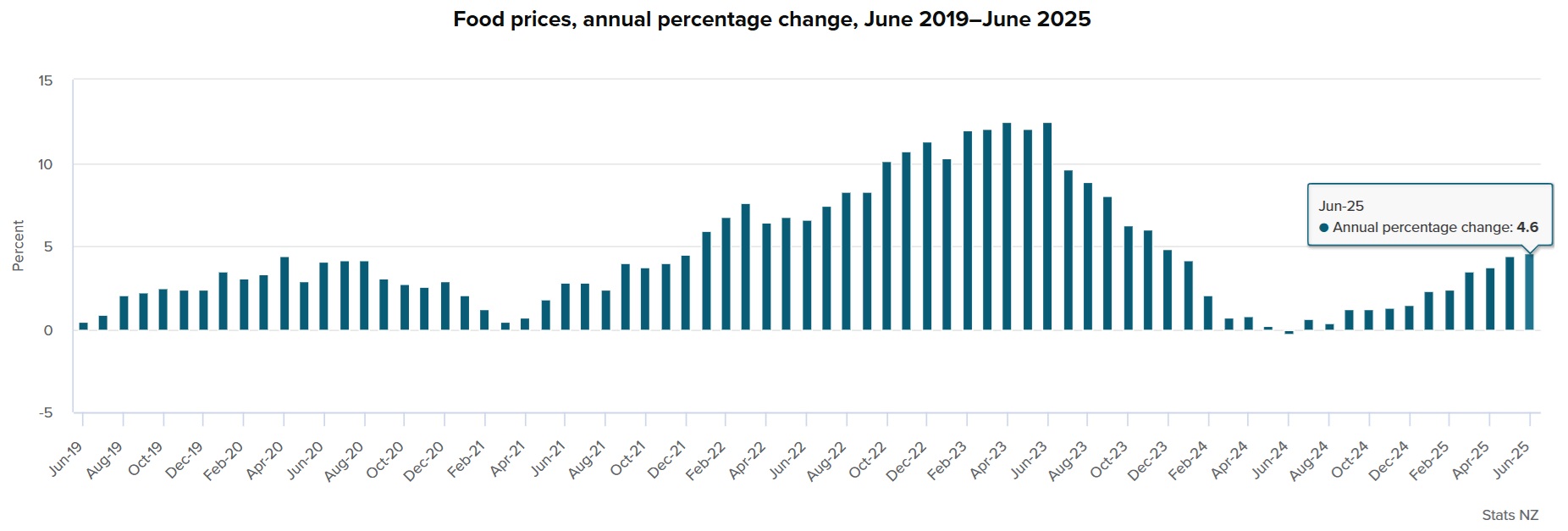

Food prices rose by 4.6% in the 12 months to June, which is the biggest annual rise since December 2023.

However, rents, up 2.6% in the year, had their smallest annual increase since 2011.

These are figures found in Statistics NZ's latest Selected Prices Indexes (SPI). The SPI is a monthly series that now features nearly 50% of the contributors to the quarterly Consumers Price Index (CPI) the accepted measure of inflation. So, they are a good early guide to what inflation's doing.

The Labour Party was quick to blame the Government for the latest spike in food prices, with Labour finance and economy spokesperson Barbara Edmonds saying that Prime Minister Christopher Luxon "promised to make the cost of living better, instead, he’s making it worse".

"It’s no wonder 47,000 people chose to leave for Australia last year."

The soaring food prices will make sure there's plenty of interest in the June quarter CPI figures, which are being released on Monday, July 21. (Food prices make up about 19% of the CPI).

The annual CPI was 2.5% as of March, which is within the Reserve Bank's targeted 1% to 3% range. The RBNZ in its last Monetary Policy Statement (MPS) in May forecast inflation to hit 2.6% for the June quarter and peak at 2.7% in the September quarter.

However, after its latest review of the Official Cash Rate (currently on 3.25%) last week, the RBNZ conceded that inflation was likely to approach the top of its 1% to 3% range in the June and September quarters.

It said: "Annual consumers price inflation will likely increase towards the top of the Monetary Policy Committee’s 1% to 3% target band over mid-2025. However, with spare productive capacity in the economy and declining domestic inflation pressures, headline inflation is expected to remain in the band and return to around 2% by early 2026."

And the latest SPI figures would appear to confirm that this spike is happening. A key thing now is whether such very visible increases in the prices of essentials will prompt re-ignition of 'inflationary expectations', which could then prompt a new wave of price rises.

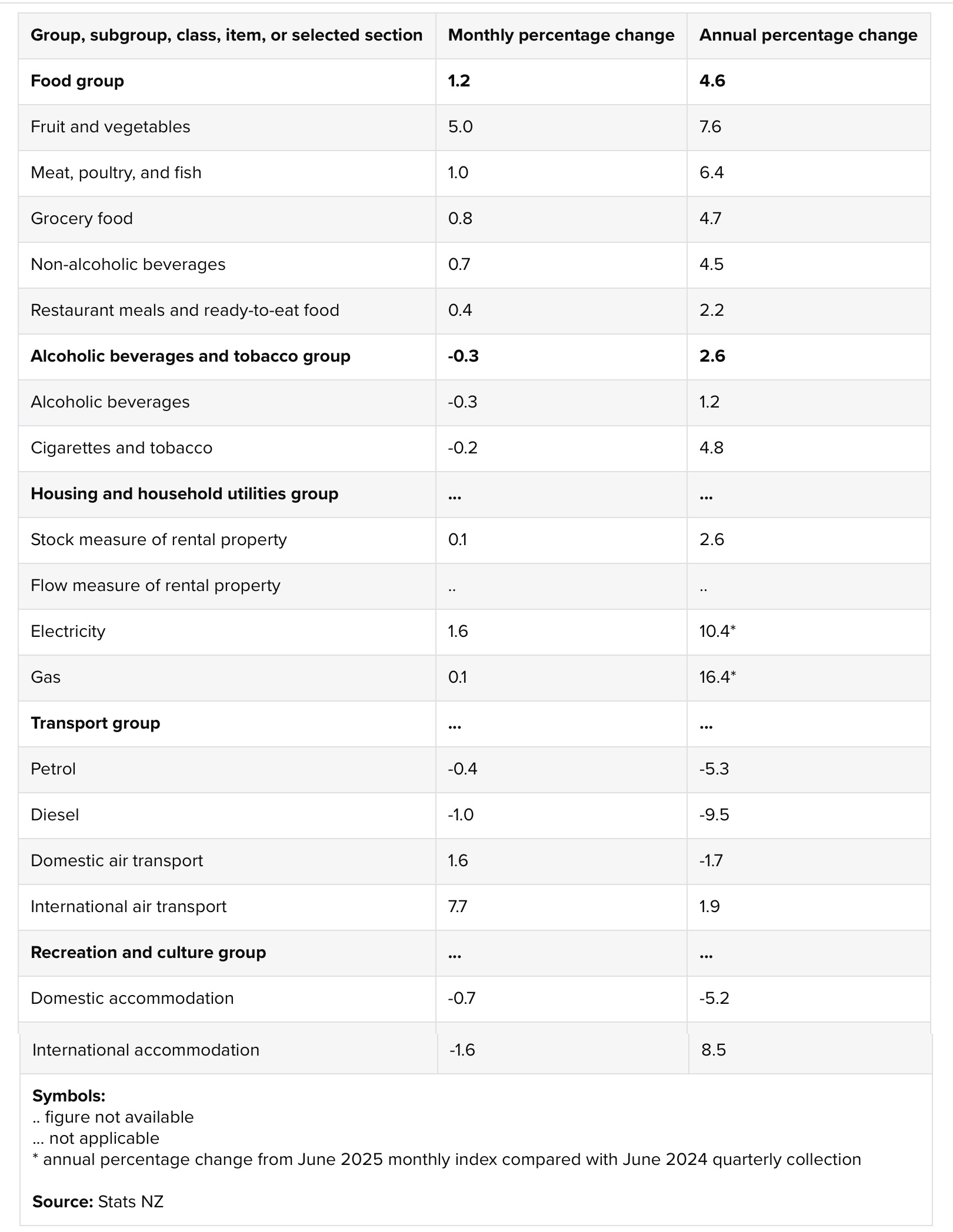

ASB senior economist Mark Smith said in the latest SPI higher prices for food, household energy, and airfares more than offset falls for tobacco & alcohol, accommodation and fuel.

The ASB economists have "pencilled in" a 2.8% figure for annual CPI inflation for the June quarter.

"We also expect 3%+ annual CPI inflation in Q3 (we currently have 3.1% yoy) but note there are good reasons to expect inflation to move lower by year end and into 2026.

"This is not without risk, with the possibility that the uptick in inflation proves to be more persistent than transitory, providing an unwelcome lift to inflation expectations that central banks have worked arduously to re-anchor post-Covid," Smith said.

Higher prices for the grocery food group and the meat, poultry, and fish group contributed most to the annual increase in food prices, up 4.7% and 6.4%, respectively, Stats NZ said.

The price increase for the grocery food group was due to higher prices for milk, butter, and cheese.

"Dairy products continue to drive the higher cost in food prices," Stats NZ's prices and deflators spokesperson Nicola Growden said.

The average price for:

- milk was $4.57 per 2 litres, up 14.3% annually

- butter was $8.60 per 500 grams, up 46.5% annually

- cheese was $13.04 per 1 kilogram block, up 30.0% annually.

“Butter prices are nearly five dollars more expensive than 10 years ago, an increase of over 120%,” Growden said.

The increase in the meat, poultry, and fish group was driven by higher prices for beef steak and beef mince, up 22.3% and 15.6%, respectively.

“The average cost for 1kg of beef mince was $21.73 in June 2025, up from $18.80 a year ago,” Growden said.

In terms of the actual month of June food prices were up 1.2%, following a 0.5% rise in May 2025.

Higher prices for the fruit and vegetables group and the grocery foods group drove the increase in food prices for June 2025, up 5.0% and 0.8%, respectively.

More expensive tomatoes, capsicum, and broccoli drove the increase for fruit and vegetables, while higher prices for boxed chocolates and eggs drove the increase for grocery foods.

Here is the detailed SPI information as supplied by Stats NZ:

28 Comments

If inflation gets going again the RBNZ would be failing their role if rates didn't go up again. That would equal further price suppression. See what happens.

Interest rates are not the only or very effective tool for fighting inflation. In WW2 we used price controls and rationing.

There is no better rationing method than price.

Exactly. Rock and a hard place.

Interest rate increases from here will make property crash harder.

But inflation is eating any saved capital and making life really hard for people.

Gonna increase my BTC acquisition (not financial advice 😉)

Food is energy. We are eating our way through the fossil stock - of course it's going to be more contested, by a species in gross overshoot. No other possibility exists.

But housing, in the First World, is a Ponzi.

Why compare the two? We can trace that failure, to the failure of economics itself - which contends that all things are fungible. Try eating 100-dollar notes, or stuffing digits into your petrol tank - all things are not fungible.

Economics was a crock - what a pity so many swallowed it.

Food is energy. We are eating our way through the fossil stock - of course it's going to be more contested, by a species in gross overshoot. No other possibility exists.

This might surprise you Power. Guyana, China, and Vietnam are arguably more self sufficient in food than Aotearoa.

Nothing like a tropical climate to grow food all year round.

Clearly the coalition have not done enough to tank the NZ economy despite their best efforts. We need to get unemployment up - obviously - I suggest further cuts to government spending and suddenly terminating multiple in-flight projects. It worked last year.

Come on NZ - let's have a decent long recession - it'll be fun and we can make up all kinds of new rules to pick on the growing number of unemployed people.

Getting New Zealand back on track.

10.4% increase in electricity cost yowzer. Best time to get solar was yesterday if you live somewhere with reasonable sunshine hours. The ROI will likely be sooner that predicted, anecdotally based on all the quotes I got were based on 5% annual increase per year only.

Spent about $10k on solar last year in Christchurch, just ran the numbers and I've saved about $1.5k this year (with no tax owing as it's a saving, not a return)

I find it hard to believe there is any risk-adjusted return out there that can match this. No brainer already, and panel prices keep falling while power prices keep rising.

The ROI has been positive for more than a decade, regardless of where you live.

My system cost me 5k - that's everything - in 2005. And say another 5k in the interim. Generator backup in the first year was $1-a-day, now maybe $10 spread over the whole year.

South of the 45th parallel, and prone t coastal clag.

At year 20, the panels are better than 90%, as far as I can make out. One wafer of one panel is looking sub-optimal, that's all. 3x 300watt separate systems.

If working at RBNZ, I personally would have considered raising rates again earlier this year to prevent any rise in inflation again above 3%.

But people still think the economy is the housing market...

Mortgage rates back to near 8%, will solve this inflation problem.

There, fixed inflation.

We should increase mortgage rates so people stop buying food and solve this.

Don't only about 30% of households have a mortgage? Shouldn't we raise rates so that the majority of households (who don't have excessive mortgage debt), who have some savings, who are seeing food prices rise but their return on savings dropping (as interest rates have been falling), get more return so they feel more encouraged to spend - and are able to buy the food they need?

Or does the entire universe revolve around those with excessive mortgage debt? Which is a minority of households in NZ.

So the cost of lending solely impacts those with mortgages on residential property and nothing else?

"Almost three quarters of ANZ New Zealand's total lending is now housing lending and CEO Antonia Watson says this is likely to rise even higher"

https://www.interest.co.nz/banking/133204/anz-nz-ceo-antonia-watson-exp…

When 3/4's of our largest banks lending is residential property, then what else are you referring to? What ever it is, its a significant minority. So should the minority rule the majority? That would be a new idea in NZ when it comes to prioritising lending to actual productive businesses other than residential property. Is that why businesses (other than residential property) pay higher rates of interests - because they are more beneficial to the country and we should support them over residential property investment?

If it’s such a small minority then it shouldn’t worry you 🤔

But it does worry you?

"So the cost of lending solely impacts those with mortgages on residential property and nothing else?"

Yeah it does, the impact from the rates rising (from agreed ridiculous lows) has been pretty grunty, maybe higher rates puts a bit of money back into the pockets of savers, but I don’t think that will inject enough cash into the economy to bring it back to life.

Also, in theory, dropping rates increases aggregate demand, which suppliers of goods and services (like food producers and supermarkets) then use as an excuse to increase the selling price of their goods. Meaning inflation goes up again..(meaning interest rates then need to increase again at a later date to reduce the aggregate demand and level out the CPI).

'Hey look people with mortgages are feeling better off because interest rates are dropping so they have spare cash...lets increase prices to absorb that additional demand which they can now pay for'.

Where's Yvil at? Tick, tick, tick. Inflation monster lurks.

Locked my mortgage in for 5 years back in May.

Deflation monster hiding 9-12 months behind the inflation monster?

Deflation for rents and house prices. Inflation for goods and services. Waiting to see if we have another crisis to allow central banks another round of QE.

I’d just lean towards plain ole deflation all around, yep rents and houses, but I don’t see where the inflation for goods and services is coming from…I’m struggling to believe that we have enough spare change sloshing around for genuine demand pull pressure…butter, council rates and electricity 🤷🏻♂️

Butter butters better, substitute for dripping if you can't afford

Some people wear shorts and tee-shirt but have the heatpump on high. Probably cry to winz for a power subsidy

Long term US rates aren't telling that story - its the opposite.

Didn't RBNZ say a a day or three ago the cash rate is coming down at the next OCR meeting without qualification? Jumping the gun I think. No doubt if they keep the OCR the same at the next meeting there'll be a convenient reason to.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.