"Goldilocks is in the building," according to the results of the latest ANZ Business Outlook Survey, which shows rising levels of business confidence and activity, but falling inflation indicators.

"While activity indicators are still at subdued levels, they lifted across the board. But we can have our cake and eat it too, for now, at least: inflation indicators continued to ease," ANZ chief economist Sharon Zollner said.

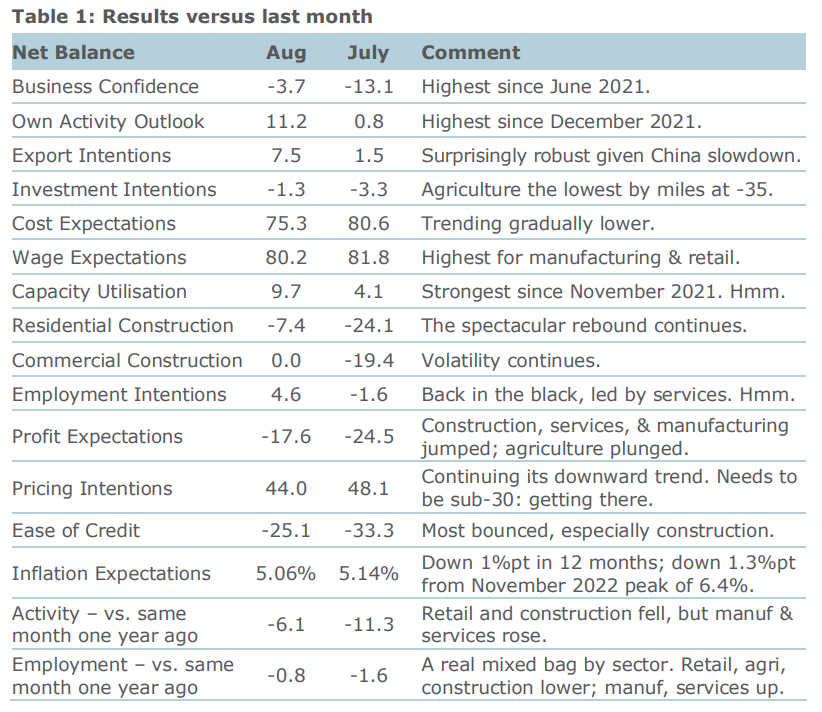

Business confidence lifted another 9 points in August to -4, the highest read since mid-2021. Expected own activity also jumped 10 points, to +11.

"Things could be (and were) worse, according to what firms are telling us in our survey," Zollner said.

"Many firms appear to have been pleasantly surprised at how well demand has held up, considering; and the Reserve Bank has stopped raising the Official Cash Rate (while reserving the right to change their minds), which may be creating a sense that the worst is over."

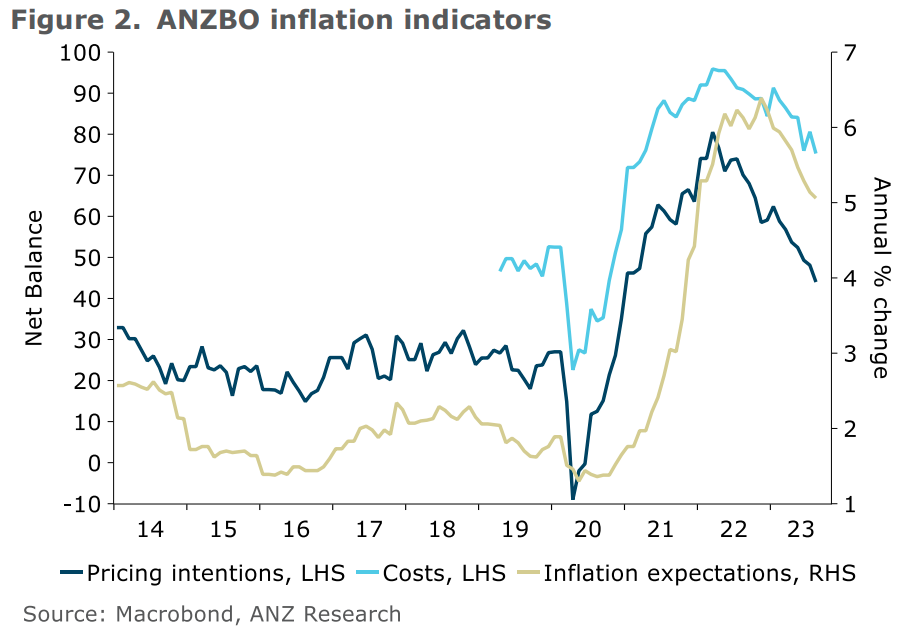

Zollner said despite a reported lift in capacity pressures, inflation expectations and pricing intentions continue to ease slowly but steadily.

“Higher activity but easing inflation pressures speak to a positive supply shock. This year’s surge in labour supply certainly fits that bill, but there will inevitably be demand impacts from net migration too, particularly in housing, and the net inflation impact remains a matter of conjecture.

“Pricing intentions are trending lower in a broad-based fashion. Firms’ views on where they see their own selling prices will be in three months’ time fell to 2.0% (from 2.4% in July).

“Firms’ expected costs in three months’ time relative to today eased from 4.3% to 3.6%, continuing its downward trend. A small tick higher for manufacturing and construction was outweighed by falls elsewhere.

Zollner said the data imply that on average, firms continue to expect margin compression, given costs are expected to lift more than prices over the next three months.

“Expected cost increases are now virtually identical to expected wage increases, whereas over 2022, other costs (physical inputs, transport costs, rent, compliance costs etc) were expected to rise even faster than expected wages, dragging up total expected cost increases."

Zollner said that as a key component of both firms’ costs and household incomes, wage growth is an important determinant of non-tradables (domestic) inflation. Reported past wage increases (versus a year earlier) ticked up to 5.6%. On the other hand, expectations for wage settlements over the next 12 months fell from 4.1% to 3.7%.

“Workers are much easier for firms to find but unemployment is still very low, and inflation signals are dropping away very tidily.

“The agriculture sector is certainly in a very different world, with prices and expected profitability plummeting, but on the other hand the construction sector appears to have taken real heart from the turnaround in the housing market.

“Does it add up to enough to get inflation all the way down to the target band sustainably? Here’s hoping."

Business confidence - General

Select chart tabs

11 Comments

Is there a link to the report somewhere and who they speak to (and how many people they speak to)? From everything I know, residential construction sentiment is still sickly.

A possibility is some are believing the hype around migration etc. And hope with a likely new government?

It’s ‘confidence’ after all (which doesn’t always reflect current or very near term business activity)

Hasn't construction been on steroids. Happens once in a blue moon

I'm not sure who they speak to. For me, sales down 20% yoy. Wages, lease and 3pl costs up significantly. Margins getting squeezed as pie gets smaller fast. I don't see much upside for at least 18 months.

Yeah exactly. Since it’s ‘confidence’ maybe as I say above some are getting a bit more (false?) confidence with a likely change of government.

Latest Tax revenues are suggesting otherwise!! I believe that with being honest in those surveys, businesses fear to fuel the pessimistic mindset so, they remain overly optimistic and that might not be according the current reality.

My unscientific survey results talking to clients would indicate the opposite (sales down, leads drying up, costs up etc) however there is a weird sort of undercurrent of 'if the government changes she'll be right' and maybe that is reflecting here?

That is one theme I have picked up on in some recent business meetings, and particularly networking/group events.

Did they ask the local kebab shop? Doubt they will be saying that people haven’t significantly cut spending. People don’t go from 2.25% to 5.5% mortgage payments without significantly cutting back. KiwiBank has a much more accurate view when it comes to this general picture and what it will mean for OCR.

ANZ are definitely on a bit of a mini spruik right now. Of course done ever so subtly

The banks have good reason’s for talking up economy, every week we get more data saying opposite, to name a few NZD tanking, China with many problems, rates will be staying around this level for a while, inflation nowhere near 2% target, crime and poor living standards for huge amount of population.these are facts many more like house price’s crashing 20% many small shops in towns up and down the country going out of business.

Stop ruining the perpetual economist doom narrative guys. What happens if the sun doesn't rise tomorrow, the tides don't go in and out or people just refuse to buy anything.

Finally the economists will get the recession they've been calling for the best part of a decade.

Goldilocks? More like little Red Ridinghood. Suspect these numbers are a wolf dressed in granny’s outfit - consumers find it hard to stop consuming - if the numbers were reporting productive sectors only then the data would be much worse - which means sooner or later the consumers will have no choice but to stop spending - but they must still have some gas left in the tank for now.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.