Recently I was invited into a conversation to share my opinion on the milk price. The conversation was in full swing and centred around the newly forecasted $6.75/kgMS from Fonterra for the 2023/2024 season. The tone of the conversation, while appreciating the tough year ahead for the entire industry, steered dangerously towards making comparisons with previous milk prices. A very human conversation on the surface of it. The milk price is currently x, it was y in the past - let’s see how x compares to y and try to predict the implications of the milk price.

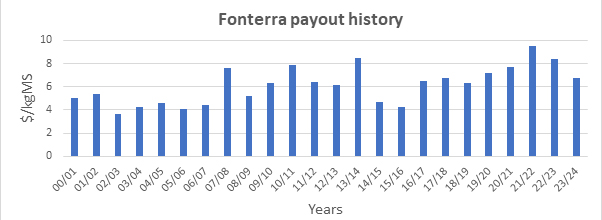

These conversations can be aided with the use of a graph of Fonterra’s payout history. This can easily be created in a style similar to those used in recent articles on this platform:

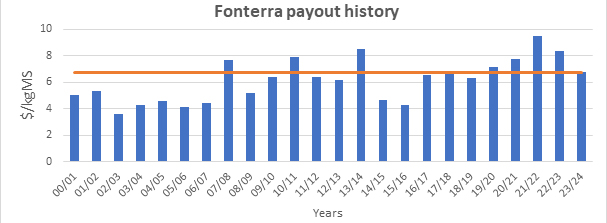

Having this graph would have made a useful visual aid to assist the conversation. Data in this format allows a reader to cast their eye across the different milk prices and compare payouts easily across the century. The current forecast of $6.75/kgMS can be used as a benchmark and then comparisons can be made. The orange line below indicates the $6.75/kgMS payout back to the start of the century. Now comparisons can be made with any historic payout.

It is quite obvious that the forecast payout this season supersedes the majority of the payouts this century. Of the 23 payouts shown the current is the eighth highest. The conversation could conceivably now continue in the direction it was headed. “The industry has survived lower payouts than this quite regularly this century” “Commentators and industry professionals may be exaggerating the situation this season” “This is because they have been used to riding the high of healthy pay-outs”. Readers know how the rest of the story goes I am sure.

But I specialise in long term agricultural investment analysis. This means I think in terms of real returns. I must always consider discount rates, future values, historic values, and present values. This is why the direction of the discussion mentioned, the graphs shown, and the idea of one casting one’s eye horizontally across those payouts in the graphs above is not an accurate comparison. This is not how one compares values across time. These are nominal values; they are the actual payouts and they are accurate but they are not suitable for comparison. Any comparison of values that occurred at different points in time must first be taken to the same point in time before they are compared.

The concept of discounting values is very complicated and I could probably write a manual on discount rates alone. However, a very simple discount criteria is simply to discount based on inflation.

As an example, if you the reader earn $100 today and also earned $100 on this day last year did you earn the same amount each day? Well, you received the same red note with a gleaming picture of Ernest Rutherford staring back at you (usually nice and crisp due to lack of handling). But, could you have purchased the same amount of ‘stuff’ with it? The answer is no, simply because of inflation. National inflation, according to Statistics New Zealand, in the last year was 6.0%. This means your 2023 $100 can be adjusted by this amount back a year to compare with your 2022 $100. This is a very easy calculation – (2023 income / (1+current inflation)) and the answer is $94.34. So, when comparing what you earned today with what you earned last year you can take your $94.34 back a year and compare it to the $100.

Readers can see where I am going with this, I am sure. What we must do, instead of casting our eye horizontally across the graph above, is cast our eye across a line that is discounted back through time at the rate of inflation. We need to consider the $6.75/kgMS, take one year of inflation off it as in the example above, and then we can reasonably compare it with the $8.40/kgMS of 2022/2023. In which case we could be comparing $6.26 with $8.40.

Avid readers with calculator in hand may have checked the calculation and disagree slightly. This is because this time I didn’t use 6.0%. I used a different inflation rate of 7.80%. This is because we must use rural inflation. The rate of rural inflation is almost always different than national inflation. Typically higher, but there are certainly times when it is lower. Rural inflation data is also available from Statistics New Zealand.

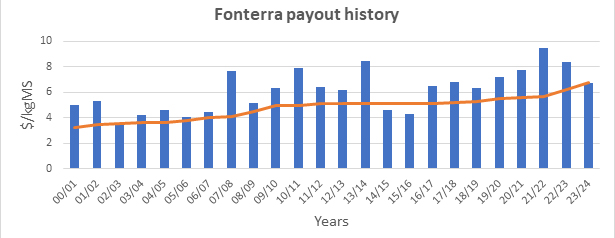

Now for some more easy calculations. One just needs to take the graph above and adjust the orange line back through time by the rate of rural inflation. The graph now appears like so:

The orange line now represents the 2023/2024 forecast of $6.75/kgMS adjusted back through time at the rate of rural inflation. Now a real comparison can be made between this year’s forecast payout and the historical payouts.

It is obvious now that only twice this century has the payout, in real terms, been lower than the 2023/2024 forecast. This was during the 2014/2015 and 2015/2016 period. It can also be seen that, in real terms, the discounted 2023/2024 milk price dips just below the lowest nominal payout this century. The lowest nominal payout was $3.63/kgMS in 2002/2003 and the current figure discounted through rural inflation arrives at 2002/2003 at $3.54/kgMS.

What this means, what dairy farmers should and can do about it, what this means for the industry, and the wider economy – I will leave to the array of capable professionals and commentators out there. I have a lot of points to offer on what can be done on-farm before, during and after tough times to build businesses resilience which can also be left for another day.

My only two cents at this stage would be please look after your mental wellbeing, particularly any dairy farmers reading this. You are the most important asset your business possesses so please look after that one! Financial stress is a very real pressure that I am sure will be felt across the industry. Please familiarise yourself with the array of tools and help available to assist you through the season.

Dan Smith is an agribusiness lecturer at Lincoln University specialising in investment in the primary sector.

26 Comments

The question to be asked from the economists and politicians and bankers is very basic one.. Why do we keep depreciating the value of money?

Answered : to keep the rich always richer than the poor who want to become rich.

You can work hard and hard and earn more but you will still be under the balls of that rich banker. Go figure

Inflation is theft. Money with an elastic supply does not work for measuring economic value, it is like trying to build a house with an elastic measuring tape.

Bitcoin fixs this. Rules without rulers.

Bitcoin fixes nothing. It's a new gold standard, which didn't work either.

You can work hard and hard and earn more but you will still be under the balls of that rich banker. Go figure

You can go live free in the woods, and likely complain how much less hospitable the environment is.

Effectively you're wanting all the benefits of this financed modern world, without any of the downside.

If you want to live even the most basic lifestyle, but want the independence of not being removed from the woods at the behest of the "authorities", you are still forced to pay for facilities you don't want, didn't ask for and didn't vote for, at an increasing rate over time.

I know a few places you could live and not have anyone bother you. It wouldn't be for most people.

Why anyone thinks they can enjoy all the merits of society with none of the costs is humorous.

Agree Pa1nter, There are those who want all of the modern world comforts without contributing.

As far as I understand it, Fonterra set up a massive milk production business in China, which folded and was sold for cheap, and is now pumping out so much milk the Chinese don't need ours.

The hopeful naivety / idiocy of neoliberal thinking would be amusing if it weren't so dangerous. In this case, the chance that the smart, motivated and industrious Chinese would take the IP and run with it at some point, thus leaving us high and dry, were/are 100%.

What you don't seem to realize is there were plenty of other suppliers available from around the world.

Didn't matter what this little country did the out come would have been the same.

Would the Slovenians et al. have been able to foster a domestic industry in the PRC as effectively as NZ? Point being that we might have bought ourselves more time by more jealously protecting our gene-stock and IP. Whether that time was used intelligently is another question - a government that allows 44% of the sales of its biggest export earner to go to one country is dismal failure of governance to start with.

Next we will be setting up Indian dairy farms, they have 400 million cows milked inefficiently.

We will absolve our consciences by telling ourselves that we are doing it for the sake of the planet.

Hopefully their religion that worships the cow, gets in the way.

nktokyo yep the Dutch guy that Fonterra had as CEO did it. On 6 mill a year then rides off into the sunset. Had all these big bright ideas. Know several farmers who got paid 2000 a yearling heifer to be shipped to China. I said to them you are creating your competition there. They said either we do it or someone else will. This was 2008 2009 time.

Tea doesn't taste the same without it

Outstanding analysis thanks Dan. Very refreshing to see someone dig below headline numbers and show it how it really is.

Does this consider the cost of intrest?

As the article says, discounting cash flows is a big topic on it's own. Dan has used rural inflation to discount back to comparable dollars. Interest rates could also be used. Since inflation reflects change in the purchasing power of the revenue from milk it seems to me to be a pretty good approach.

Excellent article Dan

Be great to hear more form this Author in future.

The day to day profitability is neither here nor there.

Most dairy farmers are in it for the tax free capital gains when they cash out - there' always a greater fool.

Good one finite, do you realize that those farmers sell to other farmers. Ahh yea thats how it works.

Like Homer Simpson told the world when asked "what is the meaning of life ' answer 'a whole lot of stuff that happens.

Start thinking bro, oh no maybe you're sister.

Whatever have a good evening.

Farm inflation could drop quite rapidly as farmers stop speeding.

Orange line bad.

Looking at the real payout price and the experience of 2014 to 2016 I would say that the payout will head lower still.

The price fluctuates as supply responds to demand signals. Bad years follow good

Why would use rural inflation rather the dairy farm input price index? What matters to dairy farmers is how much it costs to make their product (changes measured by farm ppi) and how much they get for their product, no?

> The real milk price

.. rivers green with algae, ground water being polluted with copper cynide. Swimming holes of my childhood unswimable. The real cost of milk.

Indeed. My family switched to non-dairy alternatives a couple of years ago for that reason.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.