By David Chaston

As KiwiSaver moves into its second decade of investing, a debate has broken out about the wisdom of leaving your investment in default funds.

Some see the essential risk being that low returns are being eaten up by fees.

And there are important investing lessons and experience to be gained by taking an interest in your skin in the game.

Others, such as industry players, like the idea of encouraging members to shift to more profitable funds, ones that can justify higher fees. ANZ has been vocal recently in front-footing the call for members not to use default schemes for anything other than to park funds before a move to better arrangements.

But with 10 years' history, a 10 year track record, how have these low cost default funds performed on an after-all-taxes, after-all-fees basis?

The answer is, not bad at all. In fact the better ones have delivered returns in excess of 4% on that basis. But they have been helped by a period where there have been strong bond market gains. As high interest rates fell (the OCR was 8.25% when KiwiSaver was born), bond values zoomed higher giving fixed income investors unique gains.

But that time is over. If interest rates rise - especially internationally - that effect will reverse and there will be bond losses. Conservative default funds are vulnerable.

Given that about a third of default KiwiSaver funds are held in cash, and cash gives very low returns these days - and that fund managers don't invest anything anywhere without fees attaching - the cash position of any fund's holding will be a drag on future returns.

(And that is not to overlook the conflict-of-interest that may exist where cash funds are just 'invested' in the fund manager's own term deposits.)

So, this 'cash' drag will be on top of the bond risk - and bonds make up almost half of the exposure in KiwiSaver default funds.

It is no surprise that returns for KiwiSaver default funds are sagging. Our last three years' look shows that clearly (see the table below). And we expect that to deteriorate from here.

So we are joining the call for members to move investments in default funds to other options. Which ones? Well, we will deal with that question in another review (due soon), but suffice to say that it will involve going out the risk curve. Yes, involve taking on "more risk".

If you think that is not for you, you should read on.

My guess is that you see yourself as risk averse. You would rather have the certainty of not having to worry about potential losses of your hard earned savings. But you need to know that you are thinking about this wrong.

Very wrong.

All investment involves risk - even 'cash' or 'default KiwiSaver' funds. You need to understand risk better.

Many people fear a loss far more than they appreciate a gain. Psychology suggests it is a 3:1 relationship - you will be more than three times as worried about a loss than appreciate an equivalent gain. That is illogical of course, but it is the way some of us are wired. If you can't get your head around that to see gains as equally beneficial as losses detrimental, you are not an investor and you can't make rational investment decisions. You should get someone else to handle your money. Seriously.

If you are prepared to be mature about risk, then be prepared to go out the risk curve some way. The evidence is that many cash, conservative, or moderate funds actually don't deliver after-all-taxes, after-all-fees returns better than default funds. There are exceptions, but interestingly, very few. And that is why you need to do some 'work' to figure out where and why you would move your investment. Also remember that track record isn't everything. You would be best to move to a fund that has better future prospects rather than just a good historic track record.

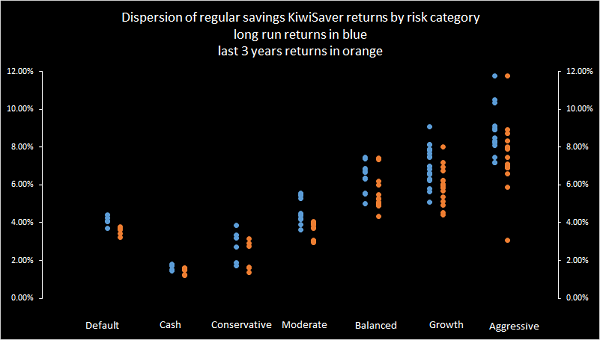

How far out the risk curve is visually suggested in this updated chart.

Return range of all funds, as at June 2018

Here are the updated results for default funds.

| Default Funds |

Cumulative $

contributions

(EE, ER, Govt)

|

+ Cum net gains

after all tax, fees

|

Effective

cum return

|

= Ending value

in your account

|

Effective

last 3 yr

return % p.a.

|

|||

| since April 2008 | X | Y | Z | |||||

| to June 2018 |

$

|

% p.a.

|

$

|

|||||

|

|

|

|

|

|

||||

| Mercer Conservative | C | C | C | 31,926 | 8,033 | 4.5 | 39,959 | 3.8 |

| ANZ Default Conservative | C | C | C | 31,926 | 7,692 | 4.3 | 39,618 | 3.3 |

| ASB Conservative | C | C | C | 31,926 | 7,360 | 4.1 | 39,285 | 3.7 |

| FisherFunds2CashEnhanced | C | D | C | 31,926 | 7,335 | 4.1 | 39,261 | 3.8 |

| AMP Default | C | C | C | 31,926 | 6,610 | 3.8 | 38,535 | 3.5 |

| BNZ Conservative | C | C | C | 19,368 | 2,355 | 4.1 | 21,723 | 3.8 |

| Kiwi Wealth Default | C | C | C | 14,624 | 1,105 | 3.5 | 15,729 | 3.5 |

| Westpac Defensive | C | C | C | 14,624 | 1,085 | 3.4 | 15,709 | 3.4 |

| Booster Default Saver | C | C | C | 14,624 | 1,074 | 3.4 | 15,698 | 3.4 |

| --------------- | ||||||||

| Column X is interest.co.nz definition, column Y is Sorted's definition, column Z is Morningstar's definition | ||||||||

| C = Conservative, D = Defensive | ||||||||

If you are not about to retire in the next few years, you should seriously review why you are in a default fund. We will review the track record performance of other classes of KiwiSaver funds over the next week or so, but being in KiwiSaver is a long term commitment and you should be applying long-term strategies to this investment.

That may well mean accepting some higher level of risk to gain a higher level of returns. Over a long-term, that is usually a sensible strategy. Sure, bumps in the road do come around (like the Global Financial Crisis) and they can knock growth fund returns. But as we have seen post-GFC, the bounce-back can turbo charge your results.

Here is where these managers have your default funds invested.

| Allocation, approx. | Mercer | ANZ | ASB | FF2 | AMP | BNZ | Kiwi Wealth |

Westpac | Booster |

| % | % | % | % | % | % | % | % | % | |

| Cash | 34.6 | 22.1 | 23.7 | 21.1 | 46.9 | 38.4 | 38.9 | 34.4 | 27.7 |

| NZ fixed income | 14.9 | 17.6 | 32.6 | 38.3 | 16.5 | 10.1 | 17.6 | 22.9 | 27.9 |

| Intl fixed income | 29.3 | 39.9 | 23.8 | 22.9 | 16.3 | 31.5 | 23.6 | 23.3 | 23.9 |

| NZ/Aust equities | 3.7 | 5.2 | 10.1 | 5.1 | 7.2 | 6.0 | 0.5 | 7.6 | 5.6 |

| Intl equities | 13.8 | 12.0 | 9.8 | 7.5 | 13.1 | 14.0 | 19.4 | 8.5 | 13.9 |

| Listed Property | 0.4 | 3.2 | 3.3 | 1.0 | |||||

| Unlisted Property | 1.3 | 5.1 | |||||||

| Other | 2.1 | ||||||||

| ---- | ---- | ---- | ---- | ---- | ---- | ----- | ----- | ---- | |

| 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

If you want your money allocated differently, you will need to change funds, either with the same manager, or with another. But before you do that, get some proper investment advice from someone who understands your investment goals and tolerance for risk. That involves work on your part. But it's not a good excuse to just leave it there because it seems too much effort.

KiwiSaver default funds are only part of a broader range of conservative funds available. Many of the 'traditional' conservative and cash funds are under performing the default funds. We will look at the rest of the conservative funds in another article.

For explanations about how we calculate our 'regular savings returns' and how we classify funds, see here and here.

There are wide variances in returns since April 2008, and even in the past three years, and these should cause investors to review their KiwiSaver accounts especially if their funds are in the bottom third of the table.

The right fund type for you will depend on your tolerance for risk and importantly on your life stage.

You should move only with the appropriate advice, and for a substantive reason.

9 Comments

Sadly, the underlying cause for this is a lack of financial literacy.

Whilst people not actively managing their KiwiSaver funds is a concern, as a former personnel manager of largely professional (graduate) staff, more of a concern was that most of these supposedly educated people probably only 50% were in KiwSaver.

Another concern of mine is that we talk accepting that the funds with great proportion invested in equities have significantly out-performed conservative funds over the past eight years or so, and assume that this is the future likelihood.

However, there is need for caution.

Equities - as with housing and for the same reason - have performed well over the past eight years or so during the GFC and its aftermath associated with stimulus due to money supply/quantitative easing such as by the US.

It is a premise of sound investing that past performance is no assurance of future performance and this applies in this situation.

Personally, I am taking a reasonably moderate view with investment, despite the long run of very good performance of the share market fueled by the global money supply, there are some dark clouds on the horizon such as, tightening of money supply in the US, improving interest rates globally (but not NZ), and the possible escalation of trade wars. While these have not yet had an impact on the equities markets as yet, there is still reasonable risk associated with these to suggest that the higher risk funds will not necessarily perform as well as previously.

Yes lets talk about the GFC, in 2008/9 my main pension lost 22+% in one year. Lets look at why it (somewhat) recovered. Crazy investing in shares and assets etc where the P/E ratio makes no sense what so ever ergo this is one giant bubble with all assets priced way beyond any sensible return and then the risk of a major correction is real and significant. So are high risk worse than conservative funds? Mark Blyth made an interesting observation all funds are really invested in a monolithic economy (I forget the exact words) so when we see a big drop in the economy all funds will lose. Another economist observed that the passive ones might actually lose the most as they react too late, not having a manager there on deck to move earlier.

Is anywhere safe then? potentially no not really.

I hope that your comment that your fund lost 22% in one year is noted.

It is also a concern that there is a generation who over the past ten years have experienced an exceptionally good period of returns - whether it be in housing or equities.

I hope that this generation don't assume that this is necessarily the future norm.

It's not just the last 8 years - longer time sequences will also show equities outperforming cash. You have to do some very careful cherry picking to find periods when cash has done better than equities over the long run.

Sure, nothing is guaranteed but as I most likely won't be accessing my kiwisaver for 35 years, heavy exposure to worldwide equities is very, very likely to do better for me than cash.

I don't have time to look for a link just now, but I've read analyses before of how well equity investors perform when they only invest at the very peak immediately before the last few big crashes. Over time, even the horrendously unlucky have done very nicely so long as they stay invested.

Hi mfd

You are correct; in the long term equities tend to outperform conservative cash deposits.

However, does one just put one's funds into a growth fund and then turn your back on it for 35 years.

I suggest that KiiwSaver funds will be getting quite large and as such need to be managed.

I am not suggesting that at the first sign of trouble one tries to beat the market by switching; just in the past year events such as the effects of Brexit and Donald's election only briefly (at least initially) affected the markets.

It is interesting that even after the 1987 share market crash, from memory the NZX50 had recovered within 12 months.

However, one needs to look at what could be significant events for a sustained period. Hindsight is a wonderful thing, but clearly the GFC was not doom and gloom for a sustained period as far as the housing and equities market were concerned and these were at the expense of cash.

The beauty of KiiwSaver funds, unlike similar managed funds one has the advantage with KiiwSaver of moving from one fund to another (and even provider) without a fee or cost.

Don't get me wrong, I am not suggesting you change funds on a regular basis, but many KiiwSaver providers annually publish a market outlook and I suggest that one can consider these (the NZ Super Fund provides an outlook with their annual report).

It all depends on what type of investor you are, but if I was in an active growth fund at the moment, given what I see as a little uncertainty, personally I would look at possibly look at pulling back a little to a more balanced fund.

. . yes, every man and his dog is going to have a different view.

I certainly agree - one should not sit in the default funds. However, I also think that people should read and seek advice, evaluate that information and from time to time review their KiiwSaver fund if need be.

Agree with all the above sentiments. For banks, these funds are a great source of cheap money.

Agree with you Rhumline.

Also note that if your provider is a bank, then you are not directly depositing your funds with the parent bank, rather a separate investment trust entity.

The investment entity may then transfer the money to their parent bank for a management fee (possibly 0.5%) and that will be at wholesale rates which tend to be far less than that offered by banks at retail (e.g. term deposit) rates.

But how much of the run in the last ten years has been inflation-nullified (especially for home-buyers) and how much was QE-spawned numbers looking for somewhere to go, as well as it going into housing?

https://www.irishtimes.com/.../can-stock-prices-stay-high-in-a-post-qua…...

What happens when everyone suddenly wants to cash in?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.