Earlier this year, the popular Auckland Cafe chain Little and Friday closed its final store in Ponsonby. That was a great personal disappointment for me as its food was wonderful, although my waistline is probably all the better for its closure.

It has now emerged that at the time of its closure, the owners owed $640,000 in tax and the company has now been put into liquidation owing creditors over $1.4 million.

This obviously puts a different complexion on the closure, and it also prompted an interesting debate amongst my tax agent colleagues, with quite a few pointing out the inconsistencies that they see in Inland Revenue’s debt management. One took particular exception to the news, commenting how he had been grilled over a relatively small adjustment, less than three figures, and yet somehow Little and Friday had been allowed to build up unpaid GST and PAYE totalling $640,000.

Focusing on the wrong target?

Another tax agent noted that he had received a call regarding a client being overdue in making their small business cashflow scheme repayments. The amount outstanding was $18,000, but as the tax agent pointed out, the client also owed several hundred thousand dollars in relation to unpaid GST and income tax. The agent was therefore rather puzzled as to why Inland Revenue seemed to prioritise the small business cashflow scheme arrears. Several other tax agents weighed in with similar points about such inconsistencies.

Now, debt management is a core role for Inland Revenue. That goes without saying. But it is also an issue where there are clearly strains emerging. We've talked previously about what's been going on with the student loan scheme, where substantial amounts of debt are allowed to build up over enormously long periods of time.

My attention has been drawn to a case where the student loan borrower left more than 20 years ago and was eventually contacted by Inland Revenue demanding over $200,000 of accumulated interest and penalties. Like Little and Friday, and other cases noted above, the unanswered question is “How did Inland Revenue manage to let it get to that stage?”

Earlier intervention needed?

When looking at Inland Revenue’s management of its debt portfolio two concerns arise – its approach seems inconsistent and it doesn’t intervene soon enough.

Inland Revenue has enormous tools at its disposal. It can put companies into liquidation and that's actually what happened with Little and Friday. But it doesn't want to do that all the time. It will sometimes hesitate before doing anything, for perfectly reasonable circumstances. But there does come a point where it is probably better for all concerned that the Inland Revenue moves sooner and doesn't allow the debt to build up.

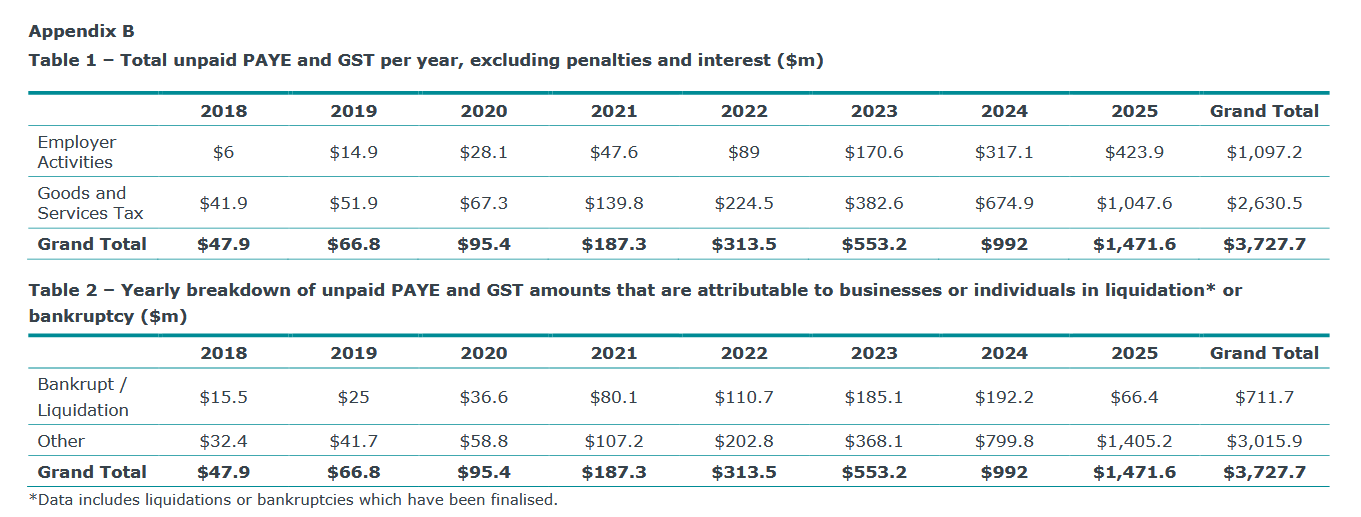

Now Little and Friday is not an unusual circumstance. While preparing for this podcast I came across an Official Information Act request about debt dating from June this year, and the number being reported was frankly horrifying. According to this report, as of 31st of March 2025, the total amount of unpaid PAYE and GST, excluding penalties and interest, stands at $3.727 billion.

As can be seen $711.7 million of that $3.7 billion represents businesses or individuals going into liquidation. The rest is simply outstanding debt which Inland Revenue is hoping to obviously try and recover. But the amount of debt it is writing off is starting to increase, as is the amount of debt that it deems non-collectible. According to this OIA report the non-collectible amount as of 31st of March 2025 is expected to be $1.1 billion dollars.

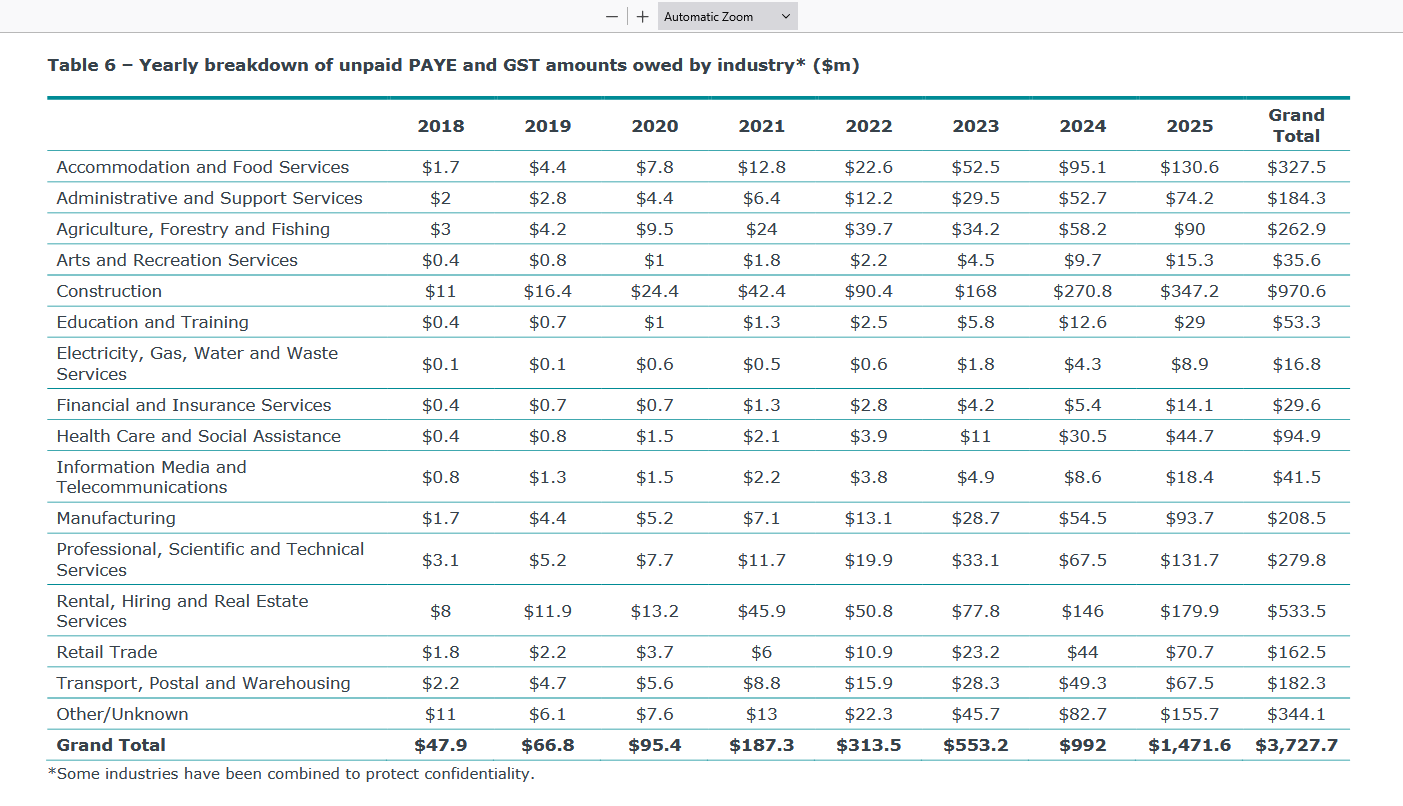

Then there's a very interesting industry breakdown of how that amount of debt has accumulated.

The sectors hardest hit in that are our construction which has $347.2 million of unpaid debt as of March 2025. accommodation and food services, i.e. cafes like Little and Friday owe $130.6 million, manufacturing $93.7 million and professional, scientific and technical services have also accelerated remarkably $131.7 million. Even rental hiring and real estate services, which you would regard as relatively strong industries, has unpaid GST and PAYE of $179.9 million as of 31st March this year.

Across the whole of the economy, these numbers are piling up and it presents a huge problem for Inland Revenue, and by extension for the Government as to how is it going to manage this issue.

Unfairly targeting student loan defaulters?

A very real threat for people owing student loans who are not meeting their obligations is being arrested at the border. But none owe $600,000 of tax. In theory, someone owing that amount of unpaid GST and PAYE could be freely entering and leaving the country without customs making a move against them.

On the other hand, someone owing $100,000 of student loan debt, which is sizeable, yes, could enter the country and be arrested. I wonder why such an inconsistent approach applies.

To be fair Inland Revenue is working through the overdue debt issue and taking enforcement action. This week it reported how an accountant, Luke Daniel Rivers, also known as Mai Qu was jailed for six years over a $1.7 million COVID-19 fraud. He made false claims over wage subsidies in the small business cash flow scheme.

Now quite correctly Inland Revenue and the Ministry of Social Development have pursued that. But at the same time, we have these other businesses falling over, owing very substantial sums of money, and it appears almost as if the defaulters are able to walk away without consequences, to the frustration of myself and other tax agents.

What about MBIE?

One other thing of note in this area are the potential breaches under the Companies Act 1993. In some cases, you'd have to say there there's a strong argument that businesses racking up hundreds of thousands of dollars of tax debt are in breach of their Companies Act obligations, which could lead to action by the Ministry of Business, Innovation and Employment.

The economy is under strain and tax debt is rising. Sometimes really bad luck hits a business or person. Small businesses can get hit particularly hard if a key person falls ill. Tax debt may just be down to sheer bad luck, the wrong thing happening at the wrong time.

But overall, Inland Revenue looks to be struggling, for want of a better word, managing the portfolio. Even allowing for maybe getting better resources to manage this, there's still the question of an inconsistent approach that I and other tax agents have noted. So, there's a lot of going on in this space.

I expect the Commissioner of Inland Revenue is reporting very frequently to the Minister of Revenue on this issue and any new initiatives to address these concerns. The most important thing would be to get the economy going again and hopefully some of these businesses are able to trade their way out. But we'll have to wait and see.

Capital gains tax to deal with housing affordability?

Now, in recent weeks, there's been quite a lot of chatter around Inland Revenue’s long-term insights briefing, which has talked about the need to perhaps expand the tax base. Last week we discussed how CPA Australia called for a capital gains tax.

This week at the Government’s Building Nations 2025 Infrastructure Summit on Wednesday 6 August, Group Chief Economist and Head of Research for ANZ Richard Yetsenga discussed the question of what he described as runaway house prices in Auckland, Australia and New Zealand. He said that we should look seriously at introducing a capital gains tax as a means of addressing house price affordability. In his view, if this issue is not resolved, “I think it's going to eat us alive. It’s our biggest intergenerational issue.”

Mr Yetsenga was speaking after addresses from the Finance Minister, Nicola Willis, and Transport Minister and Housing Minister Chris Bishop. In response he suggested looking at both the supply and demand issues of the tax system, which in his view, was one of most effective ways available to influence economic activity.

That's something I would agree with. What we don't tax is as important as what we do tax. I think the fact that we don't have a capital gains tax has resulted in major distortions for our economy. This was something which the recent International Monetary Fund report on our poor productivity mentioned. It's very interesting to see all the constant chatter on the topic of capital gains taxation.

How many people return overseas income?

Finally, Inland Revenue proactively publishes any Official Information Act (OIA) requests that it receives. These often include some very interesting data such as the breakdown of debt I discussed earlier.

One such OIA was in relation to overseas income.

The question was rather oddly phrased because the requester asked “Do you know if/believe there high compliance with NZ tax rules for NZers working overseas?” Inland Revenue’s response was basically this is actually not a request for information, it's more for an opinion so we aren’t answering that.

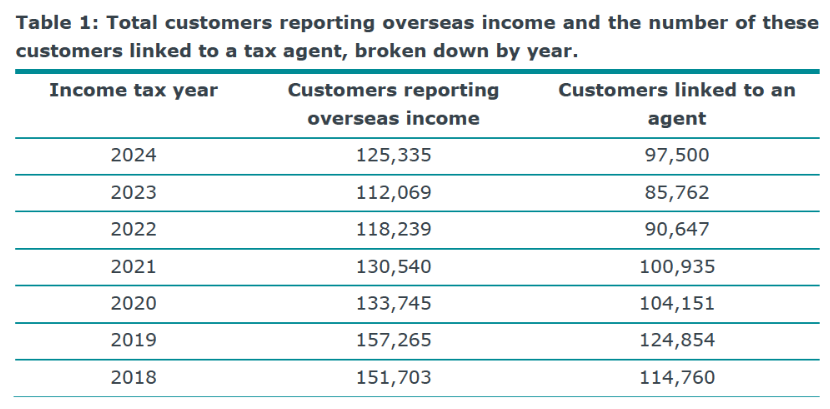

The request then asked for specific data about taxpayers reporting overseas income, and also the split between taxpayers who reported it and those taxpayers with tax agents who report it. Inland Revenue provided the following breakdown for the 2018 to 2024 tax years. (The final due date for filing tax returns for the 2024 tax year is 31st March 2025 so 2024 is the latest year for which complete details are available).

What caught my eye about this data is that the numbers have fallen since the 2019 year. In 2018, 151,703 taxpayers reported overseas income, of which 114,760 were linked to a tax agent. After an increase in the 2019 year the numbers reporting income decline each year until the 2024 year when it rises from 112,069 to 125,335.

I find it quite surprising, given the international mobility of our labour, that fewer people appear to be reporting overseas income when we have a lot more migrants arriving.

I suspect it’s possibly piqued Inland Revenue’s interest, because I've had some clients requesting assistance after they have been contacted by Inland Revenue which has received information under the Common Reporting Standards of Automatic Exchange of Information. It will be interesting to see how that number of taxpayers reporting overseas income tracks.

By the way, this OIA also references the Common Reporting Standard, confirming in response to a question it “receives financial account information automatically from the Australian Tax Office under the Common Reporting Standard. This information is matched to taxpayer accounts and risk assessments.”

This ought to be well known and, as noted above, maybe we might see an increase in the numbers reporting overseas income.

Happy Twenty-first!

Now finally this week, according to LinkedIn, Baucher Consulting is 21 years old today. So Happy Birthday to me. It's been and continues to be an amazing journey and who knows what the future will bring. In the meantime, thank you all for all the messages of support.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

9 Comments

They are between a rock and a hard place

- If they go hard here it will make the recession worse.

- If they wait and go hard as we start to come out it will make growth very weak.

- Most liquidations will have an unemployment number impact, perhaps a major one.

- If they chase money it will cause bankruptcies will will hit the housing market.

Its all a bit messy

Nah IT. the way to build a strong economy is to look at the little stuff as well. IRD should not let anybody go a month over. You know "broken windows". etc.

Yeah but the nature of IRD is you can be late you just pay fines and interest, I think their issue is lack of management as the numbers grow. They have not had or required that automation during boom times and its over run them.

Plus the be kind rubbish

Many where walking dead before covid and are now Zombies, could make a good splatter movie.

As a tax agent, on Friday I lodged a proposal for a tax arrangement. It was rejected today. No negotiations. Until they have a more nuanced approach, well, that non compliant business may as well ignore them. Of course that is crazy, if only because of the exposure to penalties and interest. For me it is also unethical. But that’s me, my values. You can see ethics through your eyes.

IR do have a difficult task collecting say income tax. By the time the liability is known the money has been spent. But wages tax and KiwiSaver? Why do they let that build up? That is really incompetent. And an opportunity to coach, coerce, catch the problem while it is small. It’s that missed opportunity that I find most disappointing.

I recall years back there was a story that a decent hunk of gst and paye was built up by those who were using NZ as a stepping stone to Aus. They had no intention of staying long term and hence no interest in compliance.

Perhaps is was conspiracy theory stuff. Or not.

Toss the Capital gains tax out the window. It will not work out. there are no free lunches. Lets get real and collect what is due now

CGT would likely only be beneficial i it were, say, backdated 10 years. LVT is inescapable so seems a better option.

If they are owed so much there’s got to be an incentive to increase their funding which, if done effectively, would finance itself many times over in recoveries.

A perfect application for AI to consistently assess cases to look for the outliers and refer for action.

Would be vastly unpopular with those with the ability to convince the IRD they deserve special treatment and those with persecution complexes - but the even handedness might prove an electoral winner...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.