Financial markets are now under-estimating the likely scope of Reserve Bank interest rate rises - particularly regarding the chances of a July rate hike, according to ANZ economists.

In their latest Market Focus the economists said that markets had "latched on to" recent signs of waning economic momentum and market pricing was now calling the RBNZ "one and done"; that is, one more rate hike through the Official Cash Rate (OCR) this month and then a bit of a pause.

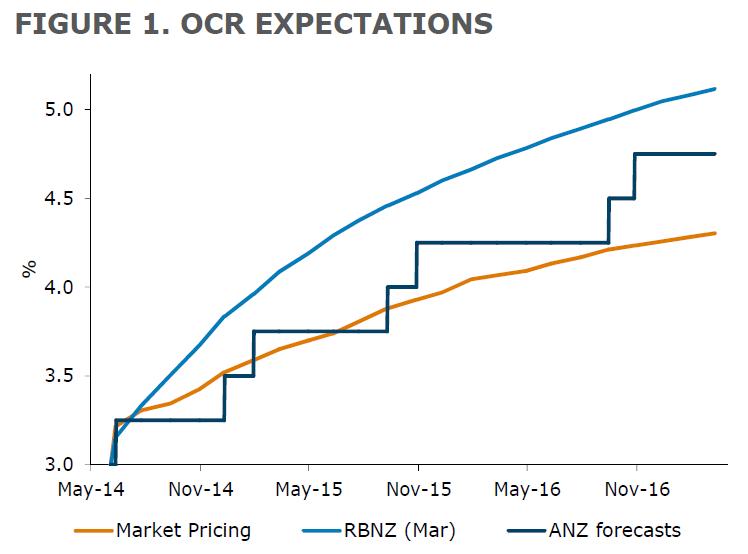

"Indeed, it is notable how far below the RBNZ’s March projections the market is now trading," they said. (See graph below)

"...We believe the market is now underpricing the likely extent of RBNZ tightening with only 95 [basis points] of OCR hikes priced by the end of 2015. Next week’s RBNZ [Monetary Policy Statement] is likely to provide a reality check."

The economists said they were expecting "only minor tweaks" to the RBNZ’s interest rate forecasts next week, "whereas the offshore market appears to be positioned for a lower track".

However, the economists agreed the economic story no longer looked "so picture perfect", but said it never was in their eyes.

"Strong growth was always masking frictions and tensions – but we’re now seeing downwards adjustments across economic indicators. Credit growth has slowed, business confidence has waned, the terms of trade are starting to recede more markedly, and anecdotes on the ground suggest the housing market has softened a lot price-wise."

But they said things needed to be put in perspective, and cited four points:

- The economy is slowing from a gallop to a canter; our composite growth indicator is still foretelling booming momentum.

- Credit growth needs to remain below nominal GDP growth – as it is now; an economy with NZ’s net external debt position cannot borrow and spend its way out of a debt-fuelled consumption jam.

- The fall in the dairy milk price (from $8.40/kg MS to $7/kg MS) is overplayed. The projection for the coming season, while down substantially on this season, will still be the fourth-highest on record and farmer cash-flow in the coming season won’t be too dissimilar to the prior one.

- If you strip out all the positives you end up with a negative picture, but the positives are substantial: the construction pipeline is still massive; employment growth is strong; migration inflows are huge; and there was a material change in the fiscal stance in the 2014 Budget which has been glossed over (the stance is still restrictive over 4 years but it moved from -3.4% to -2.3% – that’s a net boost of more than 1% of GDP).

The economists said that the idea of the RBNZ doing three hikes up front (having already hiked in March and April), then a pause, fitted with their long-held view.

"But we’re going to offer some words of caution here; if we were the RBNZ we’d be keeping the door wide open to a July hike as well, and we believe the odds on a follow-up move are now under-priced."

The economists gave the following reasons:

- The RBNZ needs the curve working in its favour, "and we note 2 and 3 year fixed mortgages are now below where they were when the RBNZ first hiked in March".

- Competition across financial intermediaries – the credit channel of monetary policy – is fierce; "all power to the consumer etc, but that can dilute monetary policy’s effectiveness".

- The change in the fiscal stance – as noted above – is material.

- While growth is moderating, it’s still outpacing supply (which we now put as 2.75-3%); demand needs to “glide” back further.

The economists said they now characterised the economy as "settling into a glide-path".

"Growth is still robust, though less breakneck in pace, and it is still putting ample pressure on resources. Right here and now growth is tracking around 3.5% – down from the 4% pace seen in late 2013. That’s a margin of excellence adjustment."

4 Comments

The markets overshot in the first place (believing bank economists who think they are still in 2003, getting over-excited on their first 'outing' of an OCR rise). Now they are coming down to reality.

Banks are not lending enough. They need more borrowing. The price of money has downwards pressure.

Forget the OCR - it's irrelevant.

Agree.

regards

ANZ are correct

Yep the OCR is irrelavent because NZ doesn't own any of the major banks anymore.

The OCR has gone up 0.5% total over the last few months and the interest rates have gone down.

I hear on the radio this morning that we are going back to the old days where they only for example loan you 6 x your annual salary. Wow that didn't work for me then and its even worse now !

The also said the average salary is now $70K and I think for starters that is WAY WRONG perhaps someone has a reliable figure becasue low $50's would be more like it if you ask me. In fact probably worse if you took the top 10% of wage earners out of the equation (they have no problems anyway with paying Auckland house prices) then its more like in the $30's.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.