This content is supplied by Rabobank.

Despite the rural sector having performed strongly through a number of recent challenges, New Zealand farmer confidence – which was already at low levels overall – has plummeted further and now sits at an historical low, the latest Rabobank Rural Confidence Survey has found.

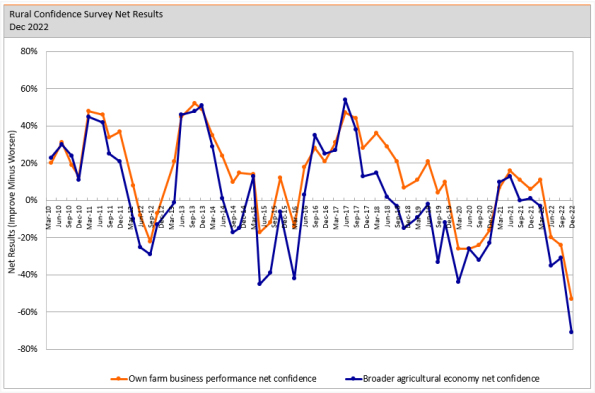

The fourth and final survey of 2022 — completed late last month — found farmer confidence was significantly down on the previous (September) quarter, with the net confidence reading slumping to -71 per cent, from -31 per cent previously.

The latest net confidence reading is the lowest in the 20-year history of the survey and far exceeds the previous low of -45 per cent recorded amid the dairy downturn in 2015. The latest survey found the number of farmers expecting conditions in the agricultural economy to improve in the coming 12 months had fallen to four per cent (from 12 per cent in the previous quarter) while the percentage expecting conditions to worsen rose to 75 per cent (up from 43 per cent). A total of 19 per cent were anticipating the agricultural economy to remain stable (down from 44 per cent previously).

Rabobank New Zealand CEO Todd Charteris said farmers from all the sectors were now significantly more pessimistic about the prospects for the broader agri economy with a cocktail of concerns weighing heavily on farmer sentiment.

“As with recent surveys, rising farm input costs and government policy were the two major reasons cited by farmers with a pessimistic outlook for the year ahead,” he said.

“But we have seen the order reverse this survey, with concern over government policy now the major source of apprehension for farmers, cited by 68 per cent (up from 58 per cent previously) while 51 per cent of farmers were worried about farm input costs (down from 71 per cent last quarter).”

Mr Charteris said the rise in concern over government policy was likely to be tied to the Government’s proposed framework for pricing agricultural emissions released in October.

“This proposal has caused significant angst among primary producers with many believing it unduly penalises farmers and the communities in which they live and work,” he said.

“One of the chief concerns was that the proposal did not fully recognise on-farm mitigants that have been put in place to sequester carbon. The Government’s subsequent announcement at Fieldays that it plans to revisit sequestration policy will have been welcome news for farmers, however, this announcement was made after the survey closed and is therefore not reflected in the results.”

In addition to concerns over government policy and farm input pricing, the survey found rising interest rates (cited by 25 per cent of pessimistic farmers) and falling commodity prices (21 per cent) were further sources of worry for farmers.

“Since the last survey, we’ve seen the official cash rate rise by 125 basis points which has increased interest costs and further squeezed farmer margins. Over this period, we’ve also seen agri commodity prices pull back as global markets react to growing recessionary fears,” he said.

“And all these factors have combined to drain farmer sentiment and leave it deep in the doldrums as we move towards the end of the year.”

Own farm business performance

The survey found farmers confidence in their own farm business performance has also dropped to a new record low, with the overall net reading of -53 per cent well below the previous low of -26 per cent recorded at the beginning of the Covid-19 pandemic (data on this measure was first collected in 2009).

Only seven per cent of farmers were expecting the performance of their own operation to improve in the year ahead, while 60 per cent of farmers were expecting their own farm business performance to deteriorate.

While dairy farmers and growers were markedly more pessimistic about their own operations, Mr Charteris said sheep and beef farmers recorded the biggest fall and the lowest net reading on this measure, dropping to a net reading of -68 per cent from -26 per cent previously.

“Only four per cent of sheep and beef farmers are expecting conditions in their own operations to improve, with 72 per cent expecting conditions to worsen,” he said.

“And again, this big fall in sentiment is likely to largely be attributable to the government’s emissions proposal which – according to the government’s own commentary – could lead to significant reductions in the net revenue and production for New Zealand sheep and beef farms.”

The survey found the net reading for growers’ confidence in their own farm business performance had fallen to -45 per cent, while the net reading among dairy farmers dropped to -47 per cent.

Farm Investment and viability

While it didn’t fall as drastically as the two farmer confidence measures, Mr Charteris said farm investment intentions were also back on last quarter and at a net record low.

“Only 12 per cent of farmers are now expecting to increase investment over the year ahead with 26 per cent planning to reduce investment. The remainder are expecting to keep investment the same,” he said.

“Although at net negative levels overall, horticulturalists now have the strongest investment intentions, while sheep and beef farmers continue to have the weakest.”

Despite the fragile sector confidence, the survey found the vast majority of those surveyed viewed their operations as viable.

“We did see a lift from last quarter in the number of farmers who now believe their operation is unviable, but close to 95 per cent of farmers continue to have faith in the long-term viability of their operations,” Mr Charteris said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

7 Comments

I'm a farmer and can relate. I've resigned myself to just stick it out for as long as possible in the hope that I'll be able to sneer at people when they complain about the price and start eating imported meat and dairy because NZ meat and dairy is such a high quality and so rare that it's all exported to rich people who value that.

We produce some of the best, lowest carbon, grass fed protein on the planet, idiot voters and politicians want to screw us over, let them eat cake.

Cake, no, no, not cake. Those Who Know Best now think we should all eat insects. Of course, they should eat all the caviar, wild salmon and grass fed beef, obviously.

The irony of your reference may be lost on younger readers, or maybe not.

Like it or not, once upon the world stage, New Zealand founded itself as a mercantile nation, and ever since then, primary production has been the driving force of its success. As far as I can see nothing in substance has emerged to overtake let alone supplant the vitalness of that historical trade. This government though embarks on a calculated and systematic program to curtail that essential part of our nation’s livelihood without offering any viable alternative as to how New Zealand is then to earn its keep.

I think many farmers are talking themselves in to depression by listening to all the negative commentators in the media and organizations like groundswell etcetera and I would have to say, many gloom merchants on this site.

Yes inputs have become expensive and environment legislation is hitting us but as far as I can remember of my 40 yrs farming it has always been hard to make a profit. Governments have come and gone and always will but they have never changed the market dynamics. Prices go up and down, in fact most of my Dairy farming friends are doing well.

There has never been much money to be made in the hills. At the moment we are doing alright on the meat side even though the short term outlook is down a bit. Personally I am confident of a bright future for protein production. Think Positive!

How could farmer be glum.

Best pay out in years.

The greed of going to big maybe the real issue here they are working for the banks.

But as the bank have run around saying over the last ten years there no money in farming but there is money in land buy all you like how much money would you like.

I guess they are caught in the Ponzi too.

Actual farming is mostly a lifestyle choice. Ya wouldn't do it for the money unless you own massive economies of scale.

Which would mean you are not actually a farmer, just a business manager beholden to your banker.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.