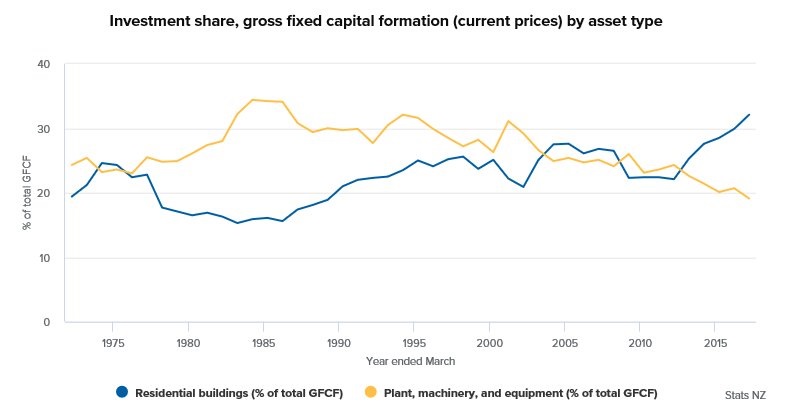

In the past year nearly a third of all investment by kiwis went into houses - which is highest level since records began measuring investment levels some 45 years ago.

At the same time, Statistics New Zealand says the share of investment going into plant, machinery and equipment investment is at a 45-year low.

The information is contained in Stats NZ's national accounts (income and expenditure) figures for the year ended March 2017.

The figures show residential building investment made up 32% of total investment in 2017. This is the first time it has been above 30 percent since the series began in 1972.

In contrast, plant, machinery, and equipment investment had its smallest share of overall investment, dropping to 19% in 2017 – to be below 20 percent of total investment for the first time.

"Until 2004, plant, machinery, and equipment was the largest component of investment. While it regained that place in 2009, residential building overtook it in 2013 – the two asset types have followed different trends since then," Stats NZ's national accounts senior manager Gary Dunnet said.

"Many factors influence investment expenditure. We know that construction costs are rising, in particular for residential buildings. Meanwhile the prices for plant, machinery, and equipment haven’t changed much overall – in large part because computers keep getting cheaper.”

Dunnet said the drop in plant, machinery, and equipment’s share of total investment also reflects the changing shape of New Zealand’s economy.

"Investment in software and other intangible assets, which aren’t part of this asset group, is increasing as all sectors of the economy make greater use of these digital tools."

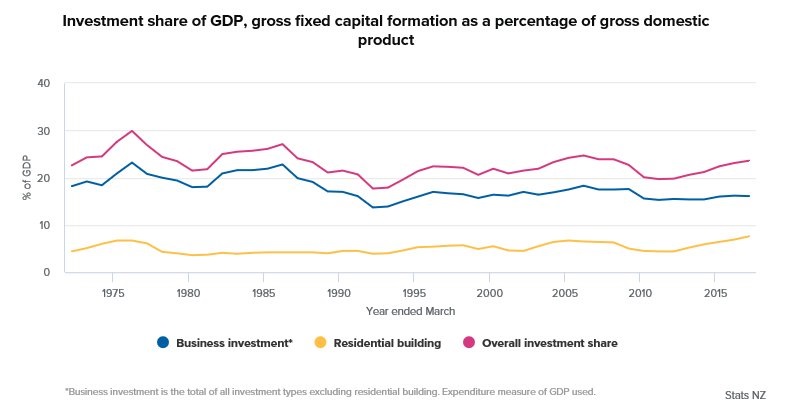

He said the impact of the surge in residential building investment could be seen by looking at the investment share of GDP. At 7.6% in 2017, residential building also had the greatest investment share across the full time series back to 1972.

The picture for business investment – the total of all investment types for all sectors, excluding residential building – was very different. Since dropping as a share of GDP in 2010, from 17.6% to 15.6%, it has shown little movement.

"This shows that investment in fixed assets other than residential building has roughly kept pace with the rest of the economy in recent years. In contrast, residential building continued to make up an ever larger share."

87 Comments

Bloody terrible

Bloody awesome : )

Struggling to understand how this can be seen as a positive for the country - wouldn't you prefer to see more investment into things which might increase productivity and improve standards of living?

8 to 1 upvotes, so far

Yvil, did you post your comment in the correct forum?

Imagine if we had huge funding into innovative companies. It wouldn't matter how many of these we sold to overseas investors, we'd just make more.

Instead we have a large demographic which is stuck with the mindset that real estate is the only worthwhile investment.

What we need is for real estate not to be the default investment of choice, either with disincentives for property investment (land taxes, CGT), or incentives for innovation and tech (tax breaks, research grants).

If you think tax or lack of is an incentive, why is work taxed? Why are professionals taxed the highest and labourers the lowest? Why is there no tax on not working, and less tax on working. Why is business tax the highest?

Unless of course you have a flawed assumption, and tax isn't actually an incentive at all, but people make decisions based on what is right for them. Most people don't have the capability to tell the difference between a good business model and a bad one, most startups end up going broke.

There are very good, obvious reasons why people choose property (those who have the brains to invest some of their money) and it has little if anything to do with tax.

Property is tax advantaged as capital gains are largely as of right or in practice untaxed.

Property is tax advantaged as home owners are preferred over renters. Home owners have invested a capital sum in a property from which they derive a benefit (accomodation) which is untaxed. A renter who invests that same capital sum elsewhere must pay tax on the benefit derived so that the funds left to the renter are net of tax. The tax free status of both capital gains and investment in a home means that the general tax burden therefore falls disproportionately on income earners, including renters.

There was recently a general election where these issues were fully canvassed by TOP. Did you miss it, were you asleep, or did you just not understand it? Please try to keep up

Well said Bobster. If only we had TOP in coalition instead of NZ First.

So you're saying tax on property investment wouldn't reduce the attractiveness?

I would definitely assume that if tax were a lever and there were analogous taxes on business investment (retirement funds, CGT on shares and index funds), then adjusting those levers could shift investment in the desired directions.

Surely this is a blueprint for a wealthy, prosperous nation? Maybe if we try hard we can get property investment up to 50% or higher. Just imagine, we could have an entire economy based on buying and selling houses. Why hasn't any other nation thought of this before? What could possibly go wrong?

Why hasn't any other nation thought of this before? Australia beat us to it.

What could possibly go wrong? It already has - Why the banks just want our houses, hence Sydney and Melbourne Are Fueling Two-Thirds of Australian Growth

Yikes! More investors fighting for the same slice of rental income pie. They might start fighting between themselves if a few start dropping their rental price, to keep their head above water. They call it "Pump and Dump" for a reason.

(All eggs) are (in) this (one) way bet that could easily become a (basket) case of a property market.

Yes. I found this article a depressing read. Our only path to real wealth as a nation is by acquiring that wealth through selling to other nations what we produce. What we sell could be tangibles or intangibles. Buying and selling houses between ourselves at ever higher prices funded with ever bigger IOUs is just a road to nowhere. Not only have we taken a one way bet on property we have effectively gambled our banking system on the bet interests rates will never meaningfully rise. We well and truly deserve to get our butts kicked, and i have no doubt at some point we will.

You could start a business and work hard for ten years to become an "overnight success".

You will probably be vilified on these pages for the cheek of it, but what the hey.

I think you would rather be vilified as a fool and a simpleton, who needs to create a business when all you need to do to get rich is buy property. Duh!?

Where else can you put your money.

I placed an inheritance in the bank only to find that when i was made redundant the amount was considered too much for me to get the dole.

Had i purchased a rental or even a better home i would be getting handouts from every direction.

NG, if you put it into Kiwisaver then it's not counted as regular income and then you get your allowances.

Home..yes correct - not touched (though TOP would sort that) kiwisaver - not touched, so the wise call. Rental...nope it's counted.

Such is the madness. Own a home with zillions of equity - get wff. However, rent and have $8,100 saved and no wff.

Rentng - then get income tested on the $500k in the bank, home owner not income tested on the $500k home. TOP get it.

Totally agree. Non home owners get totally shafted.

Well said NG

I was visiting friends in Chch a week ago. They retired early & are scratching along with a single old 1990s Corolla, using buses etc to make ends meet. I asked about the value of their 4-bedroom, 3 bathroom house, they said $600k. Symptomatic of NZers' idea of a store of wealth, encouraged by the system of course.

Sadly, even if they sold-up and bought into a retirement vila, it would probably cost them the same...

https://www.trademe.co.nz/property/residential-property-for-sale/auctio…

Interesting comment. There have been a couple of articles written in the US about earning 200k and finding it hard to make ends meet.

https://www.financialsamurai.com/how-to-make-six-figures-a-year-and-not…

(this article has been rehashed by at least one other commentator).

The content of the article is largely irrelevant but the one thing I did take away was perhaps people should look at a smaller home and save the rest which would make for a much better retirement. In other words have an expensive house / lifestyle means you have to have a high income with the ability save to support that lifestyle in retirement. As has been said before your home is not a retirement plan.

https://www.cnbc.com/2017/03/24/budget-breakdown-of-couple-making-50000…

"Still, no matter your income level, living beneath your means can help you out tremendously in the long run."

https://www.cnbc.com/2017/03/24/i-saved-100k-on-30k-salary-here-are-my-…

EDIT

It very much stems from the sense of self entitlement. I see, I want, I will have at any cost but it's just simply negative to think the music could ever stop.

Always told my kids, if freedom is precious too you then ALWAYS keep your overheads way lower than your income and you will never regret it.

Its interesting to watch how branding works with shoes and alike. The self entitled will pay big bucks for the elite brands when just a little ground work will turn up the same item way cheaper in another lesser known brand, made in the same country!

The only factors that determines how quickly you can retire is your savings rate as a % of your after-tax pay and the average return on your investments.

http://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-be…

Live within your means and you can work far fewer years.

There is nothing wrong with driving an old car. That is saving money for future needs aka deferred gratification. Even if you've got more than a few coins it's better to be sensible to build up a legacy. That's my motto anyway

At least they aren't spending their paper equity, or at least I hope they aren't. They may need to find some part-time employment just to keep up with their insurance and rates payments. If the housing market had not become so skewed over the past few years, then their rates and insurances would still be affordable. Their situation is precarious. I hope they aren't under-insured in this crazy market!

Funny, I thought insurance was based on the risk of an insured incident and the cost of paying the claim. How do housing market values affect that? Also rates are based on expenses apportioned by relative house value, not the overall value of the market.

A house of cards of houses.

Top work this man.

[slow hand clap]

"At the same time, Statistics New Zealand says the share of investment going into plant, machinery and equipment investment is at a 45-year low"

Automation. LOL.

That's a helluva lot of Kiwi's with skin in the property game!!!

Both debtors and creditors.

And most are voters.

We've incentivised people to plough money into housing and they've dutifully done so.

The irony with the picture used for in article is strong!!! Says a lot about kiwis and a certain generation -.-

Of course manufacturing has fallen, 45 years ago was 1972, there were no imports or unemployment, the oil crisis hit in 74, over the next few decades we got rid of import tariffs and subsidies and freed up the economy, manufacturing effectively started dying. Price of imported goods were cheaper and still are, than what we could make, 1987 saw the financial markets peak and bust, more money in financial dealings than producing anything. Long bow to draw to blame it on housing, when in fact manufacturing was falling without housing investment changing. I agree with the comments that we have ploughed into housing, but the housing phenomena did not start in 1972, started in 2000, what happened in between to manufacturing.

At the end of the day, well purchased, well rented property is by far the safest and best returning investment there is!!!

Haven’t got KiwiSaver or superannuation funds personally and don’t need them!

Wouldn’t be banking on KiwiSaver as the returns are pretty crap overall and it is just the contributions that make it grow as the returns are eaten away by poor returning investments and fees!

Got a son who has an Ozzie fund when he lived there and hasn’t put anything into it since he left Ozzie and it has halved in value over the past 10 years.

Brilliant investment I would say!!

You won’t beat housing if you know what you are doing, as it provides you with both a great income and your retirement funds thru capital gains and rents!

Your ignorance is astounding. NZ's massive over reliance on property as investment vehicle is a contributing factor into why NZ has such appalling wages and low productivity.

1) Why don't you accept free Government contributions for the cost of $20 a week?

2) Kiwisaver returns have consistently been in high single and low double digits for the last few years owing to a massive bull run since the GFC. Hardly "crap."

3) No, compounding returns make the returns grow. Kiwisaver fees are pretty high; I'll agree with that.

4) How has your son halved his investment during a 10 year bull run?! Is he solely investing in AAA rating bonds or something? If you know his investments are doing poorly, why not tell him to change to an aggressive fund that has higher returns?

5) Stocks and equities also return capital gains and cash flow.

As a side note, I find it amusing you talk about how safe property investment is when your entire portfolio was affected by a series of earthquakes.

Thanks to THE MAN for giving me the LOLs for the day. Actually no, it was full ROFLs :D

Meanwhile when I look at graphs for other asset classes, that don't have the hassle of residential property, across decades.......yeah I'll continue to keep my cash out of the residential property investment game. The party is over and the smart folks have already left early in a corporate cab.

THE MAN 2, only says half this stuff just to get a reaction. His comments are often so illogical that even he doesn't believe it.

THE MAN has spoken and he knows what he's talking about - ok ;-?

He has to be trolling. There's no way someone can be so stupid and ignorant.

Some people don't know what they don't know ... There is no black swan, because they have never seen one ...

Ah yes there is.....

That's why I tell others to ignore that troll!! Just by his name you can tell he is a troll. His name is well on par with other ergo inflating names like hard co_k, grand daddy or eternal supreme leader!!!

Well if TM2 is so ignorant & wrong as you all say, why do you all think Real Estate has become the most common form of investment in NZ ??? Anyone ???

Stupidity loves company.

Just because a lot of people or everyone is doing it does not make it the best thing or the right thing to do.

If nz made making P, weed or cocain legal I am sure it will become the most common form of investment for nz. But does that make it the right investment?

We've discussed exactly this before. Some funds are expensive and terrible - like you say about rental property, you have to know what you're doing. On the plus side, this can be boiled down to a couple of sentences for investing in equities - buy the cheapest, most diversified, most passive index fund you can find, keep buying it, enjoy the rest of your life.

Your son's investment seems to have been a lemon, just like many people buying rentals without doing the research have been burned.

Kiwisaver is an absolute no brainer, put in $1000 a year and get $500 from the government - if you're employed put in 3% and get another 3% from your employer. Kicks any other investment into the long grass. I personally don't put in more than 3% due to the lack of freedom to withdraw, so excess savings go elsewhere.

mfd: so something like simplicity's growth fund for kiwisaver and then a few other ETFs on invest now/sharsies for diversification reasons?

Sounds good. I'm a bit of a hypocrite as I quite enjoy active investment, so I have my kiwisaver in Simplicity, some money in index funds elsewhere, and a chunk directly invested in the NZX. I know the statistics aren't in favour of me outperforming an index over the long term, but I'm enjoying giving it a go. Last few years have done quite well compared to the NZX as a whole.

Auckland Council slashed land supply to Auckland in 2010, cost went through the roof.

NZ government are promising to open up land supply to Auckland in 2018, cost to go through the floor?

Yeah, nah. Prices are notoriously sticky on the downside and absent Compulsion, landowners can simply sit things out, hoping for a Brighter Future. Only thing that could interdict that, is a 'deemed return' income assumption on land value (as per FIF) which would fairly smartly get sales moving. But there's nothing stopping TLA's from exercising differential rating based on 'Annual Value' - see S3 Rating Act 2002. Except the usual lacks:

- Brain cells

- Joined-up economic thinking

- Cojones.....

Doesn't matter.

Auckland can access lots of land that is currently less than 1/8th the median price, closer to the city than most of the overpriced new suburbs of the existing AUP. The price of newly accessible land might easily quadruple and existing owner of Auckland might never sell - still the price of land in Auckland will fall.

On a side note, a Sales Agent specialising in Dairy Farm sales told a colleague of mine last week that they were extremely lucky to sell their farm when they did, because only one farm sale was made last month for the entire country! Everyone is trying to get out of the market all at once because the banks are no longer playing along with them.

Yes, many farmers on the Hauraki Plains having endured shockingly wet winters and now a possible drought are not happy campers. Talk is a lot wish to get out.

Didge, I am hearing the same talk amongst my Dairy Farmer friends in the lower north island. They are all being squeezed and are seriously worried about not being able to sell up.

The property bears can call me what you want, it doesn’t change a thing for me or yourselves.

I haven’t got KiwiSaver as I don’t need it as we get a great income from Rentals plus on paper our capital gains are very impressive, and even better due to total leveraging and buying well.

My son had just over 1k in his super fund when he left oZ 10 years ago and when we looked at the statement last year it was $600 and no doubt be less this year.

Yes he hasn’t contributed to it since he left Oz and the fees are what has killed the balance.

I did open Kiwisavers for the kids so they got the 1k and now paying in, but they don’t rely on it as they will be extremely well looked after due to our property investment.

If you are happy enough that KiwiSaver will be sufficient to live on when you retire then that is great.

Personally I wouldn’t be!!

My best performing stock has gone up 52% since I acquired the stock in June last year, my next best 39%. My worst performing is -17%. and next worse -11%.

Overall the NZX50 is up @ 22% since June last year.

Fair enough, BLACK TUESDAY!

If you are happy with your money invested in something that you personally have no control over then that is great.

We had several shares wiped off the board so personally won’t do it again.

Personally have far more confidence in property as was singed in 1987, and it will happen again, don’t know when but there will be a major correction downwards.

And house prices never drop - it's your equity that goes first. Perhaps you made a poor choice in which company's you invested. Without knowing the details it is a bit hard to judge. Using FUD shows your paranoia about control. Several property reports have shown the Christchurch prices are declining.

The thing is I have greater control than you - there is an open market which I can see who is offering to buy or sell my shares, I owe nothing on them, I can continually add to my portfolio (with some restrictions of minimum value) and it can be done from home over the Interweb. Compare that with the illiquid nature of rental property.

EDIT

Fuuny you should mention black tuesday 1929.. I was just reading this snippet about real-estate values in the wake of the great bubble pop of 1929...

Using new data on market-based transactions we construct real estate price indexes for Manhattan between 1920 and 1939. During the 1920s prices reached their highest level in the third quarter of 1929 before falling by 67% at the end of 1932 and hovering around that value for most of the Great Depression. The value of high-end properties strongly co-moved with the stock market between 1929 and 1932. A typical property bought in 1920 would have retained only 56% of its initial value in nominal terms two decades later. An investment in the stock market index (including dividends) would have outperformed an investment in a typical property (including net rental income) by a factor of 5.2 over our time period

But that could never happen here right?

Black Tuesday 1987

Yep, head in sand, pretend that property never crashes as hard as the sharemarket...

E-A-R-T-H-Q-U-A-K-E

How's your control over another one of those? Or bank lending criteria? Or LVR ratios? etc etc

You've previously admitted that you lost money in shares because you didn't know what you were doing so your continued bagging of them as investment just makes you look ridiculous. Other people DO know what they're doing and their returns (mine included) have been excellent.

Earthquakes have been great for a lot of people financially.

A helluva lot of money has been made and the country has received a lot thru overseas insurance.

The biggest loss has been the unfortunate loss of lives which is regrettable.

Where did I say I didn’t know what ai was doing with the sharemarket?

Thing is is can happen again if U.S.A. Continues to have problems and we are not exempt!

Your returns may be great and so have our property returns and at the end of the day our property will remain but can you say that about the price of your equities????

"If you are happy with your money invested in something that you personally have no control over then that is great."

I was pointing out that the control you believe you have over your property portfolio is not as total as you think.

Of course some people have done well out of the earthquakes, some people also did extremely well out of black Friday.

Earlier in the year you and I were commenting on a topic and you were slamming shares as usual because you'd lost money and when I called you on why you lost you said you had invested in shares without really understanding what you were doing.

There can, and will, be another recession at some point that is a reality of investing. My investments are well diversified across asset classes and geographies and I can respond to movements a lot faster to minimise losses and take advantage of opportunities a downturn would present than you can with your property holdings.

You say your properties will remain but as you've also said that you're leveraged on them then they can be taken away by the bank should any one of a number of events occur. Or a geological event, how would your empire look if another earthquake hits ChCh and wipes them out? Would your insurance payout on all of them expediently? As we've seen from the appalling way the insurance industry has handled ChCh EQ claims thusfar how well reserved are you if they delay any claims payouts or go under themselves? This is the problem with a blinkered view of property investing, you believe its "yours" when its actually the bank's, and you believe properties are permanent fixtures that are immune from events beyond your control.

Bad Robot, I have never lost money on any property transaction over many years and I will guarantee that I. The future I won’t either.

Property,is my investment vehicle of choice and I have helped several to,improve their financial position thru property.

I had Rada, Equiticorp Tasman and a couple of others wiped from the board and they had been highly regarded shares.

Chch prices have been flat for a few months but wouldn’t say they were dropping at all and I can tell you now that we buy extremely well,so drops don’t worry me whatsoever!

You have no control over what other investors do, just as Black Tuesday showed and what directors do with their company.

We don’t sell property,nowadays and with our positive returns and ability to leverage for more property then we don’t need to.

Our property portfolio is significant and valued at mega millions which started from not,investing all that much but would never again consider putting any more of our own money into shares again!

The thing is, it's this type of attitude we need to get rid of. How do we get more people thinking that property is the default/only investment? We need more investment into productive sectors and innovation, which we can continue selling to foreign investors without any detriment. Successful startup sold to a foreign investor? There'll be plenty more.

What are these productive sectors then?

We don’t want foreign money as we have stopped foreigners buying our houses.

Shares are like Bitcoin they can be here today and gone tomorrow!

..take a pill and go back to bed.

Wow, he's really living up to the stereotype, isn't he? The Cult of Property is strong with this one. He's classic bubble fodder, the last one to sell

Its exactly that kind of myopic refusal to see any downside that results in disaster. I saw the reality of what happened to the property market in 2008 - families and communities destroyed, people who had literally bet the house on property and lost absolutely everything and still haven't recovered. That same "its different this time", "it can't happen here", "it'll never go down" mentality was as strong there as it is here in NZ now.

Sorry, where was "there"?

In the land of the blind, the one-eyed man is king.

I don't think there's many people more one-eyed than The Man.

Yes, he is the living embodiment of poe's law

"What are these productive sectors then?"

Value add to raw commodities. Why the fuck do we export raw logs and milk powder when we could be exporting packaged baby formula, fine cheese, furniture etc.

Then there's the whole software industry, that can improve productivity across many sectors.

Then R&D into technology. Power, medical tools and treatments, transportation, etc.

Solidname, of course I am one-eyed, opinionistic whatever, it pays to defend what you firmly beleive in If it has worked for you!

It is procrastination that costs most people the ability to be successful financially.

I have seen it time and again where people can get ahead providing they take action.

I take responsibility for all of my actions and it has always paid off.

Chch property is going to continue to provide excellent returns for us, and what I try to point out on here is that if you are prepared to take action and work there are huge opportunity to get ahead in NZ.

Whinging on about house prices is a very defeatist action and will not achieve anything.

The article this morning has clearly displayed that housing is still very affordable for first home buyers!

" Keep both eyes open!" That helps in every facet of life....

Being one-eyed blinds people to what's coming up of them from the right ( or Left in this case of a recent change in Government!).

Pretty much, I wonder how much risk assessment the Man does, strategies to overcome risks both known and unknown. There are multiple macro and micro environmental levers in play for property - the most simple one that is playing out right now and has the potential to shift even further, a population that is of voting age not being able to afford property in their own country, the Govt is enacting policies to address this, as well as enacting less landlord friendly legislation.

The rentier class are of the opinion that the coalition will be booted out if they don't address that, I don't think they will, I'm of the opinion that the non-homeowners will want more stringent regulations put in place, restriction on the amount of rentals allowed to be owned for example - 12% of landlords vs 40% of renters. IF that were on the cards, how many home owners of the remaining 48% would go which way is the question.

The problem is what works for you can't work for everybody. Not everyone can be a multi home owning landlord, because then there would be no tenants.

Your future success relies on the fact that a portion of society will remain tenants. The issue occurs when those who no longer want to be tenants can not be home owners due to insufficient supply, or unaffordable house prices. In these scenarios society beings to break down, and as members of this society we must solve the problem.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.