Here are the key things you need to know before you leave work today.

MORTGAGE RATE CHANGES

Update: Heretaunga Building Society trimmed its one and two year fixed rates by -15 bps.

TERM DEPOSIT RATE CHANGES

BNZ today launched a 2.88% one year TD 'special'.

CHEAPER WHOLESALE FUNDING

And BNZ is also seeking more wholesale funding. It is making an offer of up to NZ$100 mln of a new series of unsecured unsubordinated fixed rate 5 year notes to New Zealand retail investors and to certain institutional investors. It suggests if could accept unlimited oversubscriptions at its discretion. The offer has an indicative margin of 0.80%–0.85% pa. so at today's 5 year swap rate, that suggests the cost to BNZ for this funding will be about 2.15%.

MORE GLOOM

New Zealand’s services sector ended 2019 at a low point. The PSI for December was 51.9, which was -1 point down from November. The December result was also the lowest level of expansion since September 2012, and well below the long term average of 54.4 for the survey. Earlier surveys show the factory PMI was in contraction in December. Both surveys confirm others like the QSBO, retail sales, that businesses aren't starting 2020 in a totally positive frame of mind.

ANZ CONTINUES EFFORTS TO SELL UDC

ANZ's efforts to sell UDC Finance continue, according to Aussie media reports. Private equity groups are touted as potential buyers in a sales process being run by investment bank Morgan Stanley. UDC posted record annual net profit after tax of $69.7 mln in December. UDC has stopped taking deposits from the public and on January 15 the RBNZ cancelled its non-bank deposit taker licence at UDC's behest.

WALKER MOVES ON

Auckland Council's CFO Matthew Walker has resigned to take up a senior administrative role with the NZTA.

WEAK RETAIL INTENTIONS, STRONG HOUSING INTENTIONS

In Australia, the latest CBA Household Spending Intentions report shows that December levels fell with households remaining very cautious about spending at the retail level. However, the same report found house buying intentions at near a record high, and the 'hope' is that a rising wealth effect will seep into general demand. But the surveyers seemed unsure this would actually happen.

EQUITY MARKET UPDATES

Asian equity markets have all opened lower today, with Shanghai opening down -0.6%, Tokyo down -0.80%, and Hong Kong opening -1.6% lower. The Moody's rating downgrade, and tone-deaf messages that Hong Kongers need 're-education' to support Beijing from the new Beijing man in Hong Kong aren't helping. Locally, the ASX200 is down -0.4% while the NZX50 Capital Index is up +0.2% so far today.

LOCAL SWAP RATES UP

Wholesale swap rates have moved higher today. The one year is up only +1 bp, but the two year is up +3 bps, the five year is up +4 bps and the ten year is up +3 bps. The 90-day bank bill rate is unchanged at 1.29%. Australian swap rates are down about -2 bps across the curve. The Aussie Govt 10yr is down -1 bp at 1.17%. The China Govt 10yr is down an unusual -5 bps today at 3.08%. The NZ Govt 10 yr yield is up +2 bps at 1.56%. The UST 10yr yield has fallen sharply in the past hour or so, down more than -3 bps and now under at 1.80%, consistent with the Asian equity market openings. At the same time, gold is up +US$5 in early trade.

NZ DOLLAR STABLE

The Kiwi dollar is little-changed from this morning at 66 USc. Against the Aussie we are unchanged at 96.2 AUc. Against the euro we are at 59.5 euro cents. That means the TWI-5 is now at 71.3.

BITCOIN HOLDS

Bitcoin is holding at US$8,640. The bitcoin price is charted in the currency set below.

This chart is animated here.

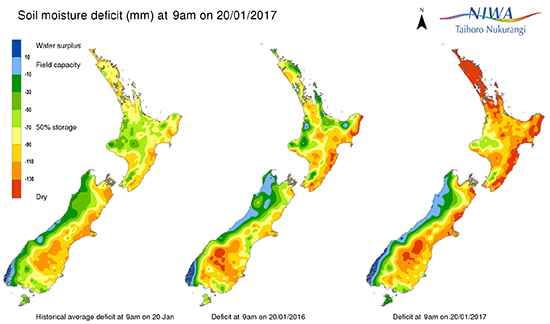

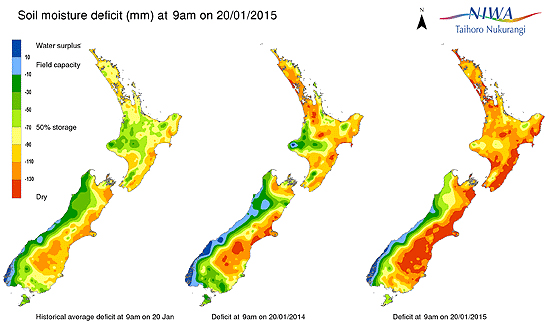

And here are the 2015 and 2017 maps for easy reference:

The easiest place to stay up with event risk today is by following our Economic Calendar here ».

24 Comments

Talking about strong OZ housing intentions, whatever happened to Joe Wilkes innumerable posts and his god at DFA… what was his name?

Over the past year people such as yourself provided good reason as to why there wasn't going to be an Auckland crash or a slow leak, and that the market had bottomed and we would be looking to the market increasing in 2020. You got labelled a "spruiker" used as a derogatory fashion. It was never about willing the market up for a personal vested interest; rather discussing the likely trend of the market which of course important to many who take an interest in this site.

The Joe Wilkes, Retired Poppy et al have just unsurprisingly disappeared.

I don't think Joe's disappearance had anything to do with his choice (banned). For all we know RP may have 'kicked the bucket' so I wouldn't go reading too much in to things.

Joe wilkes' starring role on DFA collapsed, you can actually see Martin North rolling his eyes to the extraordinary and baseless statements that Joe blurted out. As for Retired-poppy he would occasionally pop up when people were talking about him or reminiscing. Let's face it if your whole investment strategy was exposed as a crock as was his then you would probably bury yourself... no need to 'kick the bucket'.

Common element between spurikers and trolls. They appeal to emotion and are largely predictable.

J.C. I look at Interest as a business site, its motto is "helping you make better financial decisions" My posts are what I believe and I don't care about "spruking"or "trolling" at all, although I have no doubt many get emotionally wound up by my comments

Spruiking is kind of similar to soapboxing while trolling is much more about seeking emotional reactions. When I see the whole notion of "DGM" bandied around, I tend to think of trolling. Martin North is a superb example of someone who uses data well, but his narrative is incogruous to those who want to cheerlead the 'everything bubble.' Property is at the core of the bubble in the Antipodes and I think anyone who points that out should be listened to. As we have seen, the notion of overpriced assets shouldn't be taken lightly, particularly when it's at the core of your nation's economic wellbeing.

Your posts are becoming more and more about calling people out for being wrong like it's some sort of competition. That and ensuring people know that their lack of successes are 100% due to their shortcomings.

We get it, your business failed yet out of the ashes you managed to land yourself a receptionists job at a motel in Washdyke and from there you've been quite successful. Just try to be a little more humble on here instead of trolling (because that's exactly what you're doing).

To be fair to my DGM colleagues, interest rate assumptions at the end of 2018 turnout out to be wrong and the great collapse was predicated on a rise in interest rates.

I wouldn’t pat yourselves on the back too much. Yes, houses have inches back up in Auckland but only to equal the level three years ago, there is a while to go to achieve parity in real terms let alone any significant increase.

It’s an interesting point. All of the “DGM’s” would be correct but they don’t account for interference by the gov and rbnz (I know, I used be the same). Our markets, left to their own devices would collapse pretty quickly but are perpetually propped up. Are those who are saying the market will rise realising that or are they just thinking “houses always go up” without much critical thought?

Hardly, look up the work "excuses" on Google. So when you're wrong rather than admitting "hey sorry I was wrong" you go "oh I'm only not quite right because of this or because of that". Life doesn't care about your excuses.

Yes, the determination of those in power to keep the ponzi going should not be underestimated.

You can be guaranteed if the market weakened again that ocr would be cut to zero and LVRs relaxed.

Indeed, It took me a while, but that is where i landed too. No govt will let this slide substantially, so if it does, it means our economy has just just gone a bit Venezuelan

You're talking about Auckland... so many overlook the other regions of nz which is two-thirds. Auckland is big but only one-third of nz. Workers in chch earn the same as in Auckland, house prices are half of Auckland prices. Hamilton prices are about 65 percent of Auckland house prices but workers can earn the same in Hamilton and be 90 mins or less away

""Construction workers from China caught in an employment scam were promised fair treatment by the Immigration Minister but instead have been asked to leave the country""

https://www.tvnz.co.nz/one-news/new-zealand/scammed-chinese-workers-wer…

About 50 workers paid roughly $50,000 dollars each for visas and jobs in New Zealand.

Should send their recruiter to one of the CCP re education camps

Rich people are above the law in china so long as they pay for political patronage and don't do anything too public.

It must have a NZ component. At a minimum reliance on INZ not comparing work visas with IRD returns and employing under 30 labour inspectors while approving tens of thousands of work and residence visas.

I wonder if INZ found willing participation in deception?

In which case it would be absolutely fair to be asked to leave.

Speaking of Beijing...

To the hard working people of Hong Kong we wish you all the very best. We've watched & winced & wondered what would happen next (as you must do too) but I say to you keep up the good fight. You're up against a serious dinosaur but good will win out over evil. That's the point of all this technology, to bring everyone onto the upside. Instead, evil uses it to spy on its own & control everyone with a big stick.

That's not life. That's survival. And your life (lives) is worth much more than just survival.

Ohh fun, new Earthquake Prone Buildings NZ app to tell you how safe your building is; Landlords are going to love it! :P

https://survive-it.co.nz/eqpronenz-earthquake-prone-buildings/

New York Fed Considering Becoming Sugar Daddy to Hedge Funds as their Distress Grows

It’s apparently not enough of a billionaire subsidy for the U.S. Treasury’s Internal Revenue Service to give a monster tax break to hedge fund titans by allowing them to pay Federal taxes on the basis of “carried interest,” meaning that they have a special loophole to pay a lower tax rate than many school teachers, nurses and plumbers. Now, according to an article in the Wall Street Journal, the Federal Reserve is actually considering opening its super-cheap repo loan money spigot to hedge funds. It doesn’t get any crazier than this.

https://wallstreetonparade.com/2020/01/new-york-fed-considering-becomin…

Double post

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.