This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

People online vs. in real life 😂 pic.twitter.com/9iXACAed1d

— 𝕐o̴g̴ (@Yoda4ever) August 31, 2022

1) High inflation & energy rationing threaten Europe.

There was good news in the European energy market overnight. Wholesale gas prices dropped, with the European Commission saying it's looking at options to cap energy prices and cut electricity demand in proposals to combat soaring energy costs. Germany's year-ahead electricity futures dropped as much as 54% from record highs above €1,000 a megawatt-hour.

However as summer comes to an end in the Northern Hemisphere and Vladimir's Putin's war in Ukraine rages on, European gas prices are something worth watching. It's fair to say the rubber could meet the road in a pretty ugly way. And the ramifications of the continent's dependence on Russian energy may spread well beyond Europe.

Goldman Sachs predicted this week that UK inflation could surge 22% next year if energy prices continue climbing. That's well above the 13% the Bank of England recently forecast. Here's CNBC:

It comes after British households were hit with a projected 80% increase in their energy bills in the coming months, taking the average annual household bill to £3,549 ($4,197) from £1,971 and exacerbating the country’s existing cost-of-living crisis.

Britain’s energy regulator [Ofgem] announced Friday that it would raise its main cap on consumer energy bills from Oct. 1 to keep pace with rising wholesale gas prices, which have surged 145% in the U.K. since early July.

Gas prices have soared to record levels over the past year as higher global demand has been intensified in Europe by low gas storage levels and reduced pipeline imports from Russia following the invasion of Ukraine, CNBC says, also increasing electricity prices.

Ofgem is due to recalculate its price cap again in three months. However, Goldman said that if prices remain “persistently higher,” another 80% hike could be possible.

“In a scenario where gas prices remain elevated at current levels, we would expect the price cap to increase by over 80% in January ... which would imply headline inflation peaking at 22.4%,” Goldman economists, led by Sven Jari Stehn, said in the note.

Meanwhile the Czech Republic, holder of the European Union’s rotating presidency, called an extraordinary meeting of energy ministers. The meeting is scheduled for Brussels on September 9.

The scale of the problem is enormous. The Financial Times reports Europe’s fertiliser industry association warning 70% of production had been curtailed by high gas prices, "illustrating how the energy crisis is rippling across industries and threatening sectors from glassmaking to food production."

Shell's CEO Ben van Beurden says problems could persist for several years. Reuters has a look here at Europe's potential alternative energy sources, noting among other things that:

Germany has triggered stage two of its three-stage emergency gas plan and urged businesses and consumers to save gas to avoid forced rationing.

Against this backdrop Der Spiegel reports that German sentiment is warming towards nuclear power plants.

A poll commissioned by DER SPIEGEL has revealed some rather shocking numbers. According to the survey carried out by the online polling firm Civey, only 22 percent of those surveyed are in favor of shutting down the three nuclear plants that are still in operation in Germany – Isar 2, Neckarwestheim 2 and Emsland – as planned at the end of the year.

To help people cope with rising energy costs, Germany’s government wants to support its 83 million population with a one-off payment.

— Janosch Delcker (@JanoschDelcker) September 1, 2022

But the country’s IT administration can only process up to 100,000 bank transfers per day.

Yep.pic.twitter.com/vGdZ83pqKX

For those wanting more on this issue, Bloomberg's excellent Odd Lots podcast recently posed the question: Just how bad will the energy crisis be in Europe this winter? The guests were Bloomberg Opinion Columnist Javier Blas, and Singapore-based hedge fund manager Alex Turnbull.

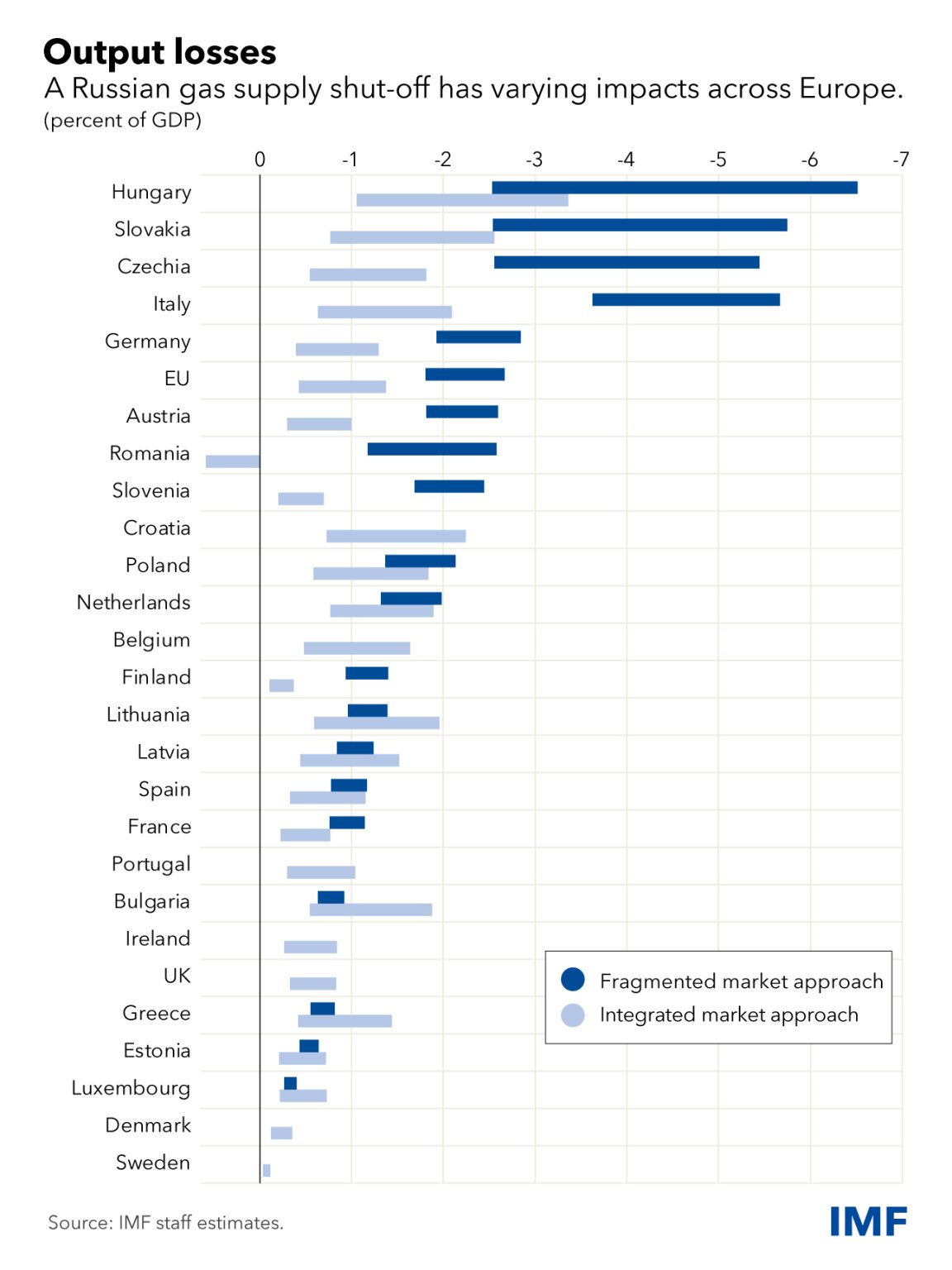

And finally back in July the International Monetary Fund looked at the possible economic impact if Russia ramps up its partial cut-off of natural gas exports to Europe to a total shut-off.

Our work shows that in some of the most-affected countries in Central and Eastern Europe—Hungary, the Slovak Republic and the Czech Republic—there is a risk of shortages of as much as 40 percent of gas consumption and of gross domestic product shrinking by up to 6 percent. The impacts, however, could be mitigated by securing alternative supplies and energy sources, easing infrastructure bottlenecks, encouraging energy savings while protecting vulnerable households, and expanding solidarity agreements to share gas across countries.

2) Zoltan Pozsar and trade expectations.

Zoltan Pozsar is typically interesting and his recent note war and industrial policy is no exception. Credit Suisse's global head of short-term interest rate strategy, Pozsar sees some pretty big changes afoot around the world.

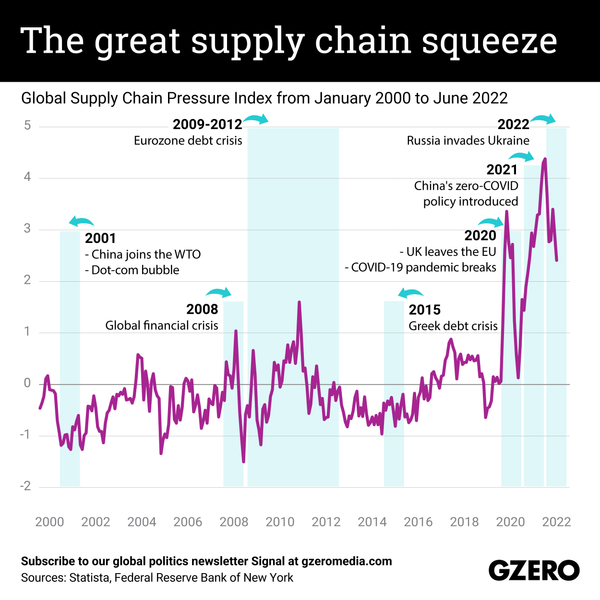

Global supply chains work only in peacetime, but not when the world is at war, be it a hot war or an economic war. The low inflation world had three pillars: cheap immigrant labor keeping nominal wage growth “stagnant” in the U.S., cheap Chinese goods raising real wages amid stagnant nominal wages, and cheap Russian natural gas fueling German industry and Europe more broadly. Implicit in this “trinity” were two giant geo-strategic and geo-economic blocks: Niall Ferguson called the first one “Chimerica”. I will call the other one “Eurussia”.

Both unions were a “heavenly match”: the EU paid euros for cheap Russian gas, the U.S. paid U.S. dollars for cheap Chinese imports, and Russia and China dutifully recycled their earnings into G7 claims. All sides were entangled commercially as well as financially, and as the old wisdom goes, if we trade, everyone benefits and so we won’t fight. But like in any marriage, that’s true only if there is harmony. Harmony is built on trust, and occasional disagreements can only be resolved peacefully provided there is trust. But when trust is gone, everything is gone, which is the scary conclusion from Dale Copeland’s book: Economic Interdependence and War.

Reviewing 200 years of history, including the Napoleonic and Crimean wars, the book explains that “when great powers have positive expectations of the future trade environment, they want to remain at peace in order to secure the economic benefits that enhance long-term economic power. When, however, these expectations turn negative, leaders are likely to fear a loss of access to raw materials and markets, giving them an incentive to initiate crises to protect their commercial interests”. This “theory of trade expectations” holds lessons for understanding not only today’s conflict between the U.S. on the one hand, and Russia and China on the other, but also the outlook for inflation. Put simply…

…if there is trust, trade works. If trust is gone, it doesn’t. Today, trust is gone: Chimerica does not work anymore and Eurussia does not work either. Instead, we have a special relationship between Russia and China, the core economies of the BRICS block and the “king” and the “queen” on the Eurasian chessboard – a new “heavenly match”, forged from the divorce of Chimerica and Eurussia…

3) What's Jackson Hole all about?

Ever wondered what the annual central banker talkfest at Jackson Hole, Wyoming is all about? This year's gathering, which occurred last week, was attended by our very own Adrian Orr plus the likes of Federal Reserve Chairman Jerome Powell.

As Adam Tooze, author and professor of history at Columbia University, puts it, the Jackson Hole conference is different.

It isn’t a jamboree like Davos, or a giant global gathering like the IMF/World Bank meetings in DC. Jackson Hole is an exclusive wonkfest attended by barely more than 100 central bankers, regulators, economists and handpicked journalists. The conversation is dominated by central bankers and the über-elite of academic economists who engage in friendly sparring over academic papers.

The Federal Reserve Bank of Kansas City, which hosts the event, has a useful explainer on the background. The Jackson Hole conference as we know it today, began in 1982, when Paul Volcker was Fed Chairman.

In the summer of 1982, perhaps no one was battling more Washington heat than Federal Reserve Chairman Paul Volcker. A trip to the cool air of Wyoming that August had to offer the promise of some relief.

Three years earlier, under Volcker’s leadership, the Federal Open Market Committee announced that it would no longer implement monetary policy by targeting the federal funds rate, but would instead fight mounting inflation in the economy by concentrating on the money supply, leaving the markets to determine interest rates. As a result, in 1981 the federal funds rate touched a record high of 20 percent while inflation moved above 13 percent.

This solution to the inflation problem was putting the economy into a recession, where Americans faced not only historically high borrowing costs and rising prices, but also double-digit unemployment rates. To no surprise, this battle against inflation left the Fed chairman fighting critics from all sides, including a president who had won the 1980 election in part on public dissatisfaction with how the economy had performed under his predecessor and a Congress that was weary of hearing from angry constituents.

But if Volcker came to Wyoming in search of respite, either through a chance for a little of his beloved fly fishing or to enjoy the cool morning breeze at the Jackson Lake Lodge, he would find precious little relief at the symposium. This was not a vacation.

Economists, by nature or nurture, are like living and breathing versions of the Picasso paintings that show both sides of a solitary image. So well-known is their use of the phrase “on one hand … but on the other hand,” that President Harry Truman once famously asked for a one-armed economist to provide him with economic counsel.

Put nearly 100 well-known economists in a room at a difficult and controversial period for the economy, make the topic “Monetary Policy Issues in the 1980s,” and they will have much to say.

4) The state and the insurance market.

Chris Nicoll of the University of Auckland's Department of Commercial Law, Faculty of Business and Economics, has written an interesting article for Newsroom about how the state and insurance sector interact. He sets out how the roles of the state and insurers differ, wrapping in the Earthquake Commission, climate change and the National Adaptation Plan.

... the roles of the state and of insurers are quite different and it is not useful for either to assume the other will provide the security the country needs. The state will lose the confidence of the public if it is perceived to have no long-term strategy; insurers will lose what public confidence they have left which will erode our healthy levels of insurance cover.

There is a final distinction between the state and the insurance market to be made here. Insurance is, by definition, against ‘fortuities’ – that is, things that may happen rather than things that will happen. Climate change induced flooding is a present and continuing reality. This contrasts with the natural hazards covered under our EQC legislation, such as earthquakes and tsunamis.

We can say with confidence there will be major flooding next winter in Tairāwhiti but not that there will be a major earthquake next year in Wellington. Nevertheless, there is still room for insurance to creatively address the gap between both, at the somewhere-in-between; in the way that life insurance exists because, while death itself is certain, insurers are very good at measuring the risk of its timing. In the face of climate change, we need more innovative thinking from the government and the insurance market.

5) Oil companies and propaganda.

Investigative journalism website Declassified UK reports on how BP and Shell paid the UK's Cold War propaganda arm, the Information Research Department (IRD), in the 1950s and '60s to help secure access to Middle Eastern and African oil. This included establishing newspapers and magazines, funding radio and TV broadcasts, and organising trade union exchanges.

UK propaganda front the Arab News Agency was the recipient of a decent chunk of the money, and Declassified UK says it's not clear whether Reuters was aware the UK government was secretly channelling oil money into its accounts.

The oil companies felt the IRD was making good use of their money and, by 1960, they wanted to help British propaganda operations expand.

For instance, Shell was “widening their field of interest and… thinking in terms of propaganda in distribution areas as well as in producing territories. They are thus concerned with the public image of the oil companies in places like West Africa as well as in the Middle East”.

As a result, the IRD “could take it that” the oil companies “had an interest in all production and refining areas and territories adjacent thereto. Thus, for example, Somalia was an area of interest because of its proximity to Aden”.

45 Comments

A great read. Thanks.

Jackson Hole is an exclusive wonkfest attended by barely more than 100 central bankers, regulators, economists and handpicked journalists.

This is a trend that needs stamping out ASAP.

1 & 5 - yes, someone hereabouts has been forewarning of this impasse, for some time. :)

A good additional read (and site) is:

https://consciousnessofsheep.co.uk

We forget that all national boundaries are a recent carve-up; nobody voted to be in Iraq or Iran, and Lawrence, Bell and Allenby either forgot, or were steeped in the patriotism of their time. A great read is Longhurst's Adventure in Oil (1958 history of BP).

Yes, 1 was a great article - only thing I found was that the 'slant' was that we have an energy crisis due to neighbours not getting along - as opposed to ultimate scarcity is beginning to bite.

I think there's still a 'hope' out there that we really don't need to adjust to a low-energy future provided we just return to all getting along.

To my mind, the root of the conflict is and always has been access to resources. Presently, Russia knows it has an edge on the way down (to ultimate scarcity).

Putin has pulled off a shock win that could destroy the free world

The Kremlin’s energy war is pushing Europe and the UK towards economic meltdown and socialism

Make that 50. The other 50 will find its way to the West with some ticket clipping!

I liked the optimism that the energy disruptions "could persist for several years."

Al Bartlett shows a way down...

https://www.albartlett.org/articles/art_meaning_of_sustainability_2012m…

Somewhat unlikely, one would have thought...

Jackson Hole. That is where Adrian Orr is told what to do, isn't it?

All that globalisation is coming home to roost. If we go back to having Hallenstein's factories back in NZ again, and not importing onions from France, that won't be all bad. Not so sure about going back to Wolseleys and Morris Marinas though. Or Austin Allegros. Or Vauxhall Vivas.

My first car was a 1976 Austin Allegro. Getting that thing to start on a cold morning required real skill!

Reminds me of my 1974 Renault 16 TS that I had in Australia. One wrong move and it was flooded. I remember giving my other half quite specific instructions on how to start it. "Don’t tell me how to start a car" she scolded. At ~11pm that night I got a phone call "your crappy car wont start".

All that globalisation is coming home to roost. If we go back to having Hallenstein's factories back in NZ again, and not importing onions from France, that won't be all bad. Not so sure about going back to Wolseleys and Morris Marinas though. Or Austin Allegros. Or Vauxhall Vivas.

Imagine the shelf price tags if NZ had to do its own manufacturing. Uniqlo won't bother with the NZ market. Not enough scale.

Fast Fashion will die a little-mourned death

Fast Fashion will die a little-mourned death

I wouldn't be so sure about that, in the case of Uniqlo anyway. It's a big world and people still need clothes.

Or tube tvs

President Harry Truman once famously asked for a one-armed economist to provide him with economic counsel.

Classic!

# 1) All of a sudden the EU is poor. Energy poor. Which they're about to learn is tantamount to just about everything they do. Germany's situation is utterly unbelievable, but true. They have literally shafted themselves, which gives us a glimpse into their socialist mindset of the past 40-50 years. Socialists have wonderful theories, but terrible realities.

# 2) Relationships are everything. Relationships with trust are unbeatable. Relationships without trust are doomed to extinction.

Remember when everybody was so possessed by 'Orange Man Bad'.

https://www.youtube.com/watch?v=9LLZBVTid4I

Might have been an idea to listen to what was being said.

You know he's about to go to jail right?

I don't know that, because I don't pay much attention to the day to day blithering of left-wing extremists.

What is pertinent, is what he (and his teams of advisors) were saying four years ago about European energy security.

If the worlds a Circus then Trump was the ring master. He is the biggest crook to ever sit in the Whitehouse and thats a pretty high bar to get over.

That's just your opinion Carlos.

You also think Putin is somebody to look up to and that "Australia is going to be unhabitable within ten years".

I think we can safely put your reckons in the cuckoo nest where they belong.

BL - or you could do some prima facie homework, rather than shooting the messenger

(It is a common, and obvious, mechanism - just sayin').

Glasshouses, stones?

One of the very few things he said and was right. Also listen to his UN speech where he said something similar with the German UN representatives sniggering in the background.

There was also likely an ulterior motive from Trump in trying to sell US gas to Germany but that is a speculation on my part.

Nothing to do with socialism - all to do with entropy.

Why do so many blame so many for so much?

Ironic that many of the folk who rant the most about socialism in NZ have left their own handouts as the only universal socialist-y redistribution.

Wrong John - that’s so backwards it’s laughable.

It was free market capitalism that decided the cheapest form of energy was Russian gas, heedless of the value of energy security.

Kicking gas (and Putin) to touch now is the best thing for the EU to do for the long term.

Bless, Larry 76 comes on to a financial website believing banning fracking, nuclear and subsidising the bejesus out of intermittent wind and solar is the free market.

We really just need to stop subsidising fossil fuels and start charging everyone the cost of cleaning up their own pollution. User pays.

..

Socialist mind set? aren't you trying to shoe horn the world into your wrong-headed ideology?

AR - that has to be the comment of the thread.

So many forget to divest their assumption-set, when addressing the next issue. So they build this empirical picture that looks more and more like the Leaning Tower - to the point where it doesn't make sense at all. Yet they stick to these assertions so doggedly....

Strong US data now gives Powell even more of a mandate to raise rates. Meanwhile Orr’s economic headroom is getting less with every domestic announcement. NZ is going to to get shredded by the Fed!

The stock market is plunging and the Fed is giving up on a ‘soft landing’ in favor of a ‘growth recession.’ Buckle up.

https://finance.yahoo.com/news/stock-market-plunging-fed-giving-1721203…

In a speech at an annual symposium in Jackson Hole, Wyo., on Friday, Fed Chair Jerome Powell said that the U.S. economy will likely experience some “pain” as the central bank continues its battle with inflation.

Diane Swonk, the chief economist at KPMG, told Bloomberg that in her mind, these comments signal that the Fed has given up on its hopes for a “soft landing,” and now recognizes a “growth recession” is necessary to reduce inflation meaning the Fed will need to slow economic growth to well below its potential.

Happening already - Much More of Much Less Demand

Re Gas prices and Supply - I detest and strongly oppose Russians invasion -- but the moral outrage int eh West and the West media about Russia using Gas and Oil as a weapon is almost as bad --

The west have cut off supplies of almost everything to Russia -- vital equipment, medical supplies, in fact almost everything tried to exclude Russia from international money markets and frozen/stolen massive gold and financial reserves all around the world -- which calls into question the safety of all overseas financial deposits --

can hardly blame the Russians from replying in kind -- its basically war -- why shouldnt they ? tactically slowly turning off the tap until winter and then just closing it completely makes great strategic sense -- perhaps blaming the lack or replacement parts for the closure !

Is it inflation or are we just stupid for accepting what is perceived to be unavoidable? Here's an example: My kids school uniform socks at an average suburban high school cost $45. Should we accept that or just send the kid to school with very similar socks without the school stripe for 10% of the price? What will happen? Will the Principal expel us? Does she have a right to do so? I can easily afford $45, but how can less lucky families cope? Apply this to any section of the economy. BTW I'm planning a sock strike. Stand with me!

Yes to this! I'm standing with you. How on earth did $45 school socks happen! And the same goes for all other school uniform items. How is this blatant robbery of Kiwi families allowed?

It's not fair, darn it....

'Chinese imports of Malaysian oil have surged above Malaysian production.'

https://twitter.com/JavierBlas/status/1564938513388343296/photo/1

Love the doggie video.

But what the hell was the human who opened the door thinking? "Oh look, the corgi just totally body slammed the glass door trying to get at the other one and everybody is going nuts. Let's open the door and see what happens." ?

1000 euros/MWh! That's the same as 1 euro/kWh. Charging a tesla battery would cost 100 euros. My computer which uses ~140 W would cost 1 euro every 7 hours. Knida puts things in perspective.

The collapse of the French/EU Socialist Republic to imperialist capitalist Russia. Who would have thought? The Western Mandarin State suicide pact still holding, for now. Should get very interesting in the next few weeks.

Talking of suicide pacts in Mandarin states:

https://www.conservativewoman.co.uk/admit-the-vaccine-death-link-now-an…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.