Speaking on a recent episode of interest.co.nz's Of Interest podcast, Steve Symon, who chaired the Ministerial Advisory Group on Transnational, Serious & Organised Crime, made the point that; "Cash is the primary currency of organised crime. And so a huge amount of our cash right now, as we sit here, is in the hands of organised crime."

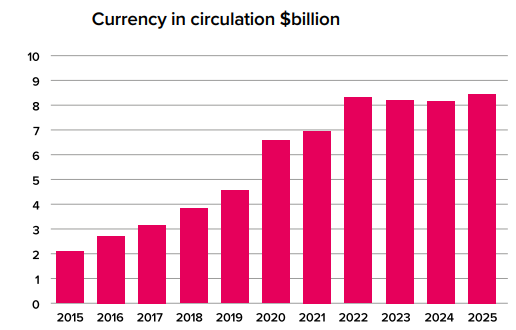

In its latest annual report the Reserve Bank, the sole supplier of New Zealand banknotes and coins, says currency in circulation was $9.1 billion as of June 30 last year, up from $8.9 billion year-on-year. (See Reserve Bank chart below).

Slightly different Reserve Bank data, on "bank notes in the hands of the public," shows an increase from just under $5 billion in 2015 to almost $8.6 billion last year. At the same time, the value of cash in $50 and $100 notes has surged. This comes even though many New Zealanders seldom carry or use cash.

So on Symon's point about large amounts of cash being in the hands of organised crime, what do the Police say?

Detective Superintendent Greg Williams, Director of the NZ Police National Organised Crime Group, says two significant markets deal predominantly in cash. They are illicit drugs and illicit tobacco.

"Wastewater testing shows meth use nearly doubled in mid-2024, so cash for this soared from an estimated $293 million per year to an estimated $533 million in 2025. Interestingly these figures are conservative, as they don't account for the fact meth is commonly diluted before reaching consumers. When expenditure on cocaine, MDMA and cannabis is included, the combined value approaches $800 million annually," Williams says.

Robbie Taylor, Reserve Bank Manager of Money and Cash Policy, says currency in circulation is influenced by public demand for cash. This is impacted by several factors including population growth and inflation, changing payment and shopping preferences, and reduced access to bank branches for cash services making it harder for individuals and retailers to bank cash.

"Cash industry activities also influence this, for example it has become more common that ATMs dispense $50 banknotes when previously $20s were predominantly dispensed. Recent natural disasters, crises, and official advice to keep cash at home for preparedness may also affect the amount of currency in circulation," Taylor says.

Meanwhile, individuals and businesses getting paid by customers in cash can be a way to avoid paying tax. Inland Revenue notes intentionally not paying the correct amount of tax is tax evasion. This can occur, for example, by a restaurant receiving payments via both cash and EFTPOS but only declaring income from the EFTPOS sales, and businesses withdrawing cash to pay staff and not paying PAYE tax on the wages.

A cashless society?

In the podcast, Symon says there's a future in which NZ will be cashless.

"Our point was the sooner you make that happen, the better we are because it will put pressure on organised crime to move it from a commodity that they can use to pay for these narcotics, and also push us into a transactional regime where there has to be a recording of the transfer or movement of these large quantities of money so that we can trace it, seize it, freeze it, recover it for the state."

"Cash at the moment is a major problem for the fight against organised crime," Symon says.

Williams says many major drug operations involve money laundering, and getting cash into an electronic banking system requires corrupting people or systems.

"One example is money laundering through cash-wage labour hire in industries," he says.

According to Williams, such industries include construction, horticulture and sex-work, which often involves the exploitation of vulnerable, sometimes migrant, workers.

"In essence, for this money laundering typology to work, it requires corruption of standard business practices and exploitation of workers, a number of which are undocumented foreign nationals, who are desperate to work. In fact it relies on targeting these people. It also allows for gangs and organised crime groups to get their money in an electronic form that can be turned into assets or cryptocurrency and moved through financial systems to pay overseas brokers and producers," says Williams.

"This is an insidious practice on so many levels, particularly considering the well documented massive social harm being caused in every community in New Zealand just from meth, combined with the violence that associates with this sort of illicit market."

"Because cash is anonymous, but difficult to use for major purchases, organised crime groups are constantly looking for ways to convert it into electronic funds or cryptocurrency," Williams says.

Automatic cash confiscation powers?

In its final report, the Ministerial Advisory Group on Transnational, Serious & Organised Crime made a series of recommendations around cash. These include;

Introduce automatic cash confiscation powers: Enable authorities to confiscate cash found with illicit items upon conviction, without needing to prove the cash was derived from crime. This would streamline enforcement under the Criminal Proceeds (Recovery) Act (CPRA).

Mandate border cash declaration and seizure: Require declaration of cash over NZ$1,000 at borders, with automatic forfeiture if undeclared and suspected to be linked to criminal activity.

Mandate electronic wage payments in high-risk sectors: Require wages to be paid via traceable methods in industries like construction, hospitality, and agriculture.

Prohibit cash payments for professional services: Ban cash payments to lawyers, accountants, immigration advisers, and real estate agents to reduce laundering risks.

Restrict cash use in remittance services: Limit remitters from accepting cash above a low threshold [$5000] for international transfers.

Ban cash purchases of cryptocurrency: Prohibit virtual currency ATMs until regulatory oversight is in place to close a major laundering loophole.

Symon says the Government "seems to be warm" to exploring ways wages in some industries could be paid by traceable methods, to see whether the benefit outweighs the burden.

"I'm not trying to take money out of the wallets of every grandparent who wants to go to a bake sale. What I am trying to do is target those industries that have been exploited by organised crime," says Symon.

The final report goes as far as saying transnational serious organised crime; "is becoming the number one threat to New Zealand’s national security."

Small businesses 'adversely affected if cash was unavailable' & the RBNZ's seigniorage

Taylor notes the Reserve Bank regularly surveys New Zealanders’ cash use. Latest research suggests 72% of small businesses would be adversely affected if cash was unavailable as a means of payment.

"Our own survey tells us while over 80% of adults use cash sometimes, over half (56%) store cash and 8% rely on cash," says Taylor.

The Reserve Bank earns revenue from its stewardship of money, cash and payments which largely relates to seigniorage. This is the net income the Reserve Bank receives from investing the funds received from trading banks from selling banknotes and coins to them, which is currency in circulation. Its 2024 annual report shows a $466 million surplus from this activity on $524 million operating revenue and $58 million of operating expenses.

Meanwhile, Symon acknowledges whilst eliminating cash would help in the fight against organised crime, it wouldn't end it.

"Because organised crime, much like a good business, will find another way to transact."

*This article was first published in our email for paying subscribers early on Monday morning. See here for more details and how to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.