A group of five farmers have launched a rearguard action to try to block the looming takeover of a majority stake in the Alliance group of meat companies by a firm in Ireland.

They plan to publish an open letter in Farmers Weekly at the end of the week, insisting it is realistic to retain Alliance’s status as a 100% farmer-owned co-operative, despite arguments to the contrary.

Signatories to the letter include the Southland farmer Andrew Morrison, who was chair of Beef + Lamb NZ during the Mycoplasma Bovis crisis.

The letter follows a warning from the Alliance board on Friday that a rejection of the Irish buy-in carries huge risks, including insolvency. But the hold-out farmers disagree.

The dispute follows last month’s confirmation that Alliance’s preferred cornerstone shareholder is the Irish food producer, Dawn Meats. It proposed to take a 65% share of Alliance for $250 million.

That would end Alliance’s status as a 100% farmer-owned co-operative, and would follow its big rival Silver Fern Farms, which ditched its co-op status a decade ago.

The Alliance board argued farmer-shareholders should accept the Dawn Meats offer after concluding they could not, or would not, provide enough capital to salvage a dire financial crisis.

The board followed this up with a tough letter last Friday, saying the Dawn Meats offer was clearly the best option.

“Alliance equity is valued between $0.35 to $0.87 per share (midpoint $0.61),” the board said.

“The Dawn Meats offer values Alliance at $1.05 to $1.31 per share (midpoint $1.18) - a 93 per cent premium, representing compelling value for shareholders.”

The board followed those figures with a harsh warning.

“If shareholders vote 'no', Alliance has a very limited and unlikely set of alternatives,” they said.

“It can pursue asset sales, site closures and large cost reductions, it can attempt to raise capital from shareholders or other investors, or it can go into insolvency.”

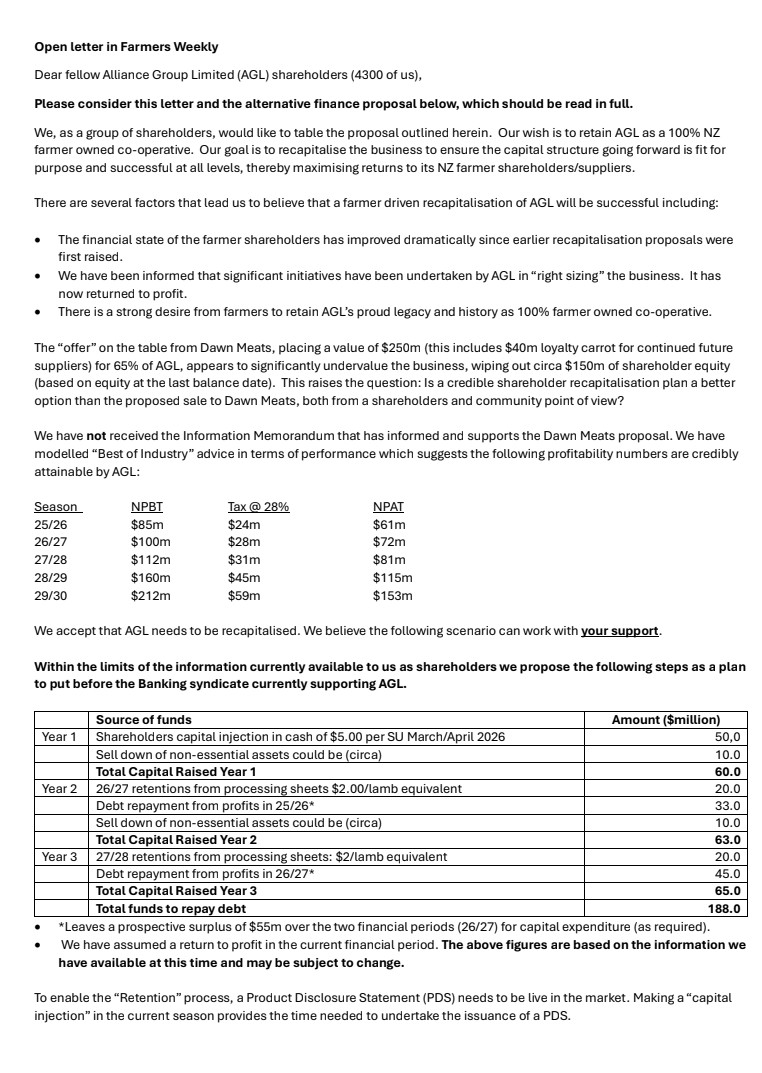

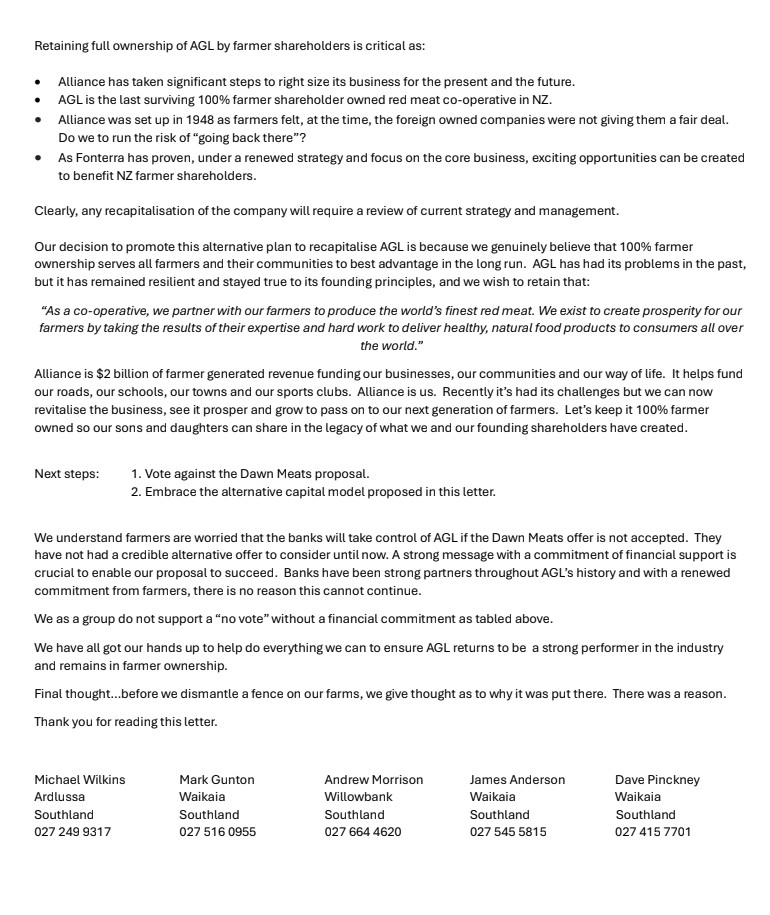

But the hold-out farmers reject that argument and say Alliance’s co-op status can be salvaged with payment of $5 per lamb equivalent.

“You have got to look at it from a per-lamb perspective,” says one of the five farmers, Dave Pinckney.

“If a lamb is worth $140, the processing company keeps $5 and returns $135 to the farmer,” he says.

Pinckney adds the exact number will vary from farm to farm, but on average, the $5 has to be kept in proportion to the $140 and not seen in isolation. Pinckney adds the $5 fee would raise $50 million. Another $10 million would come from the sale of non-essential assets.

These two events would take place in the first year. Years two and three would involve smaller payments per head of stock. Other money would come from the use of company profits to repay debt. Alliance management is forecasting a profit after two very bad years.

“Alliance is $2 billion of farmer-generated revenue funding our businesses, our communities and our way of life,” the letter from the five farmers says.

“It helps fund our roads, our schools, our towns and our sports clubs. Alliance is us. Recently it’s had its challenges, but we can now revitalise the business, see it prosper and grow to pass on to our next generation of farmers.

“Let’s keep it 100% farmer-owned so our sons and daughters can share in the legacy of what we and our founding shareholders have created.”

Pinckney is from a veteran Southland farming family which has supplied Alliance for 60 years. He insists co-op status would be better for farmers than ownership by investors, because profits would go back to farmers, instead of shareholders.

“Any business, whether it is listed on the Stock Exchange or not, will seek to maximise the return to the shareholder. Dawn Meats’ first responsibility is to its shareholders,” he says.

“A co-op’s profit, by default, is going to be slightly less because it’s maximising the price it pays to its farmer suppliers. But if you are a proprietary company, as Alliance will become if it is 65% owned by Dawn Meats, then they will pay only what they have to pay to get the lamb or the cattle to the chain.”

Pinckney says that would mean worse returns for farmers in the long run. He concedes that many farmers are worried that the banks might take control of Alliance if the Dawn Meats proposal is not followed. But he says the banks have not had a credible alternative proposal put to them up until now.

There have been some suggestions farmers would have been happy with a 50% buy-in but bristle at Dawn Meats getting a 65% stake. Pinckney himself says he gets a lot of different responses from farmers he talks to about this matter

One man who is sceptical of the suggestion is Alliance’s third largest shareholder, Grant Ludemann. He owns 1.6 million shares and is unwilling to put any more money into the cooperative.

“I think there are a lot of synergies between Dawn Meats and Alliance,” he says.

“If the farmers vote No, then the banks will most likely have a fire sale of the company pretty quickly. Dawn could possibly pick up the company at the price the banks are satisfied with to meet their needs and farmers will get nothing out of it.”

Also sceptical is the Alliance Group chairperson, Mark Wynne. He calls the letter some thinking on a page rather than a proper plan.

"I don’t believe it’s credible and it actually carries the risk of creating false hope, and there are two reasons for that.

"The first is that the letter uses financial numbers that are very high numbers compared to the New Zealand meat industry average.

"Secondly, and most importantly, the letter assumes the banks are going to tolerate an ongoing level of debt for a number of years from Alliance and we can be crystal clear that that is not going to happen. The banks have been very clear. They need their repayment of that $188 to $220 million of working capital by the end of this year."

Wynne adds the banks are concerned with the status of the red meat industry generally because of declining livestock numbers and an excess of installed processing capacity.

The final issue will be decided when Alliance holds is special general meeting to consider the Dawn Meats proposal on October 20. The verdict will be revealed the next day.

Here's the dissenting farmers' open letter.

6 Comments

There are four quarters to the meat industry operation. The farmer supplier, the processor and marketer, the workforce, and finally the market. One of the great longstanding problems has been the failure of each individual quarter to sufficiently recognise the importance of the other three. Yet to function, all of them need one another and in balance. It is has always been difficult for farmers to accept that some shiny arsed executives further up the line earn more per annum and that the price that they sometimes see being charged on the menu overseas is way above the per kg return of their schedule. For quite some time Alliance and SFF/PPCS have been scrambling together all sorts of recapitalisation only for that to then be run off in trading losses, necessitating having to have another go. Which is exactly where Alliance is now. It might well mean that if it becomes goodbye to Dawn then goodbye Alliance follows as the banks will likely be obliged to step in and once again force further consolidation in the industry.

Whatever way this goes there is still over capacity - will the new structure, Dawn or Coop be prepared to close further capacity or are they waiting for others?

To me this is the elephant in the room and seems to have fallen away from discussion.

Will meat prices stay well above average? It looks like a wave of cheap corn and soy coming in the US. Where will this end up in a few years - ultra cheap stock feed?

I agree with the rhetoric of farmer cooperatives enabling farmers to be price makers rather than price takers. What I really struggle with is the contextual analysis is severely lacking.

1 scale - Alliance is just one of multiple processors of NZ red meat and without the scale to benchmark price to farmer. What is needed is a NZ red meat cooperative with single exporter status, like Zespri or Fonterra (albeit there are non- cooperative players in the dairy sector but they are struggling due to the scale of Fonterra benchmarking farm gate milk price).

2 loyalty of farmers - the current high in the price cycle is unlikely to last. A per head levy will be an anticompetitive factor in farmer commercial decision on who to sell to. Individual farm business decisions can hinge on a few cents/kg, and will also be influenced by banks, given the high debt loading on most farm businesses.

3 procurement practices - there are periods where competing processors pay unsustainable procurement premiums to keep plants operating (arguably a practice contributing to Alliance financial performance).

4 no geographic boundaries to procuring stock - North Island companies will poach stock from the South Island and vice versa. The historic siting of processing plants was driven by a very differently regulated transport environment, both within NZ and for ports.

So although theoretically correct about the benefits of farmer owned cooperatives, in the absence of Government policy supporting the establishment of a NZ red meat cooperative, coupled with the rapid decline in the national ewe flock, and an absence of farmer drive for such to be established, sadly, the horse has bolted on Alliance.

I can agree with most of what you say, but expect that the ability to impose a single desk seller would be constrained by our free trade agreements? That is, your solution maybe has a problem?

When I was trying to make a buck from selling red meat, I was always ticked off by those “procurement benefits “. We can see that they just transferred the coops capital to a few who ingratiated themselves with the buyer. A complete lack of imagination from those shiny arsed managers referred to above.

Would require some very rare intestinal fortitude from our politicians.

No single desk exporter has been established in NZ without dissention amongst the farmers. Political gutsiness was delivered by the government of the day in each case. But Zespri is a model to emulate. The Kiwifruit industry was virtually bankrupt prior into it's establishment.

But my experience in the sheep and beef sector indicates that organising farmers has been and no doubt will continue to be like herding cats.

Cats are much much easier to herd!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.