Surprisingly weak retail sales figures for the June quarter have raised the possibility that New Zealand went into a technical recession in the first half of the year.

A 'technical' recession is two consecutive quarters of negative GDP growth. In the March quarter the NZ economy shrank by 0.2%. The figures for the June quarter are not released till September 15.

Most economists have been picking a fairly solid pick-up in economic activity for the June quarter as the country enjoyed the impact of getting over the big wave of Omicron that affected the March quarter. Indeed the Reserve Bank has forecast a +1.8% bump for the quarter.

Retail sales are just one relatively minor (about 7%) contributor to the overall GDP outcome, but the sagging sales in the June quarter definitely suggest there is a possibility the country has entered a recession.

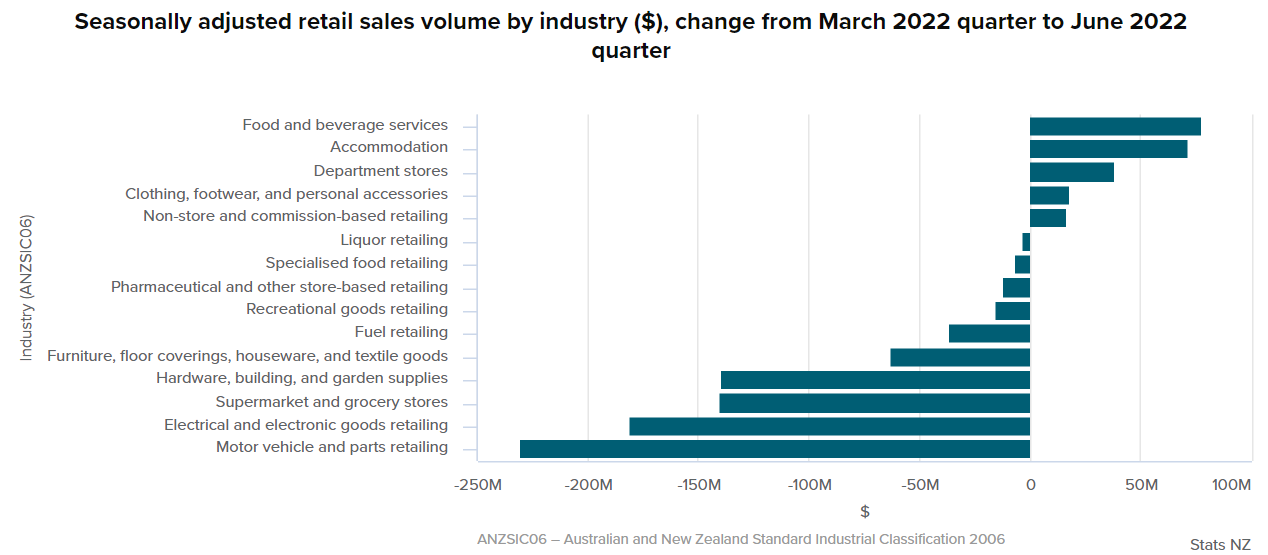

Statistics New Zealand said the volume of total retail sales fell 2.3% in the June 2022 quarter, after a 0.9% decrease in the March 2022 quarter when adjusting for price and seasonal effects.

This is the second time retail sales volumes have fallen over two consecutive quarters since the Covid-19 outbreak. The first was in the March and June 2020 quarters.

Of the 15 retail industries, 10 had lower sales volumes in the June 2022 quarter compared with the March 2022 quarter. In percentage terms the biggest fall was the 8% drop in furniture, floor coverings, houseware and textiles. Electrical and electronic goods retailing was down 6.1%. Motor vehicle and parts retailing dropped 5.8% in seasonally adjusted volumes, after a 5.3% fall in the March 2022 quarter. Hardware, building, and garden supplies were down 5.3% compared with the March 2022 quarter. Supermarket and grocery stores fell 2.9%.

ANZ senior economist Miles Workman said while the retail sales data are only a small share of total production GDP (around 7%), they do tend to provide a relatively good signal on overall GDP growth.

"On its own, today’s data present downside risk to our forecast for a 1.0% [quarter on quarter GDP] rebound. In fact, on face value, today’s data suggest the economy may have been in a technical recession in the first half of the year," Workman said.

Westpac senior economist Satish Ranchhod noted that households have been winding back their spending on durable items like electronics and furnishings, while there has also been a fall in vehicle sales.

"Those are the same categories where spending rose strongly when Covid-19 first arrived on our shores and measures to protect public health prompted a shift away from spending on services," he said.

"We’ve been forecasting a slowdown in household spending for some time, with increases in mortgage interest costs signalling a significant squeeze on households’ budgets. However, that slowdown in spending has come through sooner than expected.

"Importantly, many households have been shielded from the impact of interest rate increases to date due to the high level of mortgage fixing in the New Zealand market. Over the coming months, debt servicing costs will rise sharply for many households as they refix at higher interest rates. And coming on top of today’s soft result, that points to weak spending through the back part of the year.

"The softer than anticipated retail spending result signals downside risk to our forecasts for a 1.0% rise in June quarter GDP. More importantly, it also signals significant downside risk to the RBNZ’s forecast for 1.8% growth. In its recent policy statement, the RBNZ highlighted the strength in inflation and need for further OCR increases. However, in our view the RBNZ gave little credence to the signs of softening demand that have been emerging.

"Today’s result further reinforces our expectation that the OCR will peak at 4% by the end of this year, in contrast to the RBNZ’s projections which highlighted the risk of a higher peak," Ranchhod said.

62 Comments

I know of zero people who are confident about the future and not pulling back on spending. Most have just seen their mortgage costs double.

Who are these economists?

Lol - those economists sure are a fun bunch.

They live in the most marvellous alternate reality ... where they all sit around in banks and take turns have a jolly good guess at what the economy will be like tomorrow.

There is no missing meals, living in cars, turning to crime to feed their families in their world of cucumber sandwiches and scotch.. its awesome!

I refuse to believe those economists have their heads stuck in the sand when it comes to the economic reality facing NZ.

The unnecessarily optimistic commentary we have been seeing from their kind is just a desperate attempt to stop the bleeding on economic confidence to protect the interests of their corporate masters.

“It's difficult to get a man to understand something when his salary depends on not understanding it." -Upton Sinclair

Yeah surely they can’t be this stupid?

they are either stupid, or devious

Many are done with domestic spending and are focusing on overseas trips, this will go on for the next 2-3 years, domestic activity will slow significantly.

I'd say most aren't even vaguely concerned about overseas trips, they're more concerned with keeping a roof over their heads and being able to feed their families.

Depends whether you're in the mortgage free + rental income + superannuation life of luxury position or not....where central banks have made your life wonderful the last 10 years...

I was going to make a comment on the likely age demographic of the original poster but thought it may be overly presumptuous. You are right though, a certain section of society are thinking about holidays while the rest struggle.

Not just overseas trips. Apparently Qtown can barely keep up with pretty massive demand.

They always said this was going to be a y shaped recovery.

Some people are doing it rough, on the other hand global air passenger services can't keep up.

Most people knew life is short. Covid probably reinforced to a lot of people to enjoy what you got while you got it.

The amount of people looking to exchange foreign currency for overseas trips are phenomenal! Imagine Christmas summer holidays.

“a certain section of society are thinking about holidays while the rest struggle”

This.

The credit cycle is now replaced by an economic cycle. The greatest stagflation event of our lifetime has now entered the room and the RBNZ will need to keep hiking past 5% or the NZD is going to be unmercifully punished. I hope everyone has planned accordingly for the decade ahead.

Many people are going to be knee deep in donkey do if the OCR hits 5%.

Whilst the government and RBNZ have stuffed us. Anyone not able to manage if the OCR hits just 5% can really only blame themselves - it is pretty poor personal planning. What will they do when the downturn really starts to bite

Its pretty clear that many have either left it too late or are just in denial waiting for the reversal. If 1 year fixed mortgage rates hit numbers starting with an 8 its curtains for a lot of people. I don't believe the RBNZ "Stuffed us" , its all about personal responsibility and not looking for others to blame. Its been a great few years to be smashing that single mortgage at cheap rates and NOT taking on more debt.

I don't mean they stuffed us personally, more the fact that RBNZ have created an environment for people to 'stuff' themselves for too far and too long.

They failed their only job - to keep inflation in check. They continually try to be too clever and dont do the proven basics.

Agreed. Paying down debt and building a vulture fund as the right move. Something about doing the opposite of everyone else....

Many people were greedy when interest rates were low. Now, many people are fools not to factor in 5% OCR.

Many people do not realize the NZD fall later this year will import more inflation domestically.

Many people are not watching the Fed

Wow sitting in those ivory towers sure makes it hard to see whats happening on the ground. The USA is in a recession they have had 2 negative quarters and are about to have a 3rd, however they simply changed the rules about what a recession is so technically there is no recession. Nothing to see here folks stop loitering at the soup kitchen and kindly move on.

Carlos that tell's you all you need to know about politics and culture in 2022 and which is why I just do not buy their climate rhetoric. I saw the clip where the reporter asked the WH spokeswomen why it wasn't a recession and she replied "we don't agree with that definition". I mean, ffs, if they can be so brazen as to "cancel" the long-standing measure of recession, there is nothing they won't do.

Welcome to George Orwell's 1984 where Ministries of Truth (or misinformation) get to decide what is real and what is not there TK!

Recession! Never, recessions no longer exist as we've removed the word and its definition from the legal vocabulary.

What's the bet that the narrative shifts around the 9th of November? Just got to keep the punters upbeat until then.

It's when they start playing with the inflation indicators that it gets very Orwellian.

Luckily they can blame the war and use the UK's inflation rate to tell the masses were doing just fine.

By kare, If they start rationing the chocolate then I'll grab a sign and join Tamaki down Lambton Quay.

To be fair, the USA definition of a recession changed prior to this administration so for you to claim that they have changed it recently is disingenuous.

If you choose to not believe climate change despite the vast majority of experts on the subject being on the same page and having been warning about this for decades, well that’s your choice.

The economists' 'surprise' is evidence of incompetence - they are looking at lagging indicators. Anyone with half a brain can find leading indicators - e.g. weekly job numbers, actual earnings, card spending on discretionary items, increases in mortgage payments, rent hikes, insurance premiums, net Govt spending (etc etc). When you look at the latest data, it is obvious that aggregate demand in the economy is dropping quickly. Unemployment will follow - pouring petrol on the fire.

I'm sure economists will be surprised when the biosphere collapses too. "Seems the planet wasn't infinite after all", says top economist.

Love your work Jfoe

Happy to be educated here, but without tentacles in key sectors pulling real-time data, the average economist has to rely on Stats NZ and water-cooler talk to build a picture

It is a question of competency. Any economists commenting on the current state should be mining the latest data. The fact that they don't is a sign of their complacency and arrogance

An economist who dropped a brick on his foot was surprised that it hurt.

“Mortgage debt on the family home, which increased by 30 percent from 2018 to 2021, was the main reason for an increase in total household debt. Other real estate loans also contributed to the increase, rising 44 percent,”

The majority of this debt is being repriced at interest rates double of what the borrowers have enjoyed in recent times. At the same time inflation is at decades high levels and incomes are struggling to keep pace.

Interest rates may have doubled but it doesn’t mean their repayments have

30 year P+I on a 1 year fix would have been about 5.5% at the low and about 8.5% now.

Think June was bad? September is tracking worse!

This all is a delayed response to the big stick the RBNZ is hitting the housing market with, by the way of fast aggressive OCR hikes. Once again a massive over reaction which will see people's mortgage payments more than double. Coupled with supply side inflation, will cause a housing crash and then economic recession due to reduced household spending. This is so obvious, how can these so called ecpert ecomomists not see this happening? This is in motion now and like a snow ball gathering speed and mass down a hilltop, will gather pace and size - next year will be full on recession!

I think you need to factor in that those on six figure plus incomes cannot see the wood from the trees. Basically if your a high income earner and kissing a few arses to stay in the club you are untouchable.

I wouldn't call 6 figures a high income these days if it starts with a 1.

The common taters here always seem to claim they earn an 'above average' income.

I'm on a 6 figure income. I'm doing 3 things:

1) waiting to vote out labour

2) living on $150pwk

3) planning my permanent move to Australia.

And as a lifetime labour voter, my message to Jacinda is, I haven't left labour values or NZ values, but Labour left me and it took my country with it.

My future spending will all contribute to Australian economic growth.

Glad NZ gave you what you needed till you didn't need it anymore.

* rented you what you needed

Do we ever really own anything?

*Plays panflute*

You will own nothing, and you will be happy.

Economists surprised again? Seems to be an ongoing trend these days.

The RBNZ finds itself in a predicament.

Frankly, whatever they might want to do with the OCR for domestic purposes, they will be hamstrung by much larger global forces.

I can't see The Fed or BoE or ECB tolerating inflation at much above what we see today ahead of their winter, let alone rising double-digits. And if they decide to 'get out ahead of it', à la Volker, then the RBNZ will be dragged along for whatever ride that is. And pleasant, won't be it.

(Thought. Central Banks will have a problem serving the massive debt they have enabled at sustained higher interest rates. But a short term substantial rise, followed by a quick return to today levels, is tolerable. The question becomes, "How fast and high do they have to go for a quick fix of today's problems?")

100% bw.

Discussing what the RBNZ should do now is ignoring the elephant in the room.

To paraphrase Mr White (Spectre) - NZ is a kite caught in a hurricane. The RBE issued a statement that inflation may peak at 18%. The FED's next statement tomorrow is expectedly to be hawkish. If the housing market corrects by 30% in NZ and we go into a technical recession which is looking likely Orr will be totally emasculated by the what the FED does. If the FED moves up and it suits the UK and EU (which it currently does due to the war and secondary energy crisis) expect interest rates to rise at unprecedented speeds in these silverback economies.

The RBNZ will have no options and NZ will find itself at the whip end of decisions made 1000's of miles from here.

RBE

You surely mean BoE.

No forward intermediate economic growth priced in this yield curve.

Nice tool. The problem seems to be much the same almost everywhere, to be fair, with the possible exception of the anomaly that is Japan.

Yes - but lets be clear - NZ tore ahead and turned immigration tap on more than anyone else, dropped interest rates further than anyone else and has the biggest house price bubble in the world (i believe also we have the lowest productivity per head in OECD too).

Considering our vulnerability in the global scheme of things one would think we would be a little more careful in our risk management and keeping everything in check.

As it is we will struggle more than everyone else if we have to raise our OCR to keep in line with everyone else... because our RBNZ imposed house price bubble means the bubble will burst faster and negatively impact the rest of the economy. BUT if we choose to drag out feet (as now) and raise slower then the exchange rate will fall driving up imported inflation with very serious social and economic consequences for many.

Whilst one might say that this is all well in hindsight, it has been caused by our current RNBZ leadership making multiple wrong decisions. And that leadership is still being allowed to drive the ship.

Biggest house price bubble I agree. Not sure that either most immigration or biggest rate drops are correct.

Last OECD charts I remember seeing, NZ had the highest rate of immigration per capita - so not in absolute numbers, but in % terms of population.

Well yeah, if they won't let you into the US or Aussie, you can probably still go to NZ.

I actually think the nation state disappeared a long time ago and we're just franchises of a bigger business. There's always much cheaper labour elsewhere and if it's not competing with local wages in country, its doing the same thing by just being outsourced overseas.

Under the Biden Administration no OPEC country would be easier to enter than the US through its Southern Border- Migrant encounters at southern border exceed 2 million so far in FY 22, as Biden-era crisis continues (msn.com)

there are a few recession-proof jobs but I dont think economists realise they arent in that group and could be in for another surprise.

Wealth effect possibly hit a bump in the road

- Petrol prices down

- Retail contracting

- Housing market / building contracting

and everyone is still forecasting inflation...

Exactly

don forget rents flat / slightly down

One suspects that the reason people aren't buying cars is actually that there is a backlog of orders is many months long. Many dealers simply don't have cars available to buy.

"Ride a painted pony let the spinnin' wheel spin"... (Blood Sweat & Tears) Interesting commentary , Funny thing is when things are trending up hell for leather...few are complaining . But when adversity features how many are prepared or have a contingency option . Risk is ever present but how many realise this ? How many will sit tight waiting for something that might not happen? How many will throw the blame on this or that? How many know exactly what to do? How many don't care either way because they stand on a solid foundation that can weather any storm? We are all economists and accountants including those drawing welfare or the child buying sweets at the local dairy for the first time.... You dont need a degree to be good at making smart financial choices . The retail report reflects the current trend ...sales are slowing....my guess is we might see some pressure on pricing to counter the poor sales...but...does that mean you should rush out and buy something? As for the OCR ... its doing what would be expected...putting pressure on prices and tightening loose spending. I think theres likely one very large elephant that has been overlooked and thats how much available credit folk have given many would have sunk everything into RE ...Id imagine available credit would also be impacting retail... How many bought the house and headed off to EM TEN and engaged in 'the block home edition' renovations etc etc... Anyways fingers crossed folk can find utopia....

'Economists surprised by fall in retail spending', honestly? What kind of economists are these? If they have not heard, there is an inflation in NZ since six months, ergo people have less money to spend..

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.