Food prices have fallen for the third consecutive month, according to Statistics NZ.

Seasonally-adjusted prices fell 0.2% in November 2023 compared with the previous month.

This took the annual rate of food price inflation down to 6.0% from 6.3% in the previous month. And while that might sound quite hefty, it's down from a peak of 12.5% earlier this year and is the lowest annual rate since January 2022.

In terms of the monthly prices, Stats NZ said the fruit and vegetables group was the largest contributor to the monthly fall, driven by seasonal price falls in tomatoes, capsicums, and strawberries. Fruit and vegetable prices fell 3.4% in the month. Fruit prices themselves actually rose 4.9% but vegetables more than offset that with an 8.5% drop.

“We are seeing more food items fall in price than a year ago,” Stats NZ's consumers prices manager James Mitchell said.

"In November 2023, 46% of food items fell in price, while in November 2022, 27% of prices decreased."

Mitchell said the largest contribution to the annual change was grocery food, mainly driven by higher prices for fresh eggs, lollies, and peanuts.

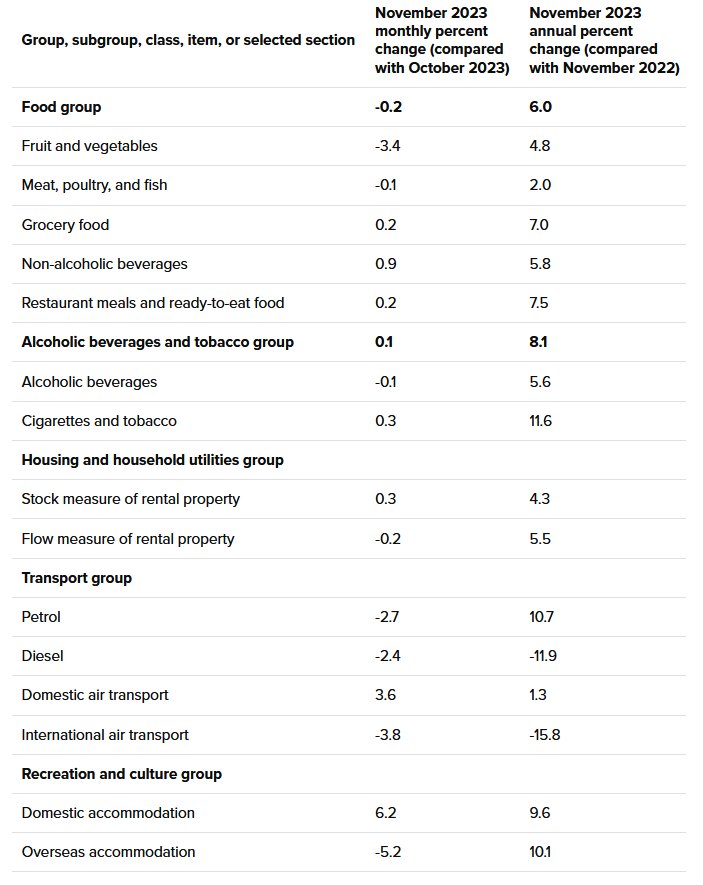

In November 2023, the annual increase was due to price rises across the five broad food categories measured by Stats NZ. Price movements for all five groups for the 12 months to November 2023, in order of their contribution to the overall movement, were:

- grocery food prices increased 7.0%

- restaurant meals and ready-to-eat food prices increased 7.5%

- fruit and vegetable prices increased 4.8%

- non-alcoholic beverage prices increased 5.8%

- meat, poultry, and fish prices increased 2.0%.

Restaurant meals and ready-to-eat food was the second largest contributor to the annual increase.

"Getting a meal from a restaurant or café and grabbing a takeaway has continued to get more expensive," Mitchell said.

The food price release was for the second month included in the new Selected Price Indexes (SPI) data series that Stats NZ has started producing to give more timely inflation information.

The SPI contains information that makes up around 45% of the Consumers Price Index, New Zealand's recognised measure of inflation. It's not a replacement for the CPI, which will continue to be issued quarterly, but is intended to provide more timely information in advance about inflation.

This new data series from Stats NZ replaces the separate releases that were formerly issued monthly for food prices and for rents. In addition to the new monthly price indexes for food and rents, Stats NZ will now publish monthly indexes for petrol and diesel, alcohol and tobacco, airfares and accommodation. The data is all backdated to 2011.

Highllights includes a (presumably seasonal) spike in both domestic airfares and domestic travel accommodation.

Rentals have been rising strongly. The latest month showed a perhaps surprising 0.2% fall in the 'flow' measure of rents, which measures costs of new rental agreements. This compared with a 0.4% rise in the previous month.

In terms of annual rent movements, the 'flow' rate dropped to 5.5%, down from 6.1% in October and a peak of 7.2% in September. In Auckland the annual 'flow' rate dropped from an eyebrow raising 9.4% as of September, to 8.5% in October and now 6.7% in November.

The 'stock' rate measuring existing rental agreements has continued to slowly push up, reaching an annual increase of 4.3% in November up from 4.2% in October.

Fuel prices fell again.

ANZ's economist Henry Russell and senior economist Miles Workman said recent inflation data "has suggested the skew of near-term headline inflation risks has shifted to the downside".

"However, the bulk of these downside risks reflect the more volatile CPI components of which the RBNZ has little or no influence over. Falling food prices as supply capacity recovers from earlier severe weather disruption, the increase in airline capacity into and around NZ, and sharp falls in oil prices in the past few months all could see tradables inflation become a large drag on headline inflation in the coming quarters.

"Just as tradables inflation was the culprit for the initial surge in inflation earlier in the pandemic, it has been responsible for most of the fall in headline inflation to date, and to a large extent has masked a still sticky domestic inflation impulse.

"For the RBNZ, disinflation from any source will be welcomed. However, until the RBNZ sees meaningful progress on getting core and domestic-driven inflation down, there isn’t likely to be much cause for celebration. We are expecting non-tradables inflation and core inflation to moderate in the near term, but still see upside risks to the RBNZ’s medium term inflation forecasts.

"That said, all else equal, faster falls in headline inflation should buy the RBNZ time, and keep them on the sidelines come February, but it is unlikely to materially change the medium-term monetary policy outlook just yet, where we see the OCR remaining at current levels until early 2025."

Here's the main movements:

Meanwhile New Zealand’s Grocery Commissioner is challenging supermarkets to step up and offer meaningful savings for Kiwi households this Christmas and New Year holiday season, to help address cost-of-living pressures.

Given large increases in food prices over the last two years – which has had a substantial impact on household living costs – Pierre van Heerden says there is a real opportunity for the major players in the $25 billion supermarket sector to “bring some Christmas cheer” to Kiwi consumers by offering genuine and meaningful savings – particularly given those players would benefit from increased consumer spend at this time of year.

van Heerden says he is encouraged by some of the pricing commitments he is seeing promoted in the sector for the Christmas and holiday period but wants to see those backed up with “genuinely good prices”, particularly at times when demand will be highest.

“We know this has been a particularly challenging year for Kiwi consumers with cost-of-living pressures, so I’m asking supermarkets to implement Everyday Low Pricing (EDLP) throughout the holiday season rather than the practice of frequently moving prices up and down – to help ensure Kiwi consumers are getting a genuinely good price when they shop for their groceries.”

19 Comments

Rate cuts are coming!

How do you figure that? Orr has been pretty clear about creating demand destruction and that includes food. Inflation suggests that has not occured.

If we keep getting disinflation, eventually Orr will need to consider the possibility of falling under his 2% target. The last thing we need is a massive switch from 5% OCR to 0%, he needs to react slowly in advance.

I wouldn’t be surprised if the next CPI figures suggest annualised inflation is well down, perhaps already at 2%.

Yes, in the second half of 2025.

Yes, Jesus is coming too. Just need to wait…and wait…

…and wait.

Lower Much Faster is a good term to use Piggy. Add a popcorn for the spectacle as well 🍿

Food price inflation in USA October 2023 YTD 3.3%

A bit of supermarket competition goes a long way.

Don’t they annualise their inflation figures though? If we annualise the last 3 months then our food inflation is negative.

House prices over there are also still rising. They didn't crash lie NZ, because people couldn't afford to sell their house otherwise they would lose their lower 30 year interest rates, meaning far less propeties on the market, creating a supply shortage. NZ is using immigration to try and get house prices rising again

ANZ see OCR cuts in 2025.....

Their record of accurate predictions is paltry in the last 3 years. I guess if they make enough of them they are bound to get at least one right sometime.

Lower Much Faster 🍿

Food prices FELL in the month. Where’s the doomsayers now. We keep on this track (with full impact of interest rates yet to hit) and we will be screwed.

February cuts 50bp

Inflation still WAY outside of the target band, could take another 12 months to see a cut. My prediction is still the first 25bps cut in August 2024.

You are probably about right. But let's say the next CPI showed quarterly inflation of 0.5% which is ~2% annualised, then a 0.5% cut is on.

- May 2023 - food prices 12.5% annual rise

- November 2023 food prices 6% annual rise

- May 2024 food prices 0% annual rise ?

- November 2024 food prices -6% annual rise ?

Interest rates haven’t changed since May 2023. If we keep the same track until August next year, our economy is going to be in the wharepaku (toilet).

The RBNZ will want to see at least 3 or 4 months data even after it hits the target. Even if things are looking good by May next year, don't expect any changes. I just don't see them making the same mistake twice, rates are not going to crash unless there is a major global event.

The mistake last time was waiting too long before increasing the OCR. Making the same mistake twice would be waiting too long to start making cuts. Manoeuvring the economy is like steering the Titanic - if they wait until we're a few metres from the iceberg it'll be too late to avoid it.

Exactly.

Managing inflation through the OCR is not a quick fix.

It’s like being beaten to death with a sledgehammer but very slowly. We need to ease off on the sledgehammer now before we flog the dead horse any longer.

6% on prices that have risen rapidly already, huge amount of inflation still.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.