By David Skilling*

‘The era of big government is over’, President Clinton, 1996 State of the Union.

One of the striking aspects of recent policy across advanced economies has been an expanding role of the state. The massive government support to households and firms to cope with Covid and now the energy crisis, as well as commitments to increased defence spending, provide recent examples.

Small state models of economic policy work better in more benign conditions. The pandemic, war, and strategic geopolitical competition are now generating new policy dynamics. Indeed, global economic and geopolitical regime change have previously led to regime change in the role of the state: the emerging narratives around the Washington Consensus, the flat world, and the end of the Cold War, supported a shrinking of the state from the mid-1990s.

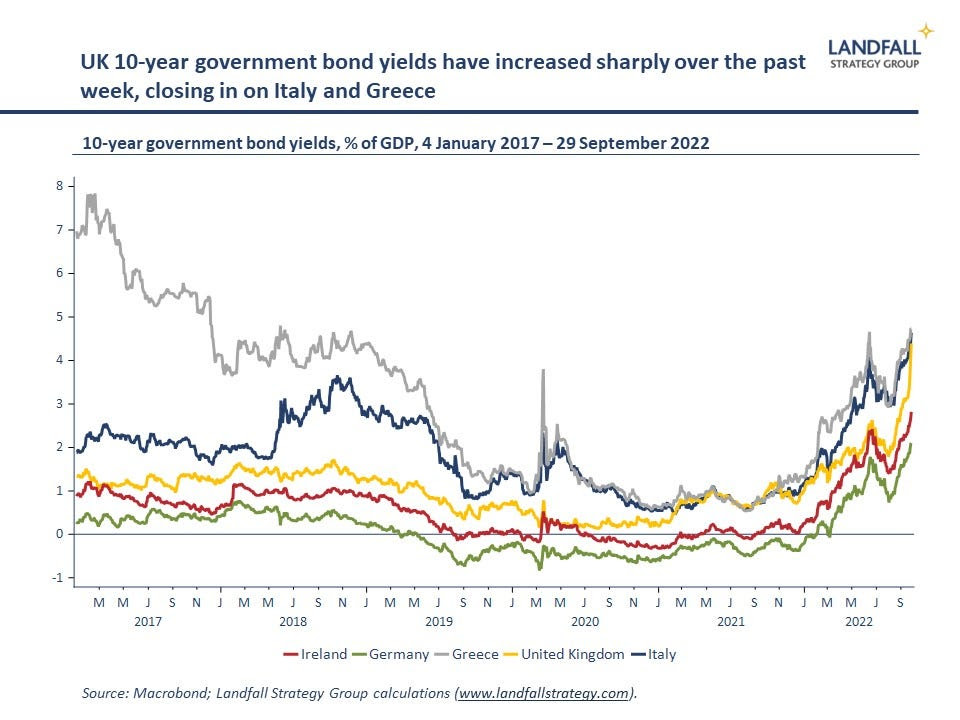

This transition will likely be turbulent. The omnishambles of last week’s UK ‘fiscal statement’ (debt-funded tax cuts on top of substantial fiscal support for energy payments) shows what can go wrong if governments try to mix new (high spending) and old (low tax) regime playbooks. And particularly in the UK context of high inflation, a large external deficit, and deep concerns about policy and institutional credibility.

Shifting centre of fiscal gravity

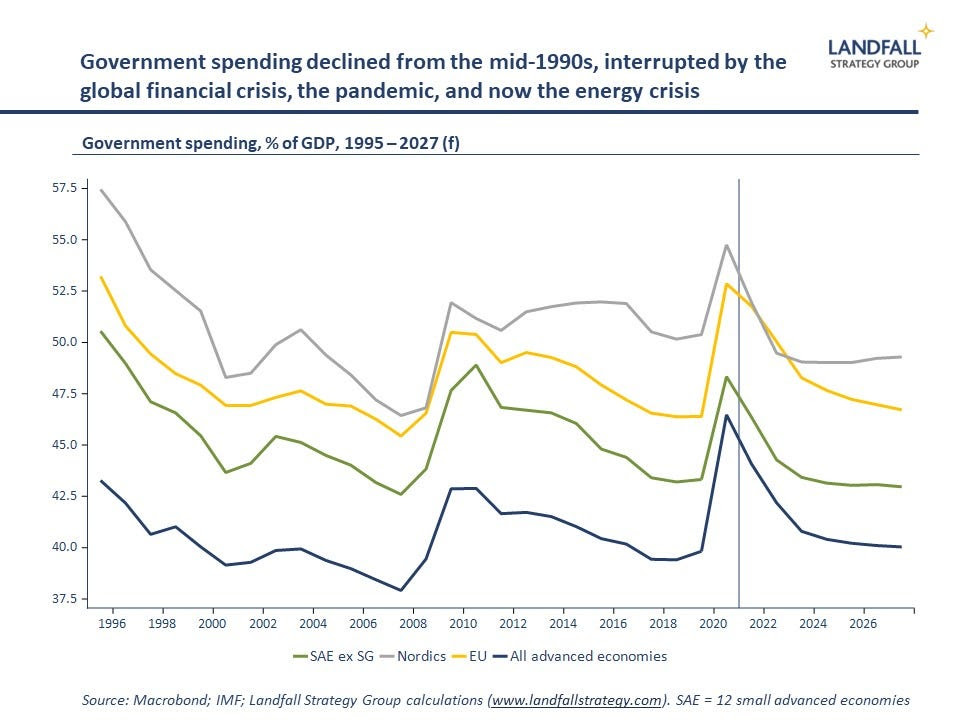

Advanced economies have had generally reducing government spending levels over the past few decades, together with reducing public debt levels – although with variation across countries.

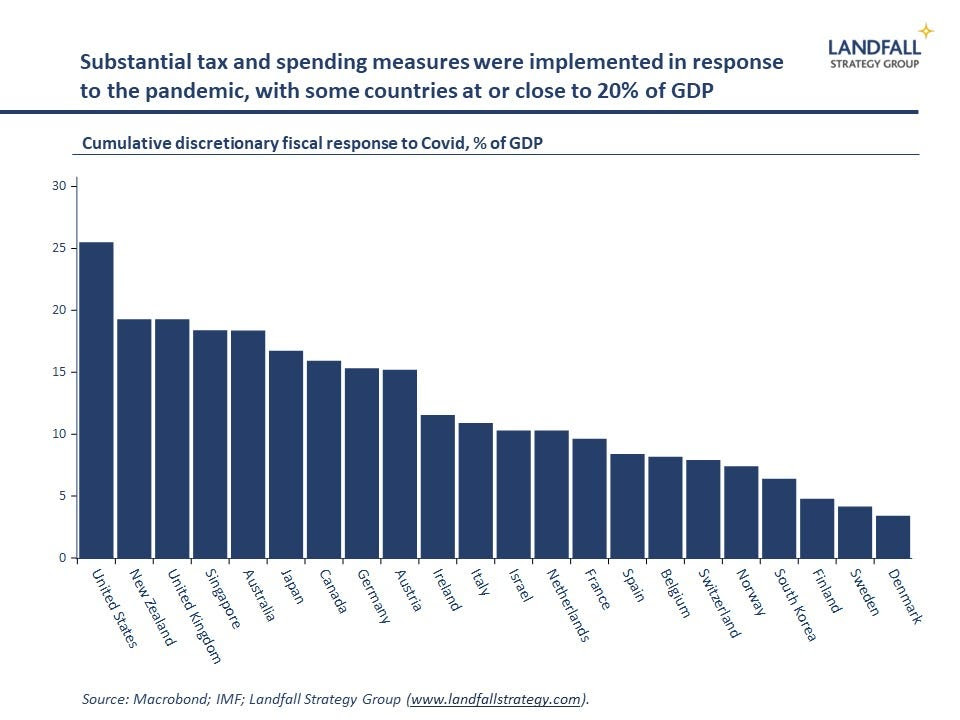

This began to change through the global financial crisis, as growth slowed and stimulus was required. There were some subsequent efforts at fiscal consolidation, supported by low borrowing rates. But spending increased through the pandemic as governments stepped in to provide substantial support to firms and households. In many advanced economies, discretionary fiscal support amounted to over 10% of GDP – with several close to or above 20% of GDP (Singapore, New Zealand, UK, US).

These schemes helped to limit unemployment and supported economic activity. But across advanced economies, gross government debt rose by ~20% of GDP through the pandemic.

And substantial fiscal support is being provided across Europe (and beyond) in response to the current energy crisis. The estimated fiscal cost of commitments made to date in the UK is ~€180 billion (6.5% of GDP) and over 2% of GDP in several other European countries (3.3% in Italy, 2.9% in France, 2.8% in Germany). Last week’s Dutch government budget announced measures to buffer households from rising energy costs (estimated at 2.7% of GDP), as well as a 10% increase in the minimum wage to address cost of living issues.

The depth of the crises over the past several years has led to changes in attitudes to government spending. Governments are under pressure to protect households and firms against major shocks. Higher levels of government spending are likely in areas from public health to social insurance in response to growing public demands. In the US, there is increased spending on measures from industry policy to the partial forgiveness of student loans.

Even in right-wing political parties, there is greater appetite for increased government spending (the Tory Party in the UK is an example on energy support payments). Indeed, my assessment is that the UK government is more likely to increase spending than to reduce spending and cut taxes; a partial reversal of last week’s fiscal announcements is likely.

Although some of these spending measures are intended as temporary, there is frequently a ‘ratchet effect’, in which government spending increases in crises but is difficult to lower subsequently.

And structurally, there will be demand for higher government spending and investment to finance the net zero transition as well as the fiscal costs of population ageing. And military spending is likely to increase sharply, with many governments committing to raise spending to at least 2% of GDP. Taken together, government spending as a share of GDP is under upward pressure.

Bond vigilantes no more?

‘I used to think that if there was reincarnation, I wanted to come back as the President or the Pope, or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody’, James Carville (advisor to President Clinton).

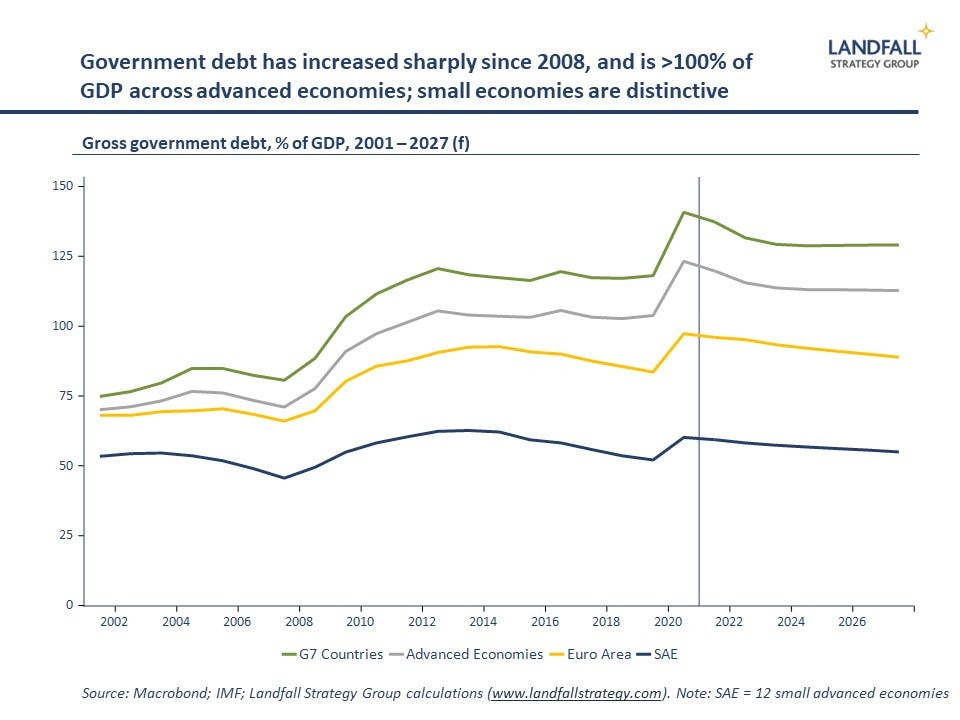

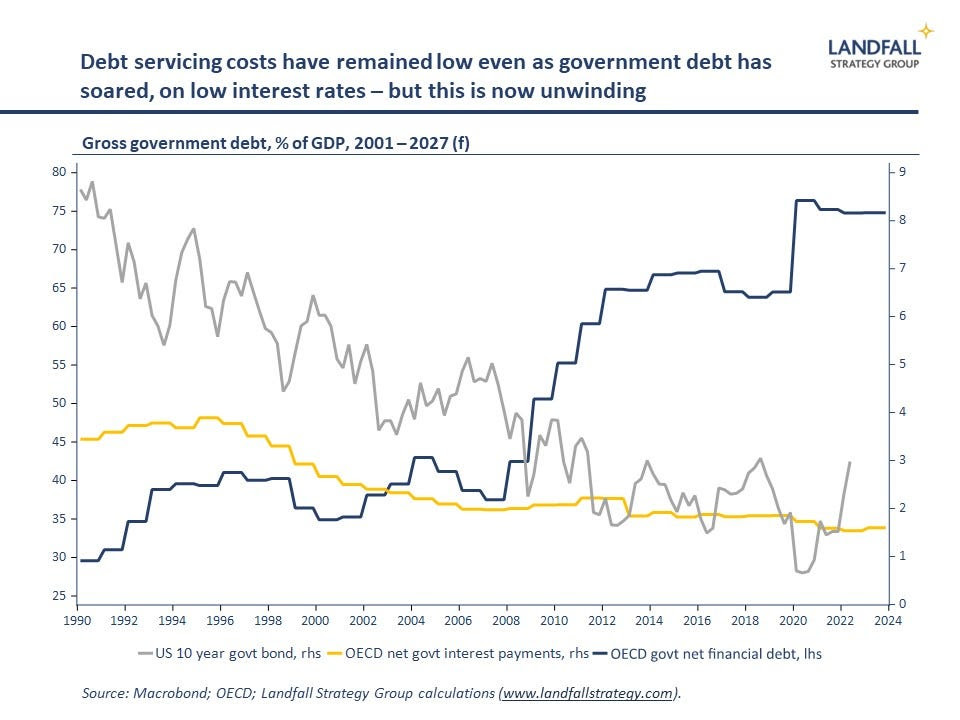

Government spending is no longer constrained to the same extent by a hard government budget constraint. In the very low interest rate environment of the past decade, public debt accumulation has been less of a concern. Government debt levels have increased markedly over the past decade, to over 125% of GDP across the G7. The IMF forecasts government debt to remain at these elevated levels over the next several years (with significant upside risk).

Even short of extreme MMT/Dick Cheney (‘deficits don’t matter’) positions, governments are acting with more freedom of manoeuvre on debt. For example, proposals are being developed to effectively relax the EU’s fiscal rules (the Growth and Stability Pact), when they are re-introduced after being suspended during the pandemic.

Note, however, that the picture is different across small advanced economies: many small economy governments (notably in Northern Europe) have government high spending but are conservative on fiscal balance – in part because they are more exposed to external shocks, and take greater care to manage risks.

Of course, bond vigilantes occasionally reappear – such as in UK gilt markets this week – when there are concerns about the scale of fiscal loosening, the quality of decision-making, and the strength of institutions. The government’s budget constraint has weakened, not disappeared.

Indeed, governments are looking to bolster their revenue-raising ability. The international minimum corporate tax agreement brokered by the OECD was motivated by a desire to increase revenue-raising capacity for larger economies (reducing tax policy competition). Firms and investors should expect increases rather than reductions in corporate tax rates – and increases in wealth taxes are likely.

Implications

The past 30 years of the Great Moderation have supported a declining government spending track, but that is now unwinding. Global stress and disruption combined with changing public expectations are leading to upward pressure on government spending and public debt levels.

Government capability becomes even more important as the size of the state increases, and as policy rules weaken in favour of policy discretion. It does not take much imagination to develop scenarios in which a larger, more activist state generates poor outcomes.

Equally, strong state capability can be a source of national competitive advantage. Many small advanced economies (such as those in Northern Europe), with strong state capability, have high levels of government spending while remaining competitive and productive, with healthy economic and social outcomes.

Indeed, the Dutch, Irish (and French) government budgets over the past week or so, announced spending and tax initiatives to support firms and households facing energy and cost of living pressures, but were judicious on tax cuts and reiterated commitments to public debt sustainability. These budgets barely made a ripple in markets.

There are broader implications of these dynamics for macro policy. The need for fiscal space is one reason that I remain cautious about the likely extent of interest rate increases. Monetary policy will need to accommodate high levels of debt: if government debt servicing costs were to increase markedly, available fiscal space would contract – requiring hard budget choices – and financial stress would accumulate. A form of fiscal dominance seems likely.

Overall, we are moving into a world with a larger role for the state – likely accompanied by higher public debt, higher inflation, and constrained policy rates – in response to political, geopolitical, and economic regime change.

There will be economic and policy turbulence as this change occurs – this week’s UK experience provides a cautionary example. In this world, state capability as well as trust in government and in institutions is of first order importance.

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original article is here. You can subscribe to receive David Skilling’s notes by email here.

43 Comments

David Skilling is funded by the WEF and is not a NZer nor based in N.Z.

... and , your point in telling us this is ?

David has worked for MFAT, Treasury, McKinsey. And a NZer based in The Hague.

Wise summary - interesting when you read it in concert with Marx's theory of historical materialism;

Marx - 100 million dead & counting

https://en.m.wikipedia.org/wiki/Mass_killings_under_communist_regimes

To be fair, Marx omitted mass genocide from his final draft of the manifesto.

The problem with communism is it requires a great deal of state control and that can be very easily corrupted. You'd need it administered by artificial intelligence or something.

The Kree do it, why can't we?

Wait confusing Marvel universes with reality... but you aren't onto a bad idea there. An AI would be (hopefully, if it's not too strong) dispassionate and use a small amount of it's processing to handle mundane tasks like governing effectively. Incorruptible and likely logical/far sighted/data drivin/unbiased... theres not a lot do dislike about the idea. Or we could go on electing monkeys with confused political ideas, personal agendas, massive egos etc and keep getting dog shit at the other end.

Maybe as long as the military/police were run by humans, maybe an AI running all the other arms of the government and institutions wouldn't be a bad thing.

Nothing to do with Marx's concept of communism - effectively a word he used to describe a state of utopianism where society is organised '"From each according to his ability, to each according to his needs".

The murderous rogue regimes, mentioned in your link, practiced totalitarianism. A totally different concept.

Arendt is my favourite philosopher in describing totalitaranism as a form of governance/political philosophy;

And capitalism when it was exported to the world killed how many?

Of course it's not the ism killing people, only the people behind it.

The reasons Marx's theories/philosophy is attacked is because it would require acknowledgment of, compassion for, and respect for others as being of equal value as fellow humans. It would require an understanding of interdependence rather than independence. It would require sharing over unfettered personal enrichment and of course motives based on something more than profit and ego. I think the idea is to come back to community and the tribe only on a larger scale.

Alienation in a myriad of forms is highlighted by experts as being a factor in many of the ills being suffered by people today, all brought about by the society we've created. It's very similar to Marx's thoughts in the link above.

It's a challenge though to consider that what has been normalised and accepted may in truth be profoundly unwell for people and planet. But that is where we're at.

The dominant institution in today's society is capital, not the state. The state's role is mostly limited to wealth protection, a function it performs by ensuring that risk and cost are socialised, and that profits end up back in private pockets.

The massive amount of state spending we've seen over the past couple of years - and continue to see today - is only being done in the context of this role. You only have to look at things like asset prices or the number of new billionaires to figure that one out. Follow the money.

Exactly.

Asset prices are driven by monetary policy and the money created by the banks not governments.

https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/programs/…

Asset prices are driven by monetary policy and the money created by the banks not governments.

Yes, but I find this somewhat of a cop out. For ex, Japan has much lower broad money growth over the past 20 years than the EU and U.S. The Japanese govt and BoJ wants firms and h'holds to borrow and spend like drunken sailors but they won't. But who is better off because of this behavior? Wayne / Karen with their million dollar mortgages in suburban NZ or the Watanable family who save the fruits of their labour in low interest post office savings instruments?

Monetary policy is a factor, true, but only one factor. Interest rates don’t drive investment though — return on investment does. In this respect, policy - namely the tax advantages of housing investment in NZ - can be a much bigger influence on asset prices.

Monetary policy is a factor, true, but only one factor. Interest rates don’t drive investment though — return on investment does.

Don't agree. If mon pol misprices capital and its costs to the downside, this directly impacts investment decisions. Now, in the case of Japan, the price of captial has been kept artifically low to keep prices stable in the Japanese domestic economy. For that reason, Japan has an ultra-competitive retail market. In the case of NZ, low interest rates have funneled the housing bubble. Risk has been kept artificially low.

My point was that interest rates are but one factor amongst others in investment, and indeed, everyday purchases. Neoclassicals and monetarists like to (delusionally) believe, for example, that people factor in a change in interest rates when they go to the supermarket and decide what's for dinner. Lol. Thinking about your point and investment, if the 'upside' of an investment (eg, housing in NZ) is still greater than the 'downside' from an incremental change in interest rates (because of huge tax advantages and other favourable investment settings), then as an investor you'd be dumb not to make the investment because of the change in interest rates.

Correlation or causation? Or by design?

I suggest the real drivers are our belief system in artificial wealth, an overriding fear of not having enough, fear/shame of being poor and egoistic claims for status and ruling power. These are all social constructs created throughout history and literally inherited/programmed into society. It's why economic theory cannot solve the problems and only continues to make things worse. Humans, we're our own worse enemy.

But people cannot be fed with printed dollars and euros. You can't feed them with those pieces of paper, and the virtual, inflated capitalisation of western social media companies can't heat their homes. Everything I am saying is important. And what I just said is no less so: you can't feed anyone with paper – you need food; and you can't heat anyone’s home with these inflated capitalisations – you need energy. Putin

Long arm of US sanction touches Indian petrochemical trading company. Comes hot on the heels of EAM's [External Affairs Minister Dr. S Jaishankar] talks at State Dept. Threatening message to govt: 'You're either with us or are with terrorists.' Link

Yes Chebs. Billionaire Stanley Druckenmiller has described this. Amazing man who talks more than orgns close to home (like the NZ govt) about the trade offs, which centers of the grinding down of the lower socio-economic classes. NZ is a perfect example. Team Cindy has pulled out all stops to ensure that the middle survive these times while those closest to the magic money taps make out like bandits. And to protect the middle is admirable.

But we shouldn't ignore the trade offs -- destruction of the value of currency and labour. Even as things improve, this destruction will remain. But I wonder if this benevolence has actually worked or is it simply delayed the inevitable: the Great Unwind. I'm yet to be convinced that we have put this demon at bay. And it seems clear as day that the ruling elite (far above Cindy's station) are working on a 'new world order' (yes I know such words are described as paranoid conspiracy). What that will look like is anyone's guess.

Referring to Jacinda as "CIndy" only displays you as being possibly sexist and a misogynist.

Referring to Jacinda as "CIndy" only displays you as being possibly sexist and a misogynist

I think I was one of the early adopters of the nickname (as well as Xindy). To me, it suggests some level of superficiality to our PM. And to be honest, I think we need to mock our leaders openly if it's not vicious in any way. Just like Crusher is not nasty for Judith Collins or ChongKee for John Key (now this could move the racism meter a little as it's using making fun of Chinese names and suggests that relationships with China are based around self interest).

I prefer " Taxcinda " as a cheeky name for her ... appropriate , because she did claim that there'd be no new taxes under her watch ...

... and there's been dozens of them ... thinly disguised as " levies " or some such ...

Sorry voters ... but she ain't whiter than white when it comes to trustworthiness , honesty , nor even to being a kind person ... anything but ...

Sorry voters ... but she ain't whiter than white when it comes to trustworthiness , honesty , nor even to being a kind person ... anything but ...

Yes. I refer to Druckemiller below. He openly talks about "the left" getting all excited about money printing but ignoring what it does to the most vulnerable and disenfranchised. Have you ever heard Ardern talk about this? I would think the probability of this is zero. So who has more empathy? Druckenmiller or Ardern? The former talks about and warns about it; the latter just bandies around all the associated words but doesn't look for solutions and transformation.

We don't really seem to have much of a left or right in NZ. We have two major parties that protect middle class property wealth and have slightly different favourites for handouts, but are otherwise pretty similar.

I thought it was shonkey, ( aka shonky, suitably slurred), which has no racial connotations

... after he was outed by a young lady barista , he became " Tugger " ... sweeeeet ...

I never quite understood this. I don't see how it's supposed to be sexist. It's more of a sarcastic reference to being good mates with her, hence the casual-sounding nickname. When people do the same with Grant Roberstson ("Robbo"), nobody ever accuses them of being sexist or homophobic.

Sometimes I think people try a bit too hard to be offended.

... I am in a minority race ... but Im not offended when called a pakeha , or a white honky ... I'd rather larf with people deriding my skin colour than get upset ...

Thick skinned people can thrive , adapt , & survive ...

... thin skinned , easily offended folk can remain on Facebook , wasting each others time with their petty squabbles ... bless them !

Without knowing the reason she’s called Cindy it’s hard to tell if it’s sexist. I always took it as reference to Cindy the Barbie rip off, but having just looked that up it was actually spelt Sindy.

it’s easy to have thick skin when your race/gender hasn’t been marginalised. But yes I think people do get a bit too offended, sexism is pretty much eliminated in NZ IMO.

"sexism is pretty much eliminated in NZ IMO"

I think you would need to check if women agree with you on that one champ!

And asset prices are going. ..........

MMT is not a policy, it merely describes how sovereign currencies operate.

https://www.levyinstitute.org/pubs/Wray_Understanding_Modern.pdf

"..shows what can go wrong if governments try to mix new (high spending) and old (low tax) regime playbooks."

Welcome to today's world.

Even worse, the old regime was never going to pay for it's liabilities, and we have a host of new expenses.

... what do you think " inflation " is for , Mr P ?

History has shown that governments are two-faced : deploring inflation to the general public ...

... but ... privately rejoicing that inflation is eroding away the cost of their debts , sweeping away the impact of their profligate spending ... ... ( gutting the life savings of the elderly , them with term deposits ) ...

I can’t think of anything dumber than subsidising energy. The reason it’s so dear is because demand exceeds supply. Demand needs to reduce, it won’t with subsidies.

... the reason energy demand exceeds supply , and keeps prices high , is usually a combination of energy industry incumbents lobbying governments in order to keep innovation & competition out ... and ... those governments themselves for being as dumb as a sack full of Kardashians ...

I think in this case it’s the Ukrainian war. So yes I guess it is governments being as dumb as a sack of Kardashians

Politicans all love to spend money = Vote Bank Politics

The banks dislike government spending as it reduces their opportunities of money creation for profit. Government spending is our only source of debt free money and money that can be added to our net savings and finance our current account deficits without increasing private debt. (sectoral balances).

We have our govt's profligate spending running at 'full steam ahead' at the same time as our RB is trying to slow our spending down????? Or should this read our RB is trying to slow down all spending other than our govts, creating a giant state driven groups of islands into the south Pacific (glug, glug, glug) under the guise of climate change.

Remember Reagan's ''Big govts are the problem not the solution.'' Regardless of the article & the times, he is still right.

Wrong John is an apt login name.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.