Core retail spending - which excludes fuel - dropped on a seasonally-adjusted basis by 0.3% in June.

The figures add to the evidence that the rising cost of living is starting to prompt people to cut back.

Westpac senior economist Satish Ranchhod said retail spending as measured by electronic card transcations "effectively stalled" in June "in the face of continued price rises and growing pressure on household budgets".

Annual inflation hit 6.9% as of the March quarter.

Ranchhod said, importantly, that small easing in spending in ex-fuel categories comes against a backdrop of strong price increases for all manner of goods and services.

"That’s constraining the volume of goods that households can purchase. In other words, while our nominal spending levels may be holding broadly steady, the amount of retail goods we’re actually buying is going backwards."

Looking to the second half of the year, Ranchhod expected that pressure on household budgets to "become even more pronounced".

"Consumer prices are continuing to climb. In addition, many households will see the costs of servicing their mortgages pushing higher over the next few months."

The Reserve Bank (RBNZ) has another review of the Official Cash Rate on Wednesday (July 13) and is pretty much universally expected to raise the OCR to 2.5% from the current 2.0%.

"The RBNZ is trying to slow demand in order to contain the current rampant inflation pressures," Ranchhod said.

"While today’s [spending] report does signal that demand is starting to ease off, the economy is still running well above trend. The RBNZ will still want to see a more meaningful slowdown."

In terms of the detail in the latest release, Statistics New Zealand said that including fuel the amount of electronic card transactions rose by 0.1% in June.

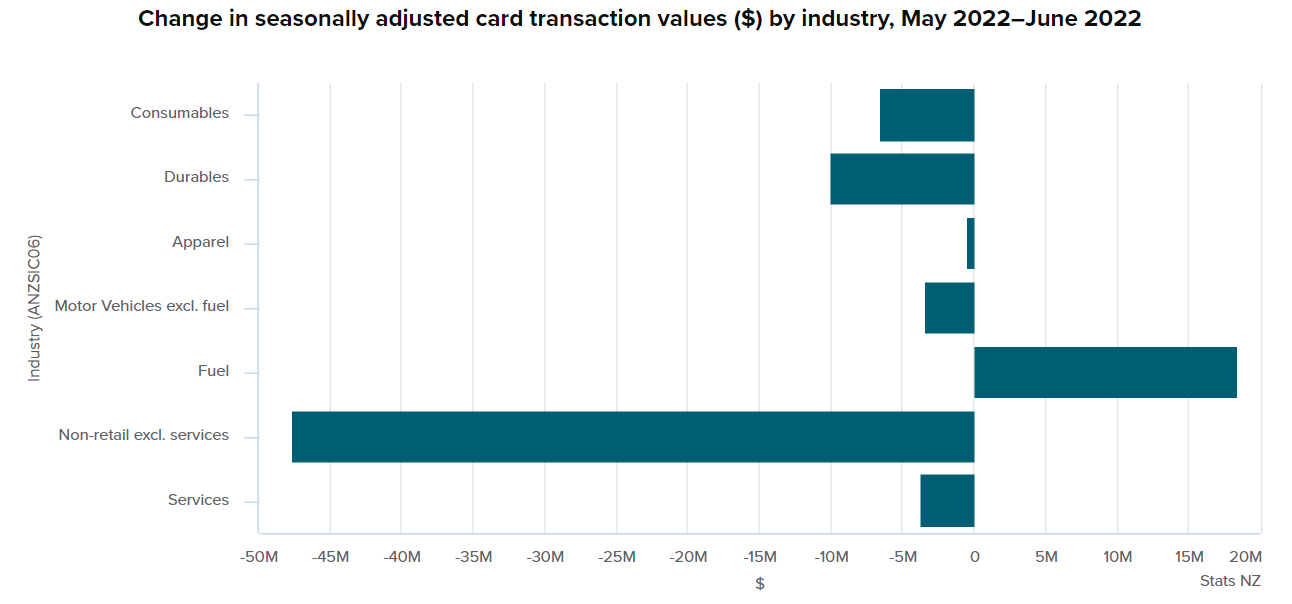

Stats NZ said by spending category, the movements were:

- fuel, up $18 million (2.9%)

- apparel, down $0.4 million (0.1%)

- consumables, down $6.5 million (0.3%)

- durables, down $10 million (0.6%)

- motor vehicles (excluding fuel), down $3.3 million (1.6%).

Stats NZ said in actual terms, cardholders made 148 million transactions across all industries in June 2022, with an average value of $56 per transaction. The total amount spent using electronic cards was $8.2 billion.

Due to the effect of Covid-19 on tourism, Stats NZ said it was unable to release seasonally adjusted figures for the hospitality industry.

"As such, we are focusing on the actual hospitality values for the June 2022 publication. We will continue to monitor this approach as more data becomes available.

"Spending in the hospitality industry fell $6.0 million (0.6%) between June 2021 and June 2022."

37 Comments

Who has money to spend on retail when your rent or mortgage just got jacked up enormously?

Agree. Some think everything will just ‘blow over’ in a short period of time, I feel we are only seeing the beginning.

The many people who are mortgage free?

The many people who's rates haven't changed yet...

RNBZ C31: There were 60k FHB from July 2020 to May 2022. I use these months, as the most common fix periods are between 1 and 2 years. The average 2 year rate in July 2020 was 2.7%, July 2021 was 2.5%. Also July 2020 & 2021 FHB number of borrowers were at least 20% higher than all preceding Julys.

So how many of these 60k FHB are due for a rate renewal of 5.5%? Also, how many of the 75k investor borrowers over that same period?

Not everyone puts 100% of their mortgage on a fixed term either, many split it up across different fixed terms... There will no doubt be more pain over the year but it doesn't impact everyone equally.

Quite right, but how many borrowers is that? 5%, 50%, 75%? I wouldn't be surprised if it's 5 - 10% that fix across multiple terms. I'd imagine most FHB don't consider breaking their mortgages up, particularly if they're exuberant from having been successful in buying and obtaining finance.

According to this schtuff article:

For many years, commentators have advised that the cheapest mortgage rate plan was to roll over a series of one-year fixes.

https://www.stuff.co.nz/business/money/300542290/is-it-time-to-fix-your…

Quite a few investors doing their sums at the moment and reaching out on Facebook for advice.

A typical example this weekend is a house with $500k mortgage that needs “topping up” currently by $12k pa at 2,5%…but now looking at refixing at over 5% so going to need another $12k….god bless these smart long term investors if/when rates get to 7.5%.That will be over $30k in top ups…..good luck offloading that golden goose.

I’m also hearing firms are realising they are going to have to cut their cloth and restructuring & job losses will soon be on the cards.

that will come as a shock to a few

If the gains for investors are as massive as critics try to say they are, then even selling below market they'll be OK unless they were a very recent borrower or increased debt as Cindy and Robbo told them to. Even then, the house value gains over the last Labour term (50%) will offset any top up cost for a few years, as long as they can pay their way.

Me? I paid my debt down, retained mortgage payments at a higher level as better rates came through and just increased rate of repayment, also sold a place at the top of the market to clear half my debt.

We all bear the consequence of our decisions, just ask all the extra voters who leaned towards Labour last election..........

with huge increases to rates, water rates, utilities, fuel, food - ...... i would suggest that most people who have achieved mortgage free are also pretty financially savvy and will have already reduced their spending levels in response to their other costs rising

Rent should be going down at least for Auckland where around 40% or the 6000 rentals are vacant.

... and counting, eh? New build investments are hitting the market every week.

Good to see some optimism in a junk mail from a local developer that assures borders reopening this month should bring in a flurry of workers and students to soak up excess rental supply.

Me - I don't have a mortgage - I own my home. Biggest expenses at the moment are rates and insurance. Just saying.

It's not like either of those ever go down.

Rates only ever go up.

Insurance only ever goes up (maybe down a bit of you chop and change providers).

I've heard of a good residential builder whose entire forward book have just cancelled. not affected by supply problems or labour issues, but that can't be a good outcome for the economy.

Matches what is being heard on the street, people are being very careful in their spending.

Low airspeed, stall imminent...

And the wings are coming off crash landing inevitable just the time it takes to drop 30000 feet.

And do we trust the current pilot to fly the plane any differently? Nah.....

Yep, discretionary spending is falling off a cliff as confidence falls and people pay higher prices at the pump, in the supermarket, and on mortgages, insurance, local govt rates, rent etc. This slump has been clear in the raw data for a few months now - and the things that are pushing prices up are basically immune to whatever Adrian Orr thinks he is doing (noting that higher rates inflate the prices of several of the things that are hurting!)

My personal view is that consumer spending in June might have been just high enough to avoid a second quarter of declining GDP, but only because February 2022 consumer spending was so low. It will be close.

Prediction -tax take will fall, benefit costs increase.

But as Robertson says - the economy is just going so well, as his regular tax take was getting pumped up by huge inflation gains. Given that he spent all that money and continued to borrow, do we really believe he has any chance of achieving a surplus ever?

Move that tax take down, and the deficits will double, last years "better than expected" 12bn deficit will look like chickenfeed with all the extra spending Robertson has committed to. Inflation is now hitting wages, so prices will stay up for even longer...... even into the recession

I think the facts are there for us all to see. Households will have numerous outgoings that are clearly going up in cost. I am getting regular emails stating that some service or product I subscribe to is going up in cost. Fuel, food, energy are blatantly obvious. Forecasters can say whatever they want but we have a reality that tells us what is really going on.

Same here. Every day this price or that price is going up.

Had some software I use for work hit me with a 400% increase the other day, which is a bit wild. That one I will be replacing ASAP, but things like mortgage, insurance and food I can hardly ditch or economise too much more on.

and some of it is just gouging -- i had a container firm lift my monthly storage fee by 50% -- not sure what their extra costs are - maybe a little bit fo night staffing -- but thats all -- container has no power heat water -- just sits on the ground! i fancy i am paying for their extra fuel costs to transport other peoples containers!

Correct. Unfortunately regardless of inflation, stagflation, recession there are many out there that will gouge at the first opportunity. If in fact we took gouging and shrinkflation out of the picture, things would probably look somewhat better for the average consumer.

So, given the significant hikes in fuel prices does a 2.9% increase in retail spend mean that the actual volume of fuel purchased has dropped considerably?

https://www.mbie.govt.nz/building-and-energy/energy-and-natural-resourc…

No reprieve for consumers. Income tax has effectively risen as tax brackets haven't been adjusted for inflation, higher cost of goods and services due to inflation, same sales tax levels.

Rents have not substantially dropped yet in response to rising rates.

Why would rents drop in response to rising rates?!? Never happened before.

Residential property investment is inverse. When rates were dropping we didn't see rents drop, so when rates rise then rents should fall.

If you look at the data since GFC, we have had three periods of increasing OCR (2010, 2014, late 2021). All three periods have also seen pretty sharp increases to rents. However, I doubt that OCR and rental levels are linked - rents tend to track what renters can afford to pay.

Alcohol duty risen by the most for decades - likely result lower duty collected, Robberson clearly has no understanding like his mate Denis Healy who in the UK increased taxes till the pips squeaked which they did resulted in a lower tax take until the Tories reversed that policy and tax take increased. Robbo may believe history does not repeat and he is about to find out something else he has been completely wrong about.

Inflation is and will continue to batter consumer spending. What was left of discretionary spending is taking and will continue to take a hammering. Yes this will kill of a bunch of activities as NZ re-balance's to the new normal, as the new normal is going to be a very bad place for those thinking the leveraged up model of the last twenty years will continue. Lets face it, the last time inflation was this out of control interest rate's reached circa 20% to stop it.

Interest rates are the only lever remaining. Each 50bp increase is another lead weight tied to Specarus as he tries to halt his plunge earthward.

The last time inflation ran this hot, it took a peace deal in the middle east and deregulation of natural gas (fracking) in the US to sort it out - and then a huge expansion of Chinese / Asian productive capacity to hold prices low for years. The only 'lever' remaining is politics and industrial policy - monetary policy is basically impotent.

Make nice with the Venezuelans and the Iranians. A bit of regime change if it can be managed without too much fuss. Problem solved.

as anyone who has ever piloted a plan knows -- as stall is followed by a rapidly increasing dive to build up enough speed to fly straight and level again -- but at a very significantly reduced level

Normally when I watch Air Crash Investigations it involves the plane plummeting into the ground, followed by slightly amateurish reconstructions of the final moments of cabin mayhem, and then some old American guy with a moustache explaining how aviation will never make the same mistake again.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.