By David Skilling*

‘It´s tough to make predictions, especially about the future’, variously attributed to Niels Bohr, Yogi Berra, & others

Last week’s note offered a summary view on the economic and political dynamics that will shape 2023, based on a paper that Mike O’Sullivan and I wrote. We discussed the ways in which structural economic and political dynamics would play out in the year ahead.

But outlooks for 2022 were quickly overtaken by events, most obviously Russia’s invasion of Ukraine in February. So to reflect the deep uncertainty that characterises the world, our paper on 2023 concluded with some ‘wildcards’. These wildcards are not predictions, but (in our view) plausible events. If we have learned anything over the past few years, it is that we should be prepared for the unexpected.

And in a period of economic and political regime change, we should be particularly careful about anchoring on recent experience. This note offers my thoughts on some of the wildcards that we identify for next year.

‘It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so’, unknown, but often attributed to Mark Twain.

Wild cards

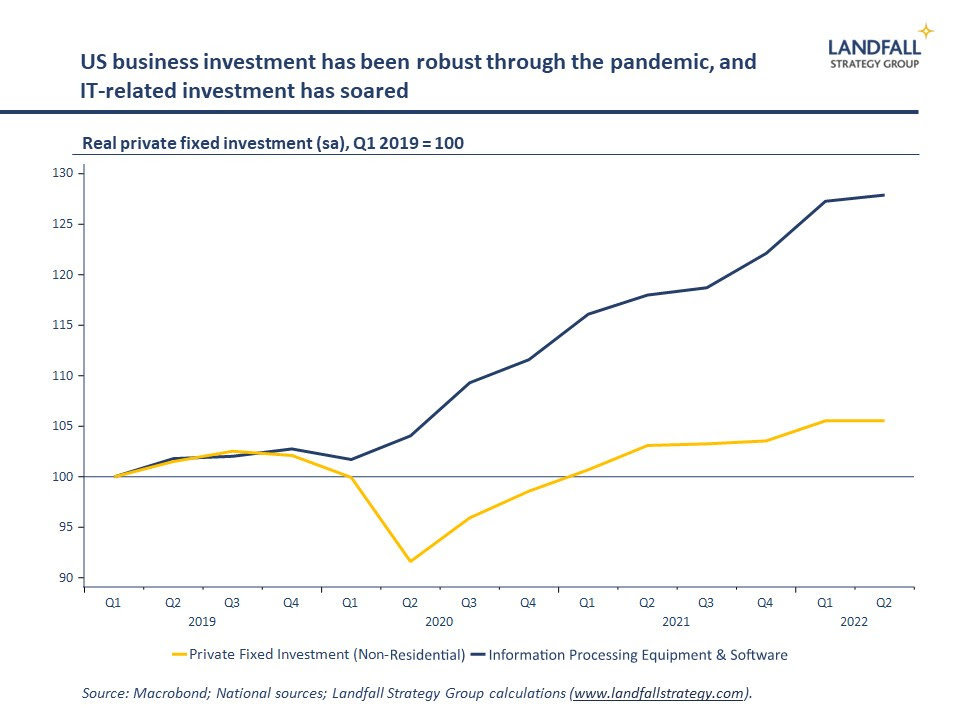

Sudden bull market on a stronger growth outlook due to a structural productivity renaissance. Behind the macro headwinds, there has been stepped-up business investment in innovation and new business models through the pandemic, technology advances (from AI and biotech to nuclear fusion and automation), and sustained increases in R&D spending. Some of these advances are happening more rapidly than expected: Chat GPT, a new AI chatbot, is just one striking example.

2023 and beyond could resemble the roaring 20s a century ago: an optimistic period characterised by a booming stock market, rapid industrialisation, and the widespread adoption of new technologies, such as the automobile and the radio. The 1970s shows that even in periods of disruptive economic and political change, technological progress can accelerate: the PC, the internet, CAT scans, and much else, were developed in the 1970s. [Disclosure: much of this paragraph was drafted by Chat GPT]

Technology stocks have been pummelled this year on higher rates and concerns about profitability. But we may be under-estimating the extent of productivity potential on the near-term horizon.

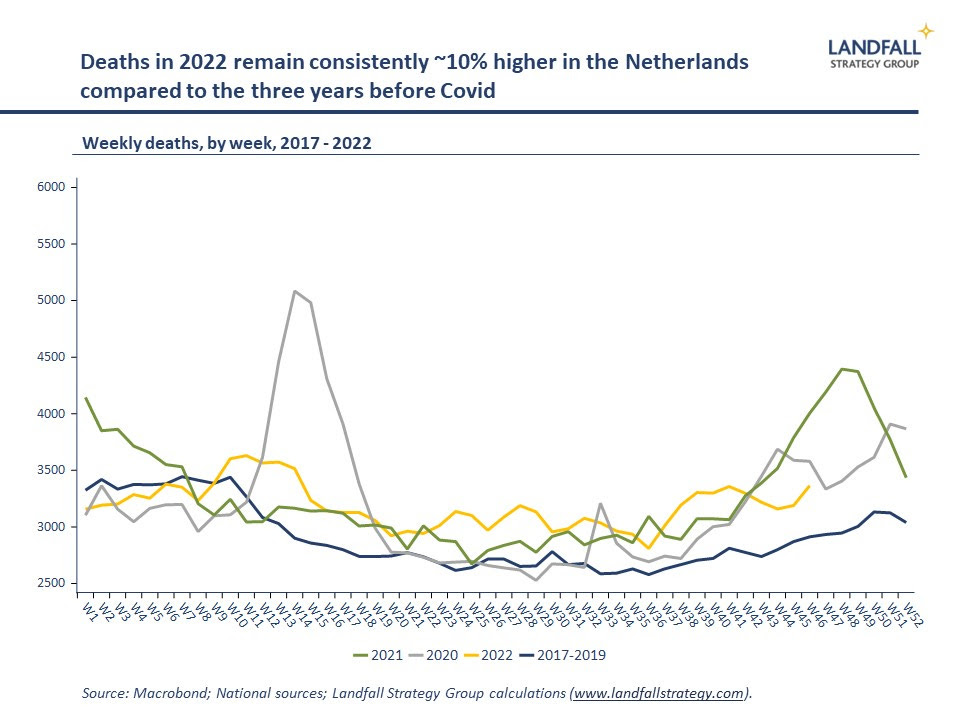

Covid’s back: The pandemic has become background noise in most advanced economies, with lockdowns and other restrictions removed despite ongoing cases. Covid no longer exerts a significant economic impact. China is clearly a different case, and it will struggle to extricate itself from zero Covid. But excess deaths - a useful proxy measure of Covid’s impact, given limited testing data - remain stubbornly high across many advanced economies: I use Dutch data in the chart to illustrate the point.

The big risk is that a more virulent and contagious Covid strain emerges, which is not effectively checked by vaccines. This would place substantial political pressure on advanced economies. Governments have limited political capital to reimpose lockdown measures. And weak policy measures could lead to very substantial economic and social losses – as fear takes hold in domestic economies to a greater extent and global supply chains seize up.

Tipping point on climate change: Extreme weather events are becoming increasingly frequent; through 2022, there was devastating flooding in Pakistan, European droughts, and much else. Attitudes and behaviour to climate change are moving gradually – even if the COP27 meetings did not make meaningful progress.

But further extreme weather events – perhaps causing significant loss of life in a G20 economy – could cause a tipping point in global public attitudes to climate change, leading to much more aggressive, fast-paced action to reduce emissions. The impact of the invasion of Ukraine on European energy prices shows that citizens are prepared to bear costs to change behaviours in the face of challenge.

Firms and economies that engage in emissions-intensive activities may have to move much, much faster to adapt than currently anticipated – with stranded assets and major new investment opportunities. Kim Stanley Robinson’s work of climate change fiction, Ministry for the Future, shows what this could look like.

The Eurasian Spring: Across Eurasia there is growing political unrest and instability. Russia’s economy initially held up better than expected in 2022, but its decline will likely accelerate markedly in 2023. Combined with ongoing evidence of military under-performance and institutional atrophy, regime change in Moscow is increasingly likely (although the end game is not necessarily liberal reforms).

This would accelerate the political instability around the periphery of Russia and across Russian regions. We may see countries in Russia’s near-abroad move decisively out of Russia’s orbit (note Kazakhstan) and for growing centrifugal pressures within Russia. Iran is another major source of political risk, as the regime continues to push back against protests. Major political shocks are possible across the region, which would spill into the global economy: this region is a central commodity exporting node in the global economy.

And China is perhaps the single largest source of domestic political risk. The combination of public anger around Covid lockdown measures, now being relaxed, combined with multiple economic challenges (perhaps reinforced by the likely public health toll from opening up), creates risks to political stability – despite the strong state apparatus. President Xi looked dominant in October at the CCP meetings, but there are fractures. And what happens in China doesn’t stay in China.

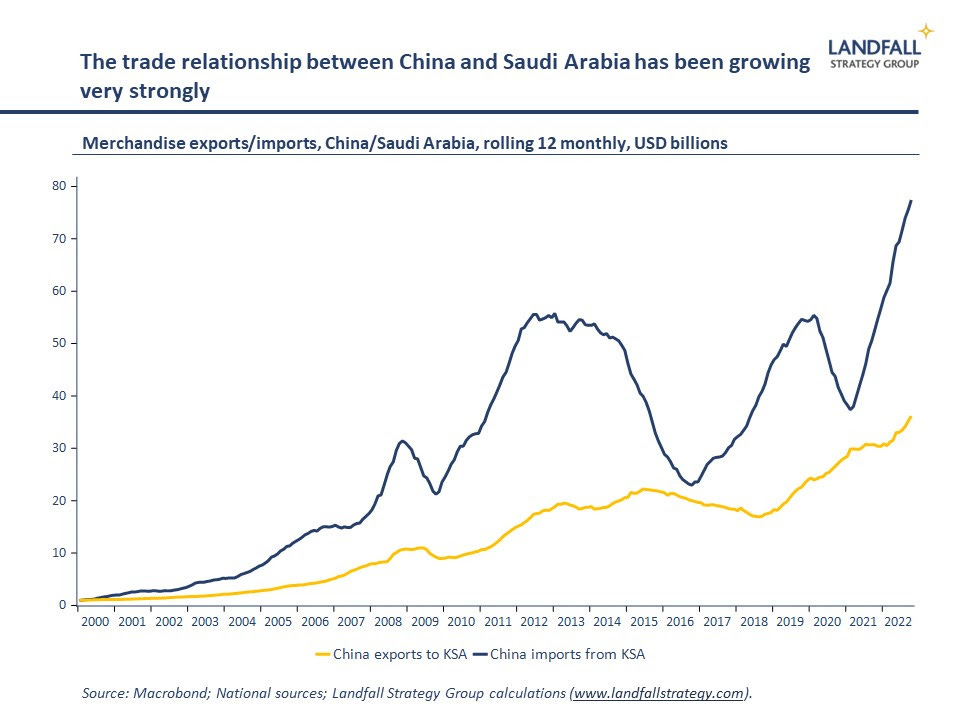

Reconfiguration of the Middle East: The Middle East was at the centre of economic and political regime change in the 1970s, most obviously the two oil shocks. And global regime change may manifest in the region again. Watch for the Gulf states to pivot rapidly towards Asia and carve out more independent positioning, starting with economic and financial relations. In hindsight, the World Cup and President Xi’s visit to Saudi Arabia may be turning points in the Gulf’s relationship with the West.

Combined with ongoing developments of Israel’s links with the Gulf states and the Arab world more broadly, a reconfiguration of Middle Eastern dynamics within the region and internationally is on the cards. Watch also for change in Iran’s behaviour in the region, perhaps with a measure of stabilisation.

Of course, this is just a partial listing. There are many other risks, from financial stability risks as rising rates place greater stress on the global financial system; to military conflict (note India/China border skirmishes this week); to cybersecurity issues (a virus of another kind); and so on.

Things not to worry about

Many of the unexpected events over the past few years have been deeply negative, from the pandemic to Russia’s invasion of Ukraine. It may be that we are overdue some positive surprises. Indeed, there are some risks in the headlines that we assess to be over-estimated.

Taiwan invasion: This is the biggest single geopolitical risk in Asia, with potentially devastating consequences. Some assess the timing of an invasion by China has been brought forward. But our sense is that this is unlikely in the near-term: the economic costs are a major deterrent, as are the observations of the Russian invasion of Ukraine.

Nuclear shock: We don’t expect Russia to use nuclear weapons, although North Korea and Iran will continue to develop nuclear weapons and delivery capabilities.

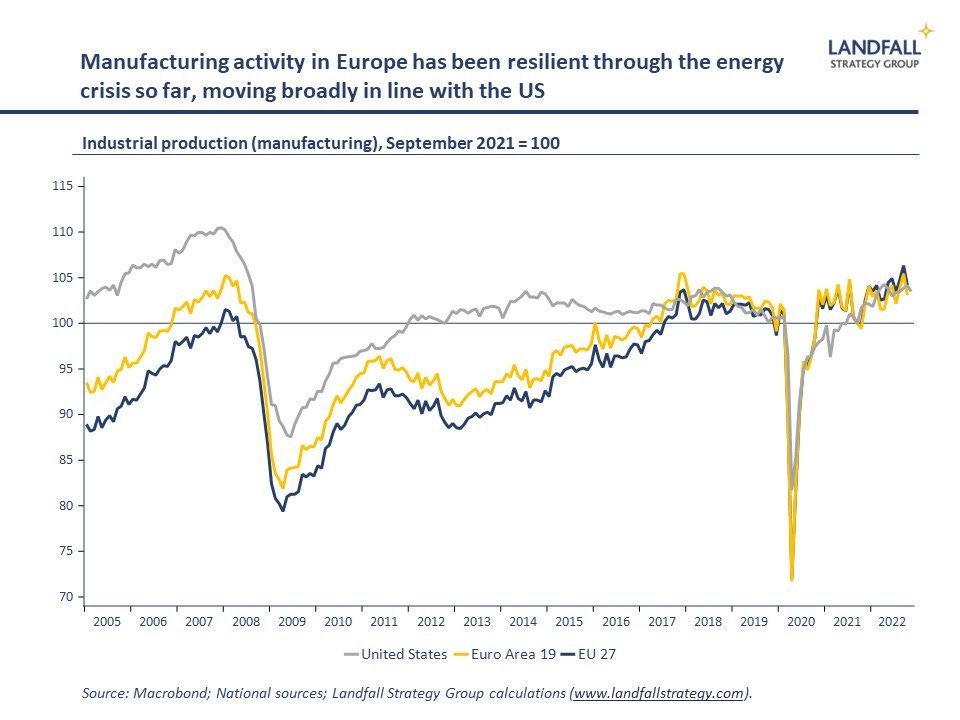

European crisis: Europe is exposed to many risks – from rising rates putting pressure on corporate and sovereign borrowers, to soaring energy prices causing deindustrialisation. But we assess the risks of a financial shock in Europe to be manageable, and European industrial activity is adapting well to the energy price shock so far.

Agility and flexibility in the face of these various risks will be crucial to performance, as will an ability to sift the signal from the noise. But first, a holiday…

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original is here. You can subscribe to receive David Skilling’s notes by email here.

**Get in touch (by reply email or at contact@landfallstrategy.com) if you would like to access the full paper referred to in the article above.

87 Comments

‘It´s tough to make predictions, especially about the future’,

Not really, he will get banned yet again, and then will yet again resurface under a different name. Maybe "The Messiah" would be befitting of his sense of self importance?

Jokes aside, an interesting piece David. Personally, I think the biggest risk in 2023 by far, is the fallout from much higher interest rates worldwide, I believe a world drowning in debt cannot survive these higher interest rates and something will have to give… probably being loan defaults !

Yes I agree Yvil , those 10% Interest Rates are going to be a Killer.

Yes I agree Yvil, and all the Central Bankers have said they are going to take rates HIGHER and keep them there for LONGER.

Central Bankers have been known to talk a strong game and then pivot hard in the opposite direction IT GUY...

Indeed! I also think interest rates are going to plummet again, probably late in 2023

Doubt we will see any significant lowering of Central Bank rates at all in 2023/24 - the echoes of the 1970's pivot/raise/pivot/raise/pivot/raise, then at the end ...still bloody high 15% inflation and BIG RAISES of interest rates to 20% to finally kill it. A lost 10 to 15 years - DO WE WANT TO REPEAT THIS AGAIN? This mess of the 1970s to early 80's - is the rulebook to learn from and not revisit.

We are in a "rising lid" of interest rate hikes and prepare for 8-10% or get out of the way of this Truck. It aint pivoting! If your exposed debt is in its way, it will be smashed.

The same people who said there would never be 7% Interest Rates This Year are also the same people who say there will never be 10% Interest Rates Next Year. They like to believe in Pivot talk and low interest talk. Its called Denial. The more overleveraged they are - the deeper the Denial.

Those that heed the warnings of The Prophet are wise. Making the same mistake twice is foolishness .

10% Interest Rates Next Year, Guaranteed !

It's sad how much effort you go to, creating multiple accounts, just to copy and paste the same crap.

It's nice how jazzed someone gets by working out there's another side to emergency interest rates.

As soon as the money got really cheap my first instinct was that in short order it'd get expensive once covid became endemic.

Are you changing camps Pa1nter ? Are you converting to the light ? Are you leaving the Darkness ? The Prophet is waiting for you with open arms !

Good time to acknowledge rates are going to 10% Next Year, Guaranteed !

There is a storm coming. Never ignore the warning signs .

https://www.youtube.com/watch?v=lPqXHhQX8eE

Which camp? The interest rates will never go up camp?

I don't know many people who've thought that.

Congratulations on predicting an economic downturn that's about 4-5 years overdue. That's still not even here yet.

Not sure who's getting jazzed Painter, always preferred rock myself...

The mess started by the fourth Labour government and intensified by that zealot Ruth Richardson is a bigger waste of resources and people - still to be corrected.

Unless central Banks decide to ignore inflation or substantially increase their approved inflation levels much above 2-3% then with an 18 month lag between rate changes and widespread effects late 2023 is probably the earliest public reaction will turn into actual results. My caveat however is reaction to substantial increases in the mortgage cost, say 12,000 on a 400k loan at 7% against 4 % interest and how this materialises in lower spending and defaults/arrears. Based on past events the reduced discretionery disposable income reduction will see effects in hospitality/entertainment/big ticket items and retail initially and increased unemployment will see this spread to all non essentials and a resultant reduction in tax take and increases in benefits plus reduced asset values and difficulty in realisation while Banks reduce lending and liquidity is generally reduced. Not looking good and typical of end times of a socialist govt.

A lot of people have little or no debt. We could see a new form of disparity, those without debt doing really well, those with debt really struggling (almost the opposite of the last 14 years where getting into debt was very prosperous). All due to those crazy low interest rates that always seemed like a dumb idea.

Interesting idea, could well be true! I'm certainly moving in the direction of reducing debt.

Loan defaults itself is not the damage, ironically it’s the health of the people that suffers - money printing and helicopter spending enabled the lockdowns without which, government wouldn’t have the cooperation of the masses. Our life saving actions have caused life damaging consequences.

“I believe a world drowning in debt cannot survive these higher interest rates”

Agree this is a massive risk. It’s hard not to see a near future with defaults. Rates may have to fall fast come 2024 as the current fear of inflation is quickly replaced with the fear of economic Armageddon.

A huge cause of this being the fast moving nature of our current environment vrs the long lag of the actual effects of interest rate rises.

Project for nz for 2023: For the love of god, we need more regular and up to date inflation and gdp statistics! Quarterly data reported months on from when it happened is no longer fit for our current world.

Very well said Jamin!

Have been a little busy this morning working on the hedge in readiness for the big day. Many people believe that hedges are a lot of work, always trimming and shaping and they're an unnecessary thing.

On the contrary, a hedge can be very beautiful and rather useful. Much like a financial hedge. Gotta have an insurance against tough times

You obviously don't have a few hundred metres of Macrocarpa.

You lucky bugger 😟, that sounds like a shelter belt. Battery powered pole trimmer works for us

You can do this one with a combo of large petrol trimmer and chainsaw. Over many weekends. Or pay some dude with a tractor and attachment to do it in like 2hrs.

Fast is best imo? Off topic but I have seen a digger used to rip off mac branches 🙃

Is Chat GPT actually useful or just a lot of hot air? Most AI has been disappointing in terms of actually having a good use case.

As with any AI there are limitations, input controls output. It certainly can’t predict or discover anything new, but having the wealth of internet information available at your fingertips is useful. Google on steroids.

Try it out - look for information about anything, or a how to guide. Consolidates the resources it has access to and saves you the time of “searching”. Some of the script or storytelling features are an impressive gimmick, not my thing though.

In saying that, foundations of this information come from people entering the information online in the first place. There’s your input source. It can’t “take over” in my opinion as it relies on a functional internet as is. You only have to look as far as the twitter AI bot to see the downside risks

I wonder if it’s another cool tech with little practical uses similar to crypto. Google is great for information. Normally I use chat for transactions like “you stuffed up my bill and it needs to be fixed”, it’s basically stuff that can’t be done through the standard website. The only way a bot can help with that is if it has an integration that the website doesn’t. If so why not just chuck it on the website instead.

I'm pretty tech-skeptical, and extremely skeptical of crypto, but this is different. There are industries that will be entirely displaced by this - mostly crap BA-graduate jobs, like churning out low-quality 'which chainsaw should I buy?' pieces for affiliate marketing sites.

It will have interesting consequences in education too - probably disastrous in the short term, possibly good in the long-term as institutions realise how crap their current methods of assessing ability are.

I've been using various AI tools for some time now (mostly looking at semi-automating content creation) and ChatGPT is a real step forward.

Your comment about job displacement is spot on. Most of my clients have either their own BA-graduates (or outsource via agencies that have hordes of them) creation of content for websites, social media campaigns etc. While some of these employees do good work and go on to do great things, many are producing work that is nothing more than plausibly-written, prettily-arranged words. Half the time, their work is just outsourced to people in low CoL countries and then edited or modified slightly (just recently I came across a supposedly reputable firm whose entire workflow went through four levels of increasingly cheap-n-nasty outsourcing before you could find the 'genesis' of any output)

After extensive testing over the last week, I'd say ChatGPT does a better job than 80% of entry level/junior 'content creators' - and ChatGPT doesn't call in sick, doesn't drink all the free booze at the work Xmas function and throw up in the charted mini bus on the way home, nor does it cost $60k plus per year in salary.

There are still problems in terms of it producing 'generic' content that hasn't got much in the way of insight or deep meaning, and there are some clear factual errors I have spotted. However, these are problems you get with human content creation anyway (especially at the more basic level)

In my test workflow, I can reduce a piece of content creation work that would normally have taken a late junior/intermediate employee around 1.5-2 hours down to no more than 30 minutes. I've already got an SoP/process set up for a business who was paying big agency rates for passable output to be able to produce something better using an in-house admin employee who is good at fact-checking and spelling/grammar editing (and who has a few spare hours a week). By doing away with that agency and using ChatGPT they will save around $15,000 per year and achieve better results.

Once you get past the novelty of making ChatGPT write a rap battle between Donald Trump and William Shakespeare about the fundamentals of junk bond trading, there is some amazingly impressive stuff it can already do - particularly with focused human oversight/editing. The downside is that the Internet will fill up with even more mediocre content than ever before as people just "pump and dump" with it.

I've also used it to produce some fairly complex Excel formulas for making reporting easier - by doing nothing more than describing the data (e.g. I have X in Y columns) and what I want the output to be, and the results have been astounding. Only once has the formula not worked to my satisfaction, and I've saved several hours this week alone.

Very interesting. That's exactly the kind of stuff I had in mind based on the examples I've seen (haven't played with it myself).

My optimistic take, as a wannabe writer who despises low-effort page-stuffing pablum, is that the people getting sacked will be those whose output was meaningless anyway, and employers might start paying attention to whether someone has the capacity for original thought or analysis or even just genuine comprehension of what they're reading. At the moment no one seems to give a shit, it's all undifferentiated content and SEO optimisation matters more than truth or readability. I can see us getting so swamped with superficially plausible AI content that an element of human skill becomes valuable again.

I'm not expecting that to happen, but it would be nice.

Write me a story about a progressive person named Jimbo that discovers the deep flaws with leftist beliefs and embraces libertarianism. This story should be written in the context of New Zealand and heavily use local colloquialisms.

Jimbo was a young, progressive person studying at the University of Auckland in New Zealand. He had always been drawn to left-leaning political ideologies and believed deeply in social justice and equality for all.

As he became more involved in activism and political organizing at the uni, Jimbo began to notice some disturbing trends within the left. Many of the people he worked with seemed more interested in virtue signalling and promoting their own agendas rather than having a meaningful kōrero or finding solutions to the issues they were protesting. He also witnessed firsthand the cancel culture that seemed to be prevalent among some on the left, with individuals being ostracized or given the flick for expressing views that were deemed to be unacceptable.

Jimbo began to feel disillusioned with the left and began to question whether his beliefs were truly aligned with the ideology he had been embracing. He decided to take some time out and have a good hard think about things. As he explored other perspectives and began researching different ideologies and ways of thinking, he realized that the left wasn't all it was cracked up to be. He saw examples of hypocrisy within the left, with people claiming to be against racism but then engaging in racist behavior themselves.

As he delved deeper into libertarianism and the principles of personal freedom and individual responsibility, Jimbo began to see the value in this way of thinking. He realized that libertarianism offered a more thoughtful and compassionate approach to social and economic issues, one that focused on empowering individuals rather than relying on the government to solve problems.

Feeling a sense of clarity and conviction, Jimbo made the decision to embrace libertarianism and began to actively share his newfound beliefs with his mates and community at the University of Auckland. Despite facing criticism and pushback from some on the left, Jimbo remained true to his principles and continued to advocate for individual freedom and personal responsibility.

In the end, Jimbo's journey towards libertarianism was a transformative one. He had discovered the deep flaws in leftist thinking, including the toxic nature of cancel culture and virtue signalling, as well as the hypocrisy and racism within the movement. He had found a more meaningful and fulfilling way of thinking that aligned with his values and beliefs. Jimbo was stoked with his decision and knew that he had made the right call.

It’s a nice story. Full of shit but it sounds great.

Jimbo has always been a right wing neo liberal who is so disillusioned by the right wing’s desire to live in the past that he has to vote left.

Jimbo - when you show me a successful socialist country full of happy wealthy citizens were those from the capitalist west attempt to emigrate too, then, voting left will become mainstream in capitalist countries.Those with an inability to understand cause and effect will continue to vote left and be surprised that their living standards remain lower than their capitalist neighbours. As Winston Churchill quipped capitalism/democracy is the worst system except for all the others.

The counter to that is even less people are interested in living in purely libertarian societies, because they're invariably lawless hell holes.

Hence we have social democracy as a dominant form of governing style.

From my personal experience, I would say that it is both overhyped, and has a lot of potential. It is quite fun to try out, but it has severe flaws at the moment.

Answers can be very repetitive, outright wrong, and once you try it out there are a lot of nothing answers with just lots of information spat out at you. In an actual production environment, in its current form, I would say it would be annoying and unreliable, but it's hard to deny it is a step forward as well. It frequently gives outright incorrect information, written in a way that sounds like a wikipedia article or other authority.

There is also the ethical implications of where the information is soured. They are not transparent about it at all, so probably safe to assume it has and will scrape all web data regardless of consent or content copyright.

Once you play around with it, you realise how incredible it is and how much closer we have just got to having an AI that can manage life for you. By starting a conversation about whether I was overweight or not, it calculated my BMI (and gave me a lecture on how BMI is not totally definitive), then moved on to calculating the calories I needed on a daily basis according to my personal situation, then it developed a 7 day eating plan that was lower than the number of calories it had calculated I needed so that it would be weight loss inducing. It remembered the data I had told it previously for input into new calculations so I didnt have to repeat myself, and it made changes to its output when I told it I didnt eat certain foods, or that I wanted it expressed in metric not US measures. It is a very powerful tool.

Its also been great at teaching economic and financial models - instead of you having to sift through three or four Google search results written on adjacent topics that might contain what you want to know, its like having an expert in the room who understands what your question is, and then step by step takes you through the answer, with the ability to expand your learning if you dont understand something or have further questions. Game changing!

If you’re not inspired with a sense of awe and wonder at GPT-chat then you probably haven’t comprehended what it actually is. It can, for example, create and debug complex c++ or python code from a plane language description. That requires highly abstract and complex reasoning with intuition and understanding. If it can do that then imagine what else it can do! Imagine if gets trained on all scientific literature. This is already science fiction manifected into reality.

https://m.youtube.com/watch?v=HTWfA7KFzoA&t=245s

Yes a Covid mutation cannot be ruled out. Big wildcard.

To your point on China

Beijing Crematorium’s Death Surge Points to Rising Covid Toll in China

BEIJING—One of Beijing’s designated crematoria for Covid-19 patients has been flooded with dead bodies in recent days as the virus sweeps through the Chinese capital, offering an early hint at the human cost of the country’s abrupt loosening of pandemic restrictions.

Beijing Dongjiao Crematory, on the eastern edge of the Chinese capital, has experienced a jump in requests for cremation and other funerary services, according to people who work at the compound.

“Since the Covid reopening, we’ve been overloaded with work,” said a woman who answered the phone at the crematorium on Friday. “Right now, it’s 24 hours a day. We can’t keep up.”

China has reported no Covid deaths in Beijing since authorities announced four deaths between Nov. 19 and 23. The information office for China’s cabinet, the State Council, didn’t immediately respond to a request for comment sent late on Friday.

The woman said that Dongjiao Crematory, which is operated by Beijing municipality and which the National Health Commission has designated to handle Covid-positive cases, was receiving so many bodies that it was conducting cremations in the predawn hours and in the middle of the night. “There’s no other way,” she said.

She estimated that there were roughly 200 bodies arriving each day at the crematorium, from 30 or 40 bodies on a typical day. The increased workload has taxed the crematorium staff, many of whom have become infected with the fast-spreading virus in recent days, she said.

Men who work at the compound, which in addition to a funeral hall includes a small complex of shops selling burial attire, flowers, caskets, urns and other funerary items, said the number of corpses had risen markedly in recent days, though none would offer an estimate of the magnitude of the increase.

One said that, typically, all the day’s corpses would be cremated by midday. But the recent increase in the number of bodies has meant that cremations are now taking place long after nightfall, he said.

In a series of abrupt moves this month, China dismantled much of the lockdown, testing and quarantine regimes that underpinned its “zero-Covid” approach for the past three years to suppress even small outbreaks of the virus.

Because of the lifting of testing requirements, the scale of China’s coronavirus surge has been hard to measure. Daily national case counts have steadily fallen as fewer people test themselves at public facilities, and health authorities earlier this week stopped releasing daily tallies of asymptomatic cases for the first time since the pandemic began.

Anecdotal evidence has pointed to an explosion in new infections, especially in Beijing, which is suffering through a cold snap. The public-health system is also under pressure, as large numbers of infected nurses and doctors reduce the ranks of active hospital workers. Sales of self-testing kits, fever and cold medicines and traditional Chinese remedies have jumped, prompting officials to warn against hoarding.

Some movie theaters in China reopened and Covid-testing booths were dismantled ahead of an announcement by authorities on Wednesday to scrap most testing and quarantine requirements. The changes come after nationwide protests against Beijing’s zero-Covid policy. Photo: Ng Han Guan/Associated Press

Earlier this month, the Beijing Emergency Medical Center urged only critically ill patients to call for ambulances, saying that emergency requests had jumped to 30,000 a day from an average of about 5,000, straining the capacity of paramedics to respond.

One of the men working at the crematorium compound said he had received a family on Friday in which the two parents, both in their 80s, had died of Covid within three hours of one another.

On Friday, a Beijing resident whose mother had died that morning recalled being told initially by Dongjiao Crematory staff that they couldn’t handle the corpse for two days. Later in the day, they said that they would be able to cremate the body that evening.

The Beijing woman wasn’t allowed to ride in the hearse with her mother because of pandemic restrictions, and followed behind in a taxi, she said as she watched crematorium workers dressed in head-to-toe protective clothing disinfecting corpses.

According to National Health Commission regulations, corpses diagnosed as Covid-positive or suspected of being Covid-positive must be cremated immediately in specially designated furnaces, with no dressing of bodies or memorial services.

The woman said her mother was 81 years old and had initially been hospitalized with a non-Covid disease. “At the hospital, if someone dies with Covid, no one would be there to dress them afterward,” she said. “Many of the nurses and doctors were already Covid-positive.”

Sales of self-testing kits, fever and cold medicines and traditional Chinese remedies have recently jumped.

—Qianwei Zhang contributed to this article.

Perhaps the grim reaper Karma is visiting Xi Jinpings China.

I predict that a National / Act coalition will be in power for Xmas 2023.

Sportbet paying National 1.65 Labour 2.2 (National have come in from 1.81 in a month)

I'll go 3:1 on National/Greens.

Interesting prospect, there is no more left/right only in/out.

Have you considered N/A/G? Doubt they’d need a threeway to get past the post.

Interesting reading online people believe the election is a foregone conclusion. I still can’t make my mind up on who to vote for. Luxon doesn’t even have any policies… aside from tax breeeeeaks for the rich and famooooous, speculators are blameleeeess, this will be paaaainlesss

The problem is we want big picture but there's too much of a mess to manage day to day.

Chuck a working group tasked with running BAU politics while government dedicates a new working group to fix forward. We need another working group to run an inquiry on working group A and report back to working group B. Since we can’t be sure the working groups are independent we need another working group to analyse the productivity of the three other working groups and given the job security of working group D relies on the necessity of failure, all three original working group outputs would be determined unfit for purpose, scrapped and started again.

Scratch that, let’s go with more lollies.

Meanwhile spend 50mil on a bike only harbour crossing working group.........

If Labour do get back in, the Housing market will Shite itself, full interest non-deductability is a certain under the Labour / Greens.

Unless you're renting to the government.

As is rent control.

National don't need any policies. All anyone wants at this point is just for basic things to work properly. We want criminals to go to jail so they cant keep committing more crimes, we want hospitals that can treat patients before they die in the emergency room, roads that you can safely drive on, and for the cost of food to stop going up 20% a year. Just fix all the broken things, or at least put them back to the way they were before Labour totally destroyed everything. Because for sure, life in 2017 was a heck of a lot better for everyone than life in 2023.

0% chance of Greens going into a coalition with National. I would bet every cent I have on that.

If it were up to the MP'S, could be . But its up to the membership to vote for any deal , and they won't go for it . Unless Labour really takes them for granted yet again .

Predicting elections (and Brexits) has often been the subject of the opposite happening in the last few years. Polls and voters have been found to be very unreliable. Lets see next years bribes first...........

People forget that Helen Clark was about to get the boot, but interest free student loans propelled her govt to a third term..... The election year lollie scramble may well tip the balance back in Jacinda's favour.

Maybe for the first time ever neither party will be able to bribe their way back into office. Any extra money on offer will be shouted down as "thats inflationary!" and "only vote for that if you want 20% interest rates and to pay $50 a kg for mince meat". Austerity should be what's on offer, and as per my comment above, all that is needed this year is for parties to promise to fix what is broken without spending more money, all of which is 100% doable considering how much the tax take has gone up over the last few years.

That's not really a prediction is it IT GUY ? As one ex commentator would say "Its Guaranteed next year"

i suspect they may have to rely on Winnie and if not Winnie then the Maori party

The covid mutation scare needs to be put in its box.

"Surely they were aware that, mostly due to the work of Professor Paul Ewald, the dominant belief in evolutionary theory about disease virulence is that it depends on the mode of transmission? Though sometimes lethal at first, respiratory diseases do evolve to become milder, while sexually transmitted, waterborne or insect-borne diseases (such as myxomatosis) don’t.

And ‘evolve’ is the right word, not ‘mutate’. The way medical scientists talk about evolution is sometimes alarmingly naive, as if random mutation is what drives it. No, no, a thousand times no: it’s selection. For example, I took a train this week, putting me at risk of catching Covid from a fellow passenger. But if two other people had been planning to travel on the same train, one with mild omicron and the other with severe delta, the latter would have been more likely to change their mind and stay home because of feeling unwell. That’s selection. The fiercest enemy of a virus is another virus. Omicron ousted delta at least partly because people with mild symptoms were more likely to go to work or parties (or not notice they were ill) than people with severe ones."

If you are one that believes in the fairy tail that covid came from a wet market, the fact that china is starting to breed thus eat crazy animals again, must make you worried that another virus will jump.....

https://www.theguardian.com/environment/2022/dec/15/chinas-return-to-wi…

I am more worried about another bio-leak, either accidental or terrorism

Too right - there were plenty of lab leak warning prior to 2019.

https://www.newscientist.com/article/dn25900-us-admits-security-breache…

https://www.theguardian.com/science/2014/dec/04/-sp-100-safety-breaches…

https://www.cbc.ca/news/canada/manitoba/national-microbiology-lab-scien…

Looking at tomorrow is always a challenge. Getting it right is the goal, but not always the outcome. Here at the ranch, we're just trying to get out of 2022 alive & well at the moment, with Mrs WJ reporting that she's tested positive for covid this morning. Lord, give us strength.

To summarise my earlier posts: Putin has to go. Preferably dealt with from within Russia itself, but I will accept any solution here. Then, Russia needs to be brought back into Europe somehow, otherwise China will grab everything. The EU needs that energy.

The EU itself is under threat from within its own borders. The corruption is beginning to leak out now & will only get worse, publicly. Europe's center has shifted East with Germany in particular letting the whole team down.

China too is showing signs of its toxic CCP leadership undermining all things. Think about what we know & then try to figure out what we don't know. My formula is to take what we know & then multiply that by 10. This is a conservative model.

The Americas are also finding ways to bring their own culture down to the lowest common denominator. South of the border decades of corruption have lead to millions of people trekking north, creating a border crisis beyond belief. MSM are asked not to cover this story, but on the ground it is massive in scale. It is not that hard to find details on this.

In the North things are being corrupted through their own educational institutions, MSM, the state itself (FBI) & lead by those in power behind the DNC (not Biden. He's just the puppet up front). The phrase "Our communists are better than your communists.'' is so true in this case. The illiberal-internal West has been far more successful at destroying itself than anything from the outside.

All in all, 2023 is shaping up to be another blockbuster chapter in how not to run a planet. Sigh.

PS: I hope I'm wrong. WJ.

Stay safe WJ, see if the Mrs qualifies for the anit-virals and get them ASAP if she does.

Agree on all you say above, it reads like the fourth turning.

There have been the odd comment on this website and elsewhere since the beginning of the Russo-Ukraine war that the main winner is the US and the EU is the loser, specifically Germany. The EU govts have manged to stave off weakening in the united front against Russia by massive subsidies. I'm wondering how long that'll last. No external publicised pressure on Ukraine to give up Crimea, Donesk and Luhans.

Perhaps the EU will wait out till Putins gone and hope that the a successor gives up the recently annexed land but allow Russia to hold onto Crimea.

There are no winners in this war, except perhaps the US using Ukraine as a proxy.

From Mr. Kunstler:

“Meantime, Mr. Musk has announced that Twitter is preparing the release of all its archives containing communication with federal agencies that sought to control and suppress truthful discussion of the pandemic 2020 to 2022. He added snarkily that his personal pronouns are “prosecute / Fauci” — in case there’s any misunderstanding about what he’s learned from the files.

What’s liable to come out of this uncorking of evil spirits in 2023 is a grotesque spewage of info about official corruption and misconduct that will make the projectile vomiting from The Exorcist look like a mere Satanic loogie in comparison. You have to wonder how the nation will handle it, especially along with the extremely uncomfortable fact that “Joe Biden” still occupies the White House.”

https://kunstler.com/clusterfuck-nation/truth-and-consequences/

.

I predict in 2023 a Dairy will be robbed and the owner will shoot/beat dead the robber, elect trial by jury and be found not guilty by self defence. Though at the speed justice doesn't work here it may be a 2024 trial.

The robbers family will say he was a good kid, just made some poor decisions.

Later we will learn these poor decisions involved previous multiple violence incidents, stealing cars, and ram raids. Gang affiliations will be hinted at.

Labour will say it's "Complex", and say all that is missing was "Wrap around support".

Jacinda will definitely not visit the scene or family of the victim. She will not visit the family of the dead kid either.

https://www.stuff.co.nz/national/300767728/machetewielding-robber-chops…

Interestingly I have a friend due to be a witness at court early Dec in a very minor criminal case started two years ago but due to a court work to rule the case is postponed to Aug 2023.

At this point, doing a few months home detention for possession of an illegal firearm is likely preferable to putting your life in danger working in a dairy.

"The impact of the invasion of Ukraine on European energy prices shows that citizens are prepared to bear costs to change behaviours in the face of challenge. "

Wrong. There are few costs directly on the citizens. Some minor behaviour changes, drop the thermostat by 2 or so degrees. Most of the direct costs are hidden by huge govt subsidies.I suspect there are and were many ordinary citizens who don't/didn't care whether Ukraine came under control of the Russians.

There's a sphere of influence most people are subjected to that has them caring less about others the more distant they are.

That said there should be enough of a memory in Europe of what happens when you let an autocrat Annex their way left right and centre.

Yes. One was allowed to "annex" Czechoslovakia and was handed it on a plate. Gave some breathing time for others to re-arm. Once Poland was invaded the Polish neutrality guarantee provided by Britain and France kicked in although it seems France had to be dragged in kicking.

France was permanently busy making white flags when they weren't on holiday, at lunch, off sick or protesting the bread crisis - ask Marie Antoinette who solved the problem by telling the peasants to eat cake.

The way the US Fed is tracking currently means we are in for a long period of higher interest rates for the forseeable future to reduce inflation to 2% ish. They seem very determined. Consequences for us of higher and higher interest rates to drop inflation by the 5% needed has to cause pain for people and businesses. A possible rerun of the seventies could be on the horizon and house values have to be one of the casualties.

The other thing people don't realise is the inflation targets are an average. So it may not even be a case of getting it to 2%, if it's running at 7% they could just as well drive it to -5%.

We’re you a house owner or a worker in the 70’s? I was both so I can say you are wrong in your assumption.

I bought my first house at the age of 21 with my fiancé aged 19 in February 71 for 4,950 pounds (mortgage 4,500). I was earning 23 pounds a week, my wife to be was a house maker. We married in June 71. Inflation and strikes were very bad if you check history. People thought we were mad to take on a mortgage of that size.

In April 72 we sold our first house for 10,500 pounds and bought a bigger house for 11,750 pounds (mortgage 5,750) My wages went up to 40 pounds a week. Uk was virtually bankrupt. In 1977 we borrowed a extra 2,000 to do a three bedroom loft conversation so we could take in students for income. I did the work myself in the evenings and on Sunday’s learning lots of new skills on the way. Saturday morning was overtime and afternoon was playing soccer.

Sold 2nd house February 83 for 47,000 pounds and bought bigger house for 60,000 pounds. My wages went up to 160 pounds a week and wife made the same from students. Uk described as sick man of Europe. I could go on but you said 70’s.

My take on this and I’ve always told young people this, inflation can be a house buyers best friend if you knuckle down. Inflation increases wages to make what looks like a huge mortgage into a small loan in no time and the opportunity to get a bigger house gets easier all the time. You have to cut things out, buy 2nd hand and maybe look for a second income, we took in students to cover extra mortgage costs and to pay for private school fees for our two children born in 77 and 79. We carried on like this and retired to NZ in December 1998 when I was just 49. Was it worth it? Well I’m still at it now, renovating a 1905 house in Wellington for $800,000 in 2017 with a value now $1,600,000 after dropping 300k this year. We have had a great 24 years in NZ getting involved as volunteers in all sorts of things and still do. Our target now is to provide a house each for our two grandchildren as our kids are already set up.

What would I say now? If you want a home, get it but plan for ways to bring in extra cash in the short term and in a couple of years you will be over the worst and it will then be plain sailing. Please choose wisely who you take advice from, somebody who has been there and done it all or a gloom and doom merchant with little real historic experience.

I have time write this as I was tested positive today and my new 2nd story deck has to wait a negative test, not bad for a 73 year old.

My 'black swan' pick for the local economy is extreme currency volatility.

I foresee a lot of reassessment of risk next year as markets adjust to a new higher-rate reality. Part of that will be taking a realistic look at the fundamentals of national economies. I think the NZD has been overvalued for a long time (look at our current account deficit) and at some point that penny will drop. Because our economy is so open and our institutions dislike intervention, the drop could be precipitous. I foresee us being an island of persistent and painful inflation even as it abates internationally.

I don't actually want to be right about this one, but I think it's plausible.

The value becomes relative though and NZ is in a better position than the majority of the world's countries.

Vis-a-vis government debt we’re in a decent position. That can change very very quickly though. I don’t see many other advantages..?

-Balance of trade less bad than many places

-Net creator of food calories

-Distance from conflict spots

-Decent rule of law/social systems/govt transparency

-Better population demographics

-Decent level of water and electricity security

That's not to say we are world leading or excellent in any of those areas, but again, currencies are priced relative to others.

My pick is for all the wild card events listed to occur in 2023 with the most destructive a high mortality rate SARs COV 2 recombinant variant with animals from the wild/farmed food trade out of China.

I have one last prediction for 2023

Gold out performs every other asset class in NZD for the year.

"But excess deaths - a useful proxy measure of Covid’s impact, given limited testing data - remain stubbornly high across many advanced economies: I use Dutch data in the chart to illustrate the point."

New Zealand continues excess death rate could also be used - 10% growth vs typical 1.4% YOY last decade.

From US data only children seem to be escaping the excess death rate.

"From April 2020 through at least the end of 2021, Americans died from non-Covid causes at an average annual rate 97,000 in excess of previous trends.

...While Covid deaths overwhelmingly afflict senior citizens, absolute numbers of non-Covid excess deaths are similar for each of the 18-44, 45-64, and over-65 age groups, with essentially no aggregate excess deaths of children. Mortality from all causes during the pandemic was elevated 26 percent for working-age adults (18-64), as compared to 18 percent for the elderly. Other data on drug addictions, non-fatal shootings, weight gain, and cancer screenings point to a historic, yet largely unacknowledged, health emergency."

https://www.nber.org/papers/w30104

https://www.stats.govt.nz/information-releases/births-and-deaths-year-e…

It’s likely to be a mix of factors: Covid is making us sicker and more vulnerable to other diseases (research suggests it may contribute to delayed heart attacks, strokes, and dementia); an ageing population; an extremely hot summer; and an overloaded health service meaning that people are dying from lack of timely medical care.

A Guardian political hitpiece with abligatory climate change thrown in. Excess deaths are seen across all advanced countries so can't blame summer. By her own analysis NZ shouldn't be seeing excess death.

Here's an example of scientific research with potential related to one of the listed wild cards 'Sudden bull market on a stronger growth outlook due to a structural productivity renaissance. '

' The validated prototype of the electrodialysis system showed an unprecedented CO2 capture flux of 2.3 mmol m−2 s−1, which is 100 times higher than the state-of-the-art existing CO2 capture technologies. The technoeconomic analysis predicts ∼$145 per ton of CO2 for 1000 ton per hour of CO2 capture capacity.' from https://pubs.rsc.org/en/content/articlelanding/2022/EE/D1EE03018C

My note - the $145/ton CO2 is 1/4 of the current price for carbon capture technology.

"Things not to worry about..." As J Powell said yesterday. Price Stability based on the CPI is his only concern. The markets can look after themselves, government policy is no concern of his and climate change is not in his brief. Price Stability is his only concern. Did I say Price Stability?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.