National

Alex's politico-economic blogroll: The Greens' Clendon doesn't like sprawl; Farrar says our borrowing's unsustainable; How Auckland's rate rise could hurt Hide

17th Dec 10, 8:57pm

15

Alex's politico-economic blogroll: The Greens' Clendon doesn't like sprawl; Farrar says our borrowing's unsustainable; How Auckland's rate rise could hurt Hide

National to lead next coalition government with ACT, United Future, iPredict says in latest election snapshot

15th Dec 10, 11:56am

National to lead next coalition government with ACT, United Future, iPredict says in latest election snapshot

Alex's politico-economic blog roll: Raise the retirement age; 50% top tax rate; Public benefits of private ownership

10th Dec 10, 5:32pm

31

Alex's politico-economic blog roll: Raise the retirement age; 50% top tax rate; Public benefits of private ownership

Will Don Brash be part of a new right wing party for 2011 election? iPredict asks

10th Dec 10, 1:00pm

9

Will Don Brash be part of a new right wing party for 2011 election? iPredict asks

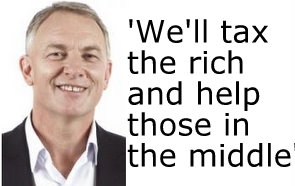

Labour leader Goff calls for Tax Working Group to tackle tax avoidance to take pressure off middle classes

7th Dec 10, 5:24pm

57

Labour leader Goff calls for Tax Working Group to tackle tax avoidance to take pressure off middle classes

Key to lead National-Act coalition in 2011 with 61 seats, iPredict says. Your view?

3rd Dec 10, 11:17am

33

Key to lead National-Act coalition in 2011 with 61 seats, iPredict says. Your view?

ANZ cuts 18 mth mortgage rate to 6.55% from 6.65% and 2 yr to 6.65% from 6.69%; National trims rates too

26th Nov 10, 5:21pm

8

ANZ cuts 18 mth mortgage rate to 6.55% from 6.65% and 2 yr to 6.65% from 6.69%; National trims rates too

Mortgage approvals blip up a bit last week, but down 26% from a year ago

BNZ CEO says Leaky Homes talks between banks and government 'not logjammed'; focus on how costs are shared

8th Sep 10, 4:00pm

BNZ CEO says Leaky Homes talks between banks and government 'not logjammed'; focus on how costs are shared

NZ banks donate NZ$3.5 mln for Canterbury earthquake relief; set up loan funds and waive mortgage payments

7th Sep 10, 9:37am

2

NZ banks donate NZ$3.5 mln for Canterbury earthquake relief; set up loan funds and waive mortgage payments

ANZ NZ CEO Jenny Fagg to step down to undergo treatment for cancer; Deputy CEO Steven Fyfe to become Acting CEO

31st Aug 10, 10:48am

ANZ NZ CEO Jenny Fagg to step down to undergo treatment for cancer; Deputy CEO Steven Fyfe to become Acting CEO

Westpac, ANZ and National cut 2 year mortgage rates to catch up with Kiwibank

CBA CEO Ralph Norris says Australasian banks have passed stress tests that assumed big falls in house prices

11th Aug 10, 10:18am

CBA CEO Ralph Norris says Australasian banks have passed stress tests that assumed big falls in house prices

ANZ, Westpac, BNZ, National, Kiwibank, TSB hike floating mortgage rates and trim longer fixed mortgage rates

10th Aug 10, 8:15am

3

ANZ, Westpac, BNZ, National, Kiwibank, TSB hike floating mortgage rates and trim longer fixed mortgage rates

ANZ and National lift variable mortgage rates, savings account rates after RBNZ hike

18th Jun 10, 6:50pm

ANZ and National lift variable mortgage rates, savings account rates after RBNZ hike

REINZ blames lack of finance for slump in farm sales and values

Why Kiwibank's growth may slow as CEO Sam Knowles leaves

26th May 10, 7:25pm

Why Kiwibank's growth may slow as CEO Sam Knowles leaves

5 key figures that indicate where bank lending and house prices might go (Update 1)

26th May 10, 10:47am

2

5 key figures that indicate where bank lending and house prices might go (Update 1)

Bank home loan approvals down 25% from a year ago in fresh de-leveraging sign

9th Apr 10, 3:46pm

Bank home loan approvals down 25% from a year ago in fresh de-leveraging sign