Budget Day lockup is a mad frenzy of activity as you basically have three and half hours to sift through a massive information dump, determine the key points and write something for release at 2 PM when the Budget is officially released.

Surprisingly, in the midst of all the information provided, you don't get copies of any accompanying legislation, bill commentary and Regulatory Impact Statements that will be also released at 2PM. Therefore, those of us who are in the Budget Lockup are a still little bit blind as to the full details of the Budget initiatives. Because of this I increasingly view the Budget Lockup as an interesting experience, a good opportunity to interact with Treasury officials, because you can actually ask for specific information and an opportunity to perhaps quiz the Minister of Finance on some points.

Budget Day – just a government showpiece?

On the other hand, it is increasingly clear from the run up to Budget Day that the budget itself is very much a set piece for the government of the day to boost specific Budget initiatives and narratives. Any detailed analysis on the day is swamped by all the good or bad news about the state of the economy or who's getting extra or reduced funding. It's not really until the week following the Budget that you start to get some detailed analysis of what is in the budget and the potential implications.

Investment Boost – a real boost to productivity or just meh?

On Budget Day the Investment Boost proposal was well received, but as people looked into the detail some concerns have emerged. What the measure does is essentially accelerate the depreciation which would have been claimed on these assets. This is done by way of an immediate 20% deduction with the remaining 80% of the asset expenditure depreciated as normal. My initial reaction was to recall the First Year Allowances I used to deal with when I was working in the UK and which operated in a similar fashion.

The twist is last year the Government removed depreciation on commercial buildings, including factories, to pay for its tax cuts. But this year commercial buildings are included in those groups of assets that are able to qualify for the Investment Boost. This about-face has prompted Andrea Black the former independent advisor to the last Tax Working Group, and a previous a guest on the podcast to write an op-ed in The Post about the Investment Boost initiative. In summary, she argues if we are trying to boost and productivity, then Investment Boost is a step in the right direction but is not the productivity game changer that is being promoted.

New Zealand is an outlier, again

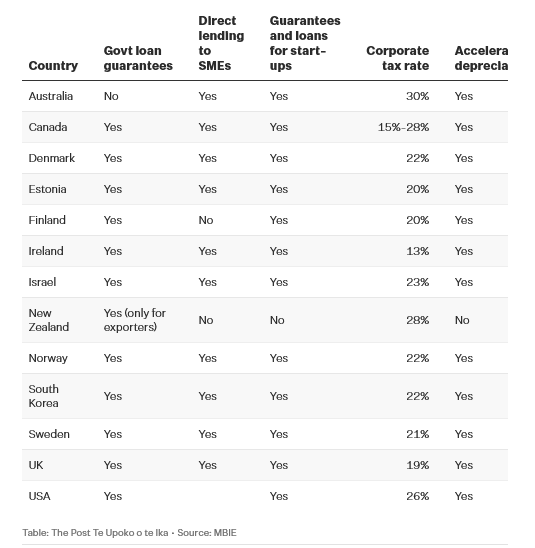

Andrea is critical that the Investment Boost initiative does include commercial property and notes that our labour productivity is poor and that direct assistance in terms of accelerated depreciation - which she strongly supports - doesn't really exist for many New Zealand manufacturers. She includes a very telling graph put together based on information obtained under the Official Information Act from the Ministry of Business, Innovation and Employment about how other countries subsidise business, including through tax breaks and government loan guarantees.

As can be seen we only grant government loan guarantees for exporters, in contrast to most other countries in the OECD. Similarly, we and Finland are the only countries which do not provide direct government lending support to small and medium enterprises. The United States, for example, has the Small Business Administration, and this initiative was something we looked at when I was on the Small Business Council back in 2018-2019. I thought then, and still do, that the lack of government financial support for our SME sector is something we really need to address.

A step in the right direction but…

As Andrea notes until Investment Boost New Zealand had no accelerated depreciation which meant we were very much out of line with other jurisdictions. So the Investment Boost initiative is a step in the right direction even if it perhaps could have gone further. I have little doubt Investment Boost will have an effect on investment, like Andrea whether it will have the effect the government is hoping for in boosting productivity, I'm not so sure.

I'm particularly concerned wearing my devious tax planner cap that the opportunity now exists for some clever financiers to put some property related deals together to accelerate the building of some commercial properties to obtain the 20% upfront deduction. I saw something similar happen in the UK with the former Business Enterprise Scheme, which was designed to boost startups but quickly saw property backed schemes emerge to claim the generous deductions. Anyway we shall see how this plays out over time.

Investment Boost, Fringe Benefit Tax and skewing the composition of our vehicle fleet

Incidental to this issue Newsroom published an interesting article talking about the impact of proposed changes to the Fringe Benefit Tax (FBT) regime treatment of motor vehicles. The article suggested that the Investment Boost proposal, which applies to vehicles as well, might mean that we might see a shift away from the use of double cab utes.

There's a number of reasons that they are now so prevalent on our streets and a growing component of the vehicle fleet. One reason is that there was a perception that double cab utes qualify for the work-related vehicles exemption from FBT. The other was that manufacturers were promoting these vehicles with some highly favourable deals.

The increase in the number of double cab utes prompted Angela Hodges, from NZ Tax Desk to comment the combination of those two factors and particularly the perceived exemption has

“skewed the composition of New Zealand's vehicle fleet over time, with tax settings influencing business-purchasing decisions in ways that probably weren’t intended”.

The Newsroom article suggests that the coming FBT changes together with the Investment Boost initiative may encourage a switch away from double cab utes to alternative vehicles. It will be interesting to see how this develops.

Inland Revenue’s “significant funding boost”– what can we expect?

Moving on and in as big a surprise as the sun will rise tomorrow, Inland Revenue was given additional permanent funding of $35 million per year to invest in tax compliance and collection activities. As the Commissioner of Inland Revenue, Peter Mersi, pointed out, “This is a significant funding boost and is recognition of what we do and the excellent results we’ve had so far this year.”

These results include for the year to 31st March 2025 assessing additional tax of $880 million from audit activity and improved debt collection activities, with just under $3 billion collected in the year to date compared with $2.7 billion for the previous year. There’s also been a doubling in the number of prosecutions and a big increase in the collection of overseas student loan repayments. In my view this is a scheme that really needs a lot of re-thinking about how it’s managed.

In addition to that $35 million Inland Revenue also got an additional $29 million per year last year for compliance and debt collection. Furthermore, the Government has also agreed to continue $26.5 million of funding set to end this year. All up Inland Revenue is getting close to $90 million of funding for investigation and debt collection activities.

This should have a significant impact given the rate of return of between seven and eight dollars for each dollar invested, which has been achieved in the past. The total return from increased compliance and collection activities is therefore potentially as high as $700 million per year.

A warning and a reminder

Against this backdrop people should keep two things in mind. Firstly, as I’ve said on many previous occasions, Inland Revenue has vast resources. It receives data from many sources, and it is increasingly efficient at absorbing, analysing and acting on that data. The basic proposition you should operate on is; if you have put anything in writing anywhere, Inland Revenue will have access to that information at some point. In particular, Inland Revenue has become increasingly efficient in tracking property transactions.

The other point is in relation to tax debt. If you are behind, take action and front up to Inland Revenue. It's much better doing so than hoping you won't be on their radar. Being proactive will get a better result for you in the long term.

The Digital Services Tax is dead – now what?

Now at last, in the run up to the budget, the Minister of Revenue, Simon Watts, announced that the Government had decided to discharge the Digital Services Tax bill from the legislative programme. This had been introduced in 2023 by the previous Labour Government. It was really intended as a backstop to OECD’s Two-Pillar international tax initiative.

According to Mr. Watts, “we've been monitoring international developments and decided not to progress the Digital Services Tax bill at this time. A global solution has always been our preferred option and we have been encouraged by the recent commitment of countries to the OECD work in this area.”

The consequence of the decision is that the forecast revenues from the introduction of the Digital Services Tax will no longer be included in the Crown accounts. This represents a $476 million reduction in tax revenue over a four-year period. The question therefore arises as to what replaces this lost revenue.

Google New Zealand’s billion-dollar service fees are not unique

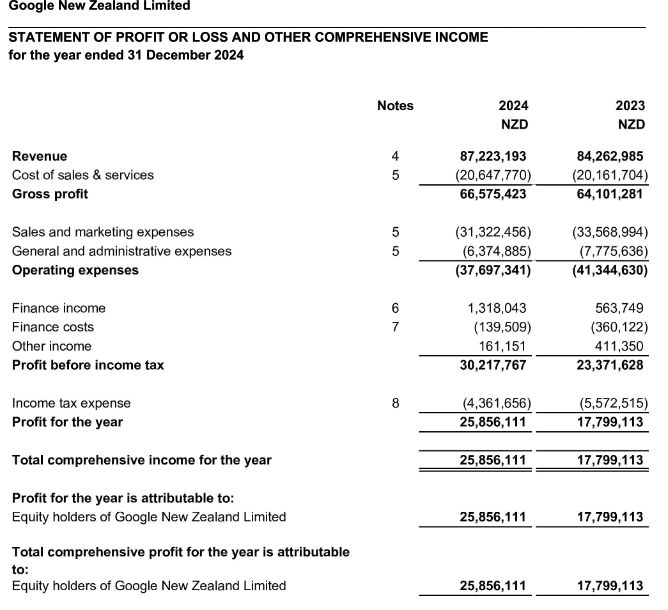

In the same week as the Budget and the announcement about the Digital Services Tax, Google New Zealand released its results for the year ended 31 December 2024.

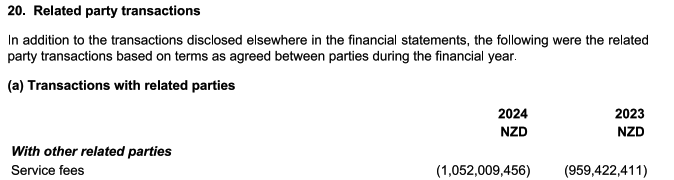

During the year Google NZ paid $1.05 billion in service fees to related parties, almost $100 million more than in 2023.

A week or so later, Facebook New Zealand announced its December 2024 results and the amount of fees it paid to associated entities was over $150 million, roughly the same as for 2023.

Jonathan Milne of Newsroom wrote an interesting article looking at the question of the payments that were being made by all the tech companies. Taking into consideration the fees paid by Apple, Amazon, Microsoft together with Google and Facebook he estimated the annual amount of service fees being paid to associated entities was close to $4 billion. Assuming all are deductible then at the corporate income tax rate of 28% that represents over $1.1 billion of lost tax revenue.

What about the OECD Two-Pillar deal?

Now, of course, it's more complicated than this simple calculation. But the withdrawal of the Digital Services Tax should be seen alongside what can only be described as regulatory capture in Washington by the tech giants. That in turn has led to these trade threats made by President Trump against digital services taxes and other attempts to tax the tech giants. This all means that the international Pillar One and Pillar Two proposals in which Minister of Revenue Simon Watts places great faith are practically dead in the water.

The Government therefore has a problem. Having accepted it's not going get $476 million of revenue from the Digital Services Tax, how does it replace that lost revenue. What about the potential $4 billion of service fees going in affiliate fees, should these be subject to some questions under the transfer pricing rules? What is going to happen in that space? Will some of the roughly additional funding of $90 million discussed earlier be deployed in boosting Inland Revenue's reviews of the transfer pricing practices of the tech companies? We don't know, but this is an area other jurisdictions around the world are also grappling with.

In Australia at the moment some of these transfer pricing issues are involved in the PepsiCo case. The case revolves around an embedded royalties issue, basically: do some of the payments made for concentrate include some form of royalty which should be subject to non-resident withholding tax? Typically, non-resident withholding taxes for royalties are between 5% and 10% of the payment. Increased focus here may be a means of recovering some of the lost revenue from the digital services tax.

This issue of the treatment of service fees is in my view probably one of the most interesting challenges in the international tax space right now. All around the world there's great interest in addressing this issue of transfer pricing. We're therefore watching to see how Inland Revenue moves and, as always, we will report on developments as and when they arise.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā.

4 Comments

Heaven forbid the private schoolboys farm Utes are not to be considered as legitimate 100% business.

All up Inland Revenue is getting close to $90 million of funding for investigation and debt collection activities.

While I'm all for everyone paying their taxes, IRD will have to be careful not to develop a predatory reputation for collecting late taxes. It won't encourage entrepreneurship which I'm sure the government would want to maintain given the private sector represents the lion's share of employment.

IRD will have to be careful not to develop a predatory reputation for collecting late taxes.

This is their job however. IRD should enforce people paying taxes on time, and penalise those who do not. It is the responsibility of the person/business to pay on time, not the IRD's to chase it or remind them. If the country has come to rely on allowances for paying late, then perhaps the way we do business needs to change, and the increased level of enforcement will assist in this.

.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.