ANZ economists see the economy as "patchy rather than capitulating" and say while the Reserve Bank is banking on the economy rolling over rapidly "we’re not convinced things are quite that weak".

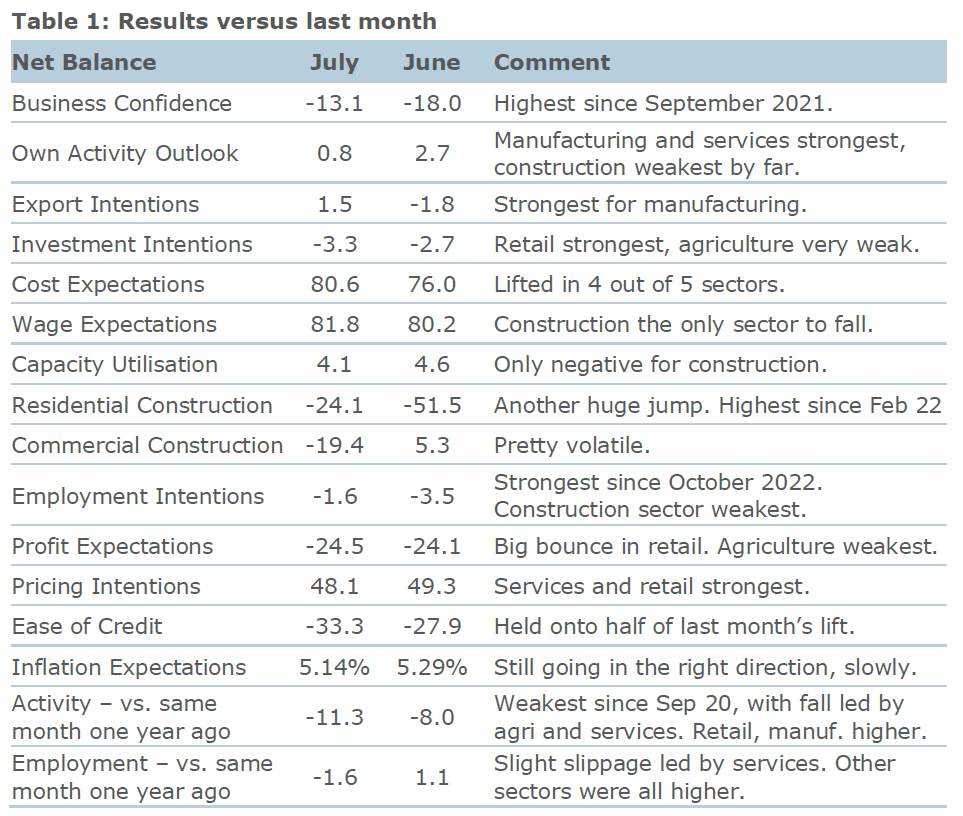

ANZ's latest monthly Business Outlook Survey shows that business confidence lifted another 5 points in July to -13, still in the negatives, but the highest read since September 2021. Expected own activity, a better indicator for the state of the economy, eased 2 points to +1.

ANZ chief economist Sharon Zollner said the economy is slowing, "but certainly not coming to a sudden stop".

"Activity indicators were a mixed bag in July, but broadly, the gains from the previous month were more or less maintained.

"Lifts were seen in business confidence, export intentions, and residential construction intentions, but expected own activity slipped. Little changed: employment intentions, investment intentions, capacity utilisation and profit expectations.

"Inflation expectations and pricing intentions continue to ease slowly but steadily. The proportion of firms reporting higher costs did tick up slightly, but to put it in context, this question saw the biggest fall last month. The downward trend remains intact."

Zollner said firms remain wary, with most activity indicators subdued. At the same time, though, most indicators are well off their lows of late last year.

"The RBNZ is banking on the economy rolling over rapidly; we’re not convinced things are quite that weak.

"Fiscal stimulus, population growth, solid household income growth, and now a bottoming housing market, are meaningful offsets to the lagged impacts of tighter monetary policy, weakening export demand, and cost-of-living pressures.

"We are forecasting a recession and associated rising unemployment – we could hardly be accused of wild optimism. But we’d characterise things as currently patchy rather than capitulating," Zollner said.

Looking further at some of the detail, Zollner said a net 62% of firms in the retail sector expect to lift their prices in the next three months. That’s high, but it’s the lowest read since March 2021.

In terms of specific numerical estimates of where firms’ own selling prices will be in three months’ time, the average read was markedly lower at 2.4%, "and they are trending lower across all sectors".

The economy-wide cost measure ticked up slightly from to 4.3%, with lifts for agriculture and services offset by falls for retail, manufacturing and construction.

"The data imply that on average, firms continue to expect margin compression, given costs are expected to lift more than prices over the next three months," Zollner said.

"Wage growth is a key determinant of the persistence of non-tradables inflation. Reported past wage increases (versus a year earlier) fell to 5.5%, easing in every sector.

"Expectations for wage settlements for the next 12 months ticked down to 4.1% and continue to trend lower.

"Overall, a net 82% of respondents reported expecting to raise wages over the next 12 months. That’s up slightly from June, but well off its peak of 94% in June last year.

"Firms continue to anticipate that they will raise wages by considerably less in the next 12 months than they did in the last."

Business confidence - General

Select chart tabs

24 Comments

Let’s see if improved expectations on residential construction are maintained (I doubt it). Maybe the ‘green shoots’ narrative is having some of its desired effect.

The Govt is underwriting all the developments again, so why wouldnt they be feeling happy?

Might be a factor, but isn’t there a relatively limited pot of money? Among quite a few developers, I don’t know any who have taken that up. I assume there are price ceilings.

I think the green shoots narrative might be more of a factor. People in the development sector tend to be very optimistic, often dangerously so, some might be buying into the narrative.

I'm definitely getting a sense that there's a new tranche of government money being released into the sector, although not just for housing. Really large surge in govt projects and tendering going on.

Kainga ora?

KO and MoE, from where I sit.

Wouldn't be an election coming up in a few months would there ? Gee 6 years and Labour are finally doing something ?

The money coming through now was likely earmarked a year or two ago.

CPI is in for a hard time, and along with it, the OCR.

Arbitration panel recommends 14.5% pay increase for secondary teachers

National…” Let’s tarseal this!”

Transport unfortunatly is important. Look at the impact on the Coromandel, Northland and the East Cape/Hawke's bay from the road outages. No food, no fuel, no traveling to holiday destination, no stock movement, no traveling to a hospital services only available elsewhere, and on and on.

Coastal shipping as a fall back position is not there, so what is the alternative?

Building more and more highways ain't a long term nor sustainable transport policy.

Why not?

What would you suggest for a transport solution between population centers the size of Tauranga or Hawkes Bay?

With EVs, autonomous vehicles (in the future), improving battery tech is roading not the best solution for NZ?

Clearly you're meant to buy your EV, receive some free money for doing so, and then park it in your garage never to use it.

I'd love to see the likes of proper passenger rail transport between major centers (but realistically we can't afford it as a country - or maybe we can't think on a big enough scale any more? Also what's the point if it isn't very fast), I ride an eBike most places around town, but the roads are crap in many places and if we are all going to drive EVs and hybrids we may as well have good roads to use them on.

horse and cart, essential travel only!

Again, genuine question, what is the alternative

There's no doubt that we need a reliable roading system (that is futured proofed for more extreme weather) given our relatively sparse population density, but have National allocated any significant funding into public transport, namely rail, over the past 40 years?

No. The Nat's sold off the rail and Cullen massively overpaid buying it back when you factored in the deferred maintenance. Was this a favor to the South Dunedin Rail union members who had always voted for him remains a talking point. Nat's did have a bunch of key roads underway that the Lab/Greens killed off, the East West Link being an example. Yes its for trucking supporting the inland port which is rail based. Personally id love less trucks on the road but rail cant go everywhere.

Don't we need an integrated strategy of Rail and Trucking?

Well you would be wrong. Look we were promised flying cars by now but pigs might fly. A poor roading infrastructure is costing us billions in Auckland in lost time, wasted gas and productivity. Should have had a 4 lane carriage way from Auckland to Wellington back when you could afford to build it.

“… not quite that weak”…. yet.

There are a number of negative mentions in that table in relation to construction. Not only will we not be building houses, lots of those people will go overseas and free up houses. The flow on from that is huge.

IMHO GFC 2.0 is still on the cards. Construction will be the biggest influence.

I'd be surprised if it saw an exodus over 10,000 people in construction. Probably much less, and new household creation will outpace it.

You'd be more likely to see more early retirement than emmigration.

New house creation for 2024 will be low. Very low.

it’s going to take a period of adjustment before things get moving again. Land value, lending restrictions and Rates, and construction costs all need to find some for of equilibrium again.

New household, not new houses, i.e. formation of 1 or more individuals that need to live somewhere.

Exactly.

Might start picking up again in 2025

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.