By Stuart Talman, XE currency strategist

Negative market sentiment continues to intensify as China's economic woes and deepening concerns regarding the financial sector of the world's second largest economy compels market participants to sell risk-sensitive assets.

Confidence in China's financial markets is deteriorating day-by-day amidst a horrendous run of poor macroeconomic data, heightened risk that one of China's largest property developers is nearing default and Zhongrong (China's Blackstone) will cause widespread spread financial destruction as it skips payments on investment products, sparking rare protests in Beijing.

Despite the Chinese authorities’ best efforts to restore confidence, including through Wednesday, setting a stronger-than-expected reference rate for the yuan whilst unleashing the largest injection of short term cash into the financial system since February, the tepid measures are failing to improve the mood, the onshore yuan sinking towards its lowest level in almost 16 years.

China-sensitive currencies are suffering, the New Zealand and Australian dollars plummeting around 7% over the past five weeks with selling momentum showing no signs of slowing.

Wednesday's price action has replicated Tuesday's, NZDUSD paring losses through the early Asian afternoon, improving back into the 0.5990's before the market's mood darkens heading into offshore trade. US equity markets continue to pullback from 16-month highs logged in July, orderly selling the state of play as market participants crystallise profits following a fierce 1H rally.

In addition to China growth concerns, the market frets over the strength and resiliency of the US economy. Unlike China, the world's largest economy continues to perform well, despite the Fed's 525bps of tightening. Whilst it appears the Fed is done or may add another quarter-point hike in November, should the incoming macro data warrant, the market has subscribed to the Fed's higher for longer mantra.

US bond yields are approaching fresh cycle highs as the run of hot macroeconomic data compels the market to push expected rate cuts further into the future, the Fed now expected to commence easing late in the first quarter of next year.

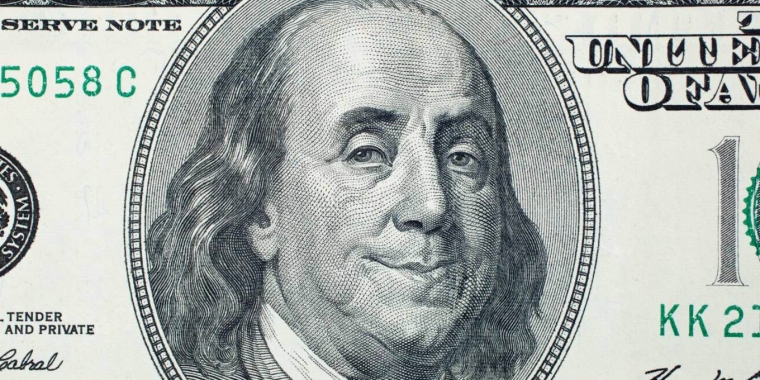

In turn, the dollar has rebounded from a 15-month low, measured via the dollar index (DXY), rallying just shy of 4% over the past 20-odd trading days. Many an analyst declared in early July, as the dollar plummeted (DXY sub-100.00) following the release of the softer-than-expected June CPI report, that a new period of cyclical dollar weakness was upon us.

Fast forward 4 weeks, the DXY has sliced through 103.00 with ease, now mounting an important test of the 200-day moving average. The DXY last traded above the widely monitored trend following indicator in December. A decisive upside acceleration through the 200d MA likely proves a major bullish development for the dollar.

Falling from a few pips above 0.5990, the New Zealand dollar marked then intraday low a few pips above 0.5330 before improving back through 0.5950 following the release of FOMC meeting minutes at 6am.

The Kiwi has again lurched lower heading towards the US close, marking a fresh 2023 low a few pips below 0.5330.

The minutes of the July meeting, in which the Fed announced a consensus quarter point hike have delivered no surprises given Chair Powell made it clear in his FOMC presser that the incoming data would dictate if additional tightening would be required.

FOMC members discussed the lag effects of monetary policy and given the mature stage of the cycle and uncertainty regarding the path for inflation, stressed the need for more data to determine the next move. However, the minutes also contained hawkish elements, specifically via the comment: most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.

Downside risks were also acknowledged as participants considered the possibility that the cumulative tightening of monetary policy could lead to a sharper slowdown in the economy than expected…..

Whilst the minutes refrained from providing any guidance re the 20 September FOMC meeting, given the downside miss for July CPI and the mixed July jobs report, the Fed is widely expected to maintain a 5.25% - 5.50% target rate.

Like the Fed, the RBNZ also recognised both downside and upside risks to inflation and the growth outlook. The key takeaways from yesterday's RBNZ interest rate decision:

- RBNZ maintains OCR at 5.50%

- Lifts the OCR track peak to 5.59%

- Immaterial changes to forecasts

As widely expected, the RBNZ delivered an on-hold decision, the second month the OCR has remained steady following 12 consecutive hikes.

The immediate reaction from the New Zealand dollar - a rebound from the year-to-date low near 0.5930, climbing 30-odd pips, through 0.5960.

Most attention was given to the surprise lift in the OCR track, lifting the previous forecast from 5.50% to 5.59%, which some analysts interpreted as a signal the RBNZ may not be done hiking. During his press conference, Governor Orr downplayed this, suggesting that modelling rather than the MPC's opinion was the reason behind the mildly hawkish projected lift.

The RBNZ acknowledged the murky outlook and uncertainty regarding the path for inflation citing global growth concerns, particularly in China and easing global inflation as downside risks whilst a slower loosening of the labour market, higher than assumed domestic inflation and a balanced housing market as upside risks.

Like the Fed, the incoming data flow will dictate if an additional late cycle hike is required. Analysts are divided, some believe the OCR at 5.50% is the cycle peak whilst others forecast another quarter-point hike by the 29 November meeting.

History informs that when pulling back from historically elevate levels, inflation can re-emerge via a second and third wave……we suspect the RBNZ, Fed, RBA and other major central banks are not done.

Looking to the day ahead, it’s a quieter economic calendar, delivering local producer prices, Aussie jobs numbers and initial jobless for the US economy.

As we go to print, the Kiwi extends lower to a fresh 2023 low through 0.5930. The 61.8% Fib level at 0.5904 we flagged earlier in the week is likely to be tested during Thursday's action.

Daily exchange rates

Select chart tabs

Stuart Talman is Director of Sales at XE. You can contact him here.

2 Comments

When the average 3 bedroom house on small section in Auckland is around a million only a matter of time before the currency’s will lose value.inflation will stay high with imported inflation. I know RBNZ said no more rates hikes but they just might have to that mortgage rate will be 9% in the not distant future.

The wheels are starting to vibrate concerningly in China. A loss of confidence amongst the population of their own government is hardly surprising after the ludicrous lockdowns of Zero Covid. Ditto here. Ditto in most civilised countries. The over baked covid responses [copy & paste from China] from panicked govts around the globe are still affecting everything. From almost 3 years of covid it will take another 3 years to sort itself out. We're currently in year 4 of that cycle. We do know how to make life difficult for ourselves don't we?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.