Update:

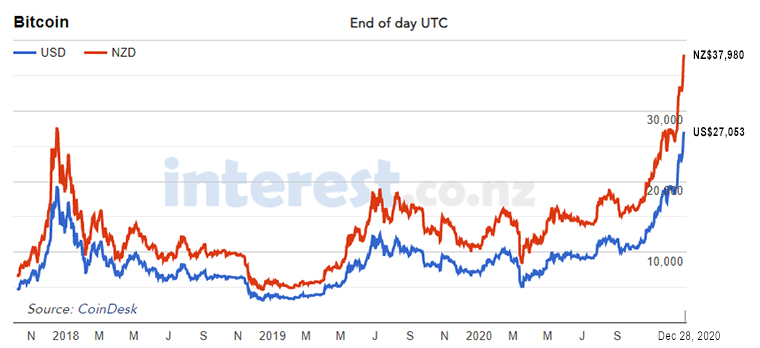

Bitcoin moved up to US$29,837 on January 2, 2021 (NZT). Then it moved up decisivively to over US$33,000 in the early hours of January 3, 2021 (7:56 am NZT). That makes it the largest daily jump (+US$3666) ever. In turn, that pushes the price in New Zealand dollars to over NZ$46,000.

In USD, the price has now risen almost +15% in the two-plus days of 2021.

December 28, 2020

In terms of asset price inflation, the dominant cryptocurrency Bitcoin is leaving New Zealand house prices in the dust.

Overnight, the bitcoin price rose to US$28,222 and a new all-time high.

And remember it started 2020 at $US$7,280. That makes it a +150% annual rise. In 2019 it rose +97% net over that earlier year, although that period did feature some wild swings in between.

However for 2020 it has mostly been gains, with the biggest and fastest rises in December. December alone has posted a +49% rise and +15% of that is in just the last week..

A feature of December's rises is the number of days of US$1000+ gains - nine in the 28 days so far, and over the past three days, the price has risen +US$3,400. This surge is far and away the largest of any period in the crypto's history.

What is driving it? It is hard to be sure when you are in the middle of the event, but some things seem likely culprits.

Firstly, a few 'whales' have suddenly become interested. A big move in by a major fund manager can shift this relatively small market quickly. And at least three 'whales' are known to have moved in, during December. They include Skybridge Capital* who invested US$25 mln so far, MassMutual who are in for at least US$100 mln, and Guggenheim Funds who may have invested up to US$500 mln. There are others too. Such major shifts in can really move a market that was only worth US$350 bln at the start of December and is now worth more than US$510 bln. Their moves are effectively manipulating the price up dramatically.

One of the reasons these so-called heavyweights are making the shift is because they are watching the fast-limiting of bitcoin supply. Already 18.5 mln of the maximum 21 million bitcoins have already been mined are in circulation. But from here on, the increase in supply will be very slow and it is estimated that not until 2140 will all 21 million bitcoins be circulating. That means only 2.5 mln more (12%) will come along over the next 120 years. Effectively the growth of supply has ground to a virtual halt, so demand rises will just mean price/value rises. These 'whales' only see upside, and their entry into the demand side at scale will itself drive the price higher. 'Whales' like bets with only upsides.

And there is a short-term effect as well. With the end of the year looming, some fund managers may also be buying bitcoin so they can brag next year about being smart enough to get in in 2020 (while glossing over the price they had to pay). This sort of positive feedback can run - until it doesn't. It is an effect known as "the greater fool theory", in this case valid because the value is only what someone else, a buyer, thinks it is.

In the real world, the worry about inflation is rising. Is the surge in asset inflation about to spill over into consumer inflation? This is essentially a worry about the debasement of fiat currencies. Central banks everywhere are printing money with abandon trying to stave off the worst economic effects of the pandemic. In the US, pandemic relief fiscal packages are creating an enormous debt burden, compounded by irresponsible tax-cuts-for-the rich packages passed over the past four years. These actions are viewed by many as potential catalysts for inflation and bad for fiat currencies, both of which could be positive for bitcoin.

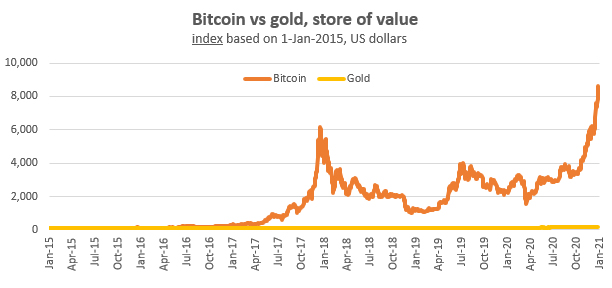

For all that, the narrative could be quite different next week. After all the runup in the bitcoin price is only stated in terms of the background fiat currencies, and the 'value' is always translated into what the fiat currencies will actually buy. Bitcoin is neither a medium of exchange, nor a unit of account, not even a standard of deferred value. It is currently only functioning as a store of value. There are many other effective stores of value, although right at this time bitcoin is hard to beat.

Since we started preparing this article, the price of one bitcoin has fallen back to US$27,106. Volatility is extreme at present.

* Anthony Scaramucci's investment bank.

82 Comments

Will it come to this?

No. Confiscating BTC will mean dismantling the network. The network could be functional again within 10 mins.

Unlikely as it would require global governance. Bitcoin is nowhere close to anonymous, so it is possible but logistically very difficult.

Having ticked off the prediction that btc would hit 20k before EOY, next is Bitcoin peaks around 350k in September before settling around 80k before the next halving cycle in 3.5 years.

In time people will see Bitcoin is the least volatile, most predictable asset that has ever existed. When we stop measuring btc in fiat, is the day we start measuring everything in btc.

Here's the comparison with Fiat and gold again for anyone interested:

https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcQNHq50XaRq5Whuduw…

Stick to the point about whether or not BTC could be made illegal for custody. Not cheerleading one of the countless predictions.

Ok. Let's look at government which drives law making related to BTC, which at a personal level can be legislated because every transactional account is public so it is the opposite of anonymous. Govt in it's best form is democratic. Messy, but necessarily so as legislating for the 10% on each side of the bell curve takes up 80% of the resource, and without that you can't have true democracy. That is the platform required at a global level to legislate BTC. The UN is not even close. So mandate wise, no government exists that can democratically halt the global march of BTC. Besides, many governments maligned by the petro-dollar are actively engaging in Bitcoin as a work around (Iran, Venezuela). So, the opposite is in effect happening where we have fringe governments, innovator companies and smaller investment funds looking at btc as a reserve alternative to the USD.

Each halving moon cycle, based on the log scales that are identical for the last four halvings show us exactly where the moon will peak. But each moon cycle needs a capital inflow to match the logarithmic size as they exponentially get bigger. The last halving was driven by the geeks when it was more challenging to buy btc than it is now. This cycle is being driven by the exact factors described in my first paragraph. The next cycle after this one will have to have much bigger fish driving it - likely to be mainstream institutions and governments.

People don't understand Bitcoin, because they don't understand the foundations and consequences of macro economic drivers like democracy. The governments previously known for freedom and democracy are forgetting these too and acting against the interests of the people. Bitcoin fixes this.

"Having ticked off the prediction that btc would hit 20k before EOY," - Interesting, I didn't see your prediction in the last year's list? I was the only one I believe (I guessed 10k)

1st comment on https://www.interest.co.nz/news/107830/no-us-election-result-more-us-jo…

Back on Nov 6 when the BTC price was 15509. We had a conversation about it ;)

#Bitcoin continues to catch up w/Tesla. Now 287% YTD vs 690% for #Tesla. Link

Yes Audaxes. Even Tupperware Brands outperformed Bitcoin in 2020.

One of the issues for the funds right now is that clients are asking them 'why don't we have any exposure to BTC' and the finance industry doesn't really have an answer. Buying BTC for their clients is largely not in their interests as the fee-munching models are not there for them to profit from this. Ironically, one of the early movers in the funds towards BTC is a notorious 'scam-like' company called DeVere. Furthermore, the funds and institutions are not really in the interests of their clients in terms of 'custody.' Basically, if you can't do it yourself, then you're not able able to become your own sovereign bank (which is essentially a key pillar of owning BTC). The funds will likely not to have considered as it's not in their interests. Also, the old farts don't really trust tech / digital assets. This puts them at a huge disadvantage to the young bucks. Interestingly, even Gen Z looks at BTC as a bit limited relative to other assets such as NFTs (non-fungible tokens for art, crypto-collectibles and crypto-gaming) and defi opportunities and staking.

By the way, saw that the stock prices of Tupperware Brands and AfterPay have outperformed BTC in 2020, even including the Dec boom.

"By the way, saw that the stock prices of Tupperware Brands and AfterPay have outperformed BTC in 2020, even including the Dec boom."

Sure - but if you compare stocks individually vs an entire asset class, I can show you alts in top 200 that bet your Tupperware Brand by 100x

Sure - but if you compare stocks individually vs an entire asset class,

I'm doing it for illustrative purposes. BTC is redefining the internet of money. TupperWare represents suburban consumer culture in the Anglosphere. More people will own TupperWare than BTC.

'What is less known is that as the capital controls game of cat and mouse escalated in recent years, so have Chinese money laundering tactics and now according to Caixin, Chinese citizens launder as much as $153 billion per year with the help of online gambling and such cryptocurrency as tether, which has long been rumored to be a key driver of upside into bitcoin (the same bitcoin we said in 2015 when it was $250 would soar thanks to Chinese attempts to circumvent the capital firewall... we were right).'

https://www.zerohedge.com/markets/how-chinese-use-illegal-online-gambli…

Yes, read that. Interesting.

The ownership of BTC is quite centralized as of now, so play it with caution.

I certainly salute anyone who wants to play the Crypto game. More power to them. However similar gains are available with shares - PEB up 950% since May. It's all about risk tolerance.

At least with equities there's a bit more transparency

Bizarre comment. Care to explain why buying BTC is not as transparent as buying equities?

From equities you get interim reports and EoY financials - all audited, plus Office holders shareholding reports and analyst reports on the various companies. From what I've seen of Crypto it's more anonymous. Having said that I don't buy Crypto so perhaps I'm wrong but reports of hacking and lost funds is enough of a deterrent for me. Cryptopia's problems spring to mind.

From equities you get.............

Well you if you wanted exposure to BTC and need an annual report to give you peace of mind, you could buy GrayScale.

BTC is not an equity (as I was asked to admit above).

950% is very low if you want to look at all crypto and the defi space. YFI went from $3 to $42,000 a coin in around 8 weeks for example.

Hook,

i am not a speculative investor, but I am very glad that I held onto my PEB shares, even as they well to under 10cents. I knew that they had a decent product to offer the market, but I didn't know whether investors would keep supporting them while they burned through cash.

and Lynch Introduce Legislation Protecting Consumers from Cryptocurrency-Related Financial Threats

https://tlaib.house.gov/media/press-releases/tlaib-garcia-and-lynch-sta…

https://tlaib.house.gov/media/press-releases/tlaib-garcia-and-lynch-sta…

My first post was asking if there was a bitcoin payment option to become a supporter of interest.co.nz.

Missed out on a 10 bagger there ;)

I'd want a discount for using Bitcoin.

"Overnight, the bitcoin price rose to US$28,222 and a new all-time high.

And remember it started 2020 at $US$7,280. That makes it a +150% annual rise."

250% rise? Or is my maths wrong?

287% rise, I think.

" Their moves are effectively manipulating the price up dramatically." - Cmon. This is not manipulation. They are required to make public disclosures and file their purchases - everything is in the open. Michael Saylor even gave everybody a 2 week notice before his $650M bitcoin buy.

Agree, it would be far more apt to use the word 'manipulation' with regards to RBNZ and house prices or renewable energy funds buying up MEL, CEN etc.

"In the US, pandemic relief fiscal packages are creating an enormous debt burden, compounded by irresponsible tax-cuts-for-the rich packages passed over the past four years".

Why is this "debt" a burden and and to whom? Government debt is a country's net money supply and there can be no private savings without it. (sectoral balances). Who holds these savings though is the question if they all end up in the hands of the already wealthy.

Governments don't even need to issue debt to cover their deficit spending, this is a throwback to the gold standard days as economist Prof Bill Mitchell explains here.

Part one. http://bilbo.economicoutlook.net/blog/?p=45106

Part two. http://bilbo.economicoutlook.net/blog/?p=45108

Just don't understand Bitcoin, its just some made up thing and is tied to fiat currency. Sure its limited to 21 million, so what its still not a physical product like gold. What's the Bitcoin end game ? Somehow Fiat becomes worthless and the whole world adopts Bitcoin because somehow it magically retains its value or even goes to the moon ? ? why would it, just create another digital currency. Its totally worthless IMO, just something to speculate on. The technology behind it has real world applications, but the product itself is fake money.

All you need to understand about money is it's just a contract between two parties of agreed future value. BTC is a vehicle that makes the contract fixed, whilst the fiat governers increasingly fiddle with the contract to suit their needs over the voting public.

First ask yourself do you understand fiat and gold and work from there...

Enough to understand that you buy bitcoin with fiat so that is the problem. If you worked each week and got paid in bitcoin then that's a currency. Bitcoin is worthless as soon as a different digital currency is universally adopted. The belief by bitcoin speculators must be that bitcoin becomes that universal digital currency. It could go to zero value almost overnight when something else becomes the choice.

Well Carlos as we speak BTC went up8%...with many people now choosing to be paid by BTC now. But you know best

Well just wait Carlos, may be not in our lifetime. When BTC is becoming the trader norm by means to purchase a house for example, very odd things this interconnected fluid world, be it physically, liquid, gas or the socio-economic they tend to have some sort of 'escapism' when different pressure applied, the compression will yield different point of relieve.. Banks soon or later will just have to adopt it (by products of their historical past neglect/ignorance on their lending policy for example), the certain things about future economic is just that.. uncertainty.

For interest sake, the first widely reported bitcoin transaction was in 2010, two pizzas were purchased for 10,000 bitcoin. In todays money that's ~380 million NZD for two pizzas. I love the bottom graph. Should add the purchasing power of tulips measured against gold in the Netherlands in 1636.

The tulip bubble lasted around 6 months, and was centralized to a small region. The bitcoin surge has gone for 11 years, an order magnitude higher, with 100 million accounts / users.

I don’t know the full tulip story. Was it a supply increase or demand decrease that caused it to pop?

Well in my humble opinion the only "value" of bitcoin it that it takes the heat of gold, of which I own a decent amount. I wouldn't touch bitcoin with a barge pole, but good on you to anyone who's made money from it. It takes courage to take the plunge and invest in something.

"This surge is far and away the largest of any period in the crypto's history."

Not quite. We jumped $3200 in around 6 hours on Sep 23 2019 following President Xi saying China would adopt China.

Hard money..BTC cannot be printed by central banks..making them almost redundant. Looking forward to the comments today as the worlds new reserve currency gains massive acceptance.

Sorry to burst your bubble but Bitcoin is far too volatile to be a currency. Why do people not understand this? Would people want to trade with NZ if our currency fluctuated up and down by 2000% per year?? In order to be a viable medium of exchange a surepy certain range of value needs to be acceptable.

In before 'it's not bitcoin increasing its simply fiat currency value spiralling down'

Am I on the right track?

Bitcoin is not a currency and will never be one, its a store of value with limited supply. Yes the dollar devalues and so does gold. Bitcoin value in years to come will prove to be an exceptional holding in my opinion.

It cannot be an exchange currency due to the fixed supply. As people buy in it fundamentally has to increase in value which means you would never want to spend it. If no one wants to spend it it will never be a currency.

There is some kind of weird bug (I think) worldwide reporting an NZD crash. Apparently BTC is now 50k NZD! Its odd because top sites like Google all have that bug. Surely the NZD can't crash that badly in a weekend....

What's going on? Still have Google saying the NZD to USD is 0.66 ?? Yet no reporting on it ??

Still unresolved.

Wow that is weird, happened on the 1st jan. A Y2.02K bug?

cowabunga dudes!...greatest computer game ever! Just waiting for the playstation version...rock on!

If I was an institutional investor I'd borrow fiat at near zero and put it all into Bitcoin.

If it's not your money sure, tulips spring to mind, again.

However when bitcoin is at 5k or lower I might jump in. Mate at work made 30% on bitcoin last month but then gave 80% of his gains back in transaction fees, wallet fees etc etc

Oerbumcum your comment on fees...cost to buy or sell $1k about $10 currently

Maybe it was the medium he was dealing with, plus his amount was less than $500 from memory, there must of been a fixed fee that obviously gets offset by the more you have in there.

Tulips lasted around a year, localized in one area. In contrast, bitcoin has gone straight for 12 years, has had 4 major crashes and survived each time. Willy Woo calculates 100 million user accounts and 30 million individuals on the blockchain. Plus 30 billion bought by institutions.

"Mate at work made 30% on bitcoin last month but then gave 80% of his gains back in transaction fees, wallet fees etc etc"

This is impossible unless he had like $10 of bitcoin. My transactions fees are less than a dollar, and wallet fees don't exist.

What % of fees should you expect to pay when buying & selling BTC to NZD ? Easycrypto advertise themselves as the lowest fees in NZ and I understand its around 2% each way.

Yes easy crypto has a massive divide - around 4% total if you buy and sell. I buy on kiwi-coin, which on a good day (if you are patient) gives you a slightly better price than the market. Maybe there is like a 0.05 percent trading fee.

Crazy, I use a Japanese exchange (Bitbank) which has a 0.12% trading fee only and huge trading volume. 0.001 BTC (NZD50) to remove your holdings off the exchange.

EasyCrypto is a nice UI but I knew something about it wasn't kosher as you don't have a fiat account and cannot see the market in real time on their site.

Thats starting to happen. Microstrategy just borrowed $650 Million to buy bitcoin.

https://www.coindesk.com/microstrategy-buys-bitcoin-debt

All those companies that were ploughing excess cash or cheap debt into buying back their own shares, now have an alternative option. Anything is better than keeping it in the bank for zero return.

https://currency.com/how-many-cryptocurrencies-are-there

there are currently more than 7,800 in existence. New tokens are popping up all the time – each with a different use case and backstory.

Beware of false prophets...bitcoin is the real and only messiah....we must believe...believe and it will be.

Bitcoin is going to be history sooner or later.

And for the same reason it is going up - supply is capped. 64KB is enough for anyone...

Another 10 years then..when ?

Maybe, that's the problem eh, noone knows. We are all riding the wave blindfolded. Carnage when it hits the shore.

I have accumulated a tiny amount of bitcoin and have mined it and played with it enough to know it is useless as a currency and will always be useless as a currency. So that leaves speculation as it's sole purpose.

* High miner fees and/or long delays to transactions

* Extreme Volatility

* Limited supply

* Money laundering issues

* Difficult for Governments to control

* Edit: Almost forgot - high energy use so incompatible with climate change

Good luck to all of us holders, just don't get caught when the music stops!

There will be a useful digital currency eventually. But it will not be bitcoin.

I have accumulated a tiny amount of bitcoin and have mined it and played with it enough to know it is useless as a currency and will always be useless as a currency

Depends. As a savings instrument, BTC has held up well. If you want to buy a cup of coffee, you are correct that it's not an effective means of exchange.

It's much too high risk to be considered savings in most people's world, and the transaction fees kill it when contributing many small amounts.

Pure speculation in my book.

Think of it as the new term deposit

It's much too high risk to be considered savings in most people's world, and the transaction fees kill it when contributing many small amounts

What do you mean by 'high risk'? That a govt doesn't guarantee BTC?

Transaction fees on the exchange I use are 0.12%. I think those fees are low. But that's just me.

We invest in bitcoin for capital gain and its value is highly volatile. There is no underlying value and yes there are no guarantees from anyone. It is easy to lose access to your funds if you do something wrong. Clearly it is very high risk and not what most people would consider savings. But the decision is for the individual.

You don't pay any miner fees to confirm the transaction? It costs me a few bucks to send anything anywhere from my wallet if I want it in a few minutes.

This becomes a bigger problem with many small transactions -aka savings- in my wallet as they must be consolidated first and the fees grow large when the network is busy.

'You' invest in BTC for capital gain. Others may own BTC for lending or a variety of reasons besides speculation. You cannot apply your situation to everyone else. And yes, it is risky for people who do not understand what they're doing. But this only applies to people who self custody.

And yes, I pay fees to Ledger to transfer crypto to an exchange, but they're not particularly excessive. But I'm a long-term HODLer so there's no need for me to be transferring chump change back and forth between an exchange and cold storage. Furthermore, there are no exchange fees to deposit crypto on to the exchange I use (Bitbank).

Great, nothing more to say apart from enjoy your wealth JC.

If you invest in it for capital value then don't send it around in a lot of small transactions... Why would you do that. It's volatile day to day but you're not trading it so just sit back, it's not volatile long term.

You're doing it wrong.

Also the fact it's not backed by any one is any company or government is not a negative for many, it's half the point.

JC. The high risk is volatility. Fine for speculation. Poisonous for any useful transaction.

But believers will believe.

What is this 'high risk' you're referring to? It's a nebulous term if you don't explain what you mean. For ex, people will say BTC is 'high risk' because the price fell from $20K to $3K. Is that what you mean? What if you were using weighted dollar cost averaging starting from $20K down to $3K? Is that considered 'high risk'?

Obviously most don't understand the flaws of Bitcoin, otherwise this could not be explained. BTC will never be a valid means of exchange due to many issues which will make it obsolete and replaced by other cryptocurrencies not very far in the future. Starting with high network transaction fees, and high fluctuations in value (nobody would pay in BTC when the value will be 10% higher tomorrow), plus the unnecessary processing power required by the network compared to other cryptos which makes it a flawed technology already, and it is precisely the technology behind it which was the only real value supporting BTC. Obviously most investors don't understand this and plenty of stupid money is flowing into an already overvalued asset.

Yes. But ask yourself some questions:

- What are these high network transaction fees you refer to? Can you be a little more precise?

- You've made the assumption that BTC is high-frequency means of exchange. Isn't BTC a store of value as opposed to a high-frequency means of exchange? You should read the Bitcoin Standard and the large stones that were used for money in the Micronesian island of Yap. These stones were also a means of exchange but exchanged very infrequently.

- BTC uses far more power than XRP. We also know XRP is connected with superior technology (Ripple) for cross-border payments than what banks are currently using through the SWIFT Network. So why is BTC more valuable than XRP?

- What are these high network transaction fees you refer to? Can you be a little more precise?

Here's a guide on how to calculate fees, percentage wise it is much more expensive (due to the associated computing costs) than other cryptos.

https://themoneymongers.com/bitcoin-transaction-fees/

- You've made the assumption that BTC is high-frequency means of exchange. Isn't BTC a store of value as opposed to a high-frequency means of exchange? You should read the Bitcoin Standard and the large stones that were used for money in the Micronesian island of Yap. These stones were also a means of exchange but exchanged very infrequently.

I have not made any assumptions and have read an understood the whitepaper since I have a background on cryptography. A currency is meant to be used as a means of exchange, which is (apart from the underlying technology in this case) where it has its value. A store of value should be something with some underlying value such as land, gold or silver, a purely speculative asset has no real value and is prone to collapse as it's happened in the past several times.

there are many superior blockchain technologies already, BTC was just the first to become widely known but far from having any future applications.

Agree with all that although I’m not sure anything has an “underlying value”, the value is just supply and demand.

Maybe you mean truly rare: yes Bitcoin supply is fixed but there are any number of alternatives, whereas with metals for example the number of alternatives is fixed.

Not quite, the supply is increasing every day as we speak and will keep doing so for quite some time, once we reach 21 million miners will have to keep making money, in which case the costs will be sifted to even higher fees.

Here's a guide.....

You didn't read my post. I gave an example (XRP) that is far more cost-effective and faster than BTC.

I have not made any assumptions and have read an understood the whitepaper since I have a background on cryptography.

'The Bitcoin Standard' is not Satoshi's white paper. It is a seminal book about the history of sound money and the rise of Bitcoin written by Saifedean Ammous and published in 2018.

Who is David Chaston? This article has pieces straight out plagiarised from an article a few days ago that ran on coindesk.

Finally, the clear winner of investment options apart from housing, sure it's minus those long term, intrinsic, peace of minds thingies, Kiwis must all embrace this, Banks clearly looking worried by the day. Remember, once the NZ participants are bigger than 60% of populations, then rest assure the authority guarantee is awaiting for it, if it's too expensive then I recommend Kiwis to embrace pokies at local Casino, the coin based started account.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.