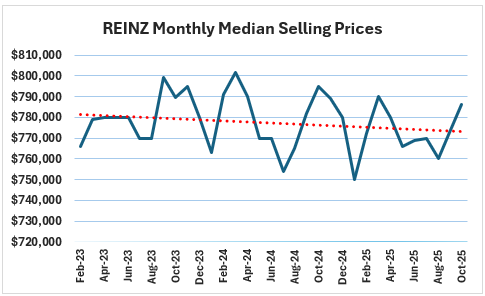

Again, a picture is worth a thousand words, so have a look at the second graph below, which plots the REINZ's median selling price since February 2023.

As with sales, the median prices are lumpy, but its the dotted red trend line that's important. And it shows a slow but steady decline in median prices that remains within a fairly narrow range. At best you could say that prices are flat but with an easing bias.

So overall, sales volumes are improving but prices remain soft.

A key reason for this is the high number of properties available for sale.

In short, more people are wanting to sell properties than are wanting or able to buy them. This has created a buyer's market and that has kept a lid on prices, even as mortgage interest rates have declined.

However, an emerging feature of the market over the last few months is that vendors have started to become more realistic in their price expectations and are realising they are not going to get the prices they might have achieved back in the boom years of 2021/22.

The lower rating valuations released for the Auckland market earlier this year were a wake up call for many vendors, and gave a push to the trend of lower asking prices.

That has narrowed the gap between the prices vendors are hoping to receive and buyers are prepared to pay, resulting in more deals being done, providing the modest upward momentum of sales, while prices remain in check.

This has resulted in steady declines in both the overhang of unsold stock each month and in the dropouts, which is the number of properties taken off the market each month.

Interest.co.nz estimates the overhang of unsold stock at the end of each month has steadily declined from more than 30,000 in April this year to just over 23,000 in October, while the number of properties being taken off the market each month has halved over the same period.

Looking ahead to the major summer selling season, we are likely nearing the end of the current easing cycle for interest rates, so any further falls in mortgage rates will probably be relatively modest.

It will likely be the volume of new listings coming up for sale and the stock levels they create that will determine where the market heads from here.

The comment stream on this article is now closed.

23 Comments

Firstly, good analysis thank you. The reality is that we are talking about three markets: Auckland, Wellington and elsewhere.

Auckland is still stock heavy and the number of new builds listed on trademe has gone from 3,000 to 4,000 over the year. New houses understate supply as developers only list 1 when they have 5 to sell. So new supply is still coming to the market and supply will continue with the rise in building consents. 13,000 new houses per annum is enough for 40,000 people and all of NZ didn't increase in population that much last year.

Wellington is the result of a gutting of the public sector. But people have stopped building. I think it will come up before Auckland.

Rest of New Zealand is still adjusting to internal migration of people and jobs away from Auckland. For many centres the cost of building a new home exceeds median values - so the prices are stable and potentially creeping up.

All we need now is a global recession

The inflation adjusted house price index looks extremely vulnerable to further drops in real terms:

https://fred.stlouisfed.org/series/QNZR628BIS

Anyone into technical analysis might say we are now at the right shoulder of a head/shoulder pattern - if true, we may still have another 20-30% in falls to come in real terms before this market bottoms.

This is the truth, but leveraged speculators are just holding debt waiting for inflation. Screw everyone else.

It will likely be the volume of new listings coming up for sale and the stock levels they create that will determine where the market heads from here.

This will impact in different ways, if the market starts falling again, more will realize they should have sold and we would see a step change lower, perhaps another 6-9%.

If the market starts to rise there is plenty of stock waiting for offers, it will likely cause more to list to take advantage of the rise. I think there will be more waiting to sell, then investors chasing the market up, as they see no exit strategy and at higher prices yields are even worse then here.

The improvement of yield outlook is poor, many who have left NZ are renting homes and rates / insurance / maintenance is rising faster than rents.

CGT looks to come and destroy the longer term returns.

The market has headwinds, the biggest being the overhang, hidden supply (developers only listing 1 of 6 new builds etc, and the withdrawn who are just hidden overhang waiting for more buyers to arrieve)

It'd be interesting to see the number of listings for those who have already moved overseas e.g rented it out and topping up, then decided to sell.

Unless you are escaping a war zone, Im not sure who, assuming you meet the criteria, would want to come here currently. If you plan to suffer expensive food and rent to get free healthcare and school for children before exit west that would make sense. A plot that many of the arrivals who came here in the last ten years are now following.

The expensive food and rent isn’t just a NZ problem anymore.

Those who fail to be accepted into Aussie come here, only to goto aussie once they have residency

You could argue that a good house on reasonable section should appreciate in value as they become less common due to development. But many of them need a lot of work otherwise they only attract the worst renters.

Problem is good houses on reasonable sections experienced 30-40 years of normal price appreciation in a 10 year period post GFC.

yes because the good house's cashflow paid for the land, which has development potential... was a savvy investment, that wen tto high, best exit has passed already

almost all land became dev potential, or was priced as if it could have 3+ houses on it, but now it's not so easy to monitise land further away from trains/bus corridor etc etc

So much land is now overvalued with a crap house on it, beware do not buy these. they really only have land value for 1 maybe 2 houses at best now...

Really good point!

they often now new land value only minus crap house demolish house, think browns bay crap...

currently valued perhaps 1.4 land 1.1 house 300k

probably worth 1mil max as a section. they have little ability to appreciate unless building suddenly gets cheap... and it will not, so as building gets higher forces land value even lower (as people can only pay so much for package) and people only want to pay so much for browns bay.

hell you can buy queen st for 899 k

Am I missing something, or is this the bargain of the century? Section on Queen Street Auckland City.

https://www.stuff.co.nz/politics/360890505/kainga-ora-set-make-2m-loss-…

KO bought up large at the peak and weren't even checking invoices for building work when approving. Sadly they a.k.a we the taxpayer, are subject to the downturn in the market. Good luck for the new owners, let's hope something productive comes from it.

You would need to go high to make money, therefore need deep pockets - limited number of buyers,

who are probably sitting on unsold units from their covid build period...

There are probably safer investments.

I wouldn't mind a stand alone house on Queen Street. Land is not much dearer than the burbs!

Surely its got to be worth more some day...

it would need to rent to pay for land, so yes its probably 900k plus a million build , could go small office to recoup investment with idea in time you sell for redevelopment...

seems not even this is popular, not the best location for office, too many hookers and drug dealers abound. maybe a lawyers office then.....

poor lighting , 290sq m little scope for off street parking, not a great area at 2am

too many hookers and drug dealers abound. maybe a lawyers office then.....

A bank, of course

Thanks for the heads up, I'll do a bit of due diligence, see what can and can't be built and any covenants.

nice replica 3 story villa?

It's Upper Queen St, so it's really in Newton, close to Symonds St. That area's around half resi and and half commercial. It's still very close to the city though.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.