Air New Zealand (AIR) is forecasting pre-tax earnings for the first half of the new financial year to be only about $34 million - the same as for the second half of the just completed year - as it continues to grapple with engine maintenance requirements and a stuttering NZ economy.

Our national carrier says it is "well positioned for recovery when the engine challenges and economic conditions start to alleviate, but these issues continue to have a significant impact on current financial performance".

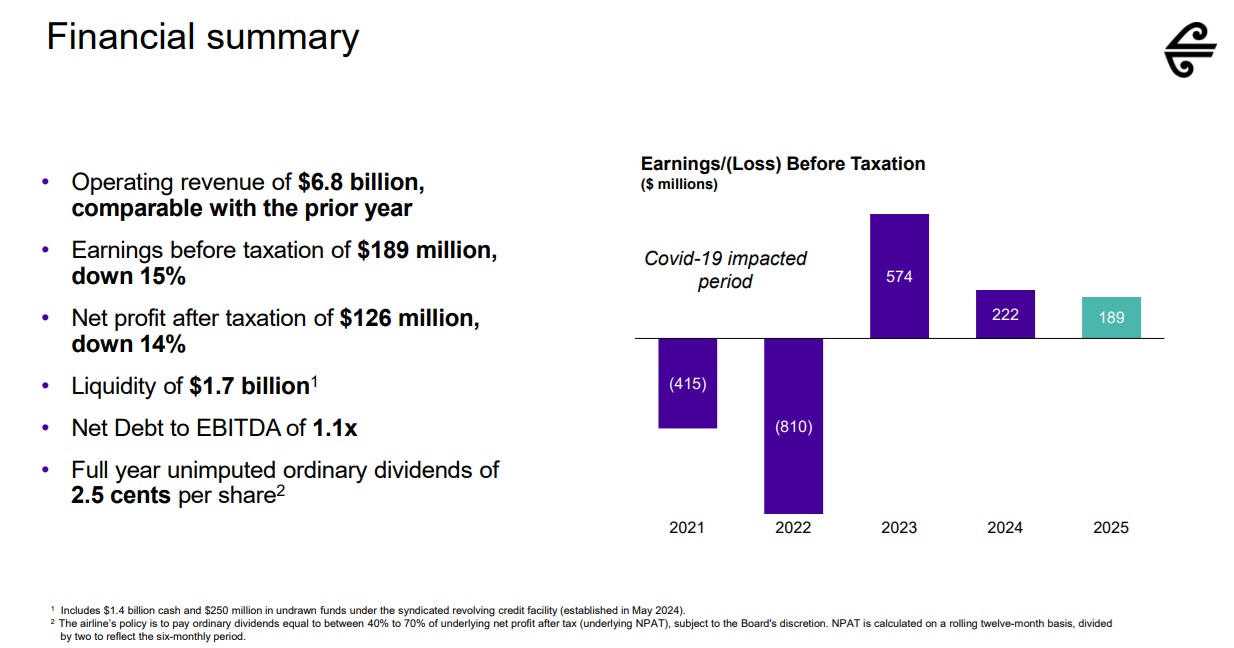

The airline reported pre-tax earnings of $189 million for the year to June 30, 2025, which was down 15% on the prior year's performance.

After-tax earnings, at $126 million, were down 14%. But the second half of the year was a real struggle, as Air New Zealand had indicated would be the case in a guidance update issued in April.

Chief executive Greg Foran, who steps down from the job later this year, said up to six narrowbody and five widebody aircraft out of service at times, during the past financial year.

"While the airline received $129 million in compensation from engine manufacturers, it estimates earnings before taxation of $189 million could have been approximately $165 million higher had the fleet operated as intended," he said.

The airline continued to work closely with both Rolls-Royce and Pratt & Whitney on compensation arrangements, and to secure a more reliable picture of when engines will return to service.

"We are confident in the medium-term recovery path but note the next year will likely be every bit as constrained as the last. Unfortunately, there are no quick fixes, and navigating the next two years will require the same focus and discipline we’ve shown to date."

While groundings related to engine availability constraints will continue into 2026, the airline notes signs of gradual improvement are beginning to emerge, Foran said.

"While we’re not through it yet, we are seeing early signs that the most acute phase of disruption will be behind us within the year. The path to recovery won’t be linear, but we’re approaching it with focus and discipline."

Foran said in the year ahead, more than half of the airline’s existing Boeing 787 fleet is expected to be flying with fully modernised, premium-focused interiors. Air New Zealand will also take delivery of its first two new Boeing 787s fitted with GE-powered engines, "a major milestone in the long-term fleet renewal strategy".

These aircraft, alongside an additional A321neo and ATR, will support increased capacity within New Zealand, across the Tasman and to North America, particularly during the peak summer period.

Foran said these were important steps, "not just to restore capacity, but to position the airline for the future".

"We know what needs to happen to lift our financial performance," he said.

"Good progress is already underway, and it will become increasingly evident as the network scales back up and our transformation work continues.

"While we aren’t yet seeing signs of recovery in the local economy, we remain confident that demand will return, and that we’re well placed to respond when it does.

"The year ahead will still have its challenges. System-wide aviation costs will be around $85 million higher, driven by increased air navigation fees, passenger levies and landing charges. Engine constraints will also remain a factor. But we’ve got the right strategy, a strong balance sheet, and a team that continues to deliver with heart, and that gives us real confidence in what lies ahead," Foran said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.