By Mark Brown*

- Markets have aggressively baked in a sequence of interest rate rises as central banks shift to tackling inflation

- These rate rises are now front-loaded and may come quicker than expected

- This may pose risks for economic activity and continued market volatility. However, markets are not signalling a recession is likely

- After an initial flurry of rate rises, we expect a pause and more patience to judge the impact on activity and inflation

Over the last few weeks, the abrupt shift in policy signals from key central banks has shaken markets into a more volatile existence and raised questions about the global economy’s ability to withstand higher interest rates. A common question has been whether the US Federal Reserve and others might overreact to surging inflation and trigger a recession in 2023. So far, the bond market is saying no, but there are some interesting messages in yield curves, both in New Zealand and offshore. Central banks are being forced into action by more persistent signals of higher inflation, and also the need to remove emergency policy settings. The ensuing hikes in interest rates and reduction in liquidity will pose challenges for economies and markets until such time as the path of monetary tightening becomes clear, and the market believes inflation risks are addressed. With recent policy announcements and market adjustments you could argue that we are already significantly down that road.

The bond market provides strong messaging for the expected path of interest rates. Yield curves around the world get a lot of attention from investors and interpreting them has been made more challenging over recent years, with the advent of very large quantitative easing (QE) programmes. But right now, there are some clear signals embedded in yield curves and some interesting interpretations that we may infer.

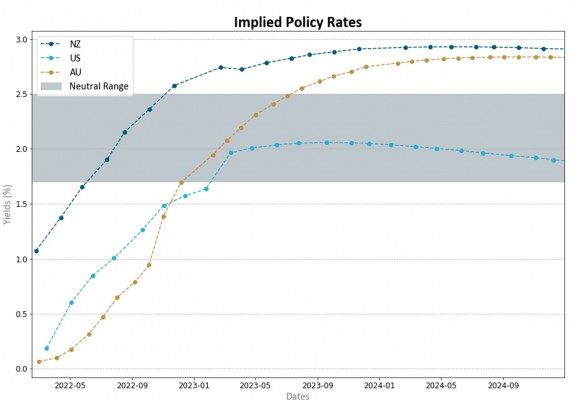

- An imminent and fairly rapid pathway of rate hikes is being anticipated in many regions. This includes not only New Zealand and the United States, where signalling has been forthcoming, but also in Australia and the Eurozone, where markets price rate hikes this year despite the Reserve Bank of Australia (RBA) and European Central Bank (ECB) giving the skimpiest of acknowledgement that a change is afoot.

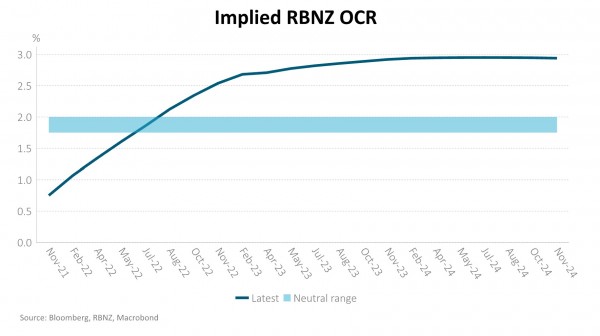

- In these markets, the rapid rate hikes are only assuming official interest rates head somewhere near or below ‘neutral’ policy settings, which are in the 2.0% to 2.5% zone. Rate hikes thereafter are modest at best. In other words, central banks may get to neutral, with little or no subsequent hikes. New Zealand is the most hawkish-looking market, with an OCR rate of 2.95% priced in, relative to a neutral estimate of 1.75% - 2.0%. Conversely, the Eurozone market has cash rates lifting from -0.5% now to zero this December.

Chart 1: Market-based expectations for the NZ Official Cash Rate exceed ‘neutral’ settings from late 2022.

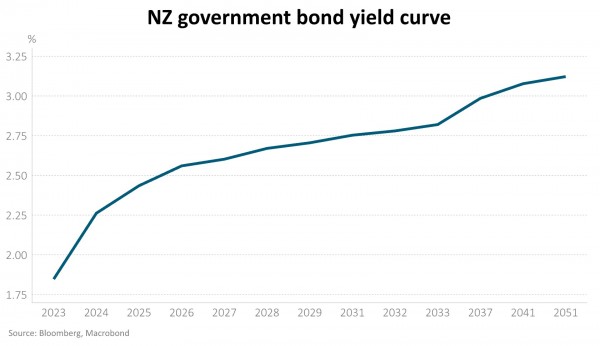

- We do not yet have negatively sloped yield curves; a recession is not being signalled. Negatively sloped yield curves occur when longer-term bond yields fall below short-term interest rates, effectively assuming a need for rate cuts in the future. However, there are some caveats here. Firstly, the QE programmes across the world are being wound back. Previous efforts to assess the impact of QE estimated that US 10-year bond yields would be 0.8% higher without QE. The unwind of QE theoretically pushes bond yields up by a similar amount. The removal of QE may obscure the signal from the bond market with regards to implied recession probabilities. Secondly, cash rates have typically been well above zero when yield curves invert into a negative slope. That’s not the case now.

Chart 2: The New Zealand Government Stock yield curve is positively sloped

So, what happens next?

Our view is that central banks may move fairly quickly away from extremely low (or negative) official interest rates towards something near neutral. This step change is largely already priced into yield curves. Arguably in some jurisdictions the pace of implied interest rate rises may be stretched. However, policy makers are expressing concern that inflation expectations are at risk of becoming unanchored with a risk that inflation expectations move to a sustained higher level. Persistently higher inflation is the greatest risk to markets and asset prices.

We know that households, firms and governments around the world have much larger debt positions these days. Higher interest rates will impact on spending more quickly than in prior tightening cycles. That is why central banks have, at this stage, only signalled a move away from very low rates. Moving into actual tight monetary conditions may not be a necessity. Central banks may want some time to see what the first round of rate hikes does to activity and the inflation outlook. Accordingly, we expect a much slower pace of rate hikes as time progresses. The mantra will be all about data dependency. That is appropriate. And, as described above, that is what yield curves are also saying right now. Equity markets too, arguably have this expectation captured (for further discussion, see Uncertainty around hawkish central banks has led to volatility, 1 February 2022)

Economists already expect growth rates and inflation to decline as the year progresses. In New Zealand, the market is quite aggressive in pricing in an Official Cash Rate of 2.75% by Feb 2023. We think it will be a stretch to reach this level so quickly. However, it will all come down to inflation and we won’t really know the answer to that question for some time. If a shift to neutral policy settings is not sufficient to control inflation, additional hikes in interest rates become more likely and that would likely bring more volatility to markets. We may even get an inverted yield curve at some stage.

*Mark Brown is a Director and Head of Fixed Income at Harbour Asset Management. This article was first published here, where you can also see Harbour's disclaimer, and is used with permission.

6 Comments

The bond yield curve is indeed interesting, as is the overall positioning of that curve. And from that, inferences that can be drawn as to what the market thinks will happen with interest rates. But any further inferences in relation to the likelihood of a recession or level of longer term growth rates of the economy are highly problematic. My own interpretation is that the bond markets do not see strong long-term economic growth rates.

KeithW

The massive eurodollar futures market confirms the same: Major Euro$ Curve Developments (also not clickbait)

keith,

"My own interpretation is that the bond markets do not see strong long-term economic growth rates". indeed and why would they.

I am looking at a World Bank graph which shows a declining global growth rate since 1960. It is not linear of course, but the long-term trend is clear.. There was strong growth from 1960-73 with a compound rare of 5.33%pa, while it was some 2.07%pa between 2007-2017.

Correlation may not equate to causation but it at least interesting to note a rising trend in fossil fuel prices over the same period.

Everytime the bond market gets it wrong, there'll be huge amount of money to be made.

"Credit tightening takes many forms in a complex financial system: withdrawal of subsidised lending, suspension of official purchases of credit instruments, raising of creditworthiness thresholds for borrowers, re-weighting of loan assets for capital adequacy purposes in the regulatory system as well as the nuanced increases in interest rates for different types of borrowers. A typical commentary infers that tighter credit means slower economic growth and lower inflation. This is not necessarily the case. Expect credit tightening to reinforce negative supply shocks in 2022. "

https://economicperspectives.co.uk/2022/01/when-credit-conditions-tight…

ps.. In NZ the vast amount of new credit growth is in Housing.... If this starts contracting fast.... watch out..

I tend to think that the current rate increase cycle will be short lived, With central bank quantitative tightening can do a lot of the work interest rates used to do, and high debt levels, the shaking put of supply chain kinks, technology driven efficiency and productivity gains, and a labour market reorientation to goods rather than services will reduce inflationary pressure sooner than expected. The price of a coffee might go up long term, but not a car or a fridge.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.