New Zealand banks have milked low interest rates over the past 17 months, greatly boosting their home lending and profits, but higher interest rates are also likely to be good for banks. Credit ratings agency Fitch says expected Reserve Bank (RBNZ) Official Cash Rate hikes will probably be credit positive for New Zealand banks, and good for their profitability.

"We expect the RBNZ to begin raising interest rates at its meeting on 18 August. Higher rates may be positive for banks' profitability and earnings due to increased returns on bank assets, particularly loans. Rate increases would likely reduce the compression of net interest margins that tends to be seen at ultra-low interest rates," Fitch says.

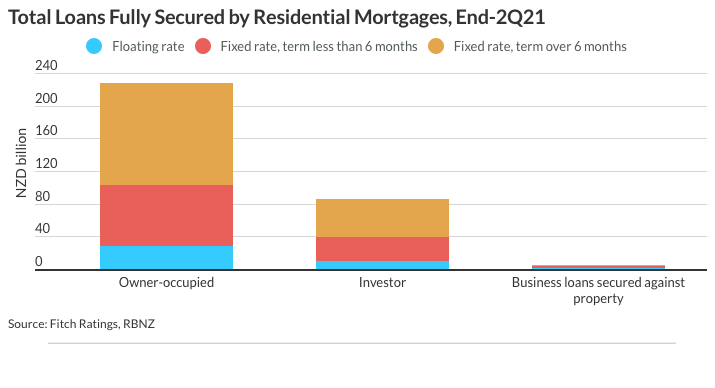

However, Fitch suggests the positive earnings impact for banks from any rate hikes may take time to flow through because the vast majority of New Zealand residential mortgages are on fixed-term interest rates.

"Banks have already started raising mortgage rates in anticipation of future rate hikes. However, more than half of banks' mortgage customers have fixed-rate terms of more than six months," says Fitch.

"Rate hikes could encourage banks to increase traditional lending and reduce liquid asset holdings, though the higher cost of borrowing will also affect demand for credit. We expect credit growth to remain strong in the next year, largely driven by residential mortgage issuance. However, growth in mortgage lending is set to decelerate modestly against a background of higher rates and tighter regulations on mortgage lending, through further loan-to-value ratio (LVR) restrictions and possible debt-to-income curbs. In other sectors, we believe business lending may pick up as strong economic conditions encourage more borrowing for investment."

"If banks are able to raise lending and returns on interest-earning assets, the positive effect on profitability will be partly offset by higher funding costs. Banks' on-call deposits have grown considerably over the last 12 months due to strong liquidity support provided by the RBNZ as well as a shift from term deposits to on-call accounts. However, we expect deposit growth to moderate as the RBNZ continues to unwind its monetary stimulus. This will encourage banks to rely more on wholesale funding, which is more expensive than on-call deposits. We believe the degree of reliance on wholesale funding will gradually return to pre-pandemic levels over the next two years," says Fitch.

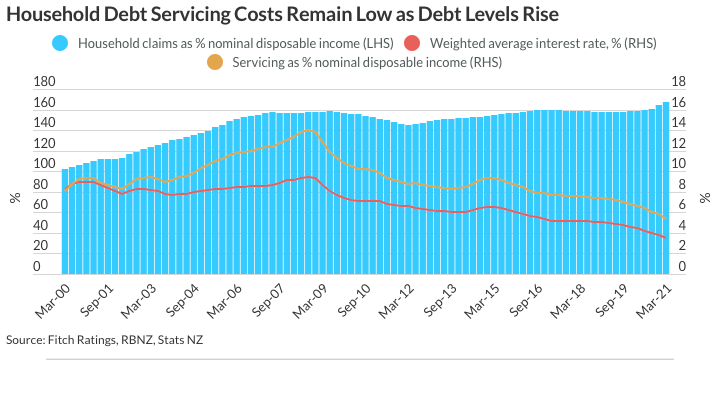

Fitch sees risk higher interest rates could have adverse effects for asset prices in NZ, particularly for house prices, which increased significantly over 2020 and the first-half of 2021 because household debt is high relative to nominal disposable incomes, at 167% in March, and low interest rates have kept debt servicing costs manageable.

"Rising interest rates may weigh on borrowers’ ability to service loans. This, combined with tighter mortgage lending restrictions, could lead to slower growth or declines in house prices over the next two years. However, the fact that the robust economic outlook and tightening labour market are factors likely to drive rates higher should support borrower servicing capacity and limit the risk of a significant deterioration in asset quality," says Fitch.

3 Comments

In respect of the graph depicting Total Loans Secured by Residential Mortgages End - 2Q21, it must be noted:

Remove the bank right to place a lien on residential property when a signed mortgage agreement is purchased for said collateral and most of the asset price dislocations we witness would be extinguished.

Banks never champion a cause if it doesn't benefit them.

The lemmings that bought their story will be surprised how an uptick in rates also pushes up inflation for them.

The House (Banks in this case) always wins.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.