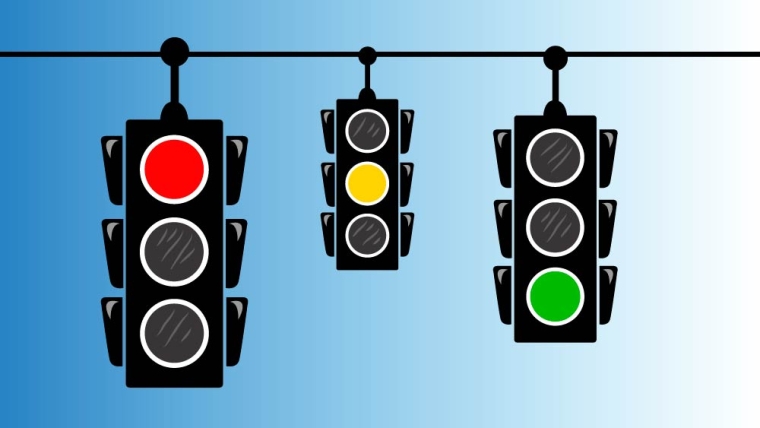

In a recent conversation, Alliance CEO David Surveyor described world red meat markets by comparing them to traffic lights.

Contrary to the evidence earlier in the year, when buyers stopped buying because of Chinese New Year closely followed by the Covid-19 shutdown, China has emerged as the brightest light with the traffic lights firmly set on green. The composition of Chinese orders has changed since the virus outbreak with retail and online sales growing considerably, while there are signs of hot pot outlets starting to reopen.

Silver Fern Farms’ Simon Limmer agrees with this assessment, although he cautions against assuming there won’t be a risk of a market reversal at some point. For the time being China is a saviour, in spite of meat exporters’ wish not to put too many eggs in the same basket.

This is not a time to pick and choose though. The rest of Asia is also quite strong with demand for grass fed beef holding up well in Japan, Korea, Taiwan and South East Asia.

At the other end of the spectrum the US market is very sluggish and, according to one of the largest meat processors in the world, Tyson Foods, the supply chain is in imminent danger of breaking because of the pandemic’s impact on production and distribution to the retail trade. The American food service sector is as severely affected as most other countries which has a detrimental effect on demand for the most expensive cuts of red meat, such as beef loins and lamb middle cuts. Surveyor rates the USA as a red traffic light.

UK and Europe, despite the difficulties imposed by different levels of lockdown, are still buying a reasonable amount of product and are considered more like amber to green. Clearly the hospitality sector has slowed almost to a stop, as in the USA, but retail and online demand remains strong and has compensated to quite a large extent.

ANZCO CEO Peter Conley echoes this assessment of the market and says transport logistics have been working well from New Zealand, although lack of air cargo space means chilled product has been largely replaced by frozen. As a result, however flexible New Zealand exporters try to be, it is no longer possible to arrange an urgent air freight of high value chilled product to satisfy a customer on the other side of the world.

Generally New Zealand’s meat exporters are coming through the uncertain period in better shape than they thought during the initial fallout from the pandemic and, because of the agile work of their sales and marketing teams, are still managing to find a home for the product.

While farmers must still worry about drought and future environmental challenges, they can at least feel confident of getting paid for their livestock, always assuming they can book space at the works.

Current schedule and saleyard prices are available in the right-hand menu of the Rural section of this website.

Y Lamb

Select chart tabs

1 Comments

Guy, any thoughts on where our imported meat supply will be by say Oct/Nov? Approx 60% of pork products consumed in NZ are from imported pork. We import eggs for hatchlings. With animals been destroyed in some countries due to meat plant issues are there likely to be repercussions here to NZ imported food supplies.

I understand in parts of the EU they are short/run out of some Asian food imports e.g. spices etc. Is anyone keeping stock of what is happening to the global food trade, outside of beef and dairy?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.