FLP

As Adrian Orr abruptly departs the Reserve Bank, it's a good time to think about what type of central bank we want

9th Mar 25, 8:49am

11

As Adrian Orr abruptly departs the Reserve Bank, it's a good time to think about what type of central bank we want

Reserve Bank signals the high levels of cash seen in the banking system since the onset of Covid may be gone by the second half of next year

23rd Oct 24, 2:30pm

6

Reserve Bank signals the high levels of cash seen in the banking system since the onset of Covid may be gone by the second half of next year

Kiwibank economists say central banks will ultimately need to have looser inflation targets in a 'world of rapidly rising, climate-related, costs

13th Mar 24, 9:34am

46

Kiwibank economists say central banks will ultimately need to have looser inflation targets in a 'world of rapidly rising, climate-related, costs

Kiwibank economists say that after some 'ferocious barking' and 'a lot of huffing and puffing' about potential interest rate hikes, the RBNZ has 'stripped off their wolf skin'

4th Mar 24, 11:41am

23

Kiwibank economists say that after some 'ferocious barking' and 'a lot of huffing and puffing' about potential interest rate hikes, the RBNZ has 'stripped off their wolf skin'

Reserve Bank leaves Official Cash Rate unchanged at 5.5% and says risks to the inflation outlook are now 'more balanced' but there is a limit to its ability to 'tolerate upside inflation surprises'

28th Feb 24, 2:13pm

104

Reserve Bank leaves Official Cash Rate unchanged at 5.5% and says risks to the inflation outlook are now 'more balanced' but there is a limit to its ability to 'tolerate upside inflation surprises'

ASB economists estimate that average household living costs will have increased by about $115 a week in 2023 - and with a further $70 hike to come next year, but income rises will probably beat that

7th Dec 23, 10:30am

42

ASB economists estimate that average household living costs will have increased by about $115 a week in 2023 - and with a further $70 hike to come next year, but income rises will probably beat that

[updated]

Reserve Bank leaves Official Cash Rate unchanged at 5.5% but warns if inflation proves stronger than expected it may have to hike the OCR again

29th Nov 23, 2:20pm

93

Reserve Bank leaves Official Cash Rate unchanged at 5.5% but warns if inflation proves stronger than expected it may have to hike the OCR again

Assistant Governor Karen Silk says RBNZ to review how it manages settlement cash in the banking system during a crisis

14th Sep 23, 7:40am

Assistant Governor Karen Silk says RBNZ to review how it manages settlement cash in the banking system during a crisis

Reserve Bank leaves Official Cash Rate unchanged at 5.50% but says interest rates need to remain at a restrictive level for some time

16th Aug 23, 2:18pm

99

Reserve Bank leaves Official Cash Rate unchanged at 5.50% but says interest rates need to remain at a restrictive level for some time

The Reserve Bank may have just ensured it won't become the meat in the political sandwich during the forthcoming election campaign

31st May 23, 7:52am

49

The Reserve Bank may have just ensured it won't become the meat in the political sandwich during the forthcoming election campaign

ASB economists rue the whiplash derived from last week's big 'dovish' shift by the Reserve Bank, while Westpac economists still see a further Official Cash Rate hike in August and ANZ economists expect one in November

29th May 23, 1:55pm

18

ASB economists rue the whiplash derived from last week's big 'dovish' shift by the Reserve Bank, while Westpac economists still see a further Official Cash Rate hike in August and ANZ economists expect one in November

[updated]

Reserve Bank raises interest rates as expected but throws in a major surprise by indicating this will be the last rise

24th May 23, 2:11pm

150

Reserve Bank raises interest rates as expected but throws in a major surprise by indicating this will be the last rise

BNZ economists say the Reserve Bank's next move is likely to be heavily influenced by its assumptions of the supply and demand impacts of a net migration inflow that is 'much stronger than anyone believed'

17th May 23, 12:05pm

65

BNZ economists say the Reserve Bank's next move is likely to be heavily influenced by its assumptions of the supply and demand impacts of a net migration inflow that is 'much stronger than anyone believed'

KPMG suggests ongoing record bank profits could be a thing of the past, at least for now

20th Apr 23, 8:42am

KPMG suggests ongoing record bank profits could be a thing of the past, at least for now

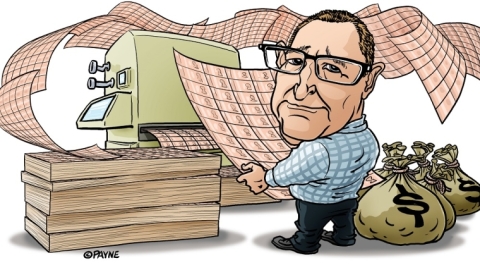

Could, or should, the RBNZ cut the interest rate it pays on banks' settlement cash accounts in order to reduce the Government's interest bill?

15th Apr 23, 9:20am

25

Could, or should, the RBNZ cut the interest rate it pays on banks' settlement cash accounts in order to reduce the Government's interest bill?