By Bernard Hickey

New listings on Realestate.co.nz rose 58% to 13,459 in February from January as home sellers sensed a turning of the market and leapt on to the website with record high asking prices.

"The New Zealand property market is finally responding to the ongoing demand for homes," said Realestate.co.nz CEO Alistair Helm in the monthly listings report. (See our video interview above and see the full report on unconditional.co.nz).

New listings were up 18% in February from a year ago and were up 14% in seasonally adjusted terms from January. The seasonally adjusted mean asking price in February was a record high NZ$426,575, up 2% from January and up 3% from a year ago.

Helm said the concurrent rise in new listings and asking prices indicated sellers were finally responding to the ongoing high demand for property.

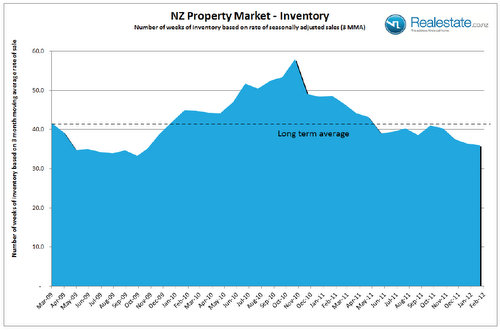

“Since the demand for property has not slowed, it’s almost surprising that we have not seen the increase in asking price until now. However, with sales continuing to remain strong and inventory falling yet again in February to 36 weeks, sellers are clearly raising their expectations," Helm said.

Inventory, measured as the number of weeks of sales in seasonally adjusted terms, fell to 36 weeks nationally from 36.4 weeks in January and was down from 37.5 weeks in February a year ago. It remains below the 41 week long term average, which realestate.co.nz says indicates a 'sellers market'

There were record high asking prices in Canterbury and the Central North Island. There was 24 weeks of inventory in Auckland, below the 33 weeks average. But there was 234 weeks of inventory in Coromandel, above its 198 week average.Wellington inventory was at 22 weeks, below its 23 weeks average.

'Market in favour of sellers'

“We are seeing the market find some level ground in many regions, as they edge closer to the long term average of 41 weeks of inventory. This suggested there is a better balance returning to the market in some areas. However, shortages are persisting in the major cities of Auckland, Wellington and Christchurch," Helm said.

Helm says that these pockets of shortages will most likely continue to prompt more sellers to list in the coming months, while the market clearly remains in their favour.

ASB comments

ASB's economists said the figures suggested the housing market may be starting to respond tight conditions.

"House prices have started to rise in areas where the housing market has become very tight, and this appears to be have enticed potential sellers to list," they said.

"Nonetheless, the level of new listings still remains very low. Total inventory levels on the housing market only just increased (up 0.2%)," they said.

"This suggests the new listings have been snapped up quickly, with the increase in supply only just meeting demand. Overall, the housing market remains very tight, particularly in Auckland. We continue to expect house prices to rise over 2012 reflecting these supply shortages."

(Updated with ASB comments)

Housing inventory

Select chart tabs

33 Comments

yep everybody wants to get out of this freakin country so list now.

Where do they go?

OZ is over-priced even if the wages is better and that looks like its about to pop. EU is a basket case....US is a banana republic......not much left...

regards

sell your 1mill NZD central auck shack - turn it into 650000euros and buy a heavily discounted villa on the algarve.

So as I suspected, lots of would be sellers who have been hanging on off the market because they cant get the price they want come out of the woodwork. Now the sellers are jumping in looking at prices they think they deserve....It will be interesting to see just how much sells.......and what for.....will they sell or will the houses vanish again for another year.....

regards

I think they will sell, people know that governments can print money to grow the economy if its in trouble.

Somehow Muppet King we have to help you get past this blockage you have...let's start by pointing out that the economy is in trouble...ok...and then...now pay attention MK....if you are correct, the govt right now would be "printing money" to "grow the economy".....right?

So how come they are not printing money right now Muppet King?

Because we're not in dire straights, its only then that the printing press comes out

Oh right...dire straights plus printing equals recovery growth and wealth for all...tui add here.

"That ain't workin' that's the way you do it

Money for nothin' and your QE for free

Money for nothin and your chicks for free.."

Go have a play in California, this home is one, the song little boxes was about

http://www.zillow.com/homedetails/37-Seacliff-Ave-Daly-City-CA-94015/15…

very close to the sea and airport.

http://www.youtube.com/watch?v=MVyVp0qMpOk&feature=fvst

Howdee Andrewj

I have been interested in US real estate since late last year, even did a trip to Phoenix, AZ to have a look around. I saw some good buys, as investments to hold.

The prices in central Auckland are just way over the top and are not justifiable - however the demand must be there, as they are selling at those prices. So good luck to them.....however, as you and I know, you can buy in the US, in a good city, a nice house for US $450K .... ie your example in Daly City ... What would you get for that in central Auckland ??? !!!

My question is do you know any Kiwis buying property over there and what have been their experiences?

Look forward to hearing from you,

Cheers

Crazy H

US$450K is like NZ$530K.

For that you get a dodgy looking (monolithic plaster) 140sqm house on a 350sqm site about 17km's from town in a suburb where McDonalds is listed as one of the major employers?

For NZ$530K you can do way better within 17km's of Auckland.

How about http://www.trademe.co.nz/property/residential/for-sale/auction-452991202.htm

CV NZ$540K for a 130sqm brick and tile on 1131sqm with a swimming pool 17km's from Queen Street.

There's no comparison

bob - my post was in response to comparing the "central" areas of Auckland - not way out in the back blocks of west Auckland.

you kiwi property spruikers very conveniently forget what you can get in the US for your dollar ...and to compare Daly City, CA with Oratia, what planet are you on?

Sure I agree the property in Daly City looked a bit 'shoddy' but you could get for the same money, in the same area, a better build quality house.

Have you been to the US and seen what you can get and in good cities too ?

You would start to look at central Auckland property prices in a very different light...........

"Have you been to the US and seen what you can get and in good cities too"..

yep, I agree! you can buy good character house not far from Detroit CBD for a fraction of the cost of Auckland CBD house.. but a rather large insurance policy and a 9mm will be a compulsory personal features.. ummm no thanks!

Simply not true. Ive looked at a house on Encanto park Phoenix and you could walk out the door and play golf, it sold for 135k. Also the States and the UK have a lot lower living costs ( well food in the UK) so your money goes further. Where we spend a lot of time in North California it is a lot safer than NZ houses are a lot cheaper,

http://www.zillow.com/homedetails/Ski-Bowl-Dr-Mount-Shasta-CA-96067/212…

But what you dont see is how cheap the food, the Gas ,the Rates, the Insurance, electricity, clothing, wine and almost anything else you need is.

I hope you enjoy your little bubble but remember thats all it is, NZ is an expensive country to live in now.

CM .... I would never buy a house in Detroit .....and neither would 99.99% of Americans.

Its just like saying that ALL property in the US is like parts of South Auckland.

ps my apologies to Eminem...a Detroit native.

Just 'cos I don't blindly accept everything you say doesn't make me a spruiker. I read what you said and disagree. How's that spruiking? Did I say Auckland prices were reasonable get in now? I just pointed out that for the same money as your example you can get a much nicer house here on 4x the land same distance from town.

Your example was 17km's away from San Fran, mine was 17km's away from Queen Street so no more 'in the back blocks' than your example.

If you want to compare a shoddy 150sqm/350sqm site 17km's from Union Square with a Central Auckland property 3-4km's from town and get upset about how the Auckland one is more expensive feel free. Don't compare it to the SF equivilent though or you won't be able to get so upset.

Hi bob

Had to respond to your comment.

Perhaps my use of the word 'spruiker" was misinterpreted, sorry about that, as what I was trying to say was that so many kiwis, mainly in Auckland, seem to think for some reason that these higher prices are "justified". However it seems you are on the right track, with you even alluding to say that Auckland prices are not 'reasonable".

My big point with the property market in the US v NZ ... or lets say SFO v AKL is although houses are expensive in both cities, and as Andrewj says just above, the cost of living is so much cheaper.

So much of so many people's income in NZ is taken up by mortgage or rent payments, leaving very little for spending on creating new business, entrepreunerial ventures and even just recreational pursuits ..... what I noticed in the US was that people who are working and remember 90% are, have so much more disposable income AFTER mortgage/rent payments .

This is no good for the people and ultimately the NZ economy with so much money "tied up" in residential property, which does not produce anything. It has been said so many times on this site that the NZ economy is tilted towards residential property and the sooner this is corrected, in what ever form that my take, the better off will all will be.

Auckland is quite a nice city but over-rated IMHO and very much overpriced. I much preferred it in the 90s, when it was less busy, less corporate, a bit more rough around the edges and bohemian, and cheaper

If I compare Auckland's CBD with Adelaide's, I think that, yes, Auckland's CBD is more built up, higher rise and corporate. But more urbane? Not sure. Adelaide is going off at the moment, with the brilliant multiple arts festivals, Clipsal 500, wine events etc. Auckland comes off very much a poor second cousin in terms of culture. And its climate is crap

Similarly, naive Auckland snobs tend to stick their noses up when people talk up Houston and its liberal planning policies. They portray Houston as soul-less and artless. In fact, Houston has a phenomenal arts scene, which again leaves Auckland for dead. Great food too, especially all the hispanic influences. And much cheaper than Auckland. Because their housing is so cheap people have more money to spend on dining out, arts and cultue etc etc. which helps support those vibrant parts of the economy

or you could move to DC

http://www.zillow.com/homedetails/1704-P-St-NW-Washington-DC-20036/4017…

Another example of this lameduck Reserve Bank Govenor allowing Banks to lend when they shouldnt

No, its up to us as mature adults to make those calls...Why should a RB Governor have to say no? How can he determine whats productive borrowing and what is not?

Dr Bollard has probably done more to save our asses from ourselves and our lamd duck Govn(s) than any other single person. It sint fair to blame the RBNZ for our government's failur eto legislate or even set policy....or direction...which comes back to we the voter....

Where is the private banks morals/responsibilities in lending? One reason I love the jingle mail concept is if a bank lends badly they are left holding the debt.....in a way its a bit to one sided, but no worse than today when you are totally left with the problem.

regards

Realistically there is absolutely nothing in the banking regulations allowing the reserve bank governor to do this. Though the reserve bank does have some ability to influence the behaviour this is probably considered going too far.

Maybe we should look at the last time this happened, in 1929. The US Fed was rightly nervous about the massive bubble forming in the share market. It put the word around officially discouraging lending through the discount window for speculation on the share market. What happened (as would be expected) is the sharemarket, which had become a well established ponzi scheme by this stage, immediately crashed by 800 points. The official heros of the day were then the couple of people who disobeyed the Fed mandate and continued to support speculation. Hooray for them, well we know how that ended shortly afterwards.

http://www.nytimes.com/library/financial/index-1929-crash.html

There were other actions as well, but if a bubble forms it obviously (with hindsight) takes more than a year to 'stabilize' it. The Fed can't do magic, neither can the RBNZ

http://www.frbsf.org/econrsrch/wklyltr/wklyltr99/el99-10.html

Stop blaming him for something which he can't do anything about.

Here we go again, new headline in a few months – record number of unsold houses and prices dropping. It’s obvious many want out of the NZ housing market, whether it’s due to high debt or low returns not really important. The fact is they want out but not for any less than what they brought, that’s just too embarrassing at the family BBQ. Better to pay years of interest on a stagnant or depreciating asset than have to admit that in front of family and friends. So any little ray of light and they all rush to exit, remains to be seen how many will be sold. Not that many I think considering all the job losses in the pipeline as announced last week.

My cousin brought in 2007 but couldn’t afford the payments on a NZ wage so then moved to Aus to pay the debt, he realised after a while that it was a liability and sold the property this month. He spent 20K on carpet and paint in order to sell and another few K on land agent commission but when asked about it says that it was all good as he got the same price as what he paid in 2007 so didn’t lose any money??? Not to mention 3 years of topping up the mortgage at approx. 100 per week. The mind-set of the average NZ property speculator is amusing.

I think you will find that he 'bought' rather than 'brought'

I prefer favor.

Anyway - how about those record high asking prices eh?

Lucky we are all long on property right?

Especially if it is Auckland Central property - then you are really creaming it.

SK.

yankee?

mmm...Not so sure about Auckland Central, I am about to list our home in Central Auck suburb and suddenly there are heaps being listed in Ponsonby/Grey Lynn.. I am begining to have 2nd thought!

Why sell now when you will get 10% more this time next year?

If that is the case it begs the Q why are so many ppling wanting to sell?

If its such "common sense" that prices next year will be 10% higher it seems with interest rates so low to be bad judgement.

regards

For me, I am selling due to personal reasons rather than trying to make huge profit, but huge profit would be nice! Also having tenants while living aboard is a real pain in the ____ .

The ppl wanting to sell are not long?

regards

I have noticed, quite a number of properties coming on the market again, having been off for a while. Asking now the same as 2009/10, or even higher, have been listed with about every agency and for auction previously, some of them for longer than 2 - 3 years ago.

I am always amazed, how optimistic some people are. Good luck to them.

Buyers are coming to the party - as is evidenced by inventory remaining static at higher volumes.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.