They giveth - and then they taketh away.

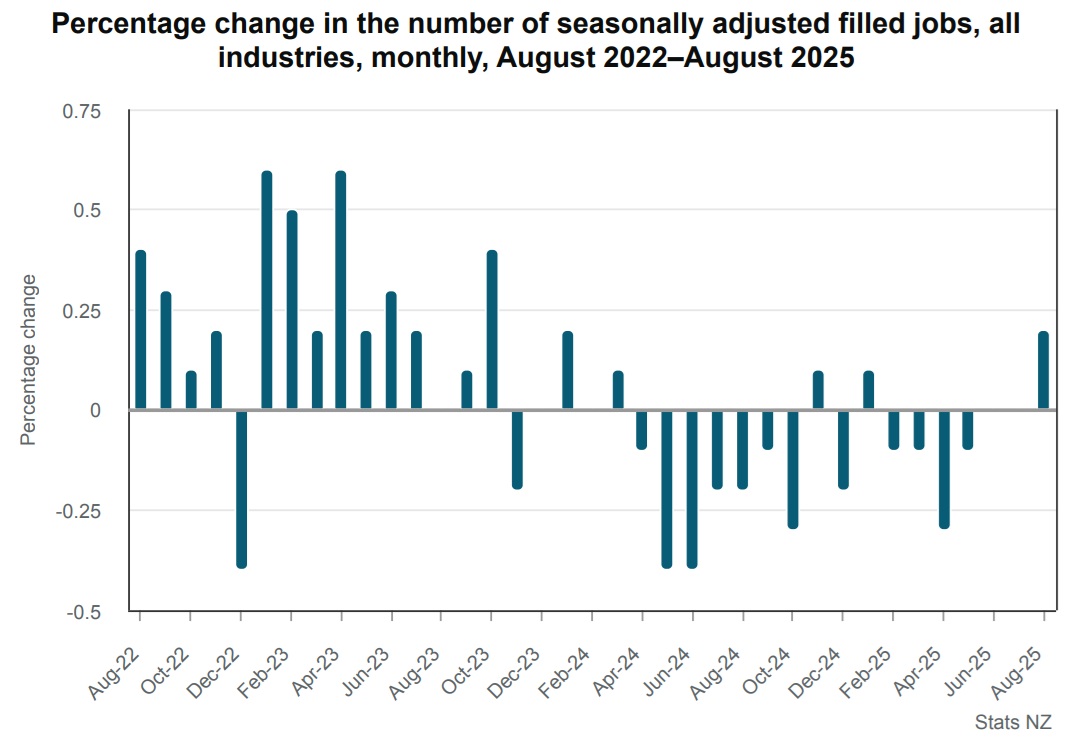

Latest Statistics NZ Monthly Employment Indicators (MEI) figures show a 0.2% rise in filled jobs for August.

However, Stats NZ has revised down the figures for both June and July that had previously showed rises - both of these months are now recorded as having a flat (neither a rise nor a fall) outcome.

The figures are therefore painting a picture of a labour market that's perhaps bottomed out - but isn't yet showing too many signs of recovering.

We have to be cautious with this data, since in recent times the monthly figures have almost invariably been revised down - so, the 0.2% rise currently recorded in filled jobs for August might not survive subsequent revisions.

The MEI figures are not directly comparable with the official unemployment figures as they are sourced quite differently - coming from Inland Revenue data - but they nevertheless have tended to be quite a good indicator of future trends.

The last official unemployment figures, for the June quarter, came out on August 6 and showed the rate of unemployment rising to 5.2% from 5.1%. The Reserve Bank (RBNZ) thinks it will go higher, to 5.3% in the quarter that's about to end. Those figures are due to be released on November 5.

Stats NZ said highlights of the job figures in August, compared (seasonally-adjusted) with the July 2025 month, were:

- all industries – up 0.2% (4,814 jobs) to 2.35 million filled jobs

- primary industries – up 0.2% (202 jobs)

- goods-producing industries – up 0.6% (2,484 jobs)

- service industries – up 0.1% (2,312 jobs).

ASB senior economist Mark Smith said it is early days but hiring data in recent months suggest that employment conditions are stabilising. "Much, however, will depend on the path of NZ economic activity."

Smith said recovering base economic momentum later in 2025 should see a pick-up in hiring and then see the unemployment rate recede before year end.

"There is still significant spare capacity in the labour market, and it will take a concerted period of strong growth to push the unemployment rate down to the 4.0-4.5% Goldilocks zone. Given the lack of growth tailwinds apparent, we expect 75bp [basis points] of OCR [Official Cash Rate] cuts and a 2.25% OCR by year end as the RBNZ [Reserve Bank] provides more economic support to the economy and broader labour market," Smith said.

In terms of the actual figures when compared with a year ago, Stats NZ said in August 2025, there were 2.33 million actual filled jobs, down 17,442 jobs (0.7%), compared with August 2024.

By industry, the largest changes in the number of filled jobs compared with August 2024 were in:

- construction – down 5.1% (10,213 jobs)

- professional, scientific, and technical services – down 2.7% (5,116 jobs)

- health care and social assistance – up 1.7% (4,829 jobs)

- accommodation and food services – down 2.5% (3,836 jobs)

- education and training – up 1.7% (3,652 jobs).

By region, the largest changes in the number of filled jobs compared with August 2024 were in:

- Auckland – down 1.3% (10,201 jobs)

- Wellington – down 2.0% (5,235 jobs)

- Canterbury – up 0.6% (1,852 jobs)

- Manawatū-Whanganui – down 1.1% (1,187 jobs)

- Hawke’s Bay – down 1.4% (1,108 jobs).

Younger people have continued to bear the brunt of the downturn in the jobs market.

By age group, the largest changes in the number of filled jobs compared with August 2024 were in:

- 15 to 19 years – down 8.2% (9,758 jobs)

- 25 to 29 years – down 3.5% (8,726 jobs)

- 30 to 34 years – down 2.6% (7,702 jobs)

- 20 to 24 years – down 3.0% (6,451 jobs)

- 35 to 39 years – up 2.3% (6,261 jobs).

2 Comments

Next unemployment numbers are out soon. Business are continuing to close or downsize. Have we really reached the bottom of the cycle? Not convinced.

Going into the end of the year and the xmas and Q1 slowdown would not be surprised for these numbers to increase when they are recompiled for March 26.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.