The Reserve Bank (RBNZ) could have prevented the post-pandemic inflation surge by hiking the Official Cash Rate (OCR) to 6% before the end of 2021, inducing a deeper recession than the Global Financial Crisis.

This analysis is based on a purely mechanical model of what policy settings would have kept consumer price index (CPI) rises below 3% after the Covid-19 pandemic and response.

An analytical note published by the central bank on Monday simulated the effect of two different monetary policy settings in the aftermath of 2020. These scenarios were described as “illustrative rather than definitive” as the economy may respond differently to extreme policy settings.

“Most importantly, the models that we use for this analysis are calibrated to typical policy responses, and it is likely that the transmission of policy would be materially different if monetary policy was set differently from those typical patterns,” it said.

“On balance, we view the simulations as providing a useful ‘ballpark estimate’ of what economic outcomes may have looked like with different monetary policy responses.”

With those caveats out of the way, the RBNZ essentially found it could have cooled overall inflation a little by reacting sooner (after the initial stimulus) but only unrealistic policy moves could’ve kept it in the target range.

The note did not look at alternative reactions to the initial pandemic shock, but the bank has previously acknowledged its bond buying and bank funding stimulus contributed to the inflation pressure.

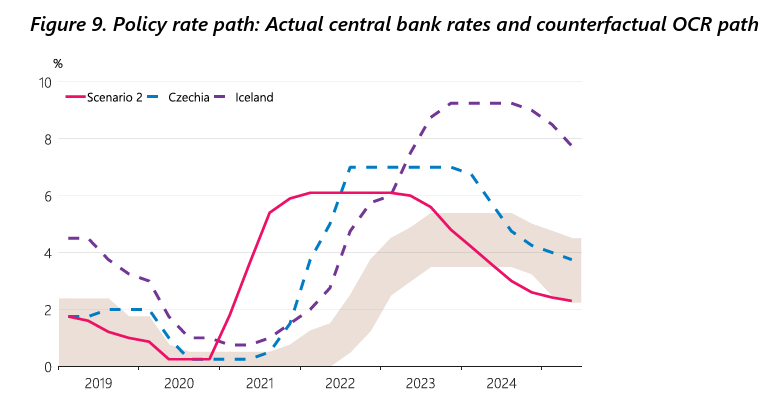

Keeping annual inflation below 3% would have required the OCR to rise 500 basis points in the first nine months of 2021, reaching 6% two years earlier than the actual 5.5% peak that eventuated in May 2023.

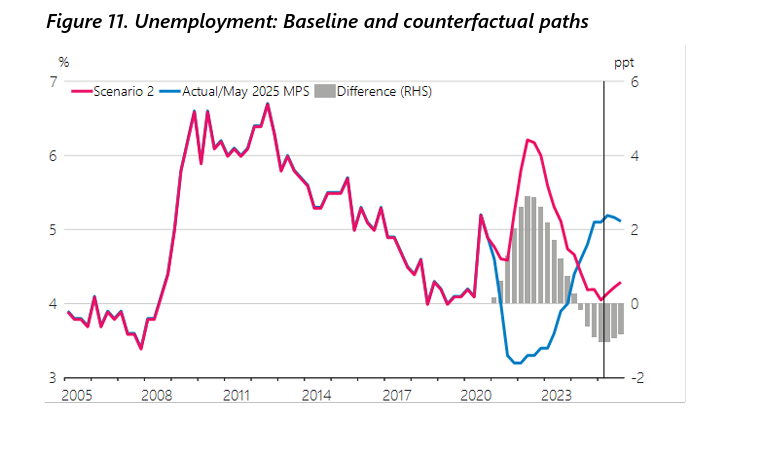

This would have crashed the economy. An output gap of -3.8% would’ve opened up (instead of -1.6%) and unemployment is estimated to have peaked at 6.2% instead of about 5.2%. Roughly 120,000 fewer people would have had jobs and mortgage rates would have hit 8%, instead of 7.4%.

But this trouble may have been short-lived. The RBNZ’s mechanical model showed a faster recovery than New Zealand has experienced, with the output gap and employment ending up in much better shape than today.

It's hard to say whether it would have worked in practice. And the question is moot, anyway, as the scenario would have breached the central bank’s monetary policy remit.

The RBNZ is tasked with keeping CPI within a 1% to 3% range but only over “the medium term” and it has to achieve it while avoiding “unnecessary instability” in economic output, interest rates, and employment.

At the time, the bank was also asked to “support maximum sustainable employment”. The Monetary Policy Committee could only have taken such a drastic path if it felt there was no alternative.

“A rapid and unexpected tightening would have been well out of step with the global monetary policy cycle and market expectations at the time. This may have constituted a significant shock to financial markets, increasing interest rate and exchange rate volatility if expectations adjusted abruptly”.

“The policy shock would also have tested the resilience of household, corporate and banking balance sheets, heightening risk to financial system soundness,” the RBNZ said in the note.

A more plausible scenario involved tightening policy two or three months sooner and getting to 5.5% six months earlier. This would have lowered the inflation peak to 6.4% from 7.3% in 2022 and caused a more moderate recession.

“These results suggest that while an earlier and steeper tightening cycle would have delivered a lower inflation peak and reduced labour market pressure, the counterfactual path would not have prevented a sustained period of above-target inflation,” the RBNZ said.

The monetary policy committee planned to raise interest rates in August 2021 but opted to delay as a second nationwide lockdown was announced during their policy meeting. This scenario imagines them going ahead with a 50 basis point rate hike, having already raised 25 points in July.

New Zealand’s OCR would have been sitting at 4% in May 2022, while Australia was still at 0.35% and the Bank of England and US Federal Reserve were at or below 1%.

Getting better

The analytical note was released as a wider update on the RBNZ’s response to a monetary policy review published in 2022.

Chief Economist Paul Conway said the RBNZ had made progress implementing the various recommendations made in the review.

These included developing a better understanding of supply shocks, neutral interest rates, and fiscal policy instruments; and monitoring the economy with more high frequency data.

Conway said the period of high inflation and economic volatility had provided valuable insights into how economic activity, price setting by businesses, and inflation expectations can evolve.

“We now have a deeper understanding of supply shocks and structural drivers of inflation and have expanded our use of high-frequency data for more timely and granular monitoring. We have developed new tools to estimate neutral interest rates and run scenario analysis. These improvements ensure the MPC [Monetary Policy Committee] is well equipped to navigate future shocks while maintaining price stability.”

Responding to the scenario analysis, Conway said an earlier or more aggressive tightening might have reduced inflation sooner.

“But this would have been difficult given the data available at the time and could have conflicted with the MPC’s mandate back then, which included maintaining maximum sustainable employment."

All four analytical notes and bulletins published on Monday can be found on RBNZ’s website.

12 Comments

Tell them to factor-in dissipation/depletion.

Until they do, they're reacting, not proacting.

Money should never be worthless. Its gives access to debt for those who don't understand it or the risks. And here we are today with bloated assets left and right.

These included developing a better understanding of supply shocks

As if they don't already have over 100 years of information relative to the effects of oil price shocks and the impact on the economy and inflation. Tears of a clown for those who have now lost their jobs, some their homes, or had to relocate out of necessity to survive, given the RBNZ's over-sedation of the economy. Now it is dozing and it will take a long time for the dose to wear off. Simply putting less in doesn't wake the patient.

Economics is a behavioural science.

Accordingly, there are big limitations to mechanical models.

Behaviours in relation to monetary policy have changed.

In particular, the general populace has an increased understanding that if interest rates go excessively low or high then there will be a subsequent counteractive effect.

As a consequence, monetary policy has become less effective in influencing individual behaviours.

KeithW

In particular, the general populace has an increased understanding that if interest rates go excessively low or high then there will be a subsequent counteractive effect.

Yet nobody pays any attention to what happened in Japan after the bubble popped. Everyone assumed that the BOJ would lower the OCR and Japanese companies, firms, and h'holds would go on a spending spree. Never happened. So they had to attempt to entice even further sending Japanese interest rates close to zero.

As a consequence, monetary policy has become less effective in influencing individual behaviours.

Partly because people are so tapped out that they can't spend, even if you pay them to. This is where the FMCG world needs some attention. Promotions and discounting is effectively subsidizing shoppers to spend in order to drive incremental sales or meet sales targets.

Science relies upon falsifiable theories, based in repeatable results with control over the variables you want to study.

Not sure economics is at that point yet, or most of the behavioural disciplines, for that matter - and much economic theory still seems to treat people as rational maximisers when behavioural economics has 'only' been around for 30+ years...

If they were acting on more recent data they would have moved rates sooner and taken the foot off the throat again sooner. Both would have been helpful.

That's right - there is only one single, solitary tool available and its the single, solitary thing that the entire economy revolves around. It's like the sun in that regard - it's called "interest rates".

Stop. Don't even think it. Don't think to yourself - "but isn't an economy a bit more complicated than that?" No. No it isn't - this is NZ and here we do things a bit differently. We only talk about interest rates - that is what the NZ economy is in it's totality - interest rates. Nothing else! Absolutely nothing else going on here. Just interest rates - that's all.

If you benefit from the debt issued then return IS the be all and end all....maybe that indicates who the economy is run for?

'Don't mention the fiscal policy?'

If the RB engineered an even deeper recession, would they have been able to engineer their way out.

It's proving to be struggle with what we have now.

I'm not sure I'd want the new governor’s job.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.