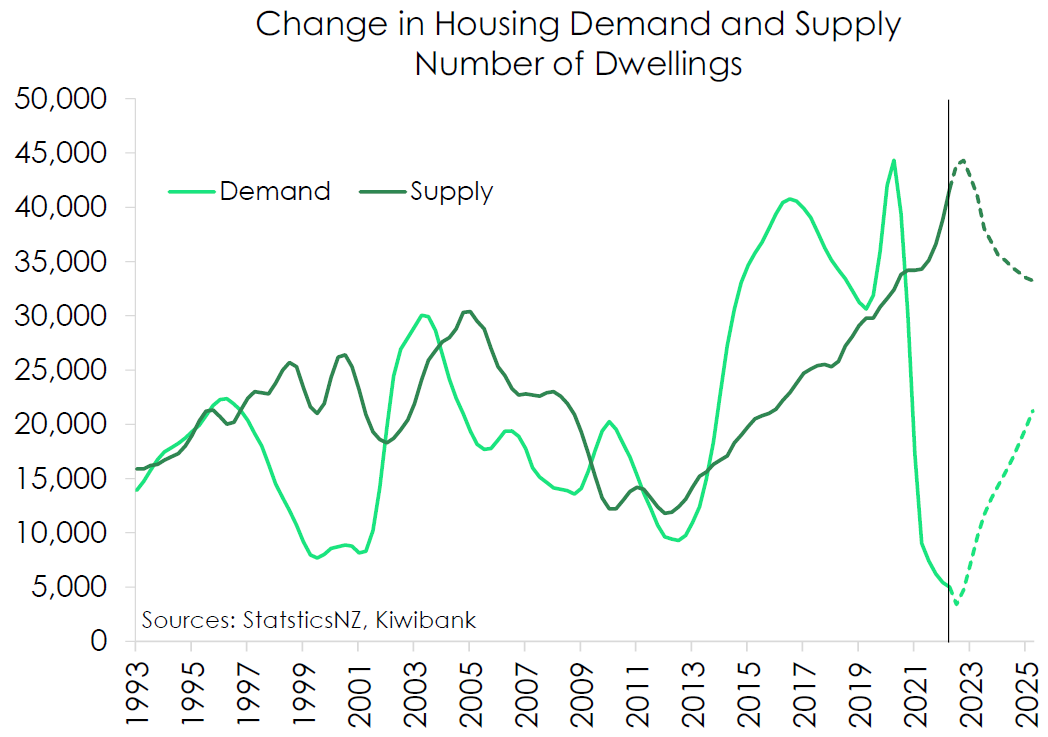

The current "yawning gap" between supply and demand points to New Zealand’s cumulative housing shortage disappearing over the next 12 months, according to Kiwibank economists.

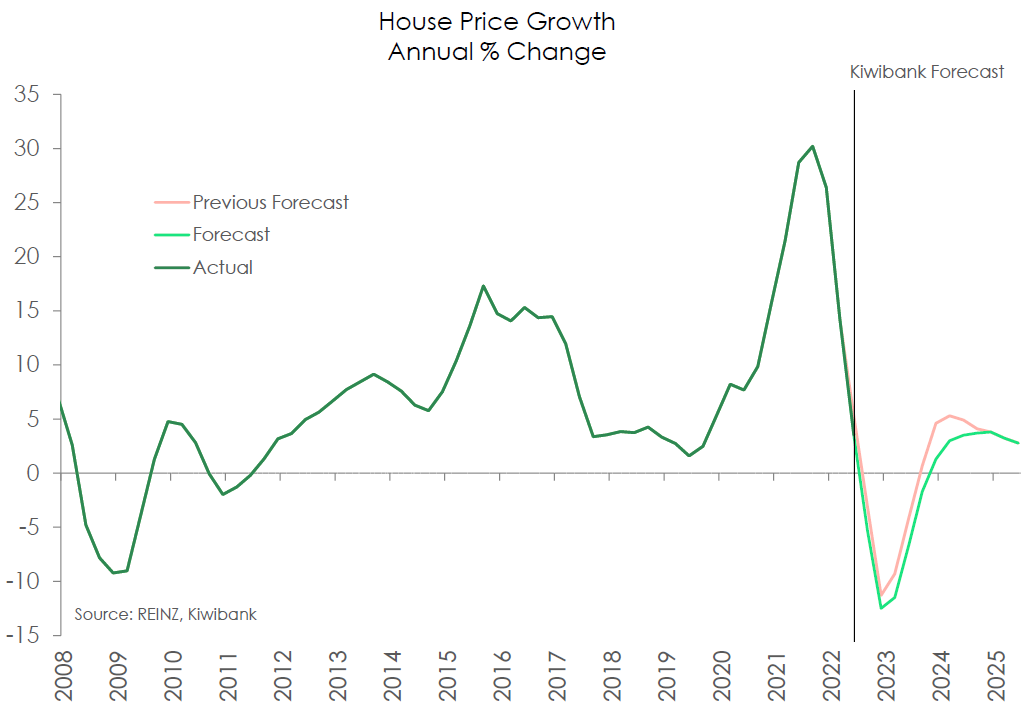

They have revised down their estimates and now see house prices dropping 13% by the end of the year. Previously they expected a 10% fall.

In the latest Inner Kiwi publication, Kiwibank senior economist Jeremy Couchman said despite the well documented material and labour shortages, an additional 41,700 private dwellings were constructed in the year to June 2022.

"That is by far the largest annual increase in dwellings in StatsNZ dwelling estimates going back to 1991," he says.

"To put the gain in homes in context, the peak in construction during the mid-2000s only managed to produce a net 30,000 homes. And looking at the 2018 census data 41,700 dwellings is roughly the same as the number in the whole Southland region."

Couchman says the "seismic shifts" seen in housing supply and demand have driven down New Zealand’s housing shortage to an estimated 23,000 homes, "still large but massively down from a revised 57,000 shortage estimated last year".

He therefore sees the housing shortage disappearing over the next 12 months.

"A growing surplus of houses ahead is likely to weigh on New Zealand’s housing market and generate a slow recovery in house prices.

"After the post-covid boom of 2021, the housing market is clearly in retreat. Credit conditions have tightened dramatically, in large part due to the RBNZ embarking on aggressive interest rate hiking to tame multi-decade high inflation. And the RBNZ isn’t done yet."

Kiwibank economists are forecasting the Official Cash rate, currently at 3%, will reach 4% by the end of 2022.

"House prices have recorded falls in every month in 2022 so far. We have downgraded our house price forecast and now see house prices fall by 13% by the end of the year. Our forecast would take house prices back to where they were at the start of 2021. Our projected recovery in house prices is weaker too," Couchman says.

He says the concern now is that with a housing market in decline, and a lack of prospective buyers, some developers may further delay or even cancel planned construction work.

"Residential building intentions data in recent business confidence surveys do indicate a sharp fall in residential investment growth is just around the corner."

77 Comments

Amazing predictions. Price falls have already exceeded their 10% prediction, so they upped it to 13%.

I guess in 2 months when that 13% has been exceeded they can revise it again

10,13,16 sounds better than 10,20,30

The magic of false precision.

https://en.wikipedia.org/wiki/False_precision

All the bank economists are clowns.

As are all orthodox economists as they don't understand the subject that they profess to be experts in. Maintaining their institutional groupthink is all that they aspire to and attacking anyone with an alternative point of view to their own.

The orthodoxy is fundamentally broken.

The money is broken. Hence why bitcoin and hard money philosophy is so interesting.

the baseline will soon be measured from the point before the market took off stupidly -- as if the 25% drop was just a correction .... queue thumbs up from TPP

It's already happened keep up.

Vested interest shouting louder than the facts.

What we need are some quality "predictions" on what the FED and Putin are going to do in the next 12 months. Add in to that China / Taiwan and the property collapse unfolding in mainland China. That would be worth reading.

You mean geopolitics and demographics?

What we need are government departments that actually talk to each other. They've got all this info already surely.

A property collapse / financial collapse in China was the basis for my 2018 prediction of a house price crash in NZ in 2022 / 2023

It does feel like everyone in NZ should pay attention to what is going on in China right now(in particular what’s happening to the property sector and wider issues it’s creating)

It will impact us due to our reliance on China (directly, but also indirectly via Australia)

Hard to predict the depth of the impact globally.

China property market is cashed up domestically I would assume.

The only indicator to keep any eye on this far would be how much consumption drops on imported goods.

China looks to be a bit like Japan over again.

Have a look ay Peter Zeihan. On You tube. He has really in sightful comentary

So it’s only now that they have worked out a big construction slump is coming???

wow

And btw I am starting to see more partly developed properties hit the market.

I have assurance from Megan Woods that once the slump is over and all our tradespeople have left due to no work that Labour will import workers into the building industry.... I wish I was joking.

There won’t be much building work in Aus either.

Probably not in Australia and not all will leave for greener pastures. But a lot will put down the tools and pick up other jobs. They won't just wait for building to pick up again.

True.

But with a sagging economy other roles might be hard to come by

They will need lots of builders soon in Dunedin for the hospital rebuild.

Nationally, a drop in the bucket.

If only we had some agencies who could employ them in down times, as in the past...oh well...

That was supposed to be the plan, to iron out the peaks and troughs

That is exactly what I asked. Does the government have any plans to keep tradespeople employed during the upcoming recession so they don't all leave. Answer was not to worry, we can just get immigrants when we need builders in the future.

Risible.

Incredible...I truly wonder at the nature of innate beliefs / norms in politicians today, that an ostensibly "labour" party can look almost identical to National in so many ways. Seems like vision has just disappeared and the search is always for short-term solutions despite their long-term costs or negative impacts on New Zealanders.

in many areas they are so far left they have arrived on the far right ---- and their centrist policies are well right of centre -- thats why its hard for national to get traction without going back to bashing benificiaries and locking up criminals --

Re building materials;

Trades that access international markets for their materials e.g. Structural Steel, are preparing for big price drops across the board due to Chinese demand evaporating and prices dropping.

Trades that access local labour and materials e.g. carpentry are preparing for more rate rises or plateaus. Fletchers and Carters don't have to drop their Plasterboard and Timber prices.

So commercial construction build prices to remain relatively stable or even decline (over the next 6-9 months) depending on the build type, whilst Residential costs to remain high. What that does to demand I don't know.

I agree residential costs will remain high, but I don’t think they will go higher, or at least not significantly. What’s your thoughts?

Still another round of building material increases to come by the end of the year.

Unlikely that price drops trickle their way down to the client.

Why ?

You think? Even with gib issues addressed, forward workload slumps etc?

Demand is one side of the equation, cost to produce the material is the other. Costs to produce have been increasing too quickly and now there are price increases already locked in. Usually building material suppliers need to give long notice periods that there is a price increase so they will have decided to increase their prices a couple months ago but don't come into effect until next month for example.

Once we hit the slump what I think will happen is supplier gives "specials" but doesn't decrease their list price. Merchant then pockets some of that margin and passes on some of it, then the builder pockets some of that margin and maybe passes on some of it.

Building material goes up 10%, client pays extra 10%

Building material goes down 10%, client pays 0-5% less.

It's almost as if they have Tim The Pricefixer on the payroll.

Huh?

You'd think any slow down in new orders would drag on Labour costs. Might take a bit of time to see that though.

Agree. Most companies have enough to carry on with in the meantime, especially in commercial land. Residential guys starting to scratch around for work though. Group home stuff is a train wreck. Alteration prices might start to come down or people just may be able to get more quotes, quicker. Also those quotes will start to trend towards fixed price rather than 'we're too busy' or, 'I'm doing you a favor' or, 'just thrown a dart at it I don't really want the work'.

The pencil sharpeners are about to be brought out of the bottom drawer.

"The pencil sharpeners are about to be brought out of the bottom drawer. "

Depends, I think.

Smaller operators (which make up the bulk of the residential building sector as I understand it) who don't have a lot of sunk costs in their enterprises may just shut up shop and do something else. Or look to work for someone else and just take wages for a while.

there is still a significant shortage of skilled tradies -- and a backlog of work already consented -- not to mention repairs and upgrades that are not done as builders prefer the larger projects - it will take a very significant slowdown before the capacity and demand reach a balance point - so would not be thinking anytime in the next 12 months -- quite possibly still a couple of years away

The change to insulation requirements plus geotech designed work for foundations will between them add $30,000-$40,000.00 to a modest (150m2) dwelling. Any benefits from falling local material costs will be surpassed well & truly! Once increased insulation to exterior walls comes into force - add yet another $5,000-$7,500.00.

It's just a pr release.

Rbnz and the banks need to sound like they are in touch with the current sentiment, in order to remain visible and credible to the masses.

No bank will go out and say 'the property market is in full meltdown' even if it were. Its Not exactly going to encourage people taking out bigger loans if they advertise bad news.

The market bottoming out this year is also a plausible outcome as of right now.

Those that are involved in production and supply chain will be aware that Toyota (recognised as the best for production systems)championed the pursuit of “one piece flow”.

The waste that came from producing items in batches ,against common sense, was shown to be able to be greatly reduced by producing items one at a time.

Companies like F&P healthcare, Gallagher, and others practicing lean methodology will be looking at Toyota & thinking of reducing production to one piece flow…. One at a time…and levelling the production out over time… they call this Muda”

The reason I raise this is that we have gone in the complete opposite direct in terms of productivity in construction. We have changed our residential construction market into one that produces in batches.

and producing six townhouses all at once might seem the smart thing to do.but you have to outlay all the costs before you get your first bit of paper you can sell to someone.

financing and producing one at a time is the cheapest way

but, and it’s a biggy

all the council licensing and titling goes up the wazzoo if you try to be commercially sensible…..all permitting and licensing done in batches… ie build the whole lot

all the bank lending processes are around projects so hence batches if multi unit

where did the builders get the skills to run much larger projects? The capital? Real dough….not valuations and imagined up equity.

a few will be sweating it for sure

You have to admire their "optimism".

"Kiwibank economists now see house prices falling 13% by the end of the year..."

Do they mean from here......as already down by 15% to 20%.

Haha - they are way smarter at making prediction statements than actual predictions.

If they just frequently change the the forecast % drop and give no context.. then is confused and nobody can pin them down on their prediction when its wrong.

Politicians, economists, etc etc

They want to control the narrative. Better that reporters report what they say rather than start reporting what the punters think will happen.

read any articles about what happens if it crashes….?

all unimaginable…for how long

True. Ireland in the 2000's - all similar and it went on for years.

When enough people cant afford to eat - the narrative loses credibility

Lots of conflicting data. Propellor Prop pushing hard (even on prime time TV) for equity rich Ma and Pa to jump in now to double your capital. Then TA pushing hard for first home buyers to "jump in now". All to bail out the developer and debt speculator (same thing really). This is add odds with low immigration, lots of supply coming, and rates up up and away. #timing

The vulture moment is close, but I agree with market sentiment. Wait a bit longer to save thousands...hundreds of Thousands...

Do Kiwibank anticipate that their new 100% owner may use their sovereign borrowing ability to provide them with additional capital to be loaned into the housing market? Allowing FHB to access 95% lower rate mortgages with a government guarantee? Its either that or prices will continue to fall to the level where buyers can service a standard bank mortgage based on their income and current interest rates. If homes cant be built for that price point then they wont be.

No need for the government to borrow as it would just be creating an asset on its own balance sheet.

Kiwibank is seeking a new career in comedy.

Im not so sure the cumulative housing shortage will disappear , The good news is we didnt go all out building like Ireland. The bad news is affordability ... How many Kiwis can afford to jump on the property ladder even if it retreats as much as is touted. Further complications will show if we do start importing labour. Cannot see the shortage disappearing nor can I envision cheaper build costs without a markedly changed ownership model appearing in the market place something like 'no frills' freehold 'frozen value' cabin lifestyle communities as a foot in the door or something similar perhaps. Frozen value to stop speculation yet enable a move onto more mainstream housing once fully paid off. Hard too see such happening in NZ too many greedy fingers and such would impact the rental market if it took flight.

Do the economists do all their thinking in a vacuum? Both major parties are ramping/ will ramp up immigration which will put that demand right back up.

Haha - those cards have already been played... t existing housing stock and current plans for new houses far outstrips demand. The last year or so of studies all showed we should have a surplus about now. So all those houses coming online will not get a lot of attention.

The openhomes for a nice modern 3 bed, 2 baths, double garage our way had zero visitors and zero bids at auction.

Plus if we are importing unskilled labour it will only put downwards pressure on prices. The skilled smart, youngsters who would be able to get a mortgage on a house are leaving in droves not coming. The incoming guys will be in shacked up in bedsits and cheap accomodation provided by employers nt buying $million houses

Why would a smart professional and their family move to unaffordable NZ. Of course. once prices drop 50%+ or so, and the economy takes a hit for a couple of years... then kiwi kids who made money overseas during the downturn might come back and snap up a bargain or two

Kiwi bank trying to keep the sheeple calm. We all know it’s going to be far bigger fall than 13%.

When we see houses at 3 or 4x median incomes we'll know the bubble has been burst. It will take a lot longer than 12 months in my view.

Yes but only jurisdictions with the right land use policies are at that ratio, ie are stable, and get to stay there.

Otherwise, it will be bust and then back into more boom-type growth to be repeated. Also so for us to get to that low multiple means pushing through a land banker/big developer collapse as well, which I can't see happening, ie the banks/Govt. allowing it to happen.

But it doesn't all have to happen on falling house prices as it is a relative measure so can be helped by rising incomes.

While Interest.co.nz doesn't like the median multiple ratio, they do show it here: https://www.interest.co.nz/property/house-price-income-multiples.

When we see houses at 3 or 4x median incomes

Reality check. Do you expect to get the land for free?

Why? Simple math. Build price is @$3,000 per sqm x 100sqm = $300,000 + Subdivision cost/services/council etc $125,000 = $425,000

$425,000 (and thats with no cost for land) is 3.5 times the Auckland household median income (yes that's 3.5 x 'household income' i.e. $120,000 not the actual median income of $60,000...)

Do you truly think house prices will fall to 4 x the median income (i.e. $60,000 x 4 = $240,000) or even 4x the household median (i.e. $480,000)?

If median income couples can’t afford to buy who will buy property. Once this downturn is in full swing house price’s will tumble, at the moment house values in Auckland are dropping $1000 once rates are pushed up this will speed up the process. Investors will not touch this market unless they enjoy losing money. Whome have you never been in a serious downturn before all sorts of things happen and house prices are first items to crash in value.

Whome have you never been in a serious downturn before all sorts of things happen and house prices are first items to crash in value.

Actually yes I have but only… the property crash after the sharemarket collapse of 1987 (sorry but property doesn’t always crash first) the Asian financial crisis mini NZ property crash , the GFC.

perhaps you don’t understand that property values never stay down forever as the cost to build rises (materials and labour) incomes and rents rise too as a result of inflation and interest rates sometimes fall as well. All that adds up to improving affordability in time.

But hey I’m probably wrong so don’t buy a property, just stay renting, property investors will love you for it.

Quite sad to see the naive views on here that values will crash and burn and never return. Values rise and fall but always have risen much more and for much longer than they fell. Drops are recovered relatively quickly in the scheme of long term property ownership.

I hope you can come back in 5 years and tell me you can buy a property in Auckland for less than today… but I’m 100% certain you won’t be able to for the reasons I already spelled out

Wow! Over the long term house prices always go up? I take it that means 30 years or more, that means if I buy a house today once I've paid it off after 30 years I'll be rich! Let me grab my hard earned savings and kiwisaver and buy any house I can possibly get, and pay WHATEVER they're asking! this is too good to be true!

Right! Just do what I do and time the market.

Solid Granite, you've just described a perfect way for you to own a mortgage free house in 30 years (so you'll be a millionaire) whilst enjoying the benefits of living in said house. Indeed an awesome proposition, yet you're being sarcastic about it. Do you prefer a get-rich-quick scheme?

If you start with the wrong figures you end up with the wrong total.

The median income multiple always uses total household income.

And if you stripped the waste out of building costs, they would come down by approx. 1/3 to 1/4, and the same with subdivision costs. And it is not just about land/building cost prices coming down, but because it is a relative ratio, it is about incomes increasing also.

The two biggest divergences are incomes not keeping up with inflation, and land costs ballooning out due to restrictive land use policies.

However, I agree getting to 3 to 4x median is probably over-optimistic because it would have to involve a land banker bust as well which won't happen as they can happily just sit on the land and wait out the bust.

But 5 or 6x is feasible, which considering where we are would be a great improvement.

They should tell ANZ. According to my online banking we're down 24% since peak.

Ouch!

It's like the perfect storm against NZ housing.

- Higher interest rates

- less credit available

- more supply / less demand

- the end of FOMO

- CGT (in the form of brightline test)

- LVR's

- No interest deduction for investors

- Zero net immigration (slight net emigration)

- Higher service test rates from banks (around 7.5%)

- CCCFA

And these too will change…

Surely the catch up in supply must be because of the 100'000 affordable homes Labour built ; )

I see what you did there, Yvil.

Seems like Retail Banks and RBNZ are not on the same page.

More good news from the Govt for the Govt

Kiwibank now an extension of Labour's PR machine...?

"41,700 private dwellings were constructed in the year to June 2022."

Why do I feel that 50,000 is a number in 2023.

"..Official Cash rate, currently at 3%, will reach 4% by the end of 2022."

More pain.

"...housing shortage to an estimated 23,000 homes"

Lack of housing (supply) was in fashion when prices were rising.

When do house prices fall enough that the large weight of home owners and real estate professional push the government to intervene? there were no complaints on the way up, just joy at how wealthy home owners were getting and wonder at how much money thier house makes on a daily basis. With all the metrics showing downward prices continuing for a while, what is the limit. I think that we are a long way from the bottom....no CG means no investment. Feels like this could get ugly.

The danger of allowing investors to using equity in previous homes to buy even more homes, when house prices are rising, is a very dangerous thing to do because it creates excess demand on the market that isn't real - i.e. it isn't supported by income generated by the real producitive economy. It is created by a feedback loop from rising equity which is just paper money...not real earned money. It essentially gives a market characteristics of a ponzi scheme, which is prices ever start falling, could cause the market to implode because suddenly investor demand disappears and people realise that house prices 10x incomes is completely unsustainable.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.