The OECD is highlighting the impact of high household debt levels on economic growth, and the value of macro-prudential tools in controlling "credit over expansion" in a world where debt has grown at three times the rate of economic activity since the 1960s.

These points are raised in a policy note entitled How to restore a healthy financial sector that supports long-lasting, inclusive growth?

One of the reasons for this massive growth in credit, according to the report, is excessive financial deregulation.

The relaxing of financial regulation across OECD countries in the 40 years leading up to the Global Financial Crisis is described as beneficial for economic activity to begin with.

"Later, however, it appears to have gone too far, weakening economic fundamentals."

Other reasons given for the long-term increase in credit and slowing of growth are; bank loans growing at a faster rate than bonds; too-big-to-fail guarantees by the public authorities; lower quality credit; and a disproportionate increase in household credit compared with business credit.

Debt's impact on economic growth is calculated

Although finance is acknowledged as a key ingredient of long-term economic growth, it can become problematic if overused, the OECD report argues.

"On average across OECD countries, a 10% of GDP increase in the stock of bank credit is associated with a 0.3% percentage point reduction in long-term growth. This conclusion holds for the long term," the report says.

In terms of boosting economic growth, the report suggests encouraging change in "the mode of finance" away from debt and towards equity, could be "particularly powerful." This would include changing tax systems away from a "debt bias" that currently encourages corporate funding through loans rather than equity.

The chart below comes from the OECD report.

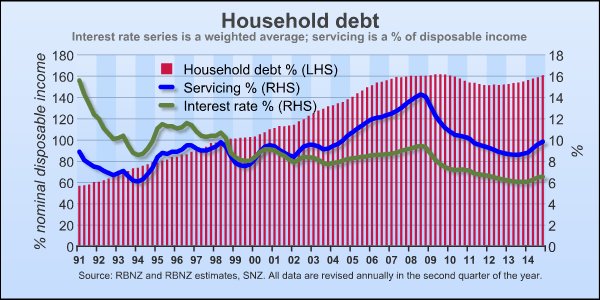

In terms of household debt, the Reserve Bank recently pointed out New Zealand's household debt as a percentage of nominal disposable income is at 160% after a big increase since the early 1990s. A 2012 working paper from the Bank For International Settlements cited New Zealand as an example of a country where a surge in private debt levels caused a drag on trend productivity growth.

The chart below comes from the Reserve Bank.

Keeping 'credit over expansion' in check

The report goes on to say macro-prudential tools, such as caps on debt-service-to-income ratios, can keep "credit over expansion" in check.

"Macro-prudential measures, however, often encounter the political economy difficulty that, at the time of their adoption, such reforms make it more difficult for buyers with limited resources to buy residential property, although this distributive effect should wane once prices adjust," the paper says.

In New Zealand the Reserve Bank has implemented one macro-prudential tool in the form of restrictions on banks' high loan-to-value ratio residential mortgage lending. In terms of debt-service-to-income ratios the Reserve Bank has been collecting data on these from banks since at least last year. In last November's Financial Stability Report it noted mortgage calculators suggested banks were willing to lend up to a multiple of more than seven times annual gross income, at least for borrowers with relatively high incomes.

But there's no debt-service-to-income ratio tool currently in the Reserve Bank's macro-prudential toolkit. And Bernard Hodgetts, head of the Reserve Bank's macro financial department, told me last month the regulator had no plans for any debt-to-income type measures.

The OECD report also argues big and fast-growing financial sectors, by sucking up many of the best and brightest employees, can influence the distribution of income.

"In Europe, financial sector employees make up 20% of the top 1% earners, but are only 4% of overall employment. The strong presence of financial sector workers among top earners is justified as long as very high productivity underpins their earnings. However, detailed econometric investigations find that financial firms pay wages well above what employees with similar profiles earn in other sectors," the report says.

This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

18 Comments

they've been using credit (interest bearing loans) to support the system for many decades if not longer. Do they even understand the principles of alternatives?

Well, monetary policy has lost its power now since 2009. Interest rate changes no longer stimulate the economy. Borrowers are using lower rates to more quickly repay debt.

http://www.smh.com.au/business/comment-and-analysis/has-monetary-policy…

Borrowers are using lower rates to more quickly repay debt.

I thought lower funding costs were offset by more debt to extinguish over longer periods, so brain challenged fellows, including myself, can steal resources away from main street to indulge in mindless $billion money making exercises similar to this, based on shaman type predictions not unlike this.

Dim Sum sales have rebounded in the second quarter, with Caterpillar Inc. among issuers of 92.3 billion yuan, compared with 88 billion yuan in the January-March period

Just as foreign NZD debt issuance has flourished over recent months, but without the same currency stability executed by the PBOC.

A broader pool of issuers will help satisfy rising offshore demand for high-quality New Zealand dollar fixed-income products. Asian central banks and official institutions, European real-money accounts and a broad range of Japanese investors are among the biggest buyers. KfW placed more than half of its notes outside New Zealand. Read more

It must be noted that foreign local currency debt issuance is exchanged via cross currency basis swaps to engineer sub libor financing for the foreign NZD/Yuan debtor, underwritten by Chinese and NZ domestic banks sourcing cheaper USD debt for their side of the swap leg - hence a proliferation of cheap hedged foreign credit wrapped domestic currency funding appears in both countries seeking speculative, but nonetheless, collateralised trading assets.

I think that's become the problem. That for those able to work the system the real productive needs are of a different scale of those same skills and profits engaged purely through financial work. So those at the bottom, don't have the ante or profit to make any difference...so aren't affected by the change.

those at the top have both deep pockets and generally have skills to ride the change.

And we have a vanishing middle, which being small only ends up affecting itself.

Pretty same in all high volatile environments.

No they're not. Look at the RBNZ chart in the story! Household debt is back to 160% of disposable income in New Zealand.

Maybe that total figure is inflated by new lending to aucklanders taking out new 600k mortgages etc. but drilling down into the behaviour and data of many individual borrowers with existing debt since 2009 might tell a different story. 60k aucklanders with new Jumbo mortgages may be disguising behaviours of more conservative borrowers/mortgagors? Hence subdued consumer spending after interest rate cuts.

DP. The SMH article suggests Aussies are using low rates to more rapidly repay debt.

See below. No it doesn't, if you look at the data set that is used. Ross Gittins is a cheerleader for "All we have to fear, is fear itself" and has just one of many views of where we are and where we are going. His view is that rising property prices are good for an economy. The OECD report, along with intuitive observation, casts severe doubt on that.

Ok. But if you put aside investment borrowers and new loans then repayment levels have increased amongst the mortgagebelt.

Put another way: have you noticed any resurgence or response from consumer spending or nonproperty business borrowing/expansion as a result of last weeks NZ rate cut? Barely registered a blip.

Thus, monetary policy may have lost its power in the general economy compared to pre 2008. (other than the uncontrolled property market/investment borrowing etc).

" Borrowers are using lower rates to more quickly repay debt.". Maybe, but more likely not! That "repay debt" analysis "ignore(s) the growth in borrowing for investment property", which currently makes up over 60% of the mortgage market in Australia. So if the biggest component of the market, which itself has the majority of 'interest only' borrowers in it, is ignored, then, yes, perhaps Christopher Kent ( who's never had a real job in his life!) might be right!

Central banks funding bubbles without benefits for the proclaimed recipients?

The Greek case offers quite a relevant view into the world of 21st century monetary alchemy, because that is what it really amounts to. Consistent with the Yellen Doctrine, the ECB conspired to a bubble (even a mini version this time) in order to create the economy that would eventually justify the bubble on an ex post facto basis – liquidity, to prices, to lending, to recovery and normal economy. That places financial factors upside down or backwards, as asset prices are no longer discounting mechanisms but simple (and ineffectve) tools not to recognize what might happen in the near future but rather to actually make it happen (rational expectations). What is left, however, is the worst of all cases; no recovery, no lending and now just more financial imbalance piled onto the same negative pressures and imbalances that never really went away. The recessionary “shock” in the first place was itself the “solutions” that central banks continue to offer; thus, what they really offer is the condition to make it all still worse. Read more

and is represented at the kitchen table when the boy grumbles about the early starts for work.

why can't I just invest to have money

we saying, you have to have money to invest.

Q: what motivates the worker workforce...

or is he right and we are too old...

It's a matter of who is underwriting whom.

3) POTENTIAL FOR PARENTAL AND SYSTEMIC SUPPORT

Moody's has affirmed ASB's Aa3 / P-1 credit ratings, reflecting the very high probability of support from its Australian parent, the Commonwealth Bank of Australia (CBA, Aa2 stable, a1). This is driven by ASB's significance to the overall group's operations, and the close regulatory and political ties between Australia and New Zealand.

The ratings also reflect the potential for systemic support to be extended to the bank in a systemic crisis. We view the likelihood of such support as moderate, given the expectations that ASB's parent would be the primary source of support. Our assessment of systemic support also reflects the importance of ASB, like its major bank peers, in funding New Zealand's net external liabilities, and the complexity of their resolution, if required. Read more

At the systemic level OBR defined unsecured creditors of the first insolvency victim are sacrificed, thereafter the taxpayer. Best to get the taxpayer locked in as a guaranteed funding source from the outset. Difficult, but examples abound in the realm of crony capitalism - can be tiring keeping up appearances.

Its no longer merely the activity of the financial sector, but its wealth-diverting presence thats the problem.

Be aware Auckland is a centre of focussed economic wealth/activity, but the bulk of NZs real wealth remains outside of of its boundaries. You know, quaint things like water, resources,primary production blah blah. Its the financialisation of the economy that enables Auckland to pull wealth in from the periphery. That wealth pump is entirely dependant on faith in fiat and other fragile constructs of the global banking authorities.

http://www.nakedcapitalism.com/2015/06/how-overgrown-financial-service-…

"More and more studies are coming to the conclusion that having a large financial sector is actually productivity destroying for an economy and slows its growth."

"Yesterday, the OECD entered the fray, releasing a new report arguing that the bloated banking systems in most developed countries are sucking growth out of their economies as well as increasing inequality. The ABC’s Michael Janda has summarised the results:

“The empirical analysis documents a link from financial deregulation, measured by an aggregate indicator, to credit expansion and slower growth,” the report found.

“The data indicate that credit intermediaries may have developed in most OECD countries to a point where further expansion is at the margin associated with slower long-term economic growth and greater economic inequality”.

…when loans exceed around 60 per cent of gross domestic product (a key measure of an economy’s output) then further lending actually dents long-term growth.

“An increase from 100 to 110 per cent of GDP is linked to a 0.25 percentage point reduction in economic growth,” the OECD observed.""

http://www.macrobusiness.com.au/2015/06/more-evidence-australias-financ…

When it proceeds too fast, deepening financial institutions can lead to economic and financial instability. It encourages greater risk-taking and high leverage, if poorly regulated and supervised. In other words, when it comes to financial deepening, there are speed limits…

How Australia’s Big 4 Banks Can Sink the Entire Economy – They’re Not Only Too Big To Fail. For Australia, They’re Too Big To Save.

http://investmentwatchblog.com/how-australias-big-4-banks-can-sink-the-…

For goodness sake bring back Glass-Steagall before it's too late. (if it's not already)

maybe that's what warren buffet is looking at, he can get a big piece cheap when they require additional capital

It was a building boom that caused 2008, along with over easy credit. So what's different about what's happening today?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.