By Hamish Pepper & Chris Di Leva*

Investment markets generally have many different factors that drive returns, however occasionally there are very few. 2022 will go down as the latter. Inflation was the dominant theme for 2022, creating an unenviable backdrop for bond markets as central banks raised rates to try and combat rising inflation. Equity market valuations fell sharply adjusting to higher discount rates.

While we pointed out the risk of inflation being more persistent in our risks and opportunities paper last year, we would be the first to admit that the magnitude of the increases was harder to foresee, as was the reaction across markets. Perhaps the scale of the market response reflected the strong consensus view in the market coming into 2022, which was that inflation, as some central banks also put it, was “transitory”. This serves as a good reminder that the greatest risks and opportunities in markets arise from consensus views, which ultimately prove incorrect and spur repricing.

Coming into 2023, the consensus is relatively downbeat. Scanning external research tells us that:

- Year-end equity price targets are flat to falling

- Inflation may take a long time to get back to 2%

- Investors are underweight tech stocks

- The US will have a mild recession in H2 2023

- China’s re-opening will be gradual, and

- Cash interest rates in New Zealand will almost hit 5.5% and remain there for some time.

Relatively bearish market sentiment gives rise to plenty of opportunities, but risks remain.

Here are our top 10 for 2023:

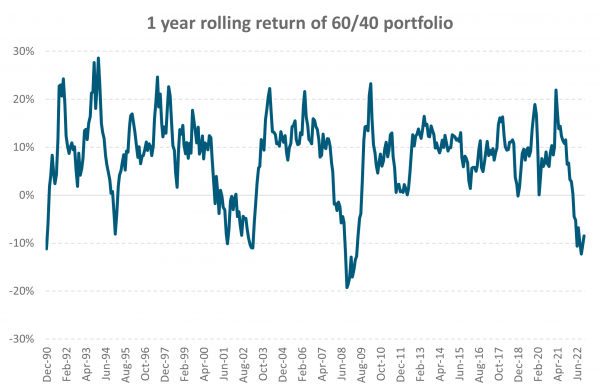

1. A much better backdrop for bond returns

2022 will go down as the worst year since the Global Financial Crisis for the 60% equities/40% bonds “balanced” portfolio. This has led to investors considering alternatives, particularly ones that can offset equity market risk. But just as investors are starting to lose faith in bonds’ role within portfolios, the forward-looking prospects for bonds are the best they have looked for years. The NZ Composite Bond Index currently has a running yield of c. 4.6%, while the Global Aggregate Bond Index yields 4.5% in New Zealand dollar hedged terms, (though it has touched over 5% in recent months). In terms of the Global Index, these recent levels of yield have not been seen since 2009.

We think that with central banks well into their tightening process, supply side inflation moderating, and demand softening, a backdrop is created for stronger bond returns compared to recent years. Importantly, bonds are now at yield levels where they have plenty of room to rally if a non-inflationary macroeconomic shock were to occur.

This more positive outlook for bonds may be tempered by the ongoing constraints of large budget deficits, a large supply of government bonds and growing government debt levels. Government fiscal deficits rose very sharply during the early and mid-stages of the COVID pandemic, leading to rises in public debt levels. The funding of larger debt issuance was essentially covered by central bank bond buying (QE). Now, governments are shifting towards a more frugal approach, but fiscal deficits look likely to remain quite high, partly due to the weaker economic cycle we are experiencing. In addition, central banks are now selling the bonds they had bought previously. QE is being replaced with Quantitative Tightening (QT). In combination, the private sector will be asked to buy considerably more government debt and that will be happening in a financial system with less liquidity chasing assets. Countries with weaker debt positions could come under some pressure and longer-dated government bonds across the world may see investors seeking a greater premium, limiting the scope for bond yields to decline as headline inflation falls back from peak levels.

Source: Harbour, Bloomberg. 60/40 portfolio is a composite of: 40% MSCI ACWI Net Index (50% hedged),

20% S&P/NZX 50 Index, 20% Bloomberg NZBond 0+ Yr Index, 20% Bloomberg Global-Aggregate Bond Index (hedged to NZD).

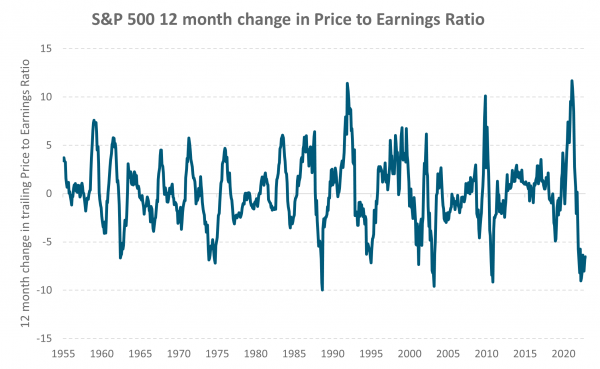

2. From valuation risk to earnings risk

Over the longer term, the key driver of a company’s share price performance will be their ability to grow earnings. However, over the shorter term, earnings announcements news can be swamped by other factors such as valuations. 2022 was one of those years. The sharp increase in interest rate expectations gave rise to one the largest multiple contractions in modern history, though not one of the largest sell-offs due to earnings holding relatively firm. We expect share price performance in 2023 to be much more driven by earnings and, in our view, this could have significant implications for style and sector performance.

2022 has been a boon year for the more defensive utilities and healthcare sectors and a tougher one for longer duration stocks such as information technology, consumer discretionary and broader growth stocks. This is not lost on valuations nor positioning, which shows investors are largely underweight growth equity sectors and overweight defensives, as consensus market expectations seem to be that the global economy will fall into recession some time in 2023. With bottom-up consensus expectations compiled by Bloomberg at 8.3% earnings growth in the US and 8.7% in New Zealand, analyst expectations are yet to catch up to the deteriorating top-down view.

Source: Bloomberg, Harbour

3. New energy beats old energy

Europe has done well to avoid an energy crisis this northern hemisphere winter given the dramatic reduction in gas supply from Russia as it seeks to counter western sanctions associated with its invasion of Ukraine. Europe has successfully found alternative supply, and demand for gas has been reduced due to rationing and a warmer winter than normal (so far). While it looks likely that Europe will enter next winter with ample inventory, there are several risks that include a drop in temperature or a pick-up in global demand for gas as China reopens.

Europe’s efforts to increase their energy sovereignty has seen huge investment in renewables. On top on this, it has seen households reconsider their reliance on the grid. One way we can measure this is through tracking installations of rooftop solar. For example, Enphase Energy recently reported a 70% quarter-on-quarter increase in solar sales to Europe. Add in the US’s Inflation Reduction Act, which energy consultancy Wood Mackenzie estimates will increase total spending on renewables to US$1.2 trillion by 2035, and the future looks bright for new energy over old energy.

4. Geopolitical risks and opportunities: US increases sanctions on China, social pressures deliver positive change in autocracies

The ongoing US-China trade war has intensified in recent months after the US announced sanctions targeting China’s use of semi-conductors within its manufacturing process. China’s increasingly assertive stance towards “re-unification” with Taiwan and greater US desire to keep US technology out of Chinese military systems may lead to an expansion of some sanctions in 2023 and a further deterioration in the US-China trading relationship. As 2022 has proved once again, sanctions are often inflationary, and history tells us they often stick around for longer than the conflict itself. We have also observed that, through time, equity risk premia have exhibited a strong correlation to geopolitical uncertainty. So, to somewhat state the obvious, these would be unwelcome developments for equity markets.

There is geopolitical opportunity, however, if ongoing social pressure delivers positive change in autocracies. Protests in China, Iran and, to a degree, in Russia have been widely covered in the western press, while in each of these countries state-controlled media has worked hard to downplay underlying dissatisfaction. It is conceivable that as pressures mount gradual change may deliver better outcomes for the supply-side of economies. At the most positive end of the scale, in Russia, dissatisfaction with the war in Ukraine seems to be gradually increasing. A resolution of the war could provide a significant change in the energy and food sectors. Equally, tensions in the geopolitical arena could just as easily deteriorate and investors will need to be attuned to points of tension.

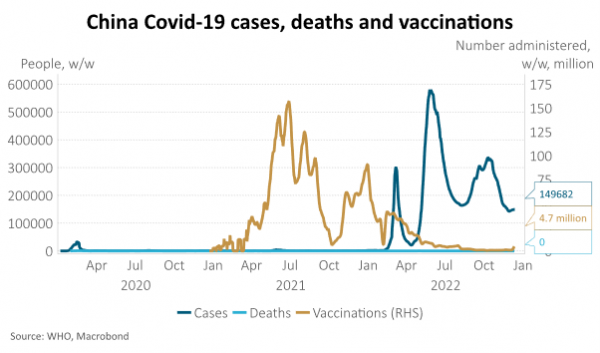

5. China fully re-opens

Until recently, most analysts had expected a very slow removal of COVID-19 restrictions in China, such that 2023 economic growth would be better than this year but not impressive. Recent policy announcements, however, suggest increased appetite to re-open more quickly. It also appears that the Chinese SINOVAC vaccine may be more effective than previously thought in protection against severe illness or death.

However, full re-opening of the Chinese economy likely requires a greater vaccination rate of the elderly and vulnerable. Should this happen quickly, economic growth next year could be as much as 6%, concentrated in H2, rather than the 4.5% expected prior to the recent announcements. This has important implications for both the health of the world economy next year (with China making up roughly 20% of global GDP), and New Zealand’s economic prospects (as China is our largest trading partner, taking about one third of all exports).

6. The global economy enters recession

Most economists expect a period of below-potential global economic growth next year rather than recession. In numbers, this equates to 2% growth in 2023, versus a long-term average of 3.5%. The view of some growth, rather than a recession, rests on an assumption that household balance sheets are strong and labour markets will remain tight enough to provide ongoing income growth as a partial offset to the negative impact of higher interest rates.

The risk, however, is that just as the reopening impulse fades in economies like the US, tight monetary policy bites much harder than expected and pushes the global economy into recession. The peak impact of changes in monetary policy occurs after approximately 18 months. Most central banks anticipate further rate hikes, but housing markets already appear to be negatively responding to large increases in mortgage rates. Prices are falling, sales are slowing, affordability is poor and residential investment is likely to decline considerably. Next year a housing and consumer-led recession could be exacerbated by Europe’s delayed energy crisis.

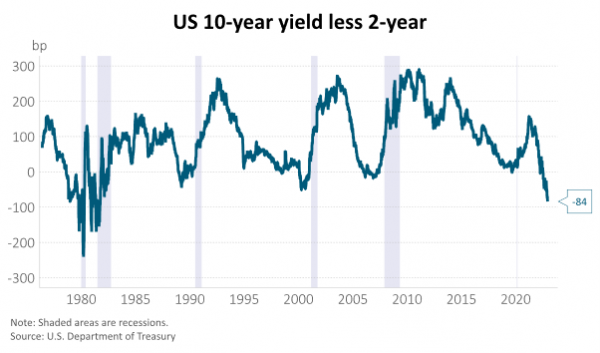

7. The US achieves a soft landing

Financial markets are pricing a high probability of a US recession next year. The US yield curve is the most inverted since the early 1980’s with 10-year yields sitting more than 80bps below 2-year yields. The implied volatility of US Treasuries is 90% of the average level seen in the past four US recessions.

The US Federal Reserve, however, believes a soft landing is possible where inflation returns to 2%, job losses are minimal, and a recession is avoided. Indicators suggest inflation is already heading lower, but the labour market remains the sticking point. There are currently 1.7 job openings for every unemployed person in the US. A soft-landing hinges on the Fed’s ability to calibrate policy that will result in higher interest rates, reducing firms’ profitability and demand for labour to better match supply - but not forcing firms to shed labour.

8. The USD weakens

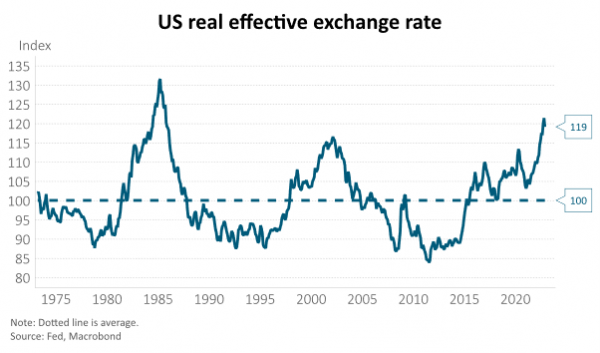

USD strength through 2022 surprised many as the currency overcame concerns about twin current account and fiscal deficits in the context of overvaluation. Instead, the USD was supported by widening interest rate differentials with the rest of the world along with its safe-haven characteristics of high-quality institutions and deep capital markets. For those holding US equities on an unhedged currency basis, this provided a useful partial offset to negative equity returns.

Most analysts expect the USD to strengthen in Q1 and slowly depreciate over the remainder of the year, to be largely unchanged from current levels. The risk, however, is that the cyclical drivers of USD strength give way to concerns about overvaluation in 2023. On a purchasing power parity basis, the USD is overvalued against 9 of the 10 G10 currencies and by as much as 85% in the case of the JPY. On a real trade-weighted basis the USD is almost 20% above its 50-year average.

A weaker USD may help reduce tradable inflation pressures outside the US by making goods denominated in USD cheaper. For emerging markets, where a large amount of debt is USD-denominated, it reduces the local currency size of this, helping to lower the external vulnerability of these countries. For investors outside the US, a weaker USD may reduce US equity returns if these are held without a currency hedge.

A soft landing is far from consensus. Investor positioning appears to be pricing in a US recession. We can observe the low valuations relative to history for cyclical stocks and relative to less cyclical, defensive stocks. Additionally, the more conservative stance towards equities overall is also reflective of the consensus outlook being one where a recession is expected. If a soft landing (while bringing down inflation) is achieved, this would be a significant positive for markets overall and could lead to a re-allocation towards cyclicals and away from defensives.

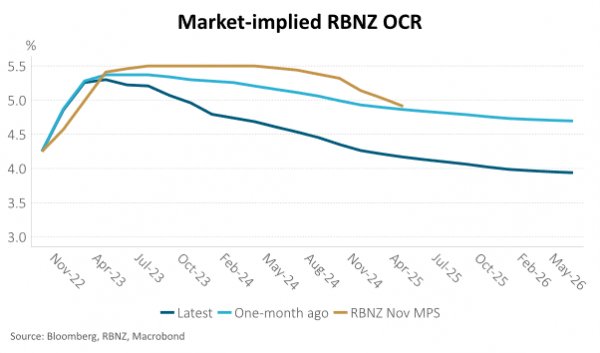

9. The RBNZ keeps policy tight for longer than expected

New Zealand financial markets don’t believe the RBNZ forecasts for the OCR to be above 5% for all of 2023 and 2024. Instead, markets assume after reaching a peak of 5.4% in May next year, broadly in line with the RBNZ forecast peak of 5.5%, that the OCR will be cut more than 100bp by the end of 2025. The risk, however, is that the RBNZ forecasts turn out to be what is required to sufficiently loosen the labour market and return inflation to target – at the expense of economic growth. Core inflation and inflation expectations are sitting well above the top of the RBNZ’s 1-3% inflation target band. The labour market remains tight and average hourly earnings are growing at 8.5% y/y. It is not clear how quickly a pick-up in net migration might help alleviate these pressures.

An alternative scenario is where the monetary policy transmission mechanism works much better than the RBNZ is currently assuming, reducing the need to take the OCR as high as 5.5% and possibly leading to a larger easing cycle than markets currently assume from H2 2023.

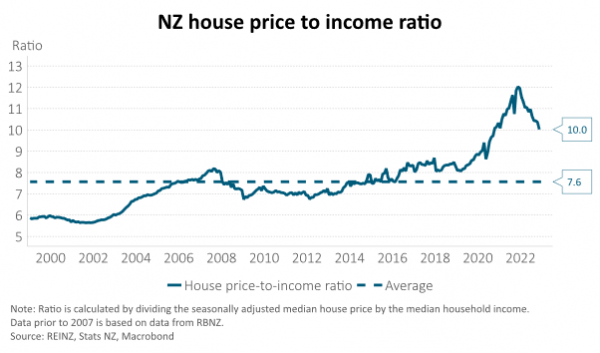

10. House prices decline by more than expected

Most economists (including the RBNZ) expect the peak to trough decline in New Zealand house prices at around 20%. Just over half of that decline has already occurred, as very low rates of population growth, high mortgage rates and ongoing increases in housing supply have overwhelmed the positive influence of a tight labour market. This dynamic is likely to continue through 2023.

Extremely poor affordability, however, suggests downside risks to house prices. House price-to-income ratios and mortgage repayment costs, for example, require a further 30% decline in house prices to return to long-term averages (all else equal).

A larger-than-expected decline in house prices will likely contribute to a larger economic recession next year as the incentive to invest in residential housing is lessened and consumers’ appetite to spend is reduced via a negative housing wealth effect. The RBNZ already anticipates a 1% contraction in economic activity starting from Q2 next year. There is also a more benign scenario for the housing market where house affordability slowly improves via ongoing income growth, reducing the pressure for house prices to fall.

*Hamish Pepper is Fixed Income & Currency Strategist and Chris Di Leva is a Portfolio Manager & Multi Asset Specialist at at Harbour Asset Management. This article first appeared here and is used with permission.

24 Comments

Quite a good, balanced piece. A little too bullish on China though in my opinion.

Globally everyone else has had a rebound as they come out of covid, can see same happening in China.

Yeah eventually, but could take awhile.

Also China has a number of non-covid headwinds.

This is true and china could come out into a global recession, while most of the world did not

I remember a car I used to own, despite being forever on its last legs it always kept running ok. The secret was that when one cylinder stopped, another fired up. Cool car eh

The laws of nature says that the more higher you go, the damage will be more when it falls.

So in last two years everything has gone up against the laws of nature and now the artificial support is gone, so fall will be more damaging. Why are we expecting a soft landing? Is not natural and in my short span of life on this great planet, the one truth i have seen is that nature wins in the end.

Or as The Prophet would say - The Pendulum Always Swings !

A nice article. From a "big picture' perspective it's clear that there are an unusually large number of very significant influences on how things shape up. Predicting is akin to picking the winning horse in 10 sequential races.

The easier picks domestically are that with employment and GDP being surprisingly resilient to date and inflation remaining stubbornly high, the casualty is going to be house prices via OCR manipulation. I believe the market is about halfway through its fall.

I also believe that we will see a dramatic collision of several factors around Q2/3 in 2023. An imminent change in government, a housing crash being declared with a wealth effect in reverse coupled with mortgage re-fixing biting after the lag. This will mean the OCR will be pulled back slightly before the end of 2023.

Yep agree on everything there.

I suspect the recession around mid year will be worse than many expect, but far from catastrophic. For a few sectors, such as residential construction, it will be dire. But some sectors will do OK.

I also think it’s easy to get blasé about the war - it still presents some very significant risks.

Let's look at what the Central Banks know they have to do, and have told us they are in the process of doing - the RBNZ paramount among them.

They are returning the cost of Debt; Interest Rates, to a positive Real state from a grotesquely distorted negative level.

There is no point 'dropping the OCR back', in the case of the RBNZ, or 'Pivoting', in the case of The Fed and all the rest, until that has been achieved.

If the CPI/Inflation rates fall, don't expect any change in interest rates until the OCR is above the CPI. And if the CPI keeps inching up, then don't be surprised to see the OCR start to chase it up in ever-increasing licks.

If we are lucky, and we will have to be, we'll get an OCR +1% higher than the CPI by this time next year. The biggest question is, "What will that CPI print be then?"

100% agree with OCR and CPI relationship. I just have a gut feeling that the CPI data is going to remain high then the elasticity in the system will be lost over a short duration and the CPI will drop rapidly. Before is enters the target range it will be the rate of change that will cause anxiety. This will spark a "stability concern" about an overshoot or hard landing and a little of the OCR will be unwound (2 x 25 bps ish).

I'm not an economist, just an armchair "enthusiast" but that's how I feel it will play out.

Don't really buy into the New Energy beats Old Energy theme on point 3. Too much of a feel good renewable narrative to me. Sure there will be a lot more uptake of solar from wealthy individuals but this is off a low base. The masses will still be on struggle street. Rationing shouldn't be seen as a positive although it is a management tool or natural response. Expect to see a lot more rationing - whether it be imposed on citizens or self imposed due to high energy costs.

This European winter may be warmer, and the wider economy will continue but a huge investment in renewables (solar and wind) over the past many years provides little help to them in true winter conditions which will come at some stage. Energy in Europe and the UK must still be a big concern.

2022 sees record production of coal, oil and gas yet new energy is somehow beating old energy. The consumer is taking a beating from flawed energy policy that see European gas left in the ground and Russian gas purchased.

Flawed climate policies are a huge risk to the global economy - just ask the Ukraine.

"Vitol is being paid £6,000 a megawatt-hour to generate in the UK’s balancing market".

"Electricity prices in Germany were at €280/MWh in early December, almost 300% higher than the €72 in early November, boosted by wind speeds and colder weather. On the political front, Germany announced that it will cap household prices at 40 cents per kWh for 80% of actual consumption. Comparatively, for industrial consumers, electricity will be limited to 13 cents per kilowatt-hour, applied for 70% of the previous year's consumption."

https://tradingeconomics.com/germany/electricity-price

40c/kWh during the worst energy crisis in 50 years does not sound that big a deal

Excellent, well balanced article.

11

nzx listed companies exposed to construction get slaughtered

bremworth,metroglass,fletchers….

some are barely holding on during the good times

Yes there will be a point (maybe mid 2023) when bonds will reach the optimum face/coupon value. Bank Bonds of course will be falling to a lower rank than Term Deposits next year as the Deposit Guarantee begins. Definitely one to watch. A good article. I see Spark has made a good move today, exiting the discretionary dollar space which will not be the place to be for the next few years. Cut your losses as they say, smart move Spark.

Recent cricket matches where NZ won, but hardly anyone saw it due to spark may have also come into play, I was in a room last year where everyone is very well paid, out of 40 only 2 had spark sport, all had sky. Sparks advertising revenue must have been terrible, and they needed 34mil to offset the rights.

Very poor decision by NZC to go with Spark. One of the most dominant periods on the field and no one to see it

Top 10 Risks and Opportunities for 2023.

I have not heard much from TTP lately. Maybe he has started a new business ?

https://www.stuff.co.nz/life-style/gender-and-society/300766190/new-zea…

Many new investors have received a right pegging lately. Maybe he is selling them lube?

Points 3 and 1 are interconnected,as there are substantive energy subsidies in place for Europe (inc UK) Which will be around 1/2 a trillion euros over the 12 months (oct yr) The subsidies are paid direct to the utilities to reduce any inflationary impact and the region still has inflation with a 10 handle.

To reduce the reliance on FF such as Russian gas,and the replacement with long haul LNG still does not decrease costs for either electricity generation or water and central heating,where baseline demand has not decreased.

Still only early in NH winter,and the cold spell saw significant drawdown in reserves ( German mean -3.12c) and the temperature change saw reserves in 1 day decrease greater then a full week in late November.

https://www.bundesnetzagentur.de/EN/Areas/Energy/Companies/SecurityOfSu…

what about Crypto

It could go down to 10K

Will the engineering of recession in the West slow down or stop in 2023 ?

That is the key matrix. Opportunities can be exploited with an upward moving economy than a downward moving one.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.