The latest ANZ Business Outlook Survey is showing that businesses are expecting better conditions in future - but the here and now is still not great.

ANZ chief economist Sharon Zollner said forward-looking activity indicators generally lifted in June as tariff noise subsided, as signalled last month by the more positive responses seen in the latter part of May.

"However, in terms of what firms are experiencing, things remain pretty soft. Economy-wide reported past activity fell marginally. The upward trend in reported past employment has petered out," she said.

"Pricing and cost expectations are still too high to be called consistent with the RBNZ’s [Reserve Bank] inflation forecasts. However, inflation expectations are well behaved."

Zollner said it continues to be a difficult business environment for many.

"Costs are still going up and margins are being squeezed, with low turnover and a highly competitive environment making it very difficult to recoup margins."

Dark clouds globally are impeding risk-taking, though there was a rebound in many forward-looking activity indicators that was presaged by the intra-month data in May, Zollner said.

"While economic growth in Q1 [the first quarter] was decent at 0.8% q/q, the omens for Q2 are not looking nearly so positive.

"We continue to expect that the RBNZ will deliver more easing than the [RBNZ Monetary Policy] Committee currently expects as the domestic recovery underperforms their expectations, though we acknowledge that the Committee seems of a mind to tread more cautiously in terms of the speed of delivery as it monitors the state of play."

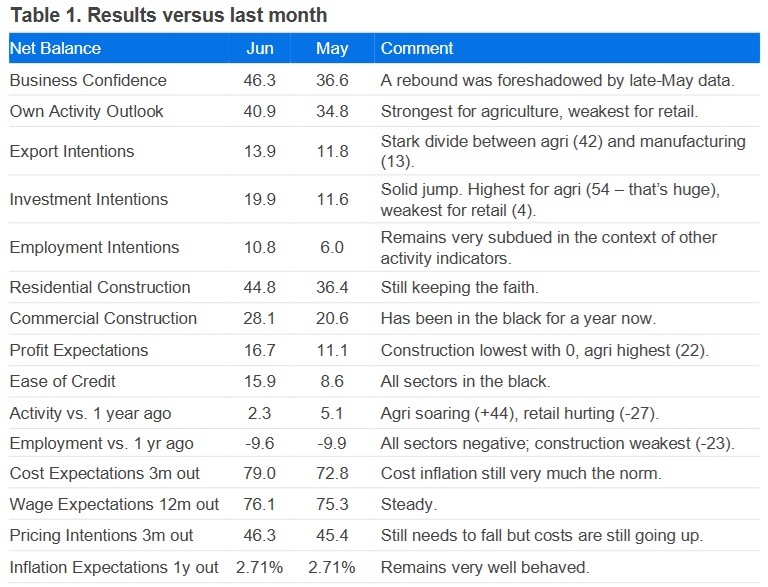

In terms of the detail in the survey, business confidence jumped 9 points to a net 46% in June expecting better business conditions, and expected own activity rose 6 points to net 41%, as the global tariff turmoil faded.

However, past own activity fell 3 points to 2, and past employment was flat at -10, both very subdued.

The net percent of firms expecting to raise prices imminently was up 1 point to 46% and the equivalent cost measure rose 6 points to 79%. One-year-ahead inflation expectations were steady at 2.71%.

Every three months the survey asks firms directly what is driving their investment decisions.

"Since we last asked the question in March, amongst firms planning to invest, central government policy has increased as a driver and is now the second most important reason for investing (presumably related to the Investment Boost in the May Budget).," Zollner said.

"Amongst those respondents who are planning on investing less over the next year, the domestic economic outlook has become more important, the global economic outlook has become much more important and is now taking second place, and geopolitical/tariff uncertainty has increased and is the fourth most important perceived impediment."

In terms of the biggest problems facing firms, competition and low turnover continue to be the biggest, while interest rates are receding as a direct issue – but have contributed to the low turnover in many instances, particularly retail and construction.

"It’s fair to say the agriculture sector is less weighted down by problems than other sectors currently, based on their broader survey responses," Zollner said.

Business confidence - General

Select chart tabs

3 Comments

ANZ also asked firms what drove their investment decisions - a question asked every three months.

"Since we last asked the question in March, amongst firms planning to invest, central government policy has increased as a driver and is now the second most important reason for investing"

Of course it's all down to the 'investment boost' not fiscal policy. Please don't say anything about fiscal policy - in the NZ economy it is not something we talk about. In fact I don't think government is a thing in the economy at all - they just do unimportant things from an economic perspective. Lets move on.

"Profit Expectations - Construction lowest with 0." Please don't mention that Kainga Ora was building 6000 homes per year. Obviously, stopping that dead in it's tracks had absolutely no impact on an already struggling sector. So need to go on and on about it.

No - it's all because of interest rates being too high. The 12,000 jobs lost in construction had nothing to do with fiscal policy. There's just no way that halting current and future home builds at a rate of 6000 per year had any impact on the construction sector. Why would it?

It's just woke nonsense to think that. We obviously don't need more houses or the private sector would be building them and we are saving a lot of money by not employing and paying 12,000 tradie's who've lost jobs over the last 2 years.

That's a big win for NZ's economy - anyone can see it. This is obvious economic common sense.

The latest ANZ Business Outlook Survey is showing that businesses are expecting better conditions in future - but the here and now is still not great

ANZ says "expect to get better" in every survey they put out. It's the old even a broken clock is right twice a day scenario.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.