This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

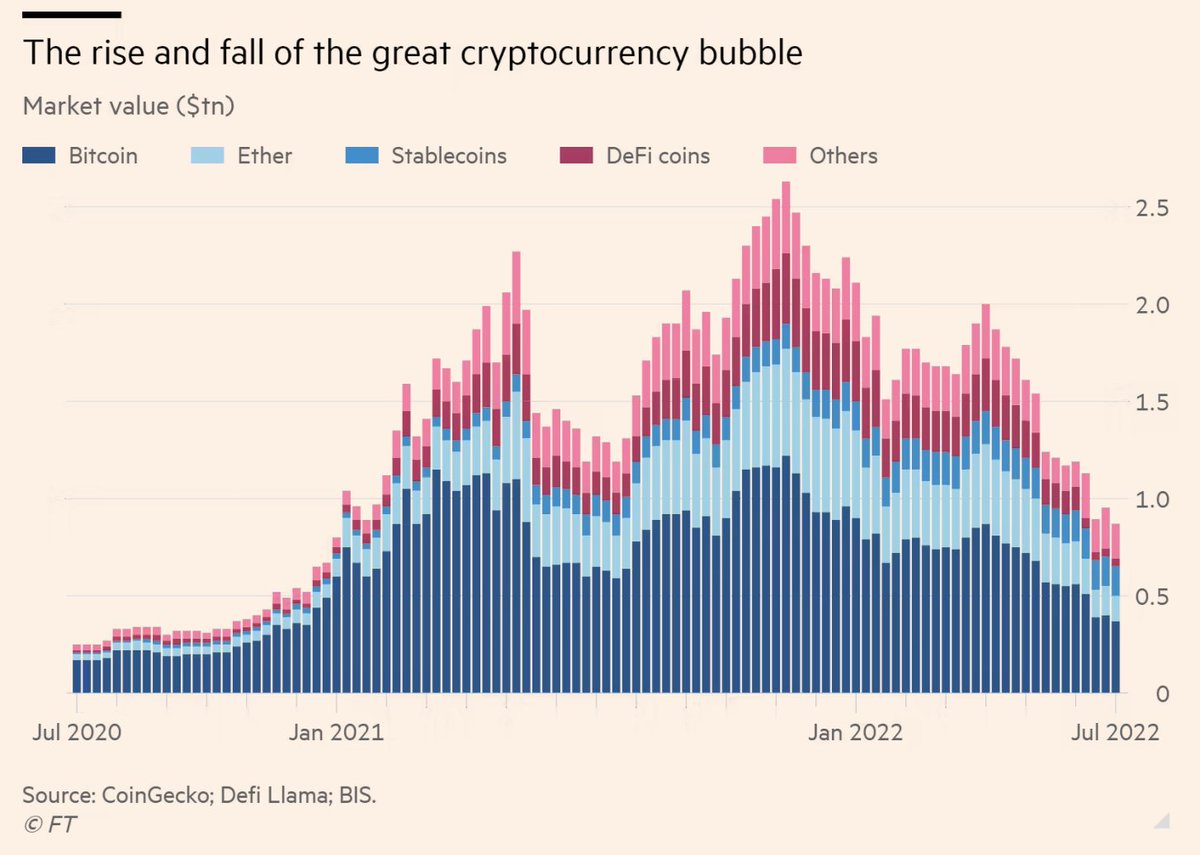

IMAGE: The Financial Times.

1) Onshoring/reshoring manufacturing, - 'it's just economics.'

Whilst preparing for the next episode of our Of Interest Podcast, I stumbled across this Bloomberg story. In it Ryan Beene writes about a big increase in the construction of manufacturing facilities in the US. A key driver of this is supply chain woes that have emerged during the pandemic, which have made China a less appealing manufacturing location for some multi-national companies.

Rattled by the most recent wave of strict Covid lockdowns in China, the long-time manufacturing hub of choice for multinationals, CEOs have been highlighting plans to relocate production -- using the buzzwords onshoring, reshoring or nearshoring -- at a greater clip this year than they even did in the first six months of the pandemic, according to a review of earnings call and conference presentations transcribed by Bloomberg. (Compared to pre-pandemic periods, these references are up over 1,000%.)

More importantly, there are concrete signs that many of them are acting on these plans.

The construction of new manufacturing facilities in the US has soared 116% over the past year, dwarfing the 10% gain on all building projects combined, according to Dodge Construction Network. There are massive chip factories going up in Phoenix: Intel is building two just outside the city; Taiwan Semiconductor Manufacturing is constructing one in it. And aluminum and steel plants that are being erected all across the south: in Bay Minette, Alabama (Novelis); in Osceola, Arkansas (US Steel); and in Brandenburg, Kentucky (Nucor). Up near Buffalo, all this new semiconductor and steel output is fueling orders for air compressors that will be cranked out at an Ingersoll Rand plant that had been shuttered for years.

Beene notes, however, that it's not a return to the halcyon days of US manufacturing, with around eight million jobs lost between peak to trough. The automation of many jobs means US factories today require smaller numbers of workers than they once might have. Additionally the strong US dollar isn't helping at the moment because as it rises against the yuan, yen, pound and euro, it becomes more expensive to make things in the US than in some other countries.

However, the article quotes Kevin Nolan, the CEO at GE Appliances, arguing that concern about high costs in the US is overdone.

It has been for years, he says. Around 2008, he came to realize that on large items -- like, say, dishwasher size and up -- the savings earned by eliminating overseas shipping could outweigh the extra money spent on labor here. The key, he determined, was to wring maximum efficiency out of the factory floor to keep those labor costs down. A year later, he decided to test the thesis out and moved some of GE’s water-heater production to Louisville. Other product lines followed.

It’s all been such a success for the company -- which is now, ironically, owned by China’s Haier Smart Home -- that Nolan has been waiting for other CEOs to follow his move. It took a pandemic to convince them to do it.

“I’ve always said, this is just economics, people are going to realize that the savings they thought they had aren’t real,” Nolan said in an interview, “and it’s going to be better and cheaper to make them here.”

As a trading nation New Zealand is, of course, heavily dependent on global supply chains. We are much, much smaller than the US and China of course. But will any significant onshoring push emerge here?

2) Advice for central banks in their inflation fight, part 1.

Central banks are getting plenty of advice on their battle with inflation. And writing in the Financial Times, Martin Sandbu weighs in with his.

Basically Sandbu argues US and European central bankers have bottled it. He points out that during the pandemic, the US Federal Reserve and European Central Bank have reformed their monetary policy strategy. Following a decade of below-target inflation with employment taking a long time to return to earlier peaks, central bankers pledged to be relaxed about inflation running temporarily above target as long as ongoing monetary stimulus was justified.

This should have steeled central bankers’ nerves in the face of several bad supply-side surprises. And for a while they did keep their cool during the resulting inflationary burst. But they have not sustained the courage of their new convictions. Instead they let criticism bully them into rejecting the possibility that high demand pressure could draw more resources into the economy than previously thought and thus over time help contain price pressures while maintaining growth.

Central banks now seem determined to restore that monetary version of toxic machismo that says if it doesn’t hurt, it’s not working. Leading policymakers are increasingly explicit about intending to bring inflation down even at the cost of slowing growth or putting people out of work. Markets have taken their cue and are bracing for recessions.

Sandhu appears to still be in the transitionary camp.

At first the rise in inflation was near universally attributed to supply shocks. But despite the obvious role of Vladimir Putin’s attack on Ukraine and the subsequent tightening of gas supplies, prevailing opinion has somehow shifted to blaming excessive demand.

Yet it is only this year that nominal spending surpassed the pre-pandemic trend in the US; and it still has not done so in the UK or eurozone. Even in the US, the total volume of goods and services bought (as opposed to their market value) is right on the pre-pandemic trend. Not so much demand running amok, then, as recovering demand (itself a triumph of crisis policymaking) facing higher prices for supply-side reasons.

The obvious retort is that even if demand is near a normal level, supply may not be, either because of the pandemic or energy and commodity price spikes. But how certain can we be that these are durable problems? (It makes little sense to cause a recession to deal with temporary supply hiccups.)

In the FT article Sandbu goes as far to say central banks should treat inflation with "benign neglect."

The last line of argument for tightening into a supply-triggered recession is to avoid a wage-price spiral. But the rationality of this depends on the risk being more than theoretical. By themselves, wage increases are of course something to welcome — and robust profit margins suggest wage costs are not driving prices up. It is also worth noting that countries with the greatest collective bargaining coverage (France, Italy, the Nordics) have the lowest inflation rates.None of this should belittle the real suffering caused by the cost of living crisis. But monetary contraction on the cusp of a recession will make things worse for no benefit. Governments have to put in place support for those worst hit by the jump in prices. But maybe central banks — for the very sake of monetary and economic stability — should treat inflation with more benign neglect.

3) Advice for central banks in their inflation fight, part 2.

Again writing in the Financial Times, Jean Boivin, a former Bank of Canada Deputy Governor who is now head of the BlackRock Investment Institute, weighs in.

Boivin sees an urgent need to raise rates back to a neutral level that neither stimulates nor suppresses economic activity. But the problem he sees is central banks going further and pledging to stamp out inflation, “whatever it takes”. This, he argues, appears to be addressing the politics of inflation when the actual economics of inflation aren't that simple and require a more nuanced solution.

The last two years have been very different. Production constraints have been hampering the economy in ways they never did during the Great Moderation. The pandemic triggered the largest — and still unresolved — spending shift recorded in the US, from services to goods. The most important bottleneck to ramping up production has been labour supply: many people are hesitant to re-enter the labour market or are taking longer to find a job in a new sector. And these production constraints have been exacerbated by large energy and food price shocks resulting from the Ukraine war.

Even when the constraints do resolve, structural trends such as geopolitical fragmentation, the rewiring of globalisation and the climate transition will affect production and push costs up for years to come.

It is possible to bring inflation back to 2 per cent quickly. But this will come at a great cost. Raising interest rates will do nothing to relax these production constraints, reduce energy prices or address the root cause of this inflation. The only way to bring inflation down is to crush the interest-rate sensitive parts of the economy that are not responsible for today’s inflation. This is a far cry from the demand-driven episodes of the last 40 years, when raising interest rates was the remedy for debt-driven spending.

Boivin goes on to argue the alternatives are central banks crushing the economy to kill inflation, or we are forced to live with more inflation.

This is not a trivial choice. Either way, we are on course for a less favourable combination of inflation and growth. Blindly pursuing the politics of inflation is almost certain to lead to even worse outcomes. A clear and nuanced framing of the issue is difficult to achieve in today’s hyper-politicised environment, but it’s what we badly need.

more than 20 govt resignations (so far)

— ian bremmer (@ianbremmer) July 6, 2022

boris, is in fact, toast pic.twitter.com/nZ4N9hpAAa

4) Dr Doom's 'mother of stagflationary debt crises.'

Nouriel Roubini is again living up to his nickname. "Dr Doom" is suggesting that we're heading for a world where the stagflation of the 1970s will be combined with the spiraling debt crises of the post-2008 era.

Writing for Project Syndicate, Roubini argues that with debt ratios much higher than they were in the 1970s, a combination of loose economic policies and negative supply shocks threatens to fuel inflation rather than deflation, setting the stage for the mother of stagflationary debt crises over the next few years.

It's not a cheerful diagnosis from Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business.

When former Fed Chair Paul Volcker hiked rates to tackle inflation in 1980-82, the result was a severe double-dip recession in the United States and a debt crisis and lost decade for Latin America. But now that global debt ratios are almost three times higher than in the early 1970s, any anti-inflationary policy would lead to a depression, rather than a severe recession.

Under these conditions, central banks will be damned if they do and damned if they don’t, and many governments will be semi-insolvent and thus unable to bail out banks, corporations, and households. The doom loop of sovereigns and banks in the eurozone after the global financial crisis will be repeated worldwide, sucking in households, corporations, and shadow banks as well.

As matters stand, this slow-motion train wreck looks unavoidable. The Fed’s recent pivot from an ultra-dovish to a mostly dovish stance changes nothing. The Fed has been in a debt trap at least since December 2018, when a stock- and credit-market crash forced it to reverse its policy tightening a full year before COVID-19 struck. With inflation rising and stagflationary shocks looming, it is now even more ensnared.

So, too, are the European Central Bank, the Bank of Japan, and the Bank of England. The stagflation of the 1970s will soon meet the debt crises of the post-2008 period. The question is not if but when.

5) Why Dutch farmers are revolting.

Climate change and agriculture is a combination we're going to be hearing a lot more about in New Zealand.

This week the Climate Change Commission released its advice on pricing agricultural emissions. Beef + Lamb New Zealand and DairyNZ responded by strongly urging the Government to adopt the primary sector’s agriculture emissions pricing solution – He Waka Eke Noa – in its full, proposed form, saying they strongly disagree with the Climate Change Commission's advice for no recognition of sequestration via the He Waka Eke Noa system.

Watch this space.

Meanwhile in the Netherlands, another major food exporter, farmers are protesting. They are blocking roads, setting fire to haystacks, and driving tractors through the streets of The Hague. The episode of Al Jazeera's Inside Story below debates what's going on.

Dutch farmers are angry. They say plans by the Government to reduce nitrogen emissions will harm their livelihoods. The Netherlands is the second largest agricultural exporter, so what is this going to mean for global food supplies?

63 Comments

Hopefully in my lifetime, we will move away from some outdated economic concepts - essential to pricing and killing stagflation: Gross wages (you only ever get the bit you're allowed to keep), Take-home pay (discretionary spend influences wellbeing, take-home pay that's fully consumed by the basics just bakes is misery) and the idea that your time spent commute shouldn't be counted as work (it's sure as hell not family/quality of living time, is it?).

Until we start challenging these assumptions, we're kind of doomed to wander around as technology gets more sophisticated, looking for ways to fill an eight hour day for many people - when in reality we're getting more work done than ever before, with none of the leisure benefits that come with it.

Until we start challenging these assumptions, we're kind of doomed to wander around as technology gets more sophisticated, looking for ways to fill an eight hour day for many people - when in reality we're getting more work done than ever before, with none of the leisure benefits that come with it.

Technology is deflationary. Jeff Booth's thesis that many people don't understand:

Technology is the most important deflationary force in the economy due to its exponential aspect, and trying to counter deflation by printing money will ultimately end up destroying any currency.

the idea that your time spent commute shouldn't be counted as work (it's sure as hell not family/quality of living time, is it?).

Faulty thinking. Your employer is not responsible for your choice of living location. When you take up a job, the contract must state where the regular work location is. You choose to take the job based on that information.

Houses that have good transport connections are valued more highly than those that don't. The solution is to build better public transport solutions everywhere people live.

Jobs that don't have fixed locations will typically include transport allowances and often company vehicles to get around.

Also if you don't like commuting, get a job that can be worked from home.

Try being a seafarer then. A shipping company may well say 'it's your responsibility to get to and from work' as an excuse for offloading a seafarer in a foreign port far from home.

The last sentence is key. Companies that offer more WFH flexibility will have a competitive advantage in the recruitment market.

Some interesting topics covered, Boris Johnson - I mean it is more Ceausescu than a functioning democracy. The guy is borderline insane and surely this shows Brexit was based on a pack of lies?

I've been keeping an eye on the Dutch protests, I see them as a bit of a litmus test. I mean, we have soaring food price inflation but Governments want to force farmers into further changes that will a) mean lower crop yields and b) higher prices. Something has to give, we are literally engineering the inflation and then pretend to be surprised.

It also turns out Russia are the largest producer of fertilizer and we have sanctioned them to the hilt.

And what to do about businesses' pollution and who should pay the cost of cleaning it up?

Who pays when consumers can't afford to?

Consumers still do, just often with their health instead of their cash.

Let me put it another way: What is the actual $$$ cost of a weekly food shop now vs. food producers covering all of their costs under future ETS schemes? Because one of those has to get paid in dollars in the here and now. Health over a long period of time effectively becomes an abstract construct if you're starving to death today.

Raises an interesting question - are we dealing with famine vs enough to eat, or are we dealing with profit margins in for-profit businesses and being able to socialise / not the cost of pollution? With agricultural subsidies of 19% of gross farm revenue in the EU (post-WW2 food security), what is the actual core issue?

Food security, ownership and distribution, profitability? They seem to get muddled in discussions.

Have a look around, I think you will find most of us are a long way away from starving to death, particularly the poor.

We can debate whether the negative externalities were being priced correctly or not. My point is that the change causes inflation and suffering so can we be honest about this instead of blaming Ukraine and energy prices for inflation. Why on earth would a cenral bank tighten rates to address this??? They should but shuffled off to Boomer land.

Yes, sorry, muddied the waters here. No pun intended.

To those with an orthodox economic lens there seems to be some realization that (almost) everything has become a negative externality and hence why orthodoxy is unable to predict the future, let alone explain the present.

Why inflict the problem on the Boomers

And yet we 'with a shrug of our shoulders' pay approx. 50% more for our housing than we need to, ie hundreds of thousands of dollars that could be more effectively put to use to pay for any extra costs as described.

It's hard to take some people seriously (not meaning you) when they complain about saving costs, themselves or the planet.

If Climate change taxs (such as the proposed NZ tax on fertiliser happens) intensified farming is going to slow and countries like NZ will slowly revert to sustainable farming just to feed our 5 million.... Billions and I MEAN BILLIONS will starve to death if we destry coutries that produce food, while countries like china and india continue to burn and build coal fired power stations...... I see madness and misery being championed by the WEF.

I try and avoid the conspiracy theories, BUT.... There is a global body co-ordinating these changes somewhere (choose your acronym) and they were not democratically elected.

Trust me I am not into it either, but have you taken a look at the WEF, exactly who voted them in to lobby???? Take a look Te Kooti, try to explain to me who they represent? its not the average NZer.... I am happy enough with my 30 sheep and 4-7 beef cows, big vege garden etc, but if the climate change WEF have there way you are not going to be eating as much meat going forward.....

International flights are mighty expensive these days.... hard to see 900k visitors to Milford sound a season returning. Beautiful place but is it worth burning that much carbon just for a holiday?

It is sad that pollution and climate discussions seem to be no-go areas in public discourse when it comes to tourism here.

I tend to agree IT. I mean, how do we square away having an international tourism industry with our Net Zero commitments? The carbon footprint for most of our international arrivals is enormous. What's left after our tourism and Primary industries are hollowed out?

What's left? Not much. At that point the wisdom of decades of politicians deliberately growing population will be revealed for the delusional policy it always was. NZ is still a nice place to live and we can still make some change mowing the bolt hole lawns of the uber wealthy.

We are an amazing country, geographically diverse, temperate. I travel a lot but always love returning. Our isolation will be our strength one day, if it's not already.

You'll own nothing, and you'll be happy (and don't forget to "eat the bugs" too)

Eating transgenic yeast and powdered cricket is just one of those little bonuses of exponential growthism economic priests are always cheerleading for. Mmm. Finite planet, meet vanishing resources. :-)

That's our housing policy, yeah.

Te Kooti,

BUT.... There is a global body co-ordinating these changes somewhere (choose your acronym) and they were not democratically elected.

Please, you are much too sensible to go down these rabbit holes. You are saying that there is/must be? such a body somewhere. Do you have one shred of evidence to support that? I am not saying that conspiracies never happen; we know that business cartels do exist for example, but cock-ups are much more common.

I was pretty careful to caveat at it, but on balance I think it more likely than not. I am science based, rational and well educated. But I have serious questions about the Climate lobby which I think is more about ROI than CO2.

Not sure of either your science or your rationality. at times. I'd suggest a little muddying via self-interest? Cake, too kind of thing?

The Climate lobby are right. Their science is robust, and longitudinal more than almost any other. But they are right about only one aspect of the human predicament.

For that reason, they mostly get it wrong; they assume a green BAU and urge construction of same. Which requires fossil energy. More fossil energy, atop BAU. Some are still away back at the 'ethical investment' stage - and that's at the front end of the debate. We have a long, long way to go, and not much time - if any - left.

Existential issues run far deeper, and are incompatible with consumption as we have recently known it.

Ultimately, people either do useful stuff, or they are parasitic. Most investors, traders, landlords, are parasitic. We will see a societal need for people all to be doing useful stuff, it'll be interesting to hear the squeals from the likes of oh-so-important high-heeled RE types, when they realise they have to dig spuds or wheel compost......

I don't vouch for this website, but the predictions are fact checked. https://empoweringamerica.org/tea-factsheet-climate-predictions-through…

Over to you.

Paid spin from the gas industry. No, you are wise not to vouch for it. I'll run an eye over it during the weekend, and will indeed get back to you. There is always a fatal flaw - sort-of cunningly buried but nonetheless there - to such spin. Once you spot the bait the switch is glaringly obvious. Like those claiming we re decoupling GDP from carbon. The two unmentioned flaws are debt, and offshoring. So it goes.

I'd point out something, though; there is NO safe CO2 level. No threshold. Merely a row of signposts we are passing on the way.

But there is an unsafe level?

... I'm totally cumfuddled , Dale ... PDK says there is no safe level of CO2 ... so , what're plants gonna do ... oxygen is bad for them , they need CO2 ...

It all makes sense now, when they said there was no safe level for drinking alcohol, they meant the CO2 in the beer. I'm only drinking Scotch from now on, with a drop of H20, or is there no safe level of H2O as well?

... if it's a good single malt , there's no safe level of H2O in Scotch ...

CO2 on the other hand , plants go gaga over that ... makes them party hard ... ... PDK is such a party pooper ...

I only drink double malts (a single malt in each hand).

DP

I take it you aren't serious with that statement? The effect of CO2 on climate is as clear as any scientific fact can be. I'm guessing you missed the high school science fact that plants respire? https://www.anu.edu.au/news/all-news/plants-release-more-carbon-dioxide-into-atmosphere-than-expected

So you are saying what?

Reply to GBH up thread. 1) He doesn't agree physics is real and 2) Plants require oxygen

I think you will find GBH was being somewhat 'tongue in cheek,' but you are a Palm Tree so you will know what's best for you. ;-)

That's why commercial glasshouses run at 800 to 1000 ppm of the Killer Trace Gas.....

Be Kind to Plants.....

Of course. This is physics and ecology, not economics. Feedback loops apply, multiple systems involved. It is probable that we are already into uncontrollable feed-back territory. Fires beget fires, melting begets melting, floods beget soil loss....

There's a fixed level of potential C02 in the system, the risk comes from what time periods deemed to be risky between it being sequestered or being in the atmosphere / organic eco system.

Gee whizz TK. Had a look at your reference and there is nothing controversial about those predictions, except the spin put on them by science illiterates. I like this one. "At the most likely rate of rise, some experts say, most of the beaches on the East Coast of the United States would be gone in 25 years." I know, a quick Google and https://oceanservice.noaa.gov/facts/coastalthreat.html . Funny how if someone can be bothered fact checking, or interpreting comments as intended, the clouds of ignorance disperse.

Palm Tree, I do not vouch for that website - it was the first with a few examples (documented) of dire predictions that never eventuated. It's been happening for 40 years. I'm all for conservation, reducing pollution and pretecting the environment, however i have a pretty fierce distaste for BS as well and if the climate lobby keep making wild forecasts that do not eventuate, sane people like me will start noticing.

High opinion of self.

Always a red flag.

Usually means fragility when faced with crisis - thus the need to avoid.

Just saying.

Totally agree with you Te KOOTI

Unreferenced opinion?

Counts for a lot. Thank you for that contribution.

I see it as worse than that. Where will we find the forex to pay for our imports (we're addicted to them) if we're not exporting? And what will we be paying for the sustainable production of our food? Too much for the market to bear, leading to a doom spiral of people walking off the land/ foreign companies buying our productive land or all sheep and beef land reverting to wilding pines.

PDK's paradise can begin all over the world once the bodies have been buried. Or Mad Max

china may be begging aussie for food rather then coal and iron ore going forward if the rain keeps falling other in the west island

Sounds like a potential false dichotomy in operation here, though, between status quo and "destroy countries that produce food" Mad Max world.

Those don't seem like the only two options possible.

The Netherlands is an extreme case of intensive agriculture though - an area less than the Canterbury region with more than 17 million people, also producing about 2/3rd's of NZ's dairy production plus carrying lots of other livestock like pigs and chickens, plus growing huge amounts of vegetables and flowers. Seems like something has to give.

The FT guys are correct.

The FT guys are indeed correct!

In a few months, we will be down to a handful of rabidly-frothing, austerity-fetishing economists calling for rate hikes. When asked why, they will answer honestly: "We need to keep the peasants on starvation wages, the poor in the gutter, and the power in the hands of the deserving few."

We may be in for interesting discussions between economists and politicians; the well-heeled former (Wolfowitz, Volker types) will do whatever without concern for the masses; the 'pollies can't. And they're all between a rock and a hard place.

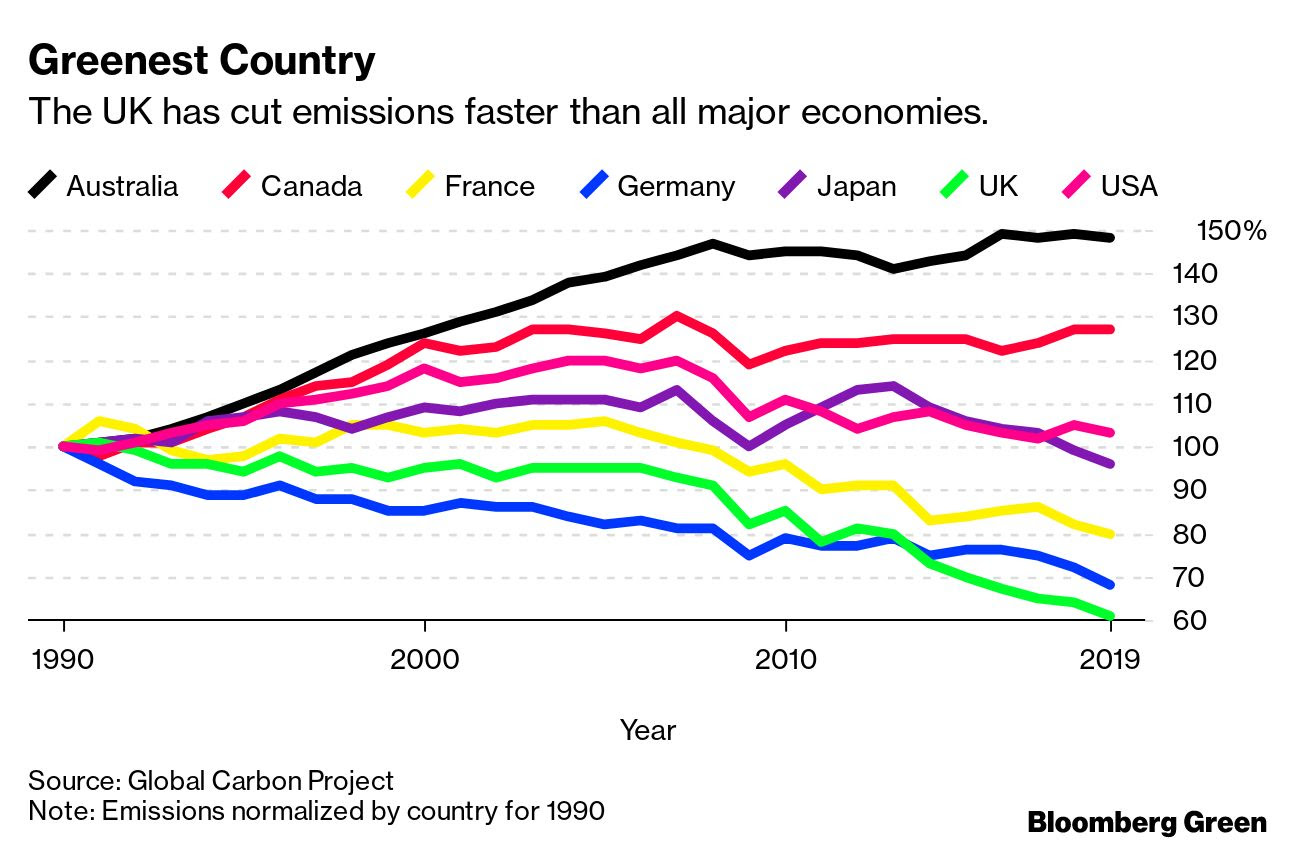

Have a good look at the second graphic here:

https://www.interest.co.nz/public-policy/115678/murray-grimwood-outline…

And realise that food has peaked. That graph is from the longest-running, still-fitting economic study of all time. This is show-time - and I reckon Putin was well aware it is. The Brics are lining up to coalesce, the West will be out in the cold, and it's two biggies are in political ruins.

Interesting times. Teaching people to produce their own food, go local, get resilient skills, that's where the future is. Oh, and maybe fighting WW3.

NZ is not on that greenest country graph but I imagine we are similar to Australia. How embarrassing.

Yeah…

well done UK

That last graph is classic greenwash. Watch those lines curve north again, once onshoring really kicks into gear and those exported emissions come home from China.

Lying to oneself never works long term. Unsurprisingly, they elected a liar; unsurprisingly, Britain is in trouble.

Whether they address their real problem, is a moot point:

https://consciousnessofsheep.co.uk/2022/07/04/fruitless-destruction/

Just in case anyone missed it ....

So much science to sequester. Come on guys, it's Friday. WJ's Friday rant:

The Dutch are not stupid people & have a history running parallel dominant cultures to the French, the English, the Spanish, the Portuguese, the Italians (Romans) the Greeks, the Babylonians, the Assyrians, the (Medo) Persians & I would think the Han Dynasty would want to be included on the global honours board as well. And some of you will think of other great cultures that have come & gone that I have omitted (not emitted) but what you're all saying is the we've reached a fork in the road (it could be a roundabout) that could be the end of the Earth as we know it & it could be run from the Swiss mountains in association with other Soros type characters, while we all do as we're told. Am I right?

I'm sorry to suggest otherwise, but this is not the end of the world, & indeed your discussion(s) above is part of the way through it, with science playing its part as usual, & if you look at things close enough you will see that there is as much good stuff going on out (read NBR) there as there is bad stuff, it's just that we're all addicted to writing & reading about the bad stuff, which is not very helpful in the long run.

The price of houses may have to come down. The price of everything may have to come down. The markets are working, even though they are going backwards. What we are witnessing is a resurgence in collaboration amongst what was once termed as The Allies (of the West) & this group of people, perhaps half of humanity now gathered, will end up looking after each other, working together better & generally doing better at stuff than the other half of humanity, which will be trying to break into our cultures at an increasing rate (Mexico/USA border) (Africa/Southern Europe sramble) as those from the other half realise that the future of planet Earth is with those who are educated, co-operative & pleasant to one another (or just to deal with) rather than the opposite.

This will not stop the other half from (wanting to) killing one another, or indeed us, if it comes down to it, however the difference between the light & the darkness will be plain for all to see & with our warts & all, we will need to communicate better (which includes listening) trading in better foods, better products & better services with hopefully better people as well, whilst we transition into tomorrows world today.

Yes, it might be painful. Good. Then we might appreciate it a bit more. It could be expensive? OK. Then we might value stuff & the peoples skills a bit more. It could be nasty? It could, but we're trying hard for it not to be, as much as we can. It could get ugly? It could. Don't say you weren't warned of the possibility.

What do we need to get through this? Better education. Yes please. And soon if possible. Better relationships with one another. Always. Better foods, better services, better family outcomes & especially better human beings - hopefully. Then, just possibly, we might have a better planet, with maybe not quite so many people, providing it's the baddies that have to go, right?

Pleasing to note as per Paris climate change agreement that emissions should not be reduced at the cost of food production. Which leaves us in a tough position. How to reduce emissions along with our zero carbon 2050 goals and not impoverish the country. I wonder where carbon farming fits in?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.