As interest.co.nz has noted in analysis published for subscribers to our Banking & Finance Daily Newsletter, banks have been filling their boots with mortgages.

Almost +$6.3 bln was added to their mortgage books in the September quarter alone, taking the total home loan book at banks to $287 bln. And that was the largest quarterly dollar rise ever recorded, and the largest relative growth since the 2016 boom.

Readers with good memories will recall that between March and April this year at the start of the nationwide pandemic lockdown, bank mortgage books actually shrank for the first time ever. But that bump has long since passed and we are back to boom times in the home loan market.

The RBNZ releases monthly data on the overall shifts in this market, and quarterly we get visibility via their Dashboard release on the data for individual banks. Our Key Bank Metrics tool is a convenient way to inspect that data yourself and compare banks.

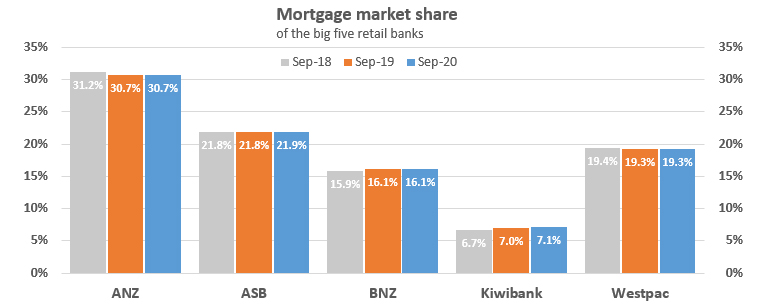

Such comparison allows us to see the market share shifts.

And the news is - there isn't any!

That's right, even as the market booms, most banks are holding their market share. No one bank is really winning, and none are losing share.

This is somewhat surprising.

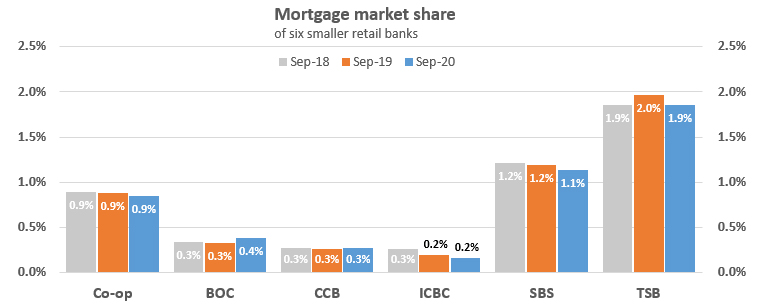

It is even tighter than that. The big banks are also holding their share against the upstart challenger banks.

The grip the big banks have is impressive.

Three years ago they held just under 95.0% of the bank mortgage market, and as at September 2020, they hold just under 95.1%. It is a trivial shift.

And it shows just how hard it is for the challenger banks to gain on the majors. It is not as though they aren't trying; they are, and hard.

And that is because the home loan market is the only sector of the overall loan market that is growing.

Lending to consumers by banks is shrinking, mainly because BuyNow/PayLater firms are eating their lunch in the credit card market.

Demand for lending from businesses is evaporating - partly because the Government has undermined the SME market with its own zero interest, "pay me back if you like" model. And large corporates are shifting to the bond market where direct investors are tolerating very low interest rates.

And lending to agriculture isn't flash either, with bank appetites for risk here - especially for dairy lending - on the wane and under the watchful eye of regulators.

The only section of the loan market with any growth is for housing. And the RBNZ gives this sector some special boosts - it says banks can hold far less capital to support housing loans, and it is about to release its Funding for Lending program that will allow banks to borrow liberally at the OCR rate. With a cost of funds of only 0.25%, banks can maintain their Net Interest Margins (which are running at about 1.85%) and still potentially chop their fixed interest rates to about 2.1% from the current average 2.6% without any pain or cost. All as as result of RBNZ policy settings and programs.

And lower interest rates improve serviceability of loans, and allow buyers to bid up asset prices. (Just a pity about first home buyers and their inability to save up the necessary deposit. But even so, the level of FHB demand is actually higher than you might otherwise conclude.)

Yes, banks have been filling their boots, and are about to boost that even further, it seems.

But the odd thing is, everyone is only just "getting their share" - there is are no winners or losers among the banks competing for this share.

Home loans are now a commodity, and the key feature for most borrowers is the "price", the interest rate. It seems when we see a low rate, we ask our existing bank to match it, and generally they do. When 'price' is taken off the table, it is just convienent to roll over the existing relationship unchanged. That is happening across the whole market. It does make you wonder why you would actually need a third party (a broker) to help with the rollover negotiation. Ask for the lowest price from any major bank, get it, re-sign.

Home loan competition is really non-existant in this cheap, commoditised, homogenous market with few distinctions.

It is such a large market, it has turned our so-called "trading banks" into "mortgage banks". All of them have a majority of their loan books in home loans.

| As at September 2020 | Total loans $ mln |

Housing loans $ mln |

Home loan proportion % |

| ANZ | 133,710.8 | 87,488.4 | 65.4% |

| ASB | 92,675.0 | 62,236.1 | 67.2% |

| BNZ | 88,369.4 | 45,849.6 | 51.9% |

| Kiwibank | 22,990.2 | 20,151.6 | 87.7% |

| Westpac | 88,254.5 | 54,889.5 | 62.2% |

| Big Five | $426,000 | $270,615 | 63.5% |

| Bank of Baroda | 104.1 | 65.5 | 62.9% |

| Bank of China | 2,101.8 | 1,093.5 | 52.0% |

| Bank of India | 78.5 | 45.0 | 57.3% |

| China Construction Bank | 1,631.1 | 777.8 | 47.7% |

| Cooperative Bank | 2,588.4 | 2,424.9 | 93.7% |

| Heartland | 3,693.8 | 586.1 | 15.9% |

| ICBC | 1,628.4 | 451.5 | 27.7% |

| Rabobank | 11,529.4 | 25.5 | 0.2% |

| SBS Bank | 4,117.2 | 3,228.0 | 78.4% |

| TSB | 6,175.9 | 5,269.2 | 85.3% |

| Challengers | $33,649 | $13,967 | 41.5% |

| All these Banks | $459,649 | $284,582 | 61.9% |

And among the main banks, there has been virtually no market share shift in the past three years.

Among the challenger banks, who are left the about 5% of this market as crumbs, it is very tough indeed.

Perhaps the Funding for Lending program which is due to roll our early in December, will allow these minnows to offer a price incentive that will separate away some significant share from the majors. But don't count on the majors allowing that. Their whole existance depends on holding on to their home loan book.

35 Comments

Orrsum - that's interesting, tbh never heard of Mandurah. A quick Google search brought up an article stating that Mandurah had the largest fall in house prices in Australia, dropping 2.2 per cent in the March to May. How would you feel about potentially loosing equity if you bought there? https://www.perthnow.com.au/business/property/perth-real-estate-mandura…

Doesn't really matter once you are in a house and buying/selling in the same area. Never heard that long term owners of houses don't really care about their house price because if they wanted to sell up and buy another, they would be "buying in the same market". Works the same if prices are falling rather than increasing.

The only difference is that Orrsum will actually be able to afford their own house, whereas in NZ, that's pretty much out of the question now for most young people without outside help.

If I was still young and unattached, no way I would still be in NZ (as an IT worker).

It matters when you see houses as a commodity and investment. The problem with that mentality being, hoses shouldn't be viewed as either. Housings is a universal basic need, there is no negotiating on that. I don't understand how Kiwis can scoff at the US's runway healthcare costs; and not realise runaway house prices are just as bad, if not worse, in terms of their social equity issues and disenfranchisement of basic rights.

I'd do my sums first bud. 11% fall in house prices since 2016, median wage <1000AU/week, rent >300AU - sounds like the big days have left with all the LNG projects finished now

https://www.watoday.com.au/national/western-australia/mandurah-perth-s-…

Granted that's a year old article but where there's smoke there's a fire

I've got mates who moved to Perth 4 years ago, bought a house as they felt priced out of Sydney although with good jobs could've probably bought in Sydney but back then felt prices were too much (around $1M for houses or around $600k for units). I'm sure they regret that in hindsight but hindsight is a beautiful thing.

Since then year after year their Perth place goes down in value meaning they'll struggle to move back to NSW which is what they wanted to do eventually.

Can you imagine how depressing it would be to see your hundreds of thousands home losing hundreds of thousands in value. It is soul destroying for them.

The mental health and subsequent social problems stemming from the psychology of losing so much money or not being able to buy in the first place are devastating. Like the meth problem referenced in Martin Norths video about Mandurah. These social problems take years if ever to sort out.

That's why I'd never live in a Kiwi small town where many have extreme drug problems and high unemployment. Levin springs to mind. Also Taumaranui, Opotiki, Waihi, Timaru and a whole host of others. Bigger towns have drug use but they have more employment opportunities.

It's the social problems caused by housing costs, renting or owning, both are expensive which are to blame for a lot of mental health issues in my opinion.

Likely done your research, something more if it helps - some see it as a bellwether, ymmv.

https://digitalfinanceanalytics.com/blog/tag/mandurah

Mandurah has dropped nearly 40% since the 2006 Boom. A lot of rich miners had holiday homes there which tells me it was a nice place. They had to sell after the mining boom was over. Prices have dropped just over 2% lately after a pandemic which tells me that the market is in the realm of normality. That gives me confidence. The 40%+ rise in Gisborne is a bad joke and is very risky. I will be mortgage free in a nicer home than I can afford in Gisborne. I have more job opportunities. There has been a problem with crime in Mandurah lately but it is no where near as bad as in Gisborne with all these 501 clowns running round thinking they own the place. It is for my mental health that I am leaving, what has happened with houses since I got back here has been so demoralizing. I will have security. It simply makes sense. If prices do drop more, then I will have a home which is ALL I WANT. It should not be too much to ask for?

Fair enough. I agree that with $300k, in a decent NZ town, one should be in a strong position to buy a property close to mortgage free. Even in a city such as Auckland one should be in a way stronger position with such a deposit. Its a joke that with that deposit you'd still have a mortgage of $700k+ in Auckland.

Land of opportunity - to be shafted you mean? Just look at the prices in the real world. This is where I am moving to with my $300k. Seriously, only a mug would stay here and allow themselves to be humiliated and degraded by these greed merchants. If you are capable, young or poor, do yourself a favour and abandon this ship. Just like the Titanic, the ones on the top deck despised the steerage passengers and did not care if they drowned. They let themselves into the lifeboats and did not let others join them, even though there were free spaces. Mr Orr is the man handing out those lifeboat places and he has already chosen the winners and its not us. https://m.realestate.com.au/buy/between-150000-300000-in-mandurah,+wa+6…

Caught up with an old friend in Auckland a few months back. Got divorced. Owned two properties. Selling both - made a million dollars on each of them after 15 years of ownership. So walks away with a million dollars. Each house has earned more than their respective wages over those years - no joke...

Our housing market is kaput

Don't give up on voting, one thing we hoped for when we changed the voting system was a large set of small parties keeping the same/same big two honest.

Media over many elections have suggested that small party vote is wasted - that is the line from the big two, very naively surprising that it still gets traction.

Vote minor always.

In regards to the RBNZ and govt policy - the answers lie back in time, the Muppet Show was much funnier back in the 80's.

Everyone is doing the same thing and getting about the same results.

The future of finance is likely to be more specialised service providers that can obtain a great depth of knowledge in market subsegments and so earn a higher average return by operating in that subsegment. It makes no sense that a bank that can make fantastic returns in one area (e.g. financing machine tools) would want to provide finance in an area where it cannot generate excellent margins (e.g. residential mortgage lending.) You can already see a huge amount of industry consolidation with banks selling or closing niche segments to get back to where they can really earn excellent returns.

There are just too many banks in retail mortgages for anyone to earn a decent margin.

There are other options...for investment.....A mere bagatell, but as you can see, cheap as chips...Green with envy.

Shop till ya drop..Arcadia..here we come..Black Friday.

https://www.dailymail.co.uk/news/article-8992973/Sir-Philip-Greens-TopS…

An interesting article by Bernard Hickey re: housing

https://www.stuff.co.nz/business/opinion-analysis/300168640/heres-why-y…

5. Gradually increase the capital requirements for bank lending to landlords to the point where landlords are only able to buy for cash. Cash-buying landlords already buy 13 per cent of all the properties transacted.

david...

Would u be interested in doing a piece on the possible vulnerability of the NZ real estate mkt. ?

I would direct u to both Richard Vague and Steve keen ..(who agrees with Richards ideas.)

https://debteconomics.org/index.php

https://www.amazon.com/Another-Financial-Crisis-Future-Capitalism/dp/15….

Basically.... when private sector debt/GDp ratio gets past about 150% ( (its 170% in NZ ) AND ..the growth in that debt/income ratio grows by 18% over a 5yr period...THEN a country is vulnerable to a financial crisis.

A country is especially vulnerable if the growth in the debt is in the Real Estate sector.

Back in 2013- 2016 the RBNZ mitigated things with its LVR restrictions. Its all been undone now by the current responses to the Covid induced ( lockdown) contraction in our GDP.. ie.. ultra low interest rates and money printing.

In NZ ...the planets are slowly lining up

In a few yrs we might have these aggregate debt/income ratios at the extremes (we already do ), we could have an over supply of housing and we could have Govt implementing some kind of Capital/wealth tax ( classically... just at the wrong moment ).

In a few yrs... ( before 2026..?? ) we could have all the ingredients for a possible real estate crash ( up to 30% fall..?? ) that would spill into a larger financial crisis.

Note that this has nothing to do with CPI inflation , and is mostly a debt growth thing..

I'm sure u would get alot hits ..writing a piece on this..!! ( maybe an interview with Richard.?? )

cheers

The small banks are simply not price competitive. Also the total amount they will lend us usually 10-15% less than the majors.

I’ve tried to place borrowing with the challengers before, they often don’t even respond. The one time I got any traction to place borrowing with them they wouldn’t match the rates on offer by kiwibank. It is like they just don’t want market share

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.