Rabobank have just released their monthly update on the agricultural sector. For those close to or associated with farming no-one should be surprised however, the reaffirming of sound prices going forward almost across the board (wool and venison improving but hardly earth shattering being the exception, still) must provide a degree of certainty to all involved.

However, New Zealand export products are not operating in a vacuum and Rabobank show that farm inputs, particularly fertilisers and oil are on upward trends.

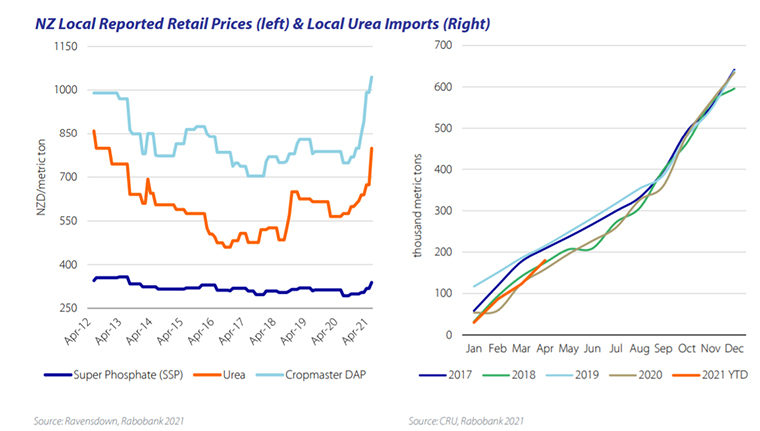

Super Phosphate, which underpins most livestock systems, has shown only modest increases but the urea based products are having rapid increases and Rabobank are predicting them to continue into the spring.

Increases are due in part to demand and partly due to shipping delays and costs. While Rabobank are also picking that oil will maintain or increase at current levels (US$70+ per barrel) the future is less certain. This uncertainty may be only short lived as OPEC+ (+ includes Russia and allies) are meeting this week about current and future productions levels. They are supposed to be favouring an increase of +500,000-1million barrels per day which should put some downward pressure on prices or at least stop increases, but there is also talk that some will resist any increase and with the improving world economy prices are liable to increase. There is of course the usual potential of unrest in the Middle East which may upset production.

On a different tack, most recent ‘research’ has discussed the falling favour of how populations in the USA and Australia view China. A recent publication from China has shown that the Chinese population has also changed its view. In this case of Australia. The average Chinese attitude toward Australia turned out to be 55.6 points - on a scale of 0 to 100 in the poll, amid deteriorating China-Australia relations, dropping from 65.3 points from 2020. The feelings of the Australian public toward China on a scale of 0 to 100 fell sharply in 2020 to 39. Australia has also been toppled off its position as the number 1 destination for education for Chinese students.

Nearly 88% of Chinese respondents consider that to Australia, China is an economic partner rather than a military threat, while about 41% said to China, Australia is more like a threat on military, political and ideology fronts, while nearly half consider the US the biggest factor in interrupting China-Australia relations. Not surprisingly the reverse is more the case in Australia.

What is perhaps surprising given what has been in the headlines over the last 24 months or so regarding the ‘breakdown’ in Australia/China trade relations, is that (at least according to Chinese numbers) Chinese imports from Australia in May rose +55% year-on-year. Whether this is on a dollar basis or on volume is unclear but looking at Australia’s iron ore exports it appears to be both. China is able to find alternative suppliers to replace Australian sources in most areas except iron ore where Australia still is an important supplier. Iron ore is Australia's single largest export and its Treasury predicts the value of that market will increase from AU$103 bln last year to AU$136 bln this financial year. In part this is due to a lack of international competition largely due to the Brazilian Samarco dam collapse, which impacted on their production plus the impact of Covid-19 in South America.

At the same time China has been ramping up steel production to meet its needs and China's National Bureau of Statistics says in the first four months of the year, their steel mills produced about +16% more steel than the same period last year. Earlier in May iron ore prices reached a record AU$240 per tonne. However, this is expected to fall, some say up to AU$110 per tonne, as more competition again starts to come into play and China is expected to reduce its demand as its domestic investment slows.

From an Australian perspective, China and Australia need to sort out their differences as once more alternative supplies come on stream (again) China is likely to try and put additional pressure on them in their tit for tat political debate. At the moment both countries need each other with China buying about 70% of the iron ore Australia exports, which in turn makes up about 60% of all the iron ore China imports. Iron ore makes up over 20% of Australian exports and mining companies pay around AU$24 billion in tax. So, a major driver of the Australian economy.

An update to the OPEC+ oil decision appears to be that there has been no definite decision, at least as yet. However, it sounds like most members are wishing to raise production in the latter period of this year in the wish to keep oil prices more stable. 400,000 barrels a day seems to be the consensus Since prices plummeted in the global slow down last year, they have risen 45% to date.

No chart with that title exists.

6 Comments

And what happens when oil begins to run out...?

False economies,

Fair question. When do you think this will happen?

That's very difficult to answer because it largely depends on us. However, I think it's probably fair to say that we'll start having issues this century under BAU scenarios.

And what happens when oil begins to run out...?

And what happens when oil begins to run out...?

And what happens when the oil runs out...?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.