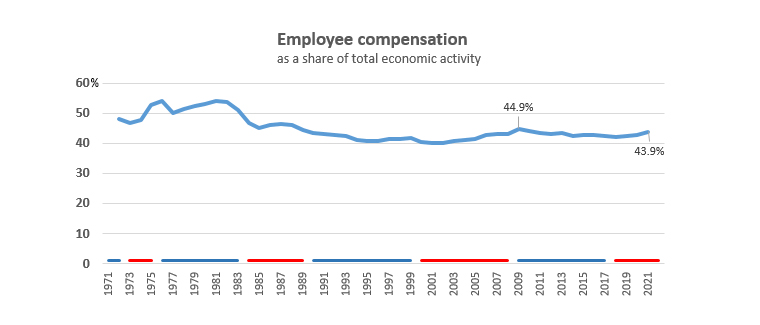

In late September after the very strong Q2-2021 GDP data was released, we noted that this showed a rising share of on economic activity was being won by employees. Overall, at least.

That data showed it up to 44% and its highest since the 2009/2010 years when it reached 45%. But it 'started' in 2002 at 40%, 2002 being when the Stats NZ data release went back to.

We observed that this data countered the popular misconception that workers aren't winning an increased share of national income, or were losing it. Al least for the last twenty years, that just isn't true.

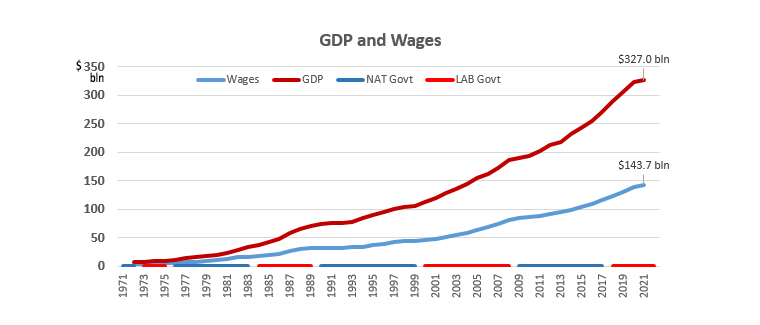

With the appreciated assistance of the good folks at Statistics NZ, we have accessed this same record all the way back to 1971, a fifty year track record.

That helps us understand the context of the 2021 44% share much better.

Alongside this data we have plotted the periods when various Governments were in power to see if there is any correlation.

Up to 1984 when the New Zealand economy was released from its centrally-planned straightjacket, GDP was actually very low. Since the inception of the modern economy, politicians controlled every aspect of the economy, protecting it from foreign forces who were assumed to have a malign influence on the locals, and assumed that New Zealanders were not capable of adapting or thriving in an open society. This drove very low economic activity, all centered around the agricultural roots.

Urban wage earners were 'protected' via strong unionism organised in giant state-owned employing groups (Post Office, Railways, construction, etc.), and they won an outsized share of the national income via these centalised and wildly inefficient institutions.

It was so inefficient, I recall having to queue at the Reserve Bank for permission to get some foreign currency for a magazine subscription.

But at least workers had [an unnaturally] large share of the meagre income the country earned.

After this straightjacket was released in 1984, through the necessity of virtual insolvency and near-bankruptcy, the economic pie started to expand, and rather rapidly. But workers weren't the early beneficiaries as those inefficient institutions and work rules were unwound. There was a lot of self-interested complaining, along with plenty of collateral damage to lives, careers, and businesses. Those 'reforms' were messy, and a second set needed to be invoked in the early 1990s, also leading to further disruption.

But that set the stage for a quite rapid expansion of the economic pie.

Various Governments talked about how the benefits of all this reform would flow to the voters, and over these fifty years it has become clear that both political stripes grew the pie, but the Labour Governments seem to have been the impetus for a greater share going to wages. These periods also featured declining productivity, and declining investment in productivity improvement, so a swing between the two different priorities has been needed to balance the 'growth' out. Sadly, the net result has been a slippage in our relative position internationally.

In 2021, almost 45% of the economic activity of the country is being won by workers. In 2022 it will likely be higher.

Interestingly, that is about the same as is won by American workers. The difference is that their economy is significantly larger on a per capita basis, so the compensation per person is so much higher there.

A smaller pie than potential is a significant handicap. It means those in poverty can have fewer resources diverted to aid them - just because there are fewer resources available nationally.

43 Comments

Well all I can say is that even with UE accredited, a trade certificate, apprenticeship and an NZCE the money in this country in wages has been a joke. Had I not purchased a house in Auckland back in 2005, I would have been financially screwed for life. Your going nowhere in this country on the average wage, its all about what you do with it that counts. Very few people getting "Rich" just working there asses off in this country.

In what country can you get 'rich' working for wages and salaries? I suspect getting 'rich' is about investing and succeeding in something most others don't or won't do.

I retired at 45 from the wages of sin - London bank dealer. Mainly because the shareholders were taking too big a share of the trading profits generated by bank proprietary trading desks. Hence I could no longer afford to work because our monetary activities were debasing wages faster than they rose, even back in 1998.

Or can't do. Investing involves having money to invest to begin with, and that has nothing to do with "won't" or "don't".

We might do well to live by something John Steinbeck once said:" work is the only good thing".

The "won't do" jobs usually fall into the category of really bad paying jobs. After years of study and 4 hour night school classes after an 8 hour work day you kind of expect something better than the average wage. Personally for me it was about doing something that I was good at, not looking at what was a high paying job in the end, my fault I guess. Still you have to have a bit of luck as well and it all worked out ok due to all the "Other" of life's decisions.

A praise piece for the virtues of Rogernomics?

The aggregate may show the "workers" are getting a good share of the income, however I wonder whether the professional, knowledge worker is getting a proportionately much larger share of the pie now, while the semi-skilled or even 'skilled but in a churn industry' are receiving a lot less. Pre-1984 a freezing worker may have been earning the same as a junior doctor - kiwis liked & supported that sort of egalitarianism. And kiwis did not vote the Lange govt in on a Rogernomics mandate.

When blue collar and govt workers were getting a good wage in pre-Rogernomics days - then a lot of social problems were prevented. Yes, we queued at the inefficient Post Office etc, but I now think some inefficiencies in the economy is good for the poor and lower-income groups because it allows some money on the table (or e.g. on the sides of the fields in ancient cultures). Strict slick efficiency is a tough system for those who do not have a tertiary education or family wealth/business behind them. Currently you're either fully in the modern tech financially driven economy, or you're definitely on the outer and struggling.

Those are anecdotal wonderings . The data shows clearly that the inequality is not actually increasing ..

https://www.interest.co.nz/news/97310/myth-households-are-getting-less-…

In aggregate perhaps.

Some qualitative analysis of the bands might shed some light on lower incomes.

Plus the household need for 2 full time incomes just to meet expenses - pre 80s more common for one main earner.

E.g. From your link a commenter - “. it is the middle 50% of the population, the teachers, midwives, the clerks, the engineers... the people targeted by kiwibuild and cant afford to by..the people who are currently on 50 or 75% of the wages of a basic MP, whereas a couple decades ago where about the same..”

"might shed some light .." - exactly - no data to support your reckons.

The only "evidence" you can come up with is more reckons from a commenter on old thread - with zero data to support his reckons ..

Aggregate household income does not really give accurate evidence of how households are faring. Particularly if there are wide differences within

The other commenter was quite accurate in that teachers are paid 50% or so than backbench MPs, as one example where before those salaries were similar

You won't find anyone that understands the data that would disagree with the statement that 'income inequalities have increased since the 80s'. The Treasury paper I included in my other comment is very clear. So is the data here: https://www.ird.govt.nz/about-us/tax-statistics/revenue-refunds/income-….

Definitely tradies are not missing out. I’m sure they earn much more than me judging by some quotes I’ve seen for a days work.

Podcast I was listening to today seems relevant "On Ayn Rand, Cooperation, and successful societies" on The Jolley Swagman podcast interviewing David Sloan Wilson.

His take in a nutshell was socialism is terrible because top down planning always fails leading to unintended consequences. Concentrated power also inevitably leads to corruption. Laissez faire free markets in pure form are likewise terrible. The optimum for successful societies is something like the social democracy of the Nordic countries.

David. Seems the worker share rose in the ten years to 2010, but for the last ten years really static.

The elephant in the room here is how that 44% is distributed. There has been plenty of research on this.

What the data shows unsurprisingly is that the 44% has become increasingly concentrated in the pay packets of the best paid people. The gini coefficient increased massively between the 1980s and 2000s and whilst a few people earning eyewatering amounts of money meant the mean wage did increase, the median wage actually went down! Treasury research described this well...

The feature that stands out is the 32.4 percent increase in average income for the top decile. Most of this occurred between the 1986 and 1991 surveys... https://www.treasury.govt.nz/sites/default/files/2018-01/twp00-13.pdf

I guess my take out here is that the size of the pie is not that important if most people are living off the crumbs.

Worth noting that income inequality is a minor villain compared to wealth inequality... https://www.wgtn.ac.nz/__data/assets/pdf_file/0007/1935430/WP-21-10-wea…

Interesting. Yes, my CE is on 450+k, the senior execs on $200k+, the professionals with postgrad quals have their jobs advertised at 65k+

Pre Rogernomics, the Director probably earned less than the in-house professionals in a lot of professional services organisations - law, accountants, lecturers, engineers, etc.

Maybe the productivity gap is getting bigger though. I know in my industry there are a lot of very clever and very productive people, they work hard, take very little sick leave, give it their all to help the company succeed, and at the end of the day get they paid fairly well. At the other end of the spectrum I’m afraid there are people that don’t give a toss, sick every Monday, and really don’t achieve that much. Of course employers are going to pay more for the productive people, if anything I think the wage gap should probably be bigger (I would personally pay more for the cream of the crop)

The 80/20 rule runs pretty consistently, 20% of people are pumping out 80% of the work. I'll happily take on a decent worker for $40-45 an hour, but an average worker is worth $0 to me.

The top 1% salary earners have seen incomes rise by 2 - 3 times in real terms since the 1980s - way more than the top 5%, top 10% etc (rest of the plebs). The top 1% are the execs that basically set their own pay - not the hard working technicians putting in the extra hours to please the boss.

At the end of the day what does it matter what the 1% earn? Would you rather live in a country where everyone is broke, or one where you get paid well and the 1% get paid stupidly well? Because realistically those are probably the only two options.

30% of families in poverty sounds pretty broke to me. Our economic model is supposed to efficiently allocate resources to the population. It doesn't.

Our economic model inherently leads to winners and losers, our political system tries to mitigate that through reallocation or resources.

Thanks, Jfoe, interesting post and linked info.

At least the minimum wage in Aotearoa is 20nzd compared to the 7.25usd federal minimum wage in USA. And yes, David, you are right. It is hard to become "rich" working for wages unless you are a CA or doctor or similar.

The least imaginative, least innovative, most mentally limited people at my client are CAs.

They have much to answer for in the lack of productivity issue. Their insistance on following cost accounting despite it being provably wrong is hilarious.

Perhaps the remarkable statistic is the remaining 55%.

Is this all a return to the owners of capital?

KeithW

That 5% over fairness perhaps is the incentivisation for capital outlay- sounds like a reasonable premium.

You make me laugh Keith. I was trying in an earlier life to create mathematical models of human hearing - we cared less what signal 90 percent of the sample population detected amongst the sample noise we generated. The important analysis was dedicated to resolving why 10 percent didn't detect the signal.

A large part is surely taken by government. Part of which finds its way into the wage and salary worker's pockets via 'working for families' etc.

But much of what is taken by Government is a transfer from wages and salaries. As such, the transfer is not in itself an economic activity. To the extent that the Government activities then generate wages and salaries, that will presumably already be in the 44%. I look forward to some clarification around these numbers.

KeithW

David Chaston has pointed me to the national income accounts.

https://www.stats.govt.nz/topics/national-accounts

The key item sitting alongside wages and salaries is 'gross operating surplus and gross mixed income' at approximately 47% in the most recent year.. The 'gross mixed income' will primarily be income earned by owners of very small companies where the income is not separated into salaries and profit. In the greater scheme of things the non-separated owner salaries will be modest.

The other item of significance in the national income accounts is taxes on production and imports, with this being primarily GST. [Income taxes are a transfer item that do not come into national income].

The bid message would seem to be that we do indeed live in a mixed economy with returns to labour and returns to capital being approximately equal.

All of this is separate from capital gains from houses and shares, which are not included in the national income accounts but are a very important part of wealth generation.

KeithW

All of this is separate from capital gains from houses and shares, which are not included in the national income accounts but are a very important part of wealth generation.

Market capitalization isn’t “wealth.” It’s the latest price, times shares outstanding. Blotches of ink on paper. Flashing pixels on a screen. If a dentist in Poughkeepsie buys a single share of Apple at a price that’s 10 cents higher than the previous trade, $1.6 billion in market capitalization emerges from thin air. If a single share trades 10 cents lower, $1.6 billion evaporates just as quickly. Whatever happens, every security in existence has to be held by someone until it is retired. Ultimately, the wealth inherent in a security is the future stream of cash flows it will deliver to its holder(s) over time. Price fluctuations don’t change those underlying cash flows. They just provide opportunities for the transfer of savings between investors. High valuations favor the sellers. Low valuations favor the buyers. Investors have never paid higher prices for those future cash flows, or accepted prospective returns so low.

Put simply, the bubble hasn’t changed the wealth, and a collapse won’t change the wealth. What will change is the market cap. I suspect that the erasure of market cap in the coming years, and possibly the coming quarters, may be brutal. Still, no forecasts are required, and our own attention will remain on observable valuations, market internals, and other factors. Meanwhile, even if an investor sells at these extremes, the only thing that will change is who holds the bag. Link

I agree that the market capitalisation is simply a financial measure of underlying real assets which have not changed. However, capital gains as measured by these market measures are a very important mechanism by which real wealth transfers do occur between individual and groups in society, with big gains to some and losses to others. The losers are those who are holding their assets in fiat currency.

KeithW

As I noted further up the thread.

Who can afford to accept NZD wages as a form of payment for work rendered, when it is so debased the unit cost of shelter is ~$1,000,000 and it takes a few $millions or more to save $10,000 p.a. at current deposit interest rates? Oh, I nearly forgot, financial repression is rabid with inflation last reported at 4.9%

The cost of shelter is not really ~$1,000,000 as you can rent or be a flat mate. If you don't have much money what can you do other than work for wages?

Gee that's interesting , if that is 47% out of the 55% balance of national income that is not wages and salaries?

Does that mean 47% of national income is generated by (effectively) self-employed/LL/sole traders? That's a lot higher as a percentage than I'd have thought - given the stress, insecurity, lack of employer-paid benefits, etc. associated with non-PAYE earnings.

There is a lot to be said for drawing a wage/salary, particularly if you don't measure 'rich' in monetary terms.

Gross operating surplus and gross mixed income will be mainly the former. Gross operating surplus has to cover capital depreciation and also fund fixed capital formation. The rest is a return to capital (one way or another). Lots of issues to be teased out.

KeithW

Thanks! Yes, very informative and interesting subject.

Inflation can be a good thing if you want your wages up.

"We find that there is a reasonably strong link between inflation and wages - 55

percent of employees have their wages set with some kind of link (formal or informal)

to inflation. This number is reasonably high internationally, but is in line with previous macro-economic studies of wages and inflation in New Zealand. Past inflation outcomes are more important for determining wages than expectations of future inflation." - J.Armstrong & M.Parker, RBNZ.

"We observed that this data countered the popular misconception that workers aren't winning an increased share of national income, or were losing it. Al least for the last twenty years, that just isn't true."

Lucky workers, getting a slightly higher share of something that matters a lot less than it used to - national income. Meanwhile governments pile rewards on those already with capital in assets, by boosting their asset prices.

All my fairly high income does is keep the govt and the landlord in business, and it pays the family bills. I'm falling behind asset owners by thousands every month.

It’s no coincidence that in 1971 the world went off the gold standard, and we started inflating our way into prosperity and living beyond our means. There was no other choice than to keep workers happy by increasing their wages, as they were distracted from the real theft of inflation. We have become addicted to high time-preference dopamine-inducing, wealth creation (greed), resulting in greater draw down on debt and faster burn/consumption of limited resources, and we have wracked up an insurmountable debt for future humanity. Every great empire hit the same wall as the debt must eventually be paid.

I run a business and invest and am constantly told by people that they couldn't possibly do the same.

Ithink David needs to dig deeper , to get a more realistic picture.

I favour the view of Ray Dalio.

He explains that we now have Two economies ... The bottom 60% and the top 40%.

Taking aggregates and averages of the whole economy gives a distorted view.

eg. 8 people earn 50 000 /yr and 2 people earn 350000/ yr.. the average income is $110,000

$110,000 is a long way away from the $50,000 most people make.

https://www.linkedin.com/pulse/our-biggest-economic-social-political-is…

The other BIG thing David ignored was debt and debt levels.... Most of our GDP growth is on the back of debt growth.... ( which is nothing to celebrate ).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.