While the falls in farm payout milk prices have not come as a huge surprise, the reduction in the forecasts for next season have.

Producers have been promised with China’s re-emergence into market all pricing woes would be over. Perhaps a slight over-statement but that has been the general conversation from banks and other commentators.

The forecasted prices now are getting dangerously close to the break-even point for many farmers who, without making serious inroads in production, have little recourse on reducing spending.

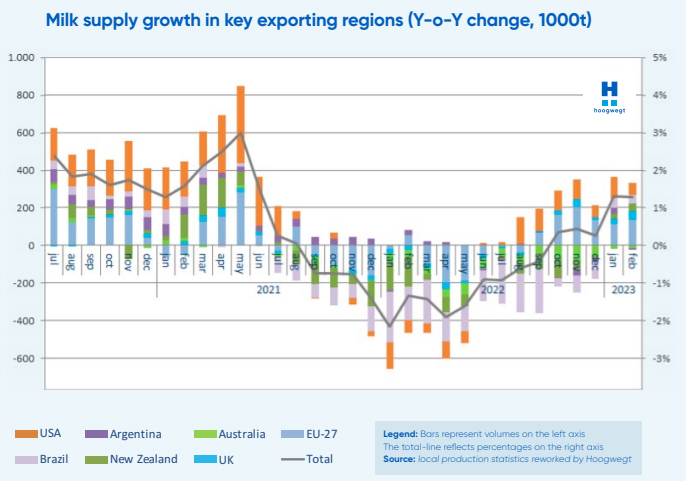

Given that global milk supply has as much of an impact upon price as does demand, it is perhaps worth a look at the EU and the US which are the other main and competing regions. The general situation in the EU is similar to what has been happening here. Up to April farmer returns have provided a positive margin over costs and to that point they have been pushing production. However, like here, farm gate prices have been steadily decreasing along with on farm price increases and they are expecting farmers once they have fallen below the break-even point to start heavily culling cows.

The US starting point has been behind that of the EU in regards to farm profitability and it sounds like farmers there are already close to or at break even and the cow cull has already begun.

In both cases it appears future production will be down. There is also the belief that part of the fall in prices has been due to a change in ‘buyer behaviour’. Not only are they paying less but also are holding less supply in stock. Some EU commentators believe that prices at pretty much at the bottom of the trough now and once the upturn does come there could be a reasonably rapid turn-around.

Of course, this is all speculation and the one thing they agree on is that there is still a large degree of uncertainty both on the supply and demand sides. Bearing in mind Fonterra’s latest forecasts, no doubt this uncertainty still features large in their thinking but they will make less enemies if they lift the price next season rather than drop it even further.

The graph above of the key exporting regions shows the volatility between years and while milk supply growth in the early part of this year is up on 2022 from what we are hearing it may not hit the heights of 2021 but also have a similar fall away as the season progresses. With supply growth only hovering around the +1% at least up to the end of February it looks like supply versus demand is fairly finely balanced however with the flat to negative results in the latest GDT auction perhaps the EU supply is still pumping and until that drops there may not too much of an upside in the short term.

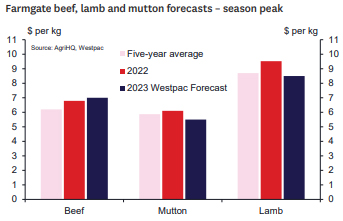

In the meantime, Westpac have put out their predictions for the red meat sector for the next while. Unlike for dairy they are expecting a reasonably settled ‘ride’ for meat. They even expect farmgate prices for beef to challenge price records in the Spring on the back of weak US beef production. I found this interesting given that some EU commentators were picking a lift in the cull dairy cow kill.

Sheep meat prices are likely to be kept in check by good production coming from over the Tasman. However, I have always found when it comes the meat sector, while the macro influences may drive the general trends, the processors respond best to local factors such as weather and supply issues.

Westpac’s forecasts are shown below. In isolation they would provide farmers with a degree of comfort, however, the high input costs being experienced will put a damper on the season.

As with all things regarding agriculture, China’s fortunes are intertwined with farm returns and all predictions have the caveat: ‘so long as China’s economy sees an upturn’. Sheep, and Beef too, to some degree can mitigate some on farm costs for a limited time but interest rate rises are going to be hard to avoid as are fuel and transport costs especially with the fuel subsidy being removed at the end of June.

As always an interesting season ahead and still being affected by the pandemic be it a couple of steps removed.

11 Comments

Looks like BAU to me. Farming has always been an uncertain game. As you were chaps.

I suppose if Ag doesn't pick up and we keep running trade deficits we can just borrow more. Problem solved.

I think if we just keep getting lots of immigrants from unsuccessful third world countries it should all be fine.

Protesters in Wellington demanding compulsory regen ag and a ban on fertilizer. That should really help with the trade deficit also.

Strangely they want cheap food as well.

And did they say what regen ag is . Other than rotational grazing and a desire to increase soil carbon I'm not sure anyone knows or has consistently defined it.

More of an idea than a definition, with lots of nuances internationally, but I think the heart of it is the soil is the basis of farming, and most soil is relying on chemical fertilizers to produce, carbon lagging behind, and microbial activity suppressed.

Of course, you get the extreme nutters protesting, but their are a lot of people doing hard work and research to show the benefits and pitfalls of the application.

Pretty rhetorical question there solar.

As far as I can see NZ could rightly claim to be the most regenerative agri country in the world, because most of us are already doing the basics. Long way to go and a lot to learn and relearn but many steps ahead of the protesters.

Yes , we are. Some overseas countries could learn alot form us. but we could learn a lot from other countries. shelter for animals from the cold and sun, for instance.

Absolutely that. We could have had a much easier, more enjoyable season with shelter from almost 3m of rain.

Long Chatham Rock

Media to blame for a lot of this. Its not actually thier fault for thier lack of understanding of the real world.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.