By Stuart Talman, XE currency strategist

The collapse of Silicon Valley Bank reverberated throughout financial markets on Monday, US policy makers forced to step in to restore confidence to ensure that a deposit run does not occur across the wider banking sector.

Market contagion has largely been contained, although banking stocks have come under intense selling pressure to start the new week as market participants fear that other banks are exposed to similar stress, caused, in part, by the Fed’s most aggressive tightening cycle in over 40 years.

News that New York based, Signature Bank, a crypto sector focused lender had also been placed in the hands of the administrators, adding to the fears of a broader crisis.

The response from US policymakers has been swift.

The Federal Reserve, US Treasury and Federal Deposit Insurance Corporation have announced two key measures to calm nerves, their joint issued statement commenting:

Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

The first step is to fully protect depositors at both SVB and Signature Bank – all depositors of these institutions will be made whole.

The second step was to create the Bank Term Funding Program, a facility that provides collateralised liquidity for troubled banks that cannot access it elsewhere. The funding provides loans of up to one year duration against high quality collateral, including mortgage-backed securities, US government bonds, agency debt and other approved securities.

The program eliminates the need for distressed banks to sell these securities (at losses) to increase liquidity, thereby avoiding scenarios such as the SVB bank-run.

So, what has been the reaction from the market?

A dramatic re-pricing of rates – the market shifting to dial back near-term Fed rate hikes.

It’s a stunning shift from last week when rates markets had moved to price in the likelihood of a 50bps hike following Powell’s hawkish testimony.

The yield on the rate sensitive US two-year bond has fallen over 100 basis points from Thursday’s peak above 5.00% - the largest three day decline since Black Monday in October 1987. The yield on the benchmark US 10yr has fallen around 60bps from Thursday’s peak causing a rapid disinversion of the yield curve.

Terminal rate expectations have nose-dived back below 5% having climbed through 5.50% last week…..the chatter regarding a potential Fed fund rate of 6% growing louder in recent weeks.

The impact for currency markets – the US dollar has been crunched.

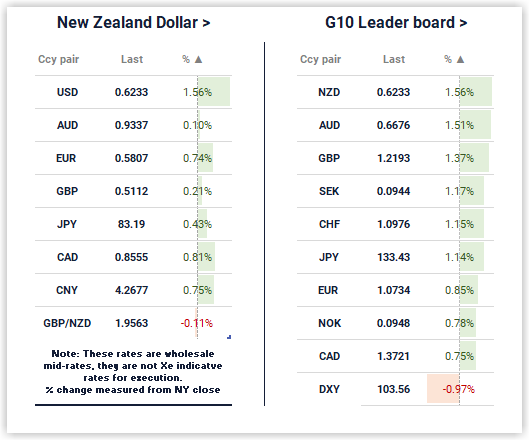

Gaining over 1.70%, the New Zealand dollar sits atop the G10 leader board as expectations for a less-aggressive Fed propels risk sensitive currencies higher. The Australian dollar also a stand-out performer, gaining around 1.50%.

Starting the new week near 0.6140, the Kiwi benefited from more positive news flow regarding SVB and the likelihood the failed bank’s assets would be acquired. As the tory evolved to include broader regulatory support for the baking sector, NZDUSD ripped back through 62 US cents to log Monday’s high a few pips north of 0.6260.

We commented yesterday that last week’s NZD price action had shown signs of basing, daily lows from Tuesday through Friday all trading within proximity to what has now evolved into key support at 0.6090.

The two-day rally has propelled NZDUSD back through 38.2% Fibonacci retracement (0.6146) of the October-February rally to within reaching distance of major resistance at 0.6270 which also coincides with the 200-day moving average.

We temper expectations for a sustained run higher given the sticky inflation/renewed Fed aggression narrative that evolved through February and into March is still relevant, albeit taking a back seat to banking sector scrutiny in the immediacy.

Yes, the Fed may well pause at the upcoming 22 March FOMC meeting, Jay Powell and his colleagues requiring more time to assess that state of play for troubled regional banks before resuming further tightening. However, we see two possible paths in the short to medium term that deliver support for the US dollar.

The first – the SVB and Signature Bank cases prove to be isolated, quickly becoming a non-issue…..the Fed resumes its late cycle hikes as inflation remains persistently above target.

The second – a wider banking crises ensues causing extreme turbulence and loss of confidence leading to dysfunctional credit markets and a flight to safety.

Which ever of these two paths emerge, the US dollar likely outperforms.

Of course, there is a third path – the one that we were heading down throughout January.

A far brighter path by which risk assets head higher on expectations the Fed can engineer a soft landing or, at worst, a mild and shallow recession. This path leads to US dollar weakness and pro-cyclical currencies including the Australian and New Zealand dollars outperforming.

The UK pension fund crisis and now the SVB/Signature collapse suggest this last path may be the hardest to navigate……cracks are appearing and widening.

Importers, please be alert in the days ahead. Should USD weakness extend through this week, you will be presented with materially favourable levels relative to last week’s lows.

Looking to the day ahead, US banking sector headlines will continue to dominate, although the focus will shift to the week’s headline macroeconomic data release – US CPI for February. Consensus estimates are calling for core inflation to print at an annualised rate of 5.5% and 0.4% month-on-month. The data point is less impactful given the shift in focus over the past few days.

Nonetheless, a deviation from the consensus should impact sort-term direction.

Jobs data for the UK is the other data release of note.

Our key NZDUSD level to monitor today is 0.6270 which provided stout resistance on multiple occasions through the back half of February and into early March. Given Monday’s mammoth moves in global bond markets, we expect more subdued price action through Tuesday……the CPI release may prove to be a non-event.

Expectations are for 0.6270 resistance to remain intact – the Kiwi to consolidate in the 0.62’s.

Daily exchange rates

Select chart tabs

Stuart Talman is Director of Sales at XE. You can contact him here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.