Results in the September ANZ Business Outlook Survey suggested 'a hint of Spring', according to ANZ's chief economist Sharon Zollner.

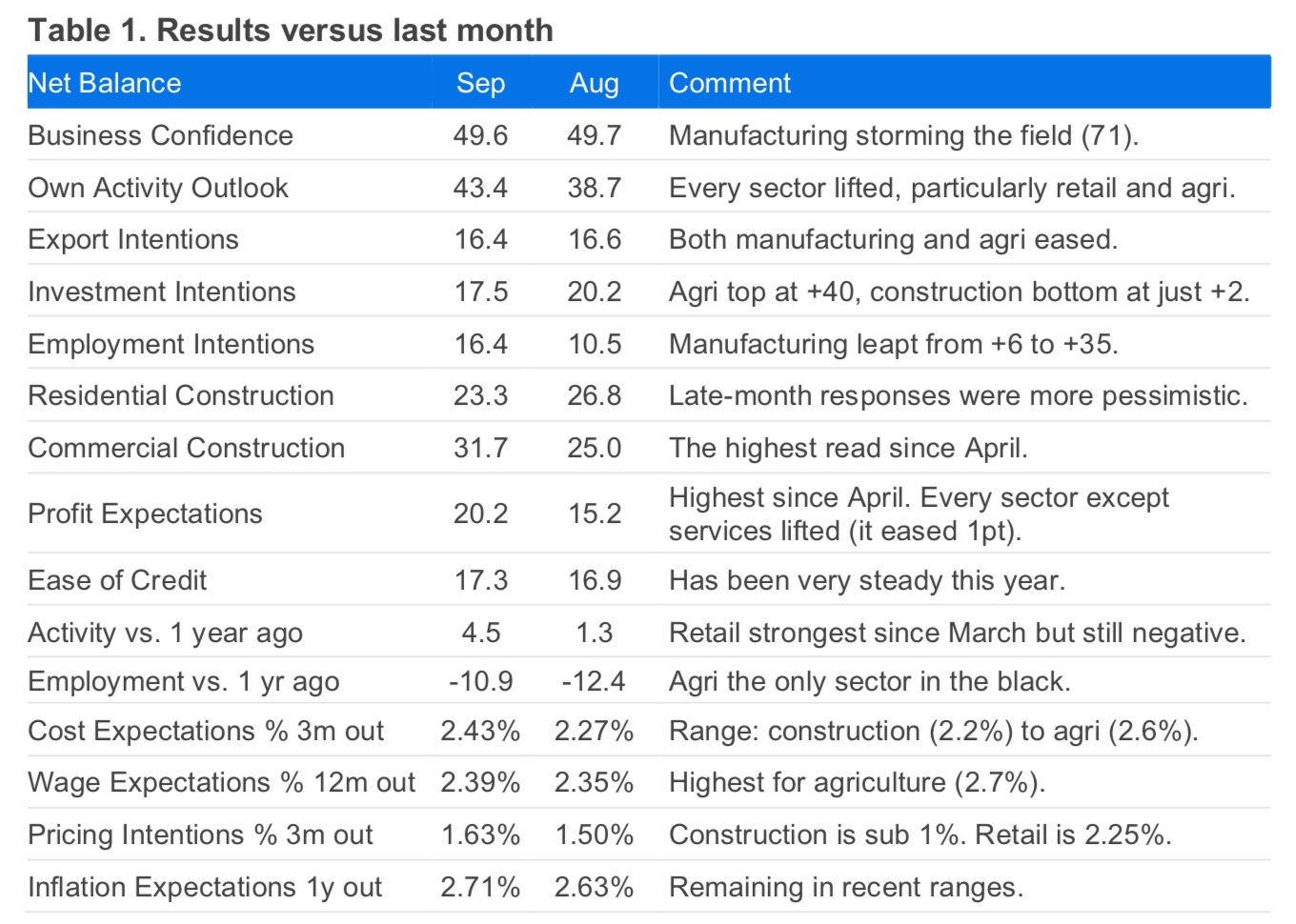

She said business confidence was unchanged in the month with a net 50% expecting better business conditions, but expected own activity rose 4 points to net 43%, its highest level in five months.

Past own activity lifted 4 points to +5, while past employment lifted 1 point to -11.

"Forward-looking activity indicators saw a mix of rises and falls this month. Reported past activity is looking brighter for retail, but construction remains under significant pressure. Pricing and cost expectations, as measured by the net percent of firms expecting increases, saw little movement, remaining in recent ranges," Zollner said.

During the middle of the survey period, June quarter GDP figures were released showing a shock 0.9% fall. And Zollner confirms there was an impact.

“It appears that the news did hit confidence. The late-month responses are more volatile by dint of being a smaller sample, but it’s a pretty consistent story," she said.

Zollner said it's "been a rough few years".

"To some extent, that was inevitable after the extreme overheating of the Covid era, but the weakness has dragged on longer than expected, and the costs are mounting."

She said it was important to acknowledge that there have also been benefits – New Zealand’s external balances have improved enormously as we’ve started living within our means again, which sets us up well for the future.

Inflation has dropped sharply. The extreme damage done to housing affordability in terms of house prices relative to incomes in the last boom "has been fully unwound".

"But now we’ve taken our medicine, firms would like to see things return to growth mode."

She said the good news was that the Reserve Bank (RBNZ) "is now seeing things that way as well, and is set to backstop the growth outlook with a lower Official Cash Rate (OCR)".

"While there’s uncertainty about the exact path of the OCR over coming weeks and months, the upshot is it will get to wherever it needs to be to ensure that the recovery we are all forecasting happens."

The RBNZ has its next review of the OCR on Wednesday, October 8. At the moment financial markets are fully pricing in another 25-point cut, which would take the OCR down to 2.75%, while there's also a better than 25% chance seen that the cut will be 50 points, which would take the OCR to 2.50%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.