Kiwibank's annual profit almost halved with the bank's CEO blaming the impact of COVID-19 and a lower interest rate environment.

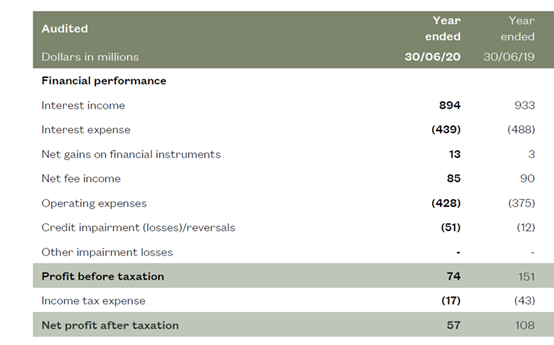

Kiwibank's June year net profit after tax fell $51 million, or 48%, to $57 million from $108 million last year.

The bank booked $51 million in credit impairment provisions, up from $12 million last year, reflecting Kiwibank's current view of the impact of COVID-19.

Operating expenses increased $53 million, or 14%, to $428 million. Kiwibank CEO Steve Jurkovich said technology spending - for mortgage brokers, for its own telephony platforms, on helping to move work around the country, and Kiwibank's cloud computing adoption - was a major factor in the rise in expenses.

Operating income dropped $34 million, or 3%, to $992 million. Kiwibank sold the Prezzy card business to epay New Zealand last November with $12 million recognised from the gain on sale in Kiwibank's annual income.

“As expected, this result reflects the impact of COVID-19 and a lower interest rate environment on the bank,” Jurkovich said.

“Kiwibank continued to grow at a faster rate than the market, with lending growth of 9% and deposit growth of 13% in [financial year] 2020. The market grew at a slower pace of 5% and 9% respectively,” said Jurkovich.

“As a result, we are growing our lending and deposit rates faster than the market to help more New Zealanders into homes, more Kiwis to save, and support more businesses – living up to our purpose of Kiwis making Kiwis better off. Looking ahead, we will continue to play our role in New Zealand’s economic recovery by offering a better banking alternative that’s committed to being fair and easy for Kiwis, the businesses they own, and for future generations,” Jurkovich said .

Against the backdrop of COVID-19, Kiwibank says it has helped customers through a "relief and resilience programme" supporting some 8,000 personal and business banking customers for loans totalling more than $2.6 billion, supporting businesses by moving from paying suppliers on the 20th of the month to paying accounts on a weekly basis, and by taking a market-leading position in the fixed home-loan market and reducing floating home loan rates through a one percentage point drop.

Commerce Commission settlement

Meanwhile, Kiwibank says it has agreed with the Commerce Commission to pay $5.2 million to customers to settle issues relating to home loan variation policies, procedures, and systems prior to April 2019.

Kiwibank is owned by NZ Post, the NZ Super Fund and the ACC. They received $17 million in annual ordinary dividends, down from $25 million last year. In April the Reserve Bank blocked banks from paying dividends until the period of economic uncertainty caused by COVID-19 passes.

As of June 30 Kiwibank's common equity tier one capital ratio, expressed as a percentage of risk weighted loan exposures, was 11.4%. That's down from 12.4% a year earlier, but comfortably above the Reserve Bank mandated minimum of 7%. In the 12 months to June 30 Kiwibank's gross lending grew $1.825 billion, or 9%, to $22.308 billion. Deposits grew $2.357 billion, or 13%, to $20.597 billion. Total assets rose $2.776 billion, or 12%, to $25.510 billion.

19 Comments

Lower interest rates mean banks make less money

So, they close branches and more people are unemployed and fewer people can see a person in a bank, instead of being online. More tech, less human contact. Less "society". Multiply that by 1000s across industries. This is "progress"?

In truth, the Bank Manager that knew you; your business and the market you operate in died decades back.

"Bank Loyalty' is non-existent today, when business and personal reputation built up over many years is reduced to filling out the required lines on the appropriate form that gets sent into Head Office/Input on Line and the answer to any question is determined by a computer programme.

Bankers aren't bankers today. They are form fillers at the bottom and trough feeders at the top.

Bankers aren't bankers today. They are form fillers at the bottom and trough feeders at the top.

Yes, the 'foot soldiers' are being phased out. Their role is basically cross selling and pushing debt. I have colleagues near the peak of the banking food chain. It's been financially rewarding, but ultimately soul destroying for them (based on my discusssions with them).

Lots of businesses are investing in technology to remove human wages, because wages are all driven by the crazy rents and housing costs. The arrival of better and better robotics will make this even worse. Progress indeed.

Has kiwibank done this? why are their operating costs up so much?

Might be because they were trying to increase their high street presence instead of being that small little bank that's hidden away as post of the Post Office. "Kiwibank is bolstering its presence in Auckland with new corporate premises at 155 Fanshawe Street, in the Wynyard Quarter."

https://www.kiwibank.co.nz/about-us/news-and-updates/media-releases/201…

The future of banking will be faceless - your mortgage application will be decided by a robot that will take into account your skin colour. It’s called racial profiling.

Tradersam, the first part of your comment is already happening, the second part is just bs. We don't need race wars in this country.

Also, how do you think a computer will know your skin colour?

Actually Tradersam is right on both counts. AI systems can only work on the data their provided which more often has bias data (Surnames, areas in which the applicant lives etc..) that will effect the out come.

Oh and by the way, even mundane tech gadgets can have skin colour bias. Example automated soap dispenser - quite often these won't work for darker skinned people because the sensor has only been set to pick up lighter skin tones. Hopefully that has only occurred due to dumb ass programmer oversight.

“As a result, we are growing our lending and deposit rates faster than the market to help more New Zealanders into homes, more Kiwis to save, and support more businesses – living up to our purpose of Kiwis making Kiwis better off." The irony,the slump in profits occurred by helping more Kiwis .Whats the current Kiwibank deposit rate?

Exactly Cowpat, it reads like they had been cranking up mortgage lending (helping kiwis) and then had a lot of poor performing loans.

More risk, more profit, although in this case less profit!

Didn't they also piss away a fortune on their dated IT system?

They lost a lot of money on trying to put in SAP.

(Send Another Payment)

If only they had backed some crystal beds. I hear there is other peoples money to had in the 5th dimension.

So growth up but profits down? Maybe they should focus on the profitability of their growth rather than just growth itself. Hell, if all you want to do is grow then lend at 0% and watch the growth. You won't make any money but wow look at how much market share increased.

They are a minor player with a long way to go before their financials affect the banking here.

The results of the majors will show the real effect of low rates, narrowing of spread, profitability etc in this Covid scenario.

Hmmm. Wonder what the Big 4s books will look like once their financial year end is all done after the close of September? I suspect there will be some extra provisioning there too

The thing that strikes me is that they talk about investment (in technology, people, buildings, outlets etc.) but they fail to deliver on top line growth. Without that they are only treading water. Sorry to be 'hard-nosed' about it is not growth no matter how it is spun.

It might be a good acquisition target for the customer base however.

May just become the retail arm of the Reserve Bank?

It is great they are investing in 'technology' but how come they are the only big NZ bank that doesn't support Apple Pay?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.