Kiwibank has reported an 8% rise in after-tax profit to $55 million for the six months to December.

Chief executive Steve Jurkovich said growth in both home loans and business lending contributed, with customer lending growth of $1.6 billion, while customer deposits grew by $1.3 billion.

He said the bank had forecast "a significant rise in mortgage and business banking loan defaults", due to Covid, but numbers remain very low "largely thanks to the hard mahi of all New Zealanders to contain the virus and keep our economy moving."

The bank is, however, signalling the closure of seven branches.

Jurkovich said as Kiwibank "delivers better customer experiences and outcomes, it needed to plan for the increase in customers who want to operate in a digital world while also addressing the significant decline in the number of people visiting branches".

“COVID-19 has only seen a further acceleration of this trend. The average customer visits a branch one to two times a year and uses online, mobile or phone banking at least five times a week.”

Jurkovich said changing customer preference and operational matters such as lease reviews had resulted in a proposal to close seven branches over the next 12 months. Visits to some branches had more than halved over the past five years.

The impacted branches are in Balclutha, Gisborne, The Palms (Christchurch), Matamata, Onehunga, Waihi, and Waipukurau. The proposal is subject to consultation with branch teams and engagement with local communities.

“We appreciate the proposed changes can create uncertainty for our people, our customers, and communities and that’s why there is a period of time so we can make fully informed decisions."

This is the release Kiwibank put out:

Kiwibank today announced a solid half year result for the six months to 31 December 2020 as it continued to focus on delivering better outcomes for customers.

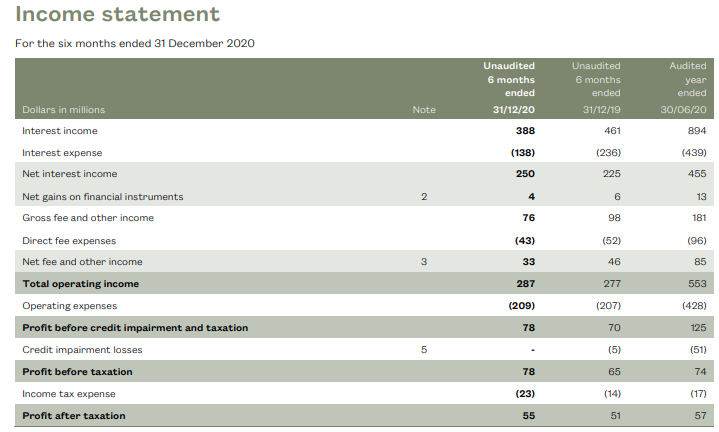

The bank recorded a net profit after tax of $55 million, up $4 million (8%) on the prior corresponding period (six months to December 2019) while operating income was up $10 million (4%) to $287 million.

Chief Executive Steve Jurkovich said growth in both home loans and business lending contributed to the result, with customer lending growth of $1.6 billion. Customer deposits also grew by $1.3 billion.

“Our purpose, Kiwi making Kiwi better off, is what drives us every day, and by putting this at the heart of everything we do we’ll be a better bank for our customers and Aotearoa,” said Mr Jurkovich.

“Everyone who works at Kiwibank knows that we have to be focused on our customers every day because they have choices. Our goal is to be customers’ first choice.”

Mr Jurkovich said the bank had made significant improvements during the first half.

“We opened a new expert lending hub at 155 Fanshawe Street Auckland, and we introduced Fast Capital in partnership with the FinTech company Ranqx, a solution that allows decisions in a few minutes on borrowing for businesses.

“Customers are also benefiting from improved processes resulting in shorter turn arounds for home lending decisions, a reduction in call-wait times despite a huge uplift in volume due to COVID-19, and we’ve also introduced a digital ID solution for new credit card applications.

“We’re investing in technology and in the capability of our teams, while continuing to closely monitor where, when, and how our customers are choosing to interact with us, which informs the decisions we make,” he said.

COVID-19 update

Mr Jurkovich said the recent community cases of COVID-19 in New Zealand and subsequent alert level changes were a timely reminder of the considerable uncertainty facing the short and medium-term outlook for the global and domestic economies.

“We had forecast a significant rise in mortgage and business banking loan defaults, but numbers remain very low largely thanks to the hard mahi of all New Zealanders to contain the virus and keep our economy moving. We remain prepared to assist our customers and support New Zealand’s recovery,” he said.

An example of a meaningful show of support was the decision to lead the market with a significant change to the New Zealand owned bank’s floating or variable interest rate by 1% (100bps) in June 2020.

“This change provided an opportunity for both our business and retail customers to pay back their loans faster, save, or buy local and support New Zealand’s economy. We like the rest of Aotearoa are still waiting for the largest banks to respond to this challenge to lower floating or variable interest rates despite a very low interest rate environment and access to Reserve Bank funding.”

Responding to changing customer preferences

Mr Jurkovich said as Kiwibank delivers better customer experiences and outcomes, it needed to plan for the increase in customers who want to operate in a digital world while also addressing the significant decline in the number of people visiting branches.

“COVID-19 has only seen a further acceleration of this trend. The average customer visits a branch one to two times a year and uses online, mobile or phone banking at least five times a week.”

Mr Jurkovich said changing customer preference and operational matters such as lease reviews had resulted in a proposal to close seven branches over the next 12 months. Visits to some branches had more than halved over the past five years.

The impacted branches are in Balclutha, Gisborne, The Palms (Christchurch), Matamata, Onehunga, Waihi, and Waipukurau. The proposal is subject to consultation with branch teams and engagement with local communities.

“We appreciate the proposed changes can create uncertainty for our people, our customers, and communities and that’s why there is a period of time so we can make fully informed decisions.

“We continue to offer all customers support to understand and use faster, safer and cheaper methods of banking, including telephone banking, mobile and internet banking, direct debits and guidance on how to set up automatic payments,” he said.

3 Comments

Mr Orr on the wires this morning not wanting to se a deflationary spiral .Australasian banking sector and share prices in fine fettle

Note 5 is very interesting. It looks like their impairment on mortgages is negligible but on business lending they are expecting to take a real kicking by comparison!

Looking at 2019s releases they are still sinking circa $50m+ a year into something they previously, and mysteriously, described as modernisation. What are they building, a death star to defeat their banking rivals or a Shangri-la for their customers? I'd be interested to see what they are doing.

something akin to the acronym for sucks all profits

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.